Spain Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Spain Duty-Free and Travel Retail Market Overview:

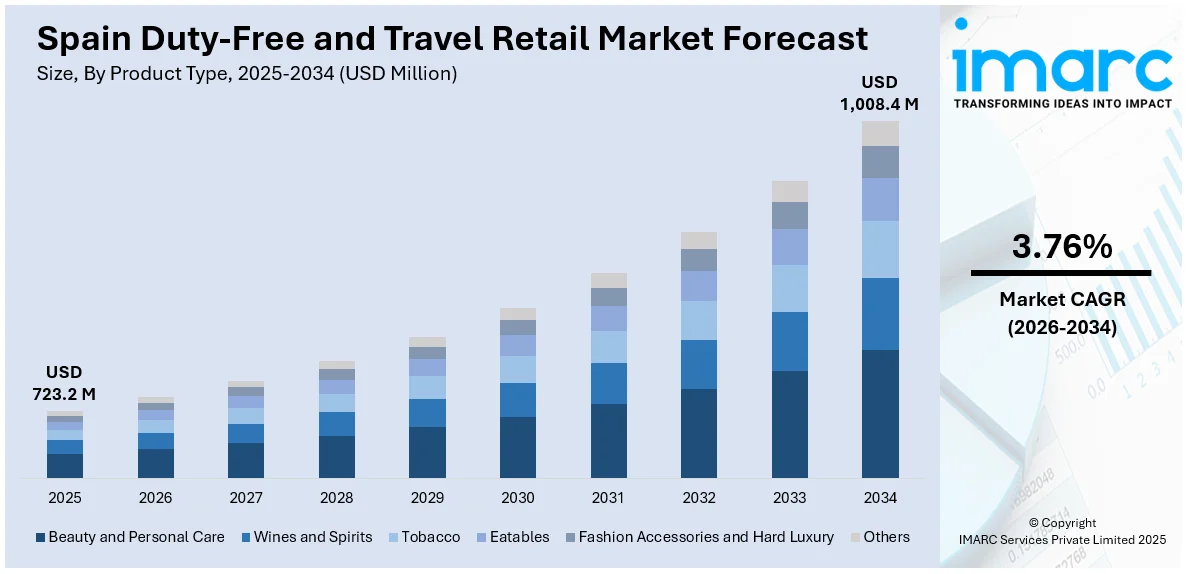

The Spain duty-free and travel retail market size reached USD 723.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,008.4 Million by 2034, exhibiting a growth rate (CAGR) of 3.76% during 2026-2034. Significant demand from international travelers, especially in airports, is one of the factors contributing to Spain duty-free and travel retail market share. Popular products include luxury goods, spirits, fragrances, and cosmetics. The sector benefits from Spain’s strategic location and tourism, driving growth in retail sales and duty-free offers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 723.2 Million |

| Market Forecast in 2034 | USD 1,008.4 Million |

| Market Growth Rate 2026-2034 | 3.76% |

Spain Duty-Free and Travel Retail Market Trends:

Luxury Personalization and Experiential Shopping

One striking trend in France’s duty-free market is the strong push toward luxury personalization and immersive shopping. High-end brands are turning airport and travel retail spaces into boutique extensions of their flagship stores. It’s no longer just about grabbing convenience items before a flight; it’s about giving travelers exclusive access to custom packaging, limited collections, and branded pop-up lounges. Many Paris airports now feature in-store craftsmen for engraving, monogramming, or bespoke perfume mixing, which makes the purchase feel special and worth a premium. French travelers, along with international tourists, expect high service standards, and brands use this to build loyalty and raise average transaction value. This keeps the luxury segment resilient against wider retail ups and downs, leaning into France’s reputation as a global style hub. The more these stores blur the line between duty-free and flagship boutique, the more they turn short dwell times into memorable moments that strengthen brand attachment, even when passengers are rushing to make their flight. These factors are intensifying the Spain duty-free and travel retail market growth.

To get more information on this market Request Sample

Strong Tech Integration and Data-Driven Upselling

A very different trend shaping France’s duty-free and travel retail market is the tight integration of technology and data-driven sales. Retailers are rolling out click-and-collect services, AI-powered recommendation tools, and loyalty apps that link airside shopping with travelers’ phones. Shoppers now research and pre-order duty-free products online, then pick them up on departure or arrival. Data collected through booking details, shopping history, and mobile activity helps brands time personalized offers that show up just as a traveler reaches the airport. This creates extra sales chances in a market that relies heavily on international foot traffic. Advanced analytics help stores fine-tune stock and promotions by nationality, season, and flight schedules, so shelves carry the right mix at the right moment. With competition tight, the tech-backed push for convenience and tailored promotions gives France’s duty-free players an advantage, especially among younger flyers who expect digital-first shopping rather than traditional browsing.

Spain Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

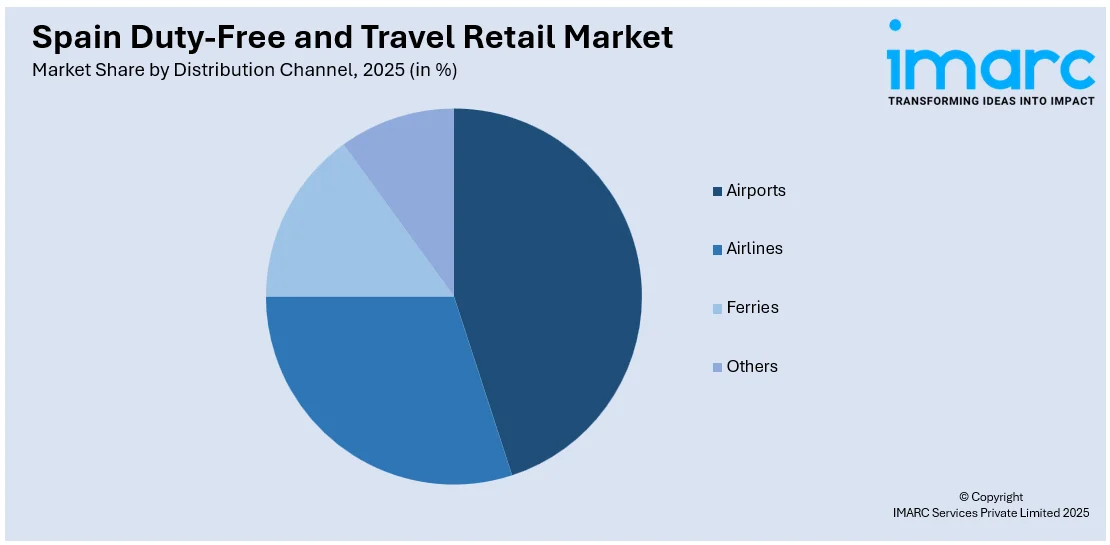

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Region Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Duty-Free and Travel Retail Market News:

- In June 2025, Mondelez World Travel Retail teamed up with LaLiga and Avolta for a football-themed promotion at Spanish airports. The campaign taps into Spain’s strong football culture to attract travelers to Mondelez’s brands. This move hints at rising opportunities for similar sports-linked promotions in the France duty-free and travel retail sector, boosting brand engagement among football-loving French travelers.

Spain Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain duty-free and travel retail market on the basis of product type?

- What is the breakup of the Spain duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Spain duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the Spain duty-free and travel retail market?

- What are the key driving factors and challenges in the Spain duty-free and travel retail market?

- What is the structure of the Spain duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Spain duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain duty-free and travel retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)