Spain E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2026-2034

Spain E-Invoicing Market Overview:

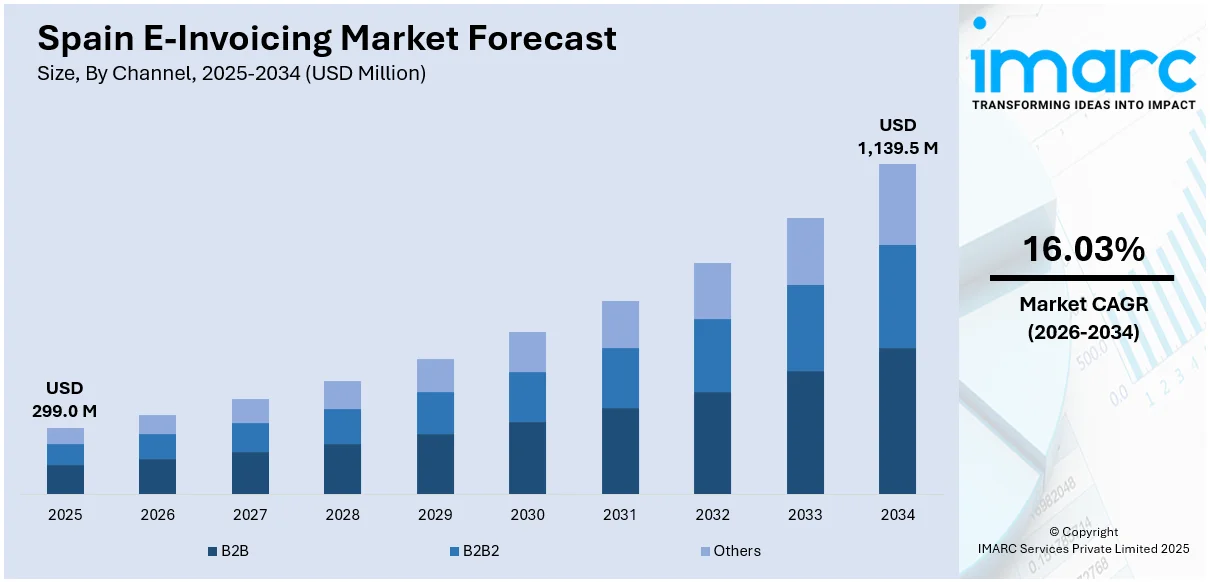

The Spain e-invoicing market size reached USD 299.0 Million in 2025. The market is projected to reach USD 1,139.5 Million by 2034, exhibiting a growth rate (CAGR) of 16.03% during 2026-2034. The market is experiencing consistent growth on account of rising digitalization, regulatory requirements, and the need for efficient billing processes in various industries. Cloud-based deployment and real-time data exchange are picking up pace, particularly for SMEs. The government's initiative toward making electronic invoicing compulsory is further fueling adoption. Finance, retail, and logistics sectors are among the prominent segments driving market demand. Such trends are anticipated to form a large part of the overall Spain e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 299.0 Million |

| Market Forecast in 2034 | USD 1,139.5 Million |

| Market Growth Rate 2026-2034 | 16.03% |

Spain E-Invoicing Market Trends:

Widening Mandatory E‑Invoicing Regulations

Spain is expanding its e‑invoicing requirements across public procurement and corporate sectors as part of its digitalization agenda. Under the draft B2B regulation (Crea y Crece Law), businesses with annual turnover above millions are expected to mandate e‑invoices one year after approval, while others will follow within two years. This staggered rollout ensures businesses have time to adapt compliant billing systems. The phased implementation has already resulted in a 20 percent increase in e‑invoice usage among major corporations in 2025, highlighting the effectiveness of regulatory alignment with EU fiscal policy. Standardizing invoice formats and requiring XML file exchanges are advancing traceability and reducing late payments. Complying businesses now benefit from integrations with public portals, enabling automated updates on transaction statuses and payment confirmations. As e‑invoicing extends to more industries, the policy is reinforcing Spain e‑invoicing market growth, supporting faster adoption among SMEs and streamlining fiscal oversight in coordination with the EU’s ViDA initiative.

To get more information on this market Request Sample

Standardized e‑Invoicing Software for SMEs

Under Royal Decree 1007/2023 and amendments in April 2025 (RD 254/2025), Spanish taxpayers not using real-time VAT recording systems must transition to certified e‑invoicing software. Software providers must meet technical specifications, such as QR-code generation, immutable records, and XML compliance by July 2025. All businesses issuing invoices will also need to comply by early 2026. This framework ensures data integrity and fraud prevention through encrypted, tamper-proof digital invoices. The regulation has driven a certified software adoption rate of nearly 80% among affected SMEs by mid‑2025. These systems ease compliance by integrating real-time invoice generation, record-keeping, and tax submissions streamlining record reconciliation and reducing manual processes. Businesses adopting these tools also benefit from built-in error detection and automated updates aligned with national guidelines, minimizing legal risk. Many SMEs report increased efficiency and fewer administrative delays after implementation. By enabling secure, traceable invoicing, this standardized approach is a key driver of the Spain e-invoicing market trends, ensuring legal alignment, strengthening fiscal transparency, and enhancing trust in Spain’s evolving digital tax system.

National e‑Invoicing Platform Enables Efficiency

Spain is advancing a public e‑invoicing platform (Verifactu) to integrate invoice issuance directly with the Agencia Tributaria. A free voluntary service launching in July 2025, sets the stage for mandatory adoption by corporate taxpayers in January 2026 and by self-employed professionals by July 2026. Through Verifactu, invoices are digitally generated, automatically tagged with QR codes, and submitted in real-time enabling instant validation and irreversible record-keeping. More than 90% of large exporters are expected to be onboard by 2026, supporting cross-border invoice verification and VAT reconciliation. This infrastructure accelerates Spain's digital tax ecosystem by reducing reliance on paper, speeding up payment cycles, and increasing transparency. It also facilitates enhanced audit readiness and reduces invoice fraud by creating an immutable trail for every financial transaction. As more organizations integrate with Verifactu, tax authorities can conduct proactive compliance checks and streamline enforcement. As it becomes the default method for domestic and B2B invoicing, Verifactu is fueling market growth, boosting efficiency and aligning national frameworks with EU digital tax standards.

Spain E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

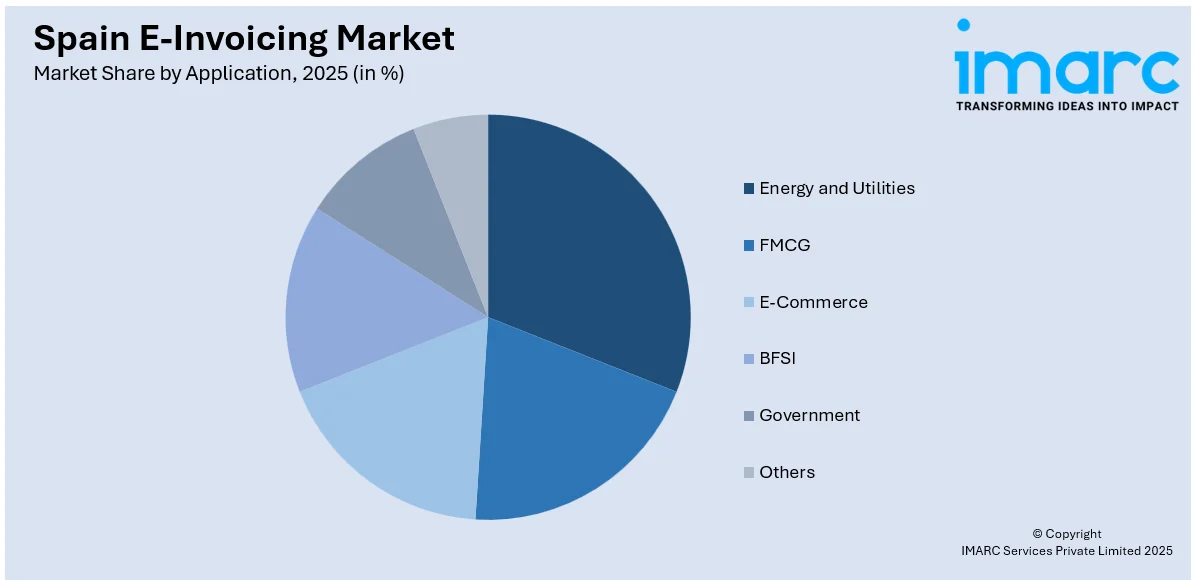

Application Insights:

Access the comprehensive market breakdown Request Sample

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain e-invoicing market on the basis of channel?

- What is the breakup of the Spain e-invoicing market on the basis of deployment type?

- What is the breakup of the Spain e-invoicing market on the basis of application?

- What is the breakup of the Spain e-invoicing market on the basis of region?

- What are the various stages in the value chain of the Spain e-invoicing market?

- What are the key driving factors and challenges in the Spain e-invoicing?

- What is the structure of the Spain e-invoicing market and who are the key players?

- What is the degree of competition in the Spain e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain e-invoicing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)