Spain Ecotourism Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Sales Channel, and Region, 2026-2034

Spain Ecotourism Market Summary:

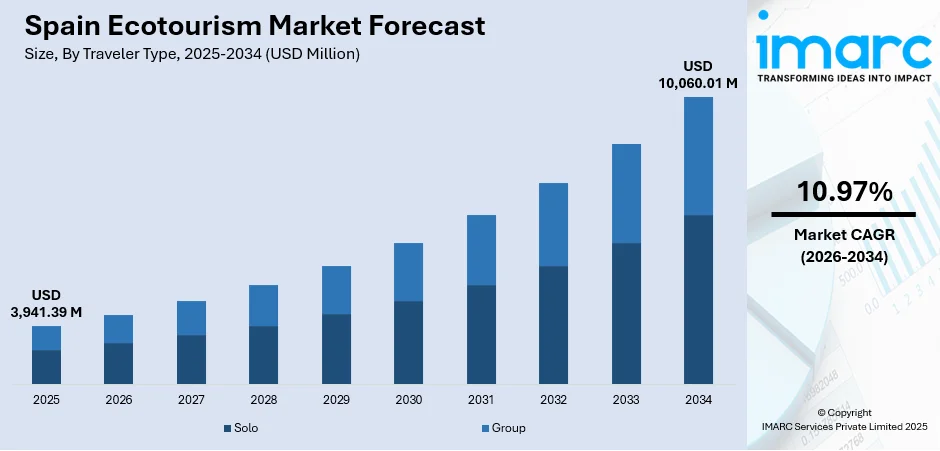

The Spain ecotourism market size was valued at USD 3,941.39 Million in 2025 and is projected to reach USD 10,060.01 Million by 2034, growing at a compound annual growth rate of 10.97% from 2026-2034.

The Spain ecotourism market is experiencing robust expansion, as environmental consciousness is reshaping travel preferences and government initiatives are promoting sustainable tourism development. Increasing demand for authentic nature-based experiences, combined with Spain's extensive network of protected natural spaces, is strengthening the country's position as a leading ecotourism destination. Advancements in sustainable tourism infrastructure, the growing interest in wildlife observation and rural cultural immersion, and strategic public-private partnerships (PPPs) are driving transformative growth across the market share.

Key Takeaways and Insights:

- By Traveler Type: Group dominates the market with a share of 81.12% in 2025, driven by organized eco-tours offering curated wildlife experiences, expert-guided nature excursions, and cost-effective packages that appeal to environmentally conscious travelers seeking communal sustainable adventures.

- By Age Group: Generation Y leads the market with a share of 59.52% in 2025, reflecting millennials' strong preference for authentic, experiential travel that aligns with their environmental values and desire for meaningful connections with local cultures and natural ecosystems.

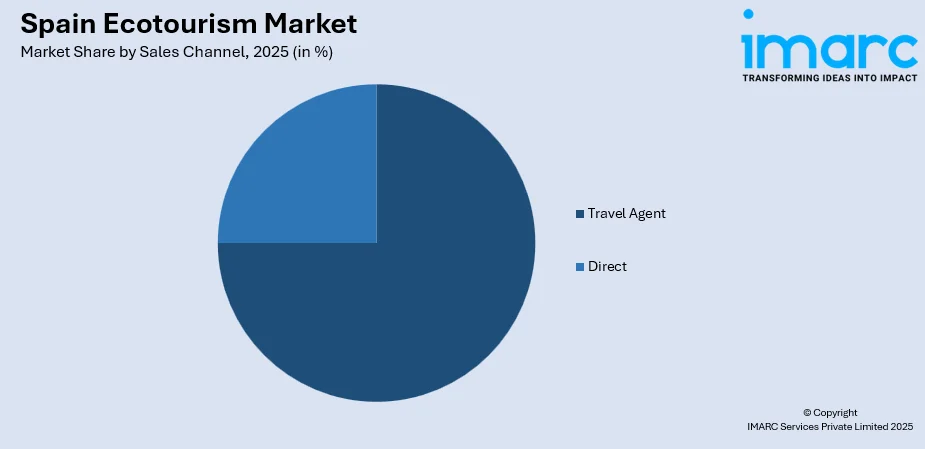

- By Sales Channel: Travel agent represents the largest segment with a market share of 77.34% in 2025, as specialized ecotourism agencies provide curated sustainable packages, expert destination knowledge, and certified eco-friendly accommodations that meet the growing demand for responsible travel planning.

- Key Players: The Spain ecotourism market exhibits a diverse competitive landscape with specialized tour operators, eco-certified accommodations, and regional tourism agencies collaborating to deliver authentic, sustainable experiences while supporting local community development and conservation initiatives.

To get more information on this market Request Sample

The Spain ecotourism market is advancing, as Spain consolidates its position as one of the world's most committed destinations in terms of sustainability. In 2024, Spain was set to designate 1,858 Million euros for funding initiatives at both local and regional levels via the Tourism Sustainability in Destinations. These substantial investments are reshaping Spain's sustainable tourism landscape by fostering nature-based experiences, improving eco-friendly infrastructure, and supporting protected natural areas that serve as primary ecotourism attractions. Digital platforms are improving access to eco-lodges and responsible tours, making sustainable travel easier to plan and book. Additionally, younger travelers and international visitors seeking authentic experiences are driving year-round demand beyond peak seasons. Investments in conservation-focused tourism infrastructure and promotion of responsible travel practices are also enhancing destination appeal.

Spain Ecotourism Market Trends:

Integration of Sustainability Certifications and Recognition

Spain has been acknowledged by Lonely Planet as the top sustainable destination in 2024, confirming its global leadership in the field. This recognition is accelerating demand for ecotourism by building strong international trust and visibility for Spain’s sustainable travel offerings. Sustainability certifications for hotels, tour operators, and destinations assure travelers of responsible practices, such as waste reduction, energy efficiency, and community support. Certified businesses gain a competitive edge through higher credibility and better promotion on travel platforms.

Digital Transformation and Eco-Friendly Urban Initiatives

Valencia was designated European Green Capital 2024 in acknowledgment of the area's progress in sustainable city development and carbon neutrality. The convergence of digital innovations with environmental stewardship is creating new opportunities for data-driven ecotourism management while enhancing visitor experiences through technology-enabled sustainable practices across the country.

Growth of Rural and Community-Based Tourism

Rural tourism is rising as travelers seek peaceful, nature-focused vacation options. Demand for farm stays, village tourism, and cultural immersion is benefiting local communities and small businesses. In 2023, 45% of individuals above 18 participated in rural tourism in Spain. Community-managed tourism creates authentic experiences while preserving traditions. This driver promotes income diversity for rural areas and reduces pressure on urban destinations. As travelers seek quiet, natural environments with personal engagement, rural ecotourism continues to expand across Spain.

Market Outlook 2026-2034:

The Spain ecotourism market is projected to expand significantly during the forecast period, driven by sustained government investments, growing environmental awareness among international travelers, and strategic regional initiatives promoting nature-based tourism. The market generated a revenue of USD 3,941.39 Million in 2025 and is projected to reach a revenue of USD 10,060.01 Million by 2034, growing at a compound annual growth rate of 10.97% from 2026-2034. The continued broadening of protected area networks, certification programs, and eco-friendly accommodation options will strengthen Spain's competitive position as travelers increasingly prioritize destinations demonstrating genuine commitment to environmental conservation and community benefit.

Spain Ecotourism Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Traveler Type | Group | 81.12% |

| Age Group | Generation Y | 59.52% |

| Sales Channel | Travel Agent | 77.34% |

Traveler Type Insights:

- Solo

- Group

Group dominates with a market share of 81.12% of the total Spain ecotourism market in 2025.

Group ecotourism in Spain benefits from the collaborative nature of sustainable travel experiences that require specialized knowledge and coordinated logistics. Organized group tours provide access to protected natural areas with certified guides who ensure minimal environmental impact while delivering educational content about conservation efforts and local ecosystems.

The preference for group travel reflects the inherent social dimension of ecotourism, where shared experiences enhance appreciation for natural environments and cultural heritage. In 2024, over 50 traditional eateries throughout Green Spain provided zero-kilometer culinary experiences, focusing on locally sourced ingredients cultivated and produced nearby, while guests could immerse themselves in local culture by opting for any of the region's 170 small rural lodging choices. These curated group experiences facilitate deeper engagement with local communities while distributing tourism benefits across rural areas that depend on sustainable visitor economies.

Age Group Insights:

- Generation X

- Generation Y

- Generation Z

Generation Y leads with a share of 59.52% of the total Spain ecotourism market in 2025.

Generation Y represents the primary demographic driving ecotourism demand in Spain, reflecting their documented preference for experiential travel that aligns with environmental and social values. Millennials prioritize authenticity, fulfillment, and sustainability in customized experiences that reflect their individual tastes and preferences, steering clear of tourism products that seem insincere, artificial, or staged for tourists, while appreciating local cultures and traditions, engaging vacations, and traveling with friends and family. This generational cohort's travel decisions are significantly influenced by sustainability credentials and opportunities for meaningful cultural immersion.

The economic power and travel frequency of Generation Y travelers make them instrumental in shaping Spain's ecotourism landscape. Millennials are attracted to eco-friendly travel choices, reflecting their wider values of environmental awareness, balancing relaxation and activity, and expressing interest in both cultural experiences and entertainment opportunities. Their willingness to invest in premium sustainable experiences and preference for authentic local engagement over mass tourism create substantial market opportunities for operators offering certified ecotourism packages that demonstrate genuine environmental and community benefits.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Travel Agent

- Direct

Travel agent exhibits a clear dominance with a 77.34% share of the total Spain ecotourism market in 2025.

Eco-travel often involves complex planning, including protected-area permits, guided tours, and sustainable accommodation selection. Travel agents simplify this process by offering well-designed eco-packages, trusted local partnerships, and safety assurance. Their expertise saves time for travelers and reduces uncertainty when choosing responsible travel options.

Additionally, travel agents provide access to certified eco-lodges, trained guides, and curated nature experiences that individual travelers may struggle to arrange online. They also educate customers about responsible behavior, local regulations, and conservation practices. Group eco-tours, wildlife trips, and rural experiences are easier to manage through agents who handle logistics and risk management. Personalized itinerary design, multilingual support, and post-booking assistance further strengthen customer confidence, making travel agents a preferred channel for Spain’s ecotourism market.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain holds prominence due to its rich green landscapes, mountain ranges, and coastal ecosystems. The region attracts visitors interested in forest trails, wildlife observation, and rural stays. National parks, biosphere reserves, and protected coastlines support demand for hiking, birdwatching, and agro-tourism. Mild summers and scenic villages encourage year-round travel. Strong focus on conservation and local experiences, such as organic farming and eco-lodges, further strengthens the region’s position as a preferred destination for nature-focused and sustainable tourism in Spain.

Eastern Spain benefits from a mix of coastal biodiversity and inland natural parks, making it attractive for marine and land-based ecotourism. Tourists enjoy coastal conservation zones, wetlands, and hiking trails within mountainous inland regions. Demand is rising for eco-resorts and sustainable beach tourism. Activities, such as kayaking, birdwatching, and cycling tourism, are driving the market growth. Proximity to major cities also enables short nature getaways. Sustainable coastal management efforts are improving international appeal of this region for responsible visitors.

Southern Spain is known for desert landscapes, wetlands, and natural reserves that support diverse ecotourism activities. Tourists are drawn to birdwatching, heritage tourism, and biosphere experiences. The region offers unique eco-attractions such as nature-friendly rural accommodations and environmental tourism routes. Warm climate supports year-round visits, particularly in wildlife zones and coastal plains. The growing investments in eco-trails and conservation efforts are improving visitor inflow. Southern Spain’s blend of nature, culture, and sustainability makes it a strong contributor to Spain’s ecotourism market.

Central Spain plays a supporting role, driven by mountain tourism, forest reserves, and countryside experiences. Travelers prefer this region for hiking, eco-retreats, and agritourism near urban centers. It benefits from easy accessibility and short-distance travel demand. Eco-tourism packages promoting local culture, organic food, and rural experiences are gaining popularity. The region’s protected areas encourage outdoor activities and environmental awareness programs. As demand for wellness and nature retreats is rising, Central Spain continues to grow as a peaceful ecotourism destination.

Market Dynamics:

Growth Drivers:

Why is the Spain Ecotourism Market Growing?

Substantial Government Investments in Sustainable Tourism Infrastructure

Substantial government investments in sustainable tourism infrastructure are strongly driving the growth of the market by improving access, quality, and environmental protection at nature-based destinations. Funding for eco-friendly transport, improved rural connectivity, waste management systems, and renewable energy in tourist areas is making remote regions more attractive and reliable for travelers. Development of visitor centers, trekking routes, and conservation facilities enhances tourist experiences while protecting natural ecosystems. Support for local communities through training programs and financial assistance encourages small businesses to adopt sustainable practices. Public investments also promote certification schemes and environmental standards, increasing traveler confidence in responsible tourism services. Additionally, improvements in digital infrastructure help promote eco-destinations and enable easier bookings. Overall, government-led development not only boosts visitor numbers but also ensures long-term sustainability, positioning Spain as a trusted destination for environmentally responsible travel in the global tourism market.

Expansion of Protected Natural Area Networks and Certifications

The expansion of protected natural area networks and sustainability certifications is strongly driving the market growth in Spain by increasing destination credibility and environmental appeal. In 2024, the Mar de las Calmas, located near the island of El Hierro in the Canary Islands, was set to become Spain's inaugural fully marine national park. The region was famous for its diverse ecosystems and submerged volcanic terrains and was expected to be the country's 17th national park. New and expanded national parks, marine reserves, and biosphere zones attract eco-conscious travelers seeking authentic nature experiences. These areas offer better-managed trails, wildlife protection, and educational tourism, which enhances visitor satisfaction and length of stay. Certifications for eco-lodges, tour operators, and destinations assure travelers of ethical practices, waste reduction, and responsible resource use. This builds trust and reduces concerns about environmental harm, encouraging bookings from international tourists and sustainability-focused tourists. Certified businesses gain better visibility on travel platforms, improving demand. Protected status also limits overdevelopment and preserves landscapes, making destinations more exclusive and high-value. Overall, stronger conservation frameworks position Spain as a premium ecotourism destination, improving long-term demand and supporting higher-quality tourism growth.

Rising Environmental Consciousness Among Key Traveler Demographics

Rising environmental consciousness among key traveler demographics is a major driver of the market expansion, especially among younger travelers, families, and international tourists. These groups increasingly prefer destinations that promote conservation, low carbon impact, and community involvement. Travelers are choosing eco-lodges, nature-based tours, and wildlife experiences over mass tourism options, boosting demand for sustainable travel products. Social media and digital campaigns are also spreading awareness about climate change and responsible tourism, influencing travel decisions. As per DataReportal, in January 2025, Spain had 39.7 Million social media user accounts, representing 82.9% of the overall population. Many tourists seek meaningful experiences, such as volunteering, cultural exchange, and farm stays, which align well with ecotourism offerings. Tour operators are responding by developing green packages and transparent sustainability policies. This shift in consumer mindset is increasing spending on eco-certified services and extending stays in rural and protected areas, supporting local economies. Overall, conscious travel behavior is reshaping demand patterns in Spain’s tourism landscape.

Market Restraints:

What Challenges the Spain Ecotourism Market is Facing?

Seasonality and Uneven Tourist Flows

Ecotourism demand in Spain remains highly seasonal, with peak travel concentrated in specific months and regions. This creates unstable revenue for eco-lodges, guides, and rural operators, making year-round business planning difficult. Many facilities remain underutilized during off-seasons, which affects cash flow and workforce retention. Seasonal pressure also causes overcrowding in popular natural destinations during peak months, harming ecosystems, while lesser-known regions struggle to attract sufficient visitors despite having strong nature-based tourism potential.

Shortage of Skilled Workforce and Quality Standards

Ecotourism requires trained staff with knowledge of local biodiversity, conservation practices, and responsible tourism management. However, many regions face shortages of skilled guides, hospitality workers, and environmental specialists. This affects service quality and reduces the educational value of ecotourism experiences. Inconsistent standards across operators also create uneven customer experiences, which can damage destination reputation. Limited access to professional training programs in rural areas further constrains talent availability and sector growth.

Environmental Pressure and Risk of Over-Tourism

While ecotourism promotes conservation, poor visitor management can unintentionally degrade natural sites. Increased footfall in forests, coastal zones, and parks causes habitat disturbance, waste accumulation, and water stress. Without strict controls, ecotourism may replicate mass tourism problems in fragile regions. Climate change also increases risks, such as wildfires, droughts, and habitat loss, limiting destination reliability. These environmental pressures demand better regulation and conservation funding to protect long-term sustainability.

Competitive Landscape:

The Spain ecotourism market features a collaborative competitive environment where specialized tour operators, certified eco-accommodations, regional tourism agencies, and conservation foundations work together to deliver sustainable experiences. Market participants differentiate through environmental certifications, exclusive access to protected natural areas, and partnerships with conservation programs that enhance experience authenticity. Competition increasingly centers on demonstrating measurable sustainability outcomes, with operators investing in carbon offset programs, local community development initiatives, and wildlife conservation contributions that appeal to environmentally conscious travelers seeking verified responsible tourism options.

Recent Developments:

- In October 2025, Barcelona-Catalonia held GEF2025, the Global Ecotourism Forum, focused on discussing and co-developing a global roadmap for ecotourism, leveraging Catalonia's experience in hosting significant sustainability events and its network of protected natural spaces, which encompassed 32% of its land.

- In August 2025, Green Spain introduced its new brand La Reserva Ecoturista, paving the way for slow, sustainable travel in Europe with a newly launched digital platform that provided a catalogue of 118 ecotourism experiences and travel packages spanning four northern autonomous communities, showcasing over 20,000 rural accommodations and more than 100 nature tourism firms.

Spain Ecotourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Generation X, Generation Y, Generation Z |

| Sales Channels Covered | Travel Agent, Direct |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain ecotourism market size was valued at USD 3,941.39 Million in 2025.

The Spain ecotourism market is expected to grow at a compound annual growth rate of 10.97% from 2026-2034 to reach USD 10,060.01 Million by 2034.

Group dominates the market with a share of 81.12%, driven by organized eco-tours, expert-guided nature excursions, cost-effective sustainable packages, and the growing demand for curated wildlife observation and cultural immersion experiences.

Key factors driving the Spain ecotourism market include substantial government investments, expansion of UNESCO Biosphere Reserves and protected area networks, rising environmental consciousness among millennial travelers, and the growing international recognition of Spain as a certified sustainable destination.

Major challenges include managing overtourism pressures in popular destinations, achieving year-round visitor distribution beyond peak seasons, balancing tourism growth with community well-being, maintaining authentic experiences amid increasing commercialization, and ensuring equitable benefit distribution to local communities in protected natural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)