Spain Furniture Market Size, Share, Trends and Forecast by Material, Distribution Channel, End Use, and Region, 2026-2034

Spain Furniture Market Summary:

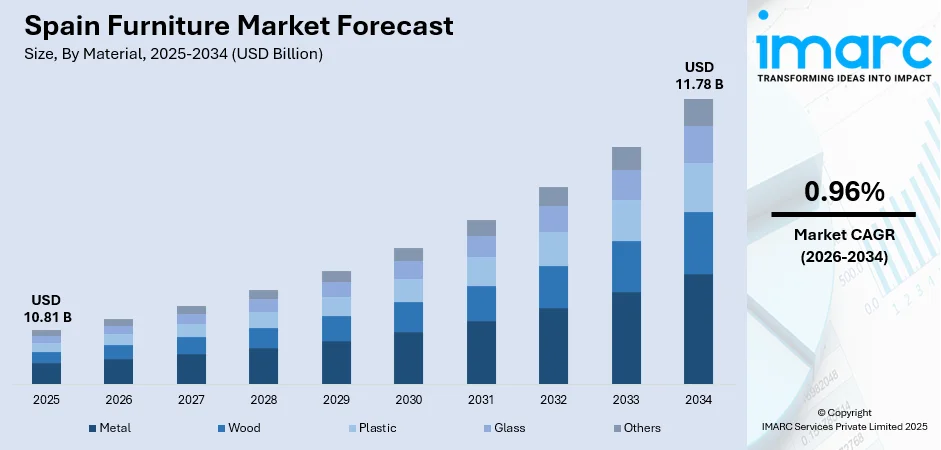

The Spain furniture market size was valued at USD 10.81 Billion in 2025 and is projected to reach USD 11.78 Billion by 2034, growing at a compound annual growth rate of 0.96% from 2026-2034.

The Spain furniture market is experiencing measured growth, driven by residential renovation activities, expanding hospitality sector investments, and evolving consumer preferences for sustainable and space-efficient designs. Market expansion is supported by increasing urbanization and rising household disposable incomes, which collectively generate consistent demand. The combination of traditional Spanish craftsmanship heritage with modern manufacturing capabilities positions domestic manufacturers competitively within the broader European furniture landscape, contributing to the Spain furniture market share.

Key Takeaways and Insights:

- By Material: Wood dominates the market with a share of 59.82% in 2025, driven by Valencia's centuries-old carpentry cluster, consumer affinity for natural finishes, and the growing demand for FSC-certified sustainable timber products.

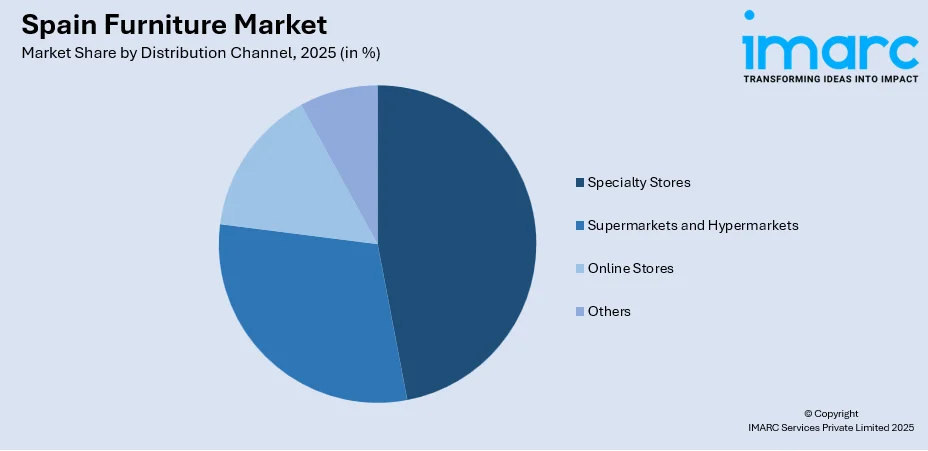

- By Distribution Channel: Specialty stores lead the market with a share of 46.54% in 2025. This dominance is driven by consumers' preference for tactile product inspection before large-ticket purchases, personalized customer service, and curated product assortments that differentiate specialty retailers from mass-market alternatives.

- By End Use: Residential represents the largest segment with a market share of 70.61% in 2025, owing to ongoing home renovation activities, replacement purchasing cycles, and Spanish households' cultural investments in living-space aesthetics that drive whole-room refurnishing demand.

- Key Players: Key players drive the market through product innovations, competitive pricing, strong retail networks, and digital sales channels. They invest in design trends, sustainable materials, and branding, while expanding online platforms and partnerships to reach wider domestic and international customer segments.

To get more information on this market Request Sample

The market demonstrates resilience through diversified demand channels spanning residential, hospitality, and contract furniture segments. Rising housing starts and renovation approvals create substantial pipelines that translate into furniture purchasing activity. In March 2025, LandCo and Patron Capital unveiled five housing projects in Spain. The initiatives are included in the firms' collaborative strategy to create 1,350 residences and achieve a revenue of €475 million within five years. Spanish furniture manufacturers continue to leverage their reputation for quality craftsmanship and design innovation to maintain export competitiveness, with international sales demonstrating the sector's appeal in European and global markets. Sustainability trends are encouraging preference for eco-friendly materials, boosting the demand for responsibly sourced wood and recyclable products. The expanding real estate rental market is also driving bulk purchases from developers and landlords. Innovations in design, along with customization options, are enhancing consumer interest in locally manufactured furniture.

Spain Furniture Market Trends:

Growing Emphasis on Sustainability and Circular Design

Spanish furniture manufacturers are increasingly adopting circular economy principles and sustainable production methods to address changing consumer demands and compliance obligations. In November 2025, Brosh commenced significant residential initiative in Estepona with €125 Million funding. The Brosh project in Estepona was conceived as a benchmark for sustainable urban growth. Particular emphasis was placed on seamlessly incorporating new structures into the natural surroundings and rehabilitating the banks of nearby waterways. Domestic producers are responding by incorporating Forest Stewardship Council (FSC)-certified wood, recycled materials, and modular designs that facilitate repair and recyclability, positioning sustainable credentials as competitive differentiators in both domestic and export markets.

Expansion of Retail Networks

Furniture retailers are aggressively expanding their Spanish footprints, intensifying price competition while broadening consumer access to minimalist, space-efficient designs. As per IMARC Group, the Spain retail market size reached USD 310.4 Billion in 2024. Major Scandinavian chains are opening multiple new stores annually across Spain, targeting nationwide network expansion over the coming years. This expansion reflects consumer preferences for value-oriented Scandinavian aesthetics suited to shrinking average household sizes, compelling domestic manufacturers to blend traditional Spanish craftsmanship with Nordic design sensibilities to defend market positions.

Changing Lifestyles and Interior Design Preferences

Shifting lifestyles, remote working trends, and rising interest in home décor are influencing furniture purchase decisions. As per survey by Eurofound, Spain is a country progressing towards remote work, with 1 in 5 job postings providing remote or hybrid options, as of August 2025. Consumers are investing in ergonomic furniture, home office setups, and multifunctional storage solutions. Modern designs, minimalist styles, and personalized interiors are gaining popularity, especially among younger buyers. The growing influence of social media and design platforms is inspiring frequent upgrades and experimentation with home aesthetics. These evolving preferences are driving steady replacement cycles and premium furniture adoption.

Market Outlook 2026-2034:

The market expansion is underpinned by sustained residential renovation activities. The hospitality sector presents additional growth opportunities, as the tourism industry drives hotel refurbishment investments across coastal regions and major urban centers. The market generated a revenue of USD 10.81 Billion in 2025 and is projected to reach a revenue of USD 11.78 Billion by 2034, growing at a compound annual growth rate of 0.96% from 2026-2034. Regulatory developments will reshape competitive dynamics, favoring manufacturers capable of demonstrating sustainable sourcing and circular design principles while maintaining affordability for price-sensitive consumer segments.

Spain Furniture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Material | Wood | 59.82% |

| Distribution Channel | Specialty Stores | 46.54% |

| End Use | Residential | 70.61% |

Material Insights:

- Metal

- Wood

- Plastic

- Glass

- Others

Wood dominates with a market share of 59.82% of the total Spain furniture market in 2025.

The wood segment maintains commanding market leadership, anchored by Spain's rich woodworking heritage and established manufacturing clusters concentrated in the Valencian Community. Spanish consumers demonstrate strong preference for natural wood finishes that convey warmth, authenticity, and durability, driving consistent demand across residential furniture categories, including bedroom sets, dining furniture, and storage solutions. The Spanish forest-based sector, encompassing forest owners, forestry operations, pulp and paper production, and wood processing industries, represents a significant contributor to the national economy with substantial annual turnover and employment across thousands of enterprises. This integrated supply chain enables manufacturers to source sustainably certified timber while maintaining competitive production costs.

The segment benefits from the growing consumer awareness about environmental considerations that favor renewable materials over synthetic alternatives. Manufacturers are responding to sustainability demands by expanding FSC-certified product offerings and incorporating recycled wood content into particleboard and composite materials used in cabinetry and shelving applications. Additionally, premium wood furniture commands higher margins in the market, with affluent consumers in Madrid, Barcelona, and coastal resort areas demonstrating willingness to invest in artisan craftsmanship and bespoke wooden furniture pieces.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Specialty stores lead with a share of 46.54% of the total Spain furniture market in 2025.

Specialty stores maintain distribution leadership through differentiated shopping experiences that emphasize product expertise, curated assortments, and personalized customer service. These retailers cater to consumers seeking professional guidance on space planning, material selection, and design coordination that mass-market alternatives cannot readily provide. The segment benefits from Spanish consumers' preference for tactile product evaluation before committing to significant furniture purchases, with showroom environments enabling customers to assess comfort, quality, and aesthetic fit within planned living spaces.

Specialty retailers are adapting to competitive pressures by integrating digital capabilities, including virtual design consultations, augmented reality (AR) room visualization, and seamless omnichannel fulfillment options. Leading trade fairs are emphasizing the contract sector alongside traditional home furniture offerings, particularly items deployed in refurbishing hotels and hospitality facilities. Leading specialty chains are also expanding contract furniture services targeting hospitality and commercial clients, leveraging showroom infrastructure to demonstrate product durability and design versatility for professional applications.

End Use Insights:

- Residential

- Commercial

Residential exhibits a clear dominance with a 70.61% share of the total Spain furniture market in 2025.

The residential segment dominates market demand, reflecting Spanish households' cultural emphasis on creating comfortable, aesthetically pleasing living environments and increasing investments in real estate. As per IMARC Group, the Spain residential real estate market is set to attain USD 309.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.24% during 2025-2033. Ongoing home renovation activities are driving replacement purchasing across furniture categories as homeowners upgrade interiors to enhance functionality and visual appeal. Housing starts and renovation approvals have increased significantly, with new residential dwelling approvals exceeding new household formation. This renovation momentum translates directly into furniture demand, as homeowners typically undertake whole-room refurnishing rather than piecemeal replacement.

Urban apartments increasingly require space-optimizing furniture solutions, including modular storage systems, expandable dining tables, and multifunctional pieces that maximize utility within compact living areas. Design is evolving toward multifunctional, versatile and modular furniture as a consequence of the flexibility required in modern living spaces. Consumer preferences are shifting towards contemporary designs that balance aesthetic aspirations with practical functionality, driving the demand for customizable configurations that adapt to evolving household needs.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain benefits from strong industrial manufacturing bases and higher household incomes in the Basque Country and Navarra regions, supporting premium furniture consumption. The region demonstrates consistent demand for quality residential and office furniture aligned with professional employment concentrations in urban centers.

Eastern Spain leads national furniture manufacturing and exports, with Catalonia and the Valencian Community accounting for dominant production capacity and design innovation. Barcelona serves as a major design hub, attracting both domestic and international furniture brands.

Southern Spain presents accelerating growth opportunities, driven by tourism-related hospitality investments along coastal regions, including Andalusia. Hotel renovation projects and vacation rental property furnishing create consistent commercial furniture demand while expanding residential construction supports household furniture consumption.

In Central Spain, the market is driven by substantial purchasing power and diverse demand across residential, commercial, and hospitality segments. The capital region attracts headquarters of major retailers and serves as a distribution hub for national furniture logistics networks.

Market Dynamics:

Growth Drivers:

Why is the Spain Furniture Market Growing?

Sustained Residential Construction and Renovation Activities

The Spanish residential sector demonstrates robust construction and renovation momentum that directly translates into furniture purchasing demand. As per IMARC Group, the Spain construction market size reached USD 110.0 Billion in 2024. Housing starts and renovation approvals have rebounded strongly, creating substantial pipelines for furniture consumption. Home sales volume has increased significantly year-over-year, indicating healthy household formation and property turnover that typically accompanies furniture replacement and new purchasing. Rising house prices encourage homeowner investment in interior upgrades that enhance property values, while rental market expansion drives landlord furniture procurement for newly leased units. The combination of new construction completions and renovation activities is creating diversified demand streams that support furniture market stability.

Increasing Tourism Activities

The growing tourism activities are fueling the market expansion in Spain. As per Trading Economics, in October 2025, Spain welcomed 9.2 Million foreign tourists, an increase of 3.2% compared to October 2024. International tourist arrivals have recovered to record levels, restoring the cash flow hotels need for property refurbishments. Tourism services enable hospitality chains to accelerate multi-million-euro renovations that absorb contract-grade furniture across accommodation, dining, and leisure facilities. The Balearic and Canary Islands present concentrated demand where replacement cycles run every few years for vacation rental properties, considerably faster than residential averages. Suppliers achieve higher margins on hospitality orders since buyers value durability and consistent aesthetics more than minimizing costs.

E-Commerce Channel Expansion and Digital Integration

Digital commerce adoption is accelerating furniture retail transformation, expanding consumer access while enabling retailers to optimize operations through data-driven inventory management and personalized marketing. As per data from the Spanish CNMCData portal, in Spain, e-commerce revenue rose by 13.1% in 2025, compared to 2024. Online channels particularly benefit younger demographics comfortable with virtual product visualization and home delivery logistics. Traditional retailers are investing in omnichannel capabilities that integrate digital discovery with showroom experiences, recognizing that online research precedes most physical store visits for furniture purchases. This channel evolution is expanding the market reach while reducing barriers to furniture shopping for time-constrained consumers.

Market Restraints:

What Challenges is the Spain Furniture Market Facing?

Raw Material Price Volatility and Supply Chain Pressures

Spanish furniture manufacturers face persistent margin pressure from fluctuating raw material costs that complicate production planning and pricing strategies. Wood, metal, and petroleum-derived materials experience significant price volatility driven by global supply-demand imbalances and logistics disruptions. Smaller workshops lacking purchasing scale bear disproportionate burden from input cost increases that larger retailers can buffer through global procurement contracts and negotiated supplier terms.

Intensifying Competition from International Retailers

The Spanish furniture market is facing increasing competitive pressure from well-capitalized international retailers that leverage global supply chains, standardized products, and aggressive pricing strategies to capture market share. Nordic furniture chains and e-commerce platforms challenge domestic manufacturers and traditional specialty retailers through value-oriented positioning that appeals to price-sensitive consumers seeking contemporary designs at accessible price points.

Regulatory Compliance Costs for Sustainability Requirements

Evolving European Union sustainability regulations impose documentation, certification, and product design requirements that increase compliance costs, particularly for smaller manufacturers. Meeting recyclability, recycled content, and product passport requirements demands investments in supply chain traceability systems and manufacturing process modifications that strain limited resources.

Competitive Landscape:

The Spain furniture market competitive landscape reflects diverse positioning across the value, mid-range, and premium segments served by international retailers, domestic manufacturers, and specialty distributors. Market leaders leverage established distribution networks, brand recognition, and purchasing scale to maintain competitive positions while differentiated players focus on design innovation, sustainability credentials, and customer service excellence. The competitive landscape is marked by continual consolidation as larger players acquire regional specialists and expand multi-format retail strategies spanning physical showrooms, e-commerce platforms, and contract furniture services. Success factors increasingly emphasize omnichannel integration, sustainable product development, and operational efficiency that enables competitive pricing without sacrificing quality standards expected by Spanish consumers.

Recent Developments:

- In November 2025, Inditex’s flagship brand launched its new store in Spain. The area was arranged into separate sections similar to rooms in a house, featuring a central lounge designed like a living room, complete with a wall-length bookshelf and a spacious freestanding couch. The furniture, designed by Zara Home in partnership with Van Duysen, was made from materials like wood, metal, and diverse textures, and could be bought.

Spain Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Metal, Wood, Plastic, Glass, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain furniture market size was valued at USD 10.81 Billion in 2025.

The Spain furniture market is expected to grow at a compound annual growth rate of 0.96% from 2026-2034 to reach USD 11.78 Billion by 2034.

Wood holds the largest material segment with a market share of 59.82%, driven by rising consumer preferences for natural finishes and the growing demand for FSC-certified sustainable timber products.

Key factors driving the Spain furniture market include sustained residential construction and renovation activities, tourism sector recovery, expanding e-commerce adoption enabling broader consumer access, and the growing consumer preferences for sustainable and space-efficient furniture designs.

Major challenges include raw material price volatility affecting production costs and margins, intensifying competition from international retailers leveraging global supply chains, regulatory compliance costs associated with upcoming EU Ecodesign requirements, logistics cost increases impacting distribution networks, and economic uncertainties influencing consumer discretionary spending patterns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)