Spain Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2026-2034

Spain Gaming Market Summary:

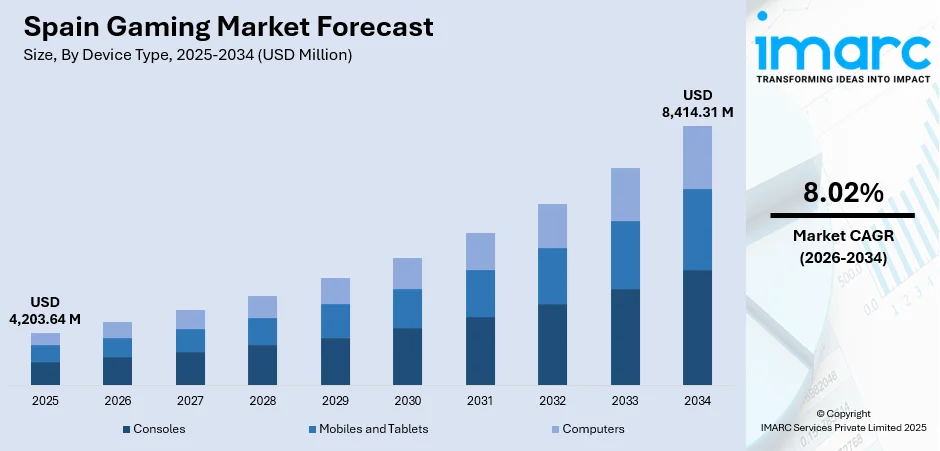

The Spain gaming market size was valued at USD 4,203.64 Million in 2025 and is expected to reach USD 8,414.31 Million by 2034, growing at a compound annual growth rate of 8.02% from 2026-2034.

The market is experiencing robust expansion, driven by widespread smartphone adoption, advanced telecommunications infrastructure, and the growing consumer demand for interactive entertainment experiences. The increasing popularity of mobile gaming platforms, coupled with a thriving esports ecosystem, continues to attract both domestic and international investments. Rising consumer interest in immersive virtual reality and augmented reality technologies further enhances engagement, while evolving monetization strategies through in-game purchases sustain revenue growth across the Spain gaming market share.

Key Takeaways and Insights:

- By Device Type: Mobiles and tablets dominate the market with a share of 51.42% in 2025, driven by extensive smartphone penetration across all demographics, affordable high-speed internet connectivity, and the accessibility of free-to-play gaming applications optimized for portable devices.

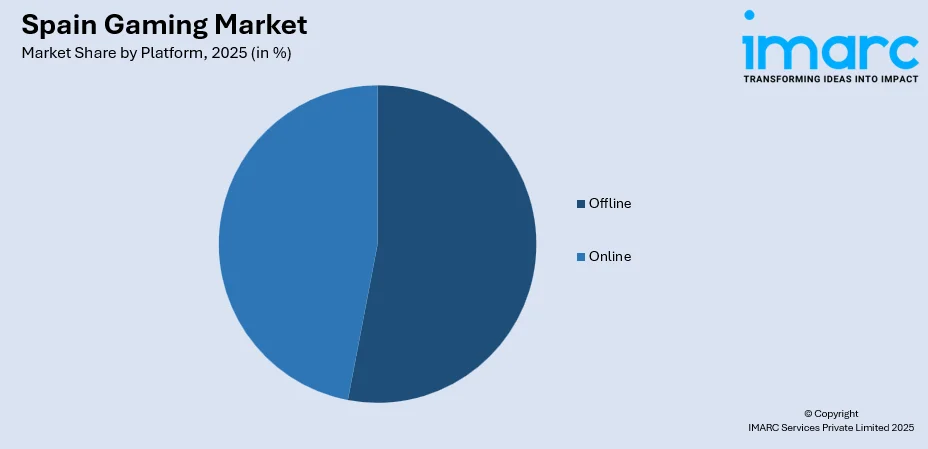

- By Platform: Offline leads the market with a share of 53.6% in 2025, owing to the established console gaming culture among Spanish households, preference for physical game ownership among dedicated gamers, and traditional retail distribution networks.

- By Revenue Type: In-game purchase represents the largest segment with a market share of 63.45% in 2025, driven by the prevalence of free-to-play gaming models offering cosmetic items, virtual currencies, and character enhancements that appeal to engaged players.

- By Type: Adventure/role playing games prevail the market with a share of 41.18% in 2025, fueled by Spanish consumers' preference for narrative-driven experiences, character progression systems, and immersive world-building elements.

- By Age Group: Adults comprise the largest segment with a market share of 75.14% in 2025, reflecting mature consumer spending power, growing acceptance of gaming as mainstream entertainment, and higher disposable income enabling premium content purchases.

- Key Players: The Spain gaming market exhibits a competitive landscape, characterized by established multinational gaming corporations alongside emerging local development studios, with competition intensifying across mobile gaming, console distribution, and esports sectors.

To get more information on this market Request Sample

The Spain gaming industry has evolved into a significant economic force, positioning the country as one of the largest gaming markets in Europe. The esports sector secured high investments, with funding attracting substantial international stakeholder interest. Smartphone gaming has become particularly prevalent, with mobile devices serving as the primary gaming platform across all age demographics, supported by high-quality telecommunications infrastructure and widespread connectivity. Spain boasts an exceptionally high smartphone usage rate in 2025, with almost 90% of the population actively using them. Game subscriptions, in-app purchases, and downloadable content are strengthening revenue streams. Local developers are gaining visibility through global platforms, encouraging innovation and partnerships. Improved payment systems and digital wallets are making online purchases easier and safer for users.

Spain Gaming Market Trends:

Expansion of Cloud Gaming Infrastructure

Cloud gaming platforms are gaining substantial traction across Spain, enabling gamers to access high-quality gaming experiences without requiring expensive hardware investments. The advancement of telecommunications infrastructure, including 5G connectivity, supports seamless streaming capabilities, allowing players to enjoy graphically demanding titles across multiple devices. As of mid-2024, 5G mobile networks reached 96% of the Spanish population, reflecting an increase of more than 3.5 percentage points from 2023, as stated in a government report on national connectivity. This technological progression democratizes access to premium gaming content, particularly appealing to casual players seeking flexibility and reducing barriers associated with traditional console or personal computer gaming requirements.

Integration of Immersive Technologies

Virtual reality (VR) and augmented reality (AR) technologies are transforming gaming experiences throughout Spain, with enhanced consumer interest in immersive entertainment driving adoption rates upward. Developers are increasingly incorporating spatial computing elements into gaming applications, developing immersive spaces that merge digital elements with real-world settings. The accessibility of standalone headsets and mobile-based AR applications has expanded the potential audience, making immersive gaming experiences available beyond traditional enthusiast communities.

Rise of Social and Competitive Gaming

Multiplayer gaming experiences emphasizing social interaction and competitive elements are flourishing within the Spanish market. The growing popularity of esports tournaments and online streaming platforms has cultivated vibrant gaming communities, with players increasingly valuing shared experiences over solitary gameplay. In October 2025, the Federation of Call of Duty (FECOD), established in Spain, revealed a collaboration with the esports tournament platform Torneum. Consequently, the two parties would work together to create a Call of Duty esports circuit that would take place throughout the Call of Duty: Black Ops 7 season. This trend has spurred investments in gaming infrastructure supporting large-scale events while encouraging development of titles designed around collaborative gameplay mechanics.

Market Outlook 2026-2034:

Mobile and tablet gaming will continue to dominate device preferences as smartphone technology advances, while in-game monetization strategies become increasingly sophisticated. The market generated a revenue of USD 4,203.64 Million in 2025 and is projected to reach a revenue of USD 8,414.31 Million by 2034, growing at a compound annual growth rate of 8.02% from 2026-2034. The assimilation of artificial intelligence (AI) and immersive technologies promises enhanced gameplay experiences, with subscription-based gaming services gaining momentum alongside traditional purchase models. Regional development hubs will attract continued international investments.

Spain Gaming Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Device Type | Mobiles and Tablets | 51.42% |

| Platform | Offline | 53.6% |

| Revenue Type | In-Game Purchase | 63.45% |

| Type | Adventure/Role Playing Games | 41.18% |

| Age Group | Adults | 75.14% |

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

Mobiles and tablets dominate with a market share of 51.42% of the total Spain gaming market in 2025.

The mobile and tablet gaming segment has emerged as the cornerstone of Spain's gaming industry, driven by exceptional smartphone penetration rates that enable gaming accessibility across all demographic groups. In 2023, the daily duration spent on smartphones in Spain was 3.64 hours. Spanish consumers increasingly favor gaming applications optimized for portable devices, appreciating the convenience of entertainment access during commutes, leisure periods, and daily activities.

The proliferation of affordable data plans and widespread connectivity ensures uninterrupted gaming experiences, while app store ecosystems provide immediate access to expansive gaming libraries. The segment's dominance reflects fundamental shifts in gaming consumption patterns, with casual and mid-core gaming experiences particularly suited to mobile platforms. Free-to-play gaming models thrive within this environment, offering low-barrier entry while generating substantial revenue through optional purchases.

Platform Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads with a share of 53.6% of the total Spain gaming market in 2025.

The offline gaming segment maintains substantial market presence through established console gaming ecosystems and physical game distribution networks that have cultivated loyal consumer bases across Spain. Console manufacturers continue to deliver compelling exclusive titles and hardware innovations that attract dedicated gaming enthusiasts who prioritize performance, graphical fidelity, and immersive experiences achievable through dedicated gaming equipment. Spanish households demonstrate strong console ownership rates, with gaming systems serving as entertainment centerpieces for family and social gatherings.

Physical retail channels remain influential within Spain's gaming landscape, with specialized electronics retailers and gaming-focused stores maintaining significant distribution presence. Spanish consumers often prefer tangible game ownership, appreciating collector value and the ability to resell or trade physical media. The segment benefits from robust pre-order cultures surrounding major game releases and seasonal purchasing patterns concentrated around holiday periods.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

In-game purchase exhibits a clear dominance with a 63.45% share of the total Spain gaming market in 2025.

The in-game purchase segment has become the primary revenue driver within Spain's gaming ecosystem, reflecting global monetization trends that prioritize ongoing player engagement over one-time transactions. Spanish gamers demonstrate willingness to invest in virtual goods and gameplay enhancements that personalize their gaming experiences or accelerate progression. Free-to-play gaming models have normalized microtransactions across all demographic segments, with mobile gaming platforms particularly effective at converting engaged players into paying customers.

The segment's growth trajectory reflects increasingly sophisticated monetization strategies employed by developers who balance revenue generation with player satisfaction. Subscription services, season passes, and battle passes provide recurring revenue streams while delivering continuous content updates that maintain player engagement. Spanish players respond favorably to limited-time offers and exclusive content, with monetization conversion rates demonstrating healthy engagement levels across popular gaming titles.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

Adventure/role playing games represent the leading segment with a 41.18% share of the total Spain gaming market in 2025.

Adventure and role-playing games have captured the largest share of Spanish gaming preferences, appealing to consumers who value narrative depth, character development, and immersive world-building elements. Spanish players demonstrate particular affinity for games offering extended gameplay experiences with meaningful progression systems that reward investment of time and skill. The genre's emphasis on storytelling resonates with cultural appreciation for engaging narratives, while character customization options enable personal expression within virtual environments.

The segment benefits from strong representation across all gaming platforms, with console releases, mobile adaptations, and computer versions addressing diverse consumer preferences. Spanish developers have contributed notable titles within the adventure and role-playing genre, leveraging local mythology and cultural elements to create distinctive gaming experiences. The genre's popularity extends across age demographics, with adult players representing the primary consumer base for premium titles offering extensive gameplay content.

Age Group Insights:

- Adults

- Children

Adults comprise the largest segment with a 75.14% share of the total Spain gaming market in 2025.

The adult demographic represents the overwhelming majority of Spain's gaming market revenue, reflecting the maturation of gaming as mainstream entertainment embraced across age brackets previously associated with non-gaming populations. Spanish adults aged between twenty-five and fifty-four demonstrate consistent gaming engagement, with many having grown alongside the gaming industry and maintained lifelong entertainment preferences. Higher disposable incomes enable significant spending on premium content, gaming hardware, and subscription services that enhance overall experiences. As per Trading Economics, in Spain, disposable personal income rose to 416,443 EUR Million in the second quarter of 2025, up from 396,086 EUR Million in the first quarter of 2025.

Gaming has evolved beyond youthful entertainment within Spanish society, with adults increasingly recognizing interactive entertainment as valuable relaxation, social connection, and cognitive engagement activities. Adult gamers demonstrate preferences for convenience-oriented gaming experiences compatible with professional responsibilities and family commitments, driving the demand for mobile gaming applications and time-flexible gaming formats. The segment's spending patterns influence industry development priorities, with publishers tailoring content strategies to address mature consumer preferences.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain demonstrates growing gaming engagement through expanding esports communities and improving digital infrastructure connectivity. The region contributes to Spain's gaming ecosystem through regional tournaments and emerging development talent cultivated by educational institutions offering gaming-related programs.

Eastern Spain, anchored by Barcelona's thriving gaming hub, holds prominence by hosting international development studios, generating substantial revenue, and employing a major portion of the country's gaming workforce. The region's concentration of talent attracts continued multinational investment.

Southern Spain presents emerging opportunities through tourism-linked gaming initiatives and regional government partnerships promoting the gaming sector. The region has partnered with esports organizations and gaming companies to leverage gaming's cultural appeal for regional promotion and economic development.

Central Spain, centered around Madrid, maintains significant gaming presence through established development studios, gaming media operations, and growing esports infrastructure. The capital region attracts gaming industry headquarters and serves as a key distribution hub for physical gaming products.

Market Dynamics:

Growth Drivers:

Why is the Spain Gaming Market Growing?

Widespread Smartphone Adoption and Connectivity

Spain's exceptional smartphone and internet penetration rates create fertile conditions for gaming industry expansion, with mobile devices becoming universal gaming platforms accessible to virtually all population segments. As per DataReportal, at the beginning of 2025, 46.2 Million people in Spain accessed the internet, with online penetration reaching 96.4%. Advanced telecommunications infrastructure supports seamless gaming experiences through reliable connectivity enabling multiplayer gaming, content streaming, and in-game purchases without technical interruption. Spanish telecommunications providers continue to expand network capabilities, including next-generation connectivity that enhances gaming performance and enables cloud gaming services. The affordability of mobile gaming compared to dedicated gaming hardware reduces entry barriers, encouraging participation from demographics previously underrepresented within gaming communities.

Strong Influence of Social Media and Streaming Communities

Social media platforms and streaming sites significantly drive interest and engagement in the Spain gaming market. According to statcounter, as of November 2025, 88.3% of the population in Spain was using Facebook, a well-known social media platform. Influencers showcase gameplay, strategies, and reviews, guiding audience preferences. Viral gaming content promotes new releases instantly. Viewers often convert into players after watching streams. Interactive chat features strengthen community bonds. Developers use influencers for marketing campaigns, product launches, and promotions. This digital exposure reduces marketing costs while increasing trust. Gamers interact directly with creators, forming emotional connections with brands. Online communities encourage modding, fan content, and user-driven growth. Advertisers also sponsor influential creators, opening new revenue channels. Seasonal events and collaborations generate excitement among fans. Content creation shortens product adoption cycles and builds hype before releases. Player loyalty increases through constant engagement. Streaming culture transforms gaming into daily digital entertainment, sustaining high growth potential.

Youth-Driven Demand and Changing Entertainment Habits

Youth-driven demand and changing entertainment habits are major forces accelerating the market expansion. Younger consumers increasingly prefer interactive and on-demand entertainment over traditional television and cinema, making gaming a primary leisure activity. Mobile games, online multiplayer titles, and esports attract students and young professionals due to their accessibility and social interaction features. Gaming is also becoming a key channel for communication, where players connect with friends and build online communities. Social media and streaming influence game discovery and trend adoption among youth, driving rapid popularity of new releases. In-game purchases and customization appeal to personal expression, encouraging spending. Educational and creative games further expand interest beyond pure entertainment. As digital-native generations grow, their long-term loyalty and expanding spending power ensure sustainable growth, transforming gaming from a hobby into a mainstream entertainment industry in Spain.

Market Restraints:

What Challenges the Spain Gaming Market is Facing?

Regulatory Complexities and Compliance Requirements

In Spain, the gaming industry navigates complex regulatory environments governing online gaming, gambling elements, and consumer protection requirements that create compliance burdens for market participants. Legislation imposes requirements around deposit tracking and player protection measures that increase operational complexity, particularly for companies operating across multiple jurisdictions within Spain's autonomous regional structure.

Intense Competitive Pressures

The market faces heightened competition as international gaming corporations expand their presence alongside emerging domestic studios competing for consumer attention and market share. Market saturation within certain gaming categories challenges profitability, particularly for independent developers lacking resources to compete with heavily marketed international releases.

Economic Sensitivity and Consumer Spending Patterns

Gaming expenditure remains discretionary spending vulnerable to broader economic conditions affecting Spanish household budgets. Economic uncertainty can prompt consumers to reduce gaming-related spending on hardware, premium content, and in-game purchases, potentially constraining market growth during challenging economic periods.

Competitive Landscape:

The Spain gaming market demonstrates a diverse competitive environment, characterized by established multinational gaming corporations operating alongside innovative local development studios and emerging technology companies. The market structure reflects Spain's position as both significant consumer market and increasingly important development hub within the European gaming ecosystem. International publishers maintain substantial presence through localized distribution networks and Spanish-language content, while global technology companies have established development operations attracted by talent availability and supportive business environments. The competitive landscape continues to evolve as Barcelona-based studios achieve international recognition and acquisition interest from major gaming corporations. Competition intensifies across mobile gaming segments where numerous publishers compete for consumer engagement and monetization opportunities.

Recent Developments:

- In November 2025, Mondia, a prominent tech firm focused on digital experiences and mobile commerce, teamed up with Alsa, Spain’s top long-distance bus transport provider, to offer Getmo Games to travelers via its onboard entertainment platform. With this partnership, Alsa travelers could access two complimentary hours of gaming while on their journey by just signing up with an email and password, without having to provide any payment information.

Spain Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain gaming market size was valued at USD 4,203.64 Million in 2025.

The market is expected to grow at a compound annual growth rate of 8.02% from 2026-2034 to reach USD 8,414.31 Million by 2034.

Mobiles and tablets dominate the market with a 51.42% share, driven by exceptional smartphone penetration rates, affordable mobile gaming options, and convenient access to gaming content across all demographic segments.

Key factors driving the Spain gaming market include widespread smartphone adoption and advanced connectivity infrastructure, thriving esports ecosystem attracting substantial investment, growing consumer interest in immersive AR and VR technologies, and evolving monetization strategies through in-game purchases.

Major challenges include navigating complex regulatory requirements across autonomous regions, intensifying competition from international gaming corporations, economic sensitivity affecting discretionary consumer spending, market saturation within certain gaming categories, and maintaining engagement amid expanding entertainment alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)