Spain Glamping Market Size, Share, Trends and Forecast by Age Group, Accommodation Type, Booking Mode, and Region, 2026-2034

Spain Glamping Market Overview:

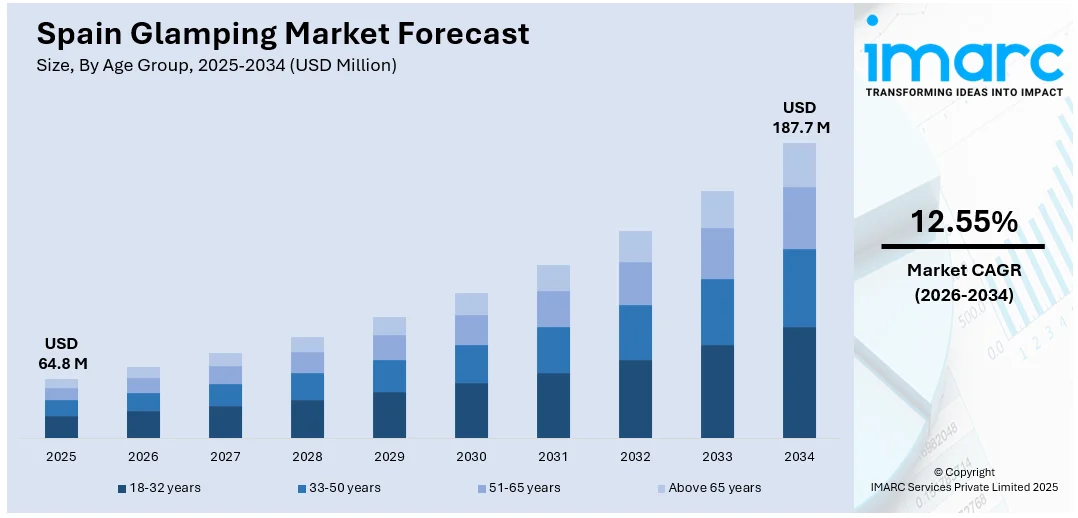

The Spain glamping market size reached USD 64.8 Million in 2025. The market is projected to reach USD 187.7 Million by 2034, exhibiting a growth rate (CAGR) of 12.55% during 2026-2034. The market is propelled by the increasing need for unique outdoor experiences with high comfort and sustainability. In addition to this, growing eco-consciousness and preference for nature-based stays are pushing operators to develop well-equipped sites with minimal environmental impact. Moreover, strong domestic tourism and the implementation of supportive government initiatives to promote rural and adventure travel further augment the Spain glamping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 64.8 Million |

| Market Forecast in 2034 | USD 187.7 Million |

| Market Growth Rate 2026-2034 | 12.55% |

Spain Glamping Market Trends:

Rising Preference for Eco-Friendly Accommodation

A notable trend shaping the market is the increasing emphasis on sustainability and eco-conscious travel. Tourists, especially millennials and younger families, now actively seek accommodation options that minimize environmental footprints without sacrificing comfort. Glamping operators are responding by integrating renewable energy solutions, using reclaimed materials for structures, and implementing zero-waste policies. Solar panels, composting toilets, and rainwater harvesting systems are becoming standard in many premium sites. For instance, in Benidorm, a coastal resort area along Spain’s Costa Blanca, water consumption has dropped by 18% even though the local population has grown by 40 percent over the past 25 years. In addition, some businesses collaborate with local conservation projects, giving guests opportunities to participate in activities that support biodiversity and ecosystem preservation. Furthermore, government investments in sustainable tourism practices and certifications helps properties demonstrate environmental compliance, which enhances brand value and consumer trust. For instance, in 2023, Spain initiated its third round of sustainable tourism projects, approving 175 programs aimed at advancing sustainability across the country. These efforts are supported by an investment of USD 527 Million (EUR 478 Million) from the NextGeneration EU funds. As urban travelers increasingly value green credentials when choosing getaways, the demand for eco-certified glamping sites is likely to strengthen, encouraging further innovations and investments in sustainable infrastructure. This trend is significantly contributing to the Spain glamping market growth.

To get more information on this market Request Sample

Growth of Domestic Tourism and Rural Regeneration

The market industry has benefited significantly from the rise in domestic travel, particularly during and after the pandemic, as residents sought safe, open-air alternatives close to home. As per industry reports, domestic travel has rebounded strongly, reaching 166.6 Million trips within Spain in 2023, marking a 7.3% increase compared to 2022. Moreover, remote working trends and extended weekends have encouraged families and young professionals to explore countryside destinations previously overlooked. In addition to this, regions like Asturias, Galicia, and Andalusia have emerged as popular spots for glamping due to their scenic landscapes, cultural richness, and relative seclusion. Also, local governments and rural councils support such ventures through funding and incentives aimed at revitalizing declining villages and promoting sustainable tourism. Glamping sites often repurpose abandoned agricultural land or underused estates, generating local employment and encouraging the preservation of traditional skills. By drawing visitors to rural communities, these projects help diversify regional economies and reduce urban-rural divides. As Spain’s domestic travelers continue to prioritize wellness, tranquility, and outdoor recreation, the glamping segment remains well-positioned to contribute to broader rural development goals and long-term tourism resilience.

Spain Glamping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on age group, accommodation type, and booking mode.

Age Group Insights:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 18-32 years, 33-50 years, 51-65 years, and above 65 years.

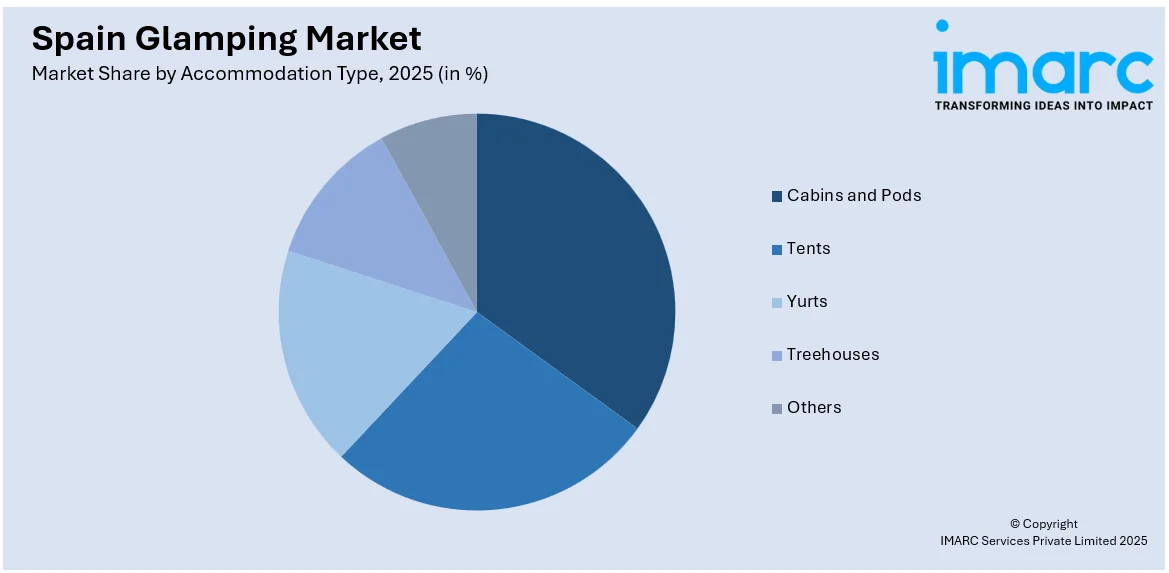

Accommodation Type Insights:

Access the comprehensive market breakdown Request Sample

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

A detailed breakup and analysis of the market based on the accommodation type have also been provided in the report. This includes cabins and pods, tents, yurts, treehouses, and others.

Booking Mode Insights:

- Direct Booking

- Travel Agents

- Online Travel Agencies

The report has provided a detailed breakup and analysis of the market based on the booking mode. This includes direct booking, travel agents, and online travel agencies.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Glamping Market News:

- On May 29, 2025, Elche’s town council granted environmental and construction approval for Las Lomas de Balsares, a new four‑star camping resort in the Balsares district. The development features 60 RV pitches, 48 cabins, 42 tent sites, three swimming pools, restaurants, sports zones, and support facilities designed to host up to 725 guests. Bringing together traditional camping, glamping, and RV amenities, Las Lomas de Balsares has been developed to strengthen the local tourism sector.

Spain Glamping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Accommodation Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Booking Modes Covered | Direct Booking, Travel Agents, Online Travel Agencies |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain glamping market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain glamping market on the basis of age group?

- What is the breakup of the Spain glamping market on the basis of accommodation type?

- What is the breakup of the Spain glamping market on the basis of booking mode?

- What is the breakup of the Spain glamping market on the basis of region?

- What are the various stages in the value chain of the Spain glamping market?

- What are the key driving factors and challenges in the Spain glamping market?

- What is the structure of the Spain glamping market and who are the key players?

- What is the degree of competition in the Spain glamping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain glamping market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain glamping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain glamping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)