Spain Grocery and Food Market Size, Share, Trends and Forecast by Product Category, Distribution Channel, Consumer Behavior, and Region, 2026-2034

Spain Grocery and Food Market Overview:

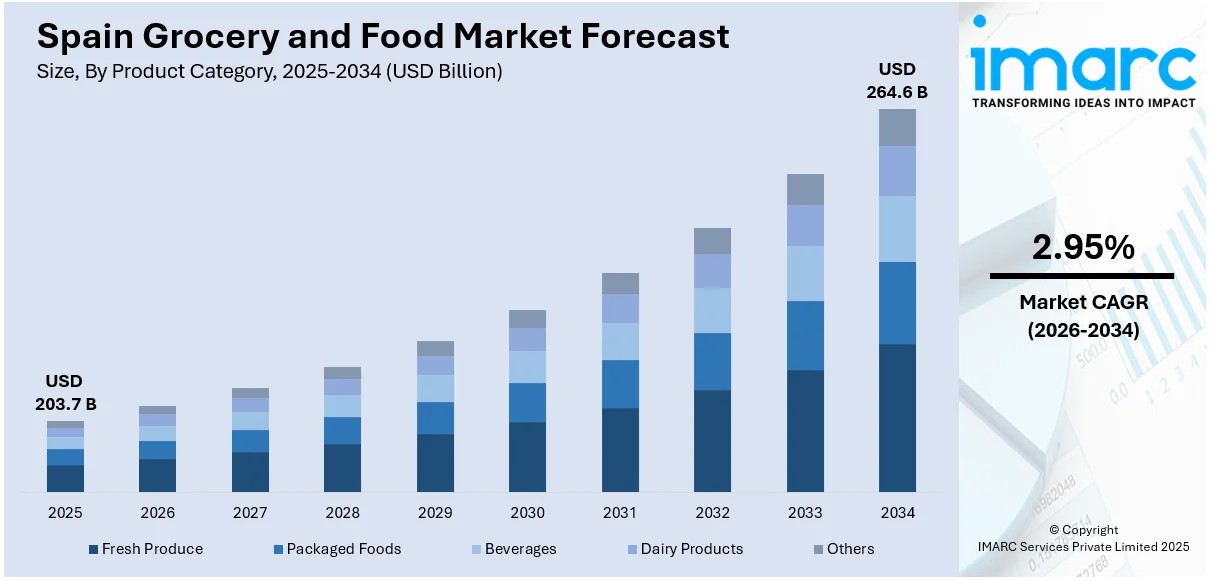

The Spain grocery and food market size reached USD 203.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 264.6 Billion by 2034, exhibiting a growth rate (CAGR) of 2.95% during 2026-2034. The market is growing due to rising demand for rapid delivery, automation in fulfillment, AI-driven supply chains, and sustainable packaging. Retailers are focusing on convenience, efficiency, and reducing waste to stay competitive and meet evolving consumer expectations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 203.7 Billion |

| Market Forecast in 2034 | USD 264.6 Billion |

| Market Growth Rate (2026-2034) | 2.95% |

Spain Grocery and Food Market Trends:

Automation Reshaping Grocery Fulfilment in Spain

Spain’s food retail sector is shifting towards large-scale automation to manage rising online demand and improve order processing. Alcampo’s collaboration with Ocado shows how retailers are moving beyond manual picking and embracing full automation for efficiency and scale. With more consumers turning to online grocery shopping, especially in urban regions like Madrid, retailers need infrastructure that supports fast, accurate, and cost-effective fulfillment. Automation helps reduce errors, cut labor costs, and handle large volumes with ease. In July 2024, Alcampo and Ocado launched Spain’s first automated Customer Fulfillment Centre (CFC) in Madrid. It features On-Grid Robotic Pick (OGRP) and Automated Frameload (AFL) technologies, handling up to 70,000 weekly orders. This development also integrates electric and hybrid delivery fleets, improving both performance and sustainability. Unlike traditional in-store picking systems, automated fulfillment centers process large orders with minimal delays and fewer human touchpoints. This trend is pushing Spain’s grocery market toward more centralized, tech-driven logistics models. It also allows retailers like Alcampo to stay competitive in the fast-growing e-commerce space by scaling operations quickly and delivering better customer experiences. As more retailers explore similar models, automated fulfillment is expected to become a standard across Spain’s grocery sector.

To get more information on this market Request Sample

AI Adoption Improving Supply Chain Precision

As inventory complexity grows in Spain’s grocery and food retail market, AI is becoming central to supply chain planning. Supermarket chains are adopting predictive tools to manage regional variations in demand, reduce stockouts, and cut waste—especially in the fresh category. By replacing manual planning with AI systems, retailers gain visibility across their networks and react faster to changing consumption patterns. In July 2024, UVESCO Group adopted RELEX Solutions’ AI-driven platform for supply chain optimization across its 331 stores and seven distribution centers. Known for BM Supermarkets and Super Amara, UVESCO is now using AI for forecasting, inventory control, and fresh product rotation, covering over 16,000 SKUs. The system helps balance inventory levels, reduce operational costs, and support store-level execution more accurately. This move reflects a growing trend where mid-to-large grocery retailers in Spain are moving away from fragmented systems toward unified planning platforms. AI tools also improve promotional planning by analyzing historical data and local behavior, giving supermarkets the ability to run targeted campaigns without overstocking. For UVESCO, it also supports their regional expansion strategy by making their operations more scalable and resilient. This shift is gradually improving service levels and reducing food waste across the country’s retail networks.

Spain Grocery and Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product category, distribution channel, and consumer behavior.

Product Category Insights:

- Fresh Produce

- Packaged Foods

- Beverages

- Dairy Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product category. This includes fresh produce, packaged foods, beverages, dairy products, and others.

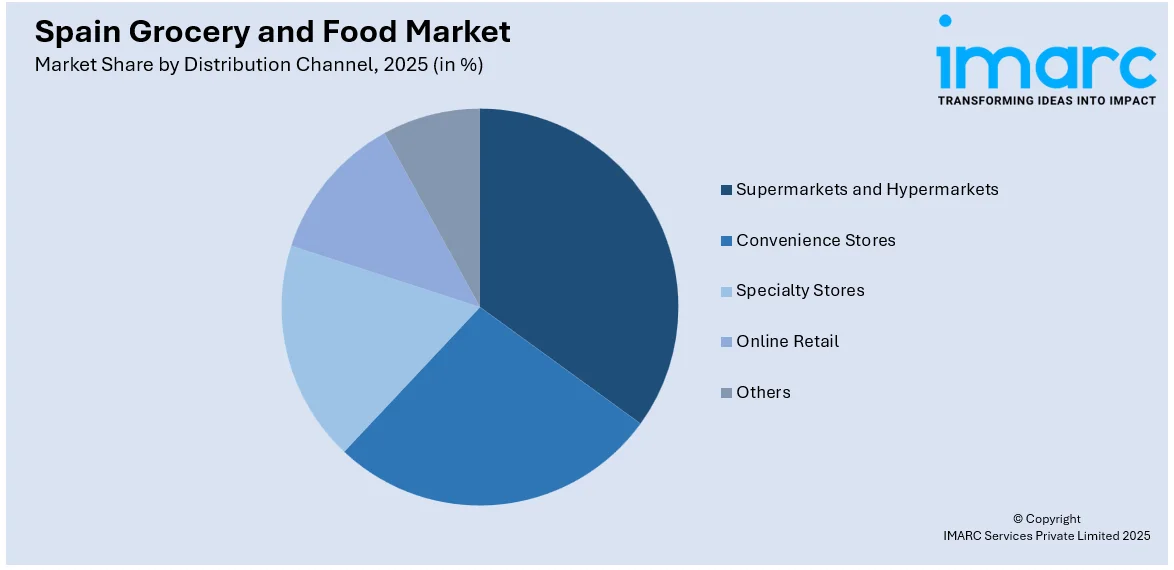

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online retail, and others.

Consumer Behavior Insights:

- Health-Conscious Consumers

- Price-Sensitive Consumers

- Convenience-Oriented Consumers

- Others

The report has provided a detailed breakup and analysis of the market based on the consumer behavior. This includes health-conscious consumers, price-sensitive consumers, convenience-oriented consumers, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Grocery and Food Market News:

- January 2025: Carrefour and Just Eat expanded rapid grocery delivery in Spain, offering over 4,500 products within 30 minutes. This strategic move strengthens omnichannel retail, improves convenience, and supports the fast-growing demand for quick commerce in Spain’s grocery and food sector.

- January 2025: Amazon Fresh began piloting bio-based, food-safe grocery bags in Valencia, Spain. Made from corn starch and vegetable oils by Novamont, the compostable bags reduce plastic use, support circular packaging, and promote sustainable practices in Spain’s grocery and food delivery industry.

Spain Grocery and Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Categories Covered | Fresh Produce, Packaged Foods, Beverages, Dairy Products, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others |

| Consumer Behaviors Covered | Health-Conscious Consumers, Price-Sensitive Consumers, Convenience-Oriented Consumers, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain grocery and food market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain grocery and food market on the basis of product category?

- What is the breakup of the Spain grocery and food market on the basis of distribution channel?

- What is the breakup of the Spain grocery and food market on the basis of consumer behavior?

- What are the various stages in the value chain of the Spain grocery and food market?

- What are the key driving factors and challenges in the Spain grocery and food market?

- What is the structure of the Spain grocery and food market and who are the key players?

- What is the degree of competition in the Spain grocery and food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain grocery and food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain grocery and food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain grocery and food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)