Spain Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region 2026-2034

Spain Meat Market Summary:

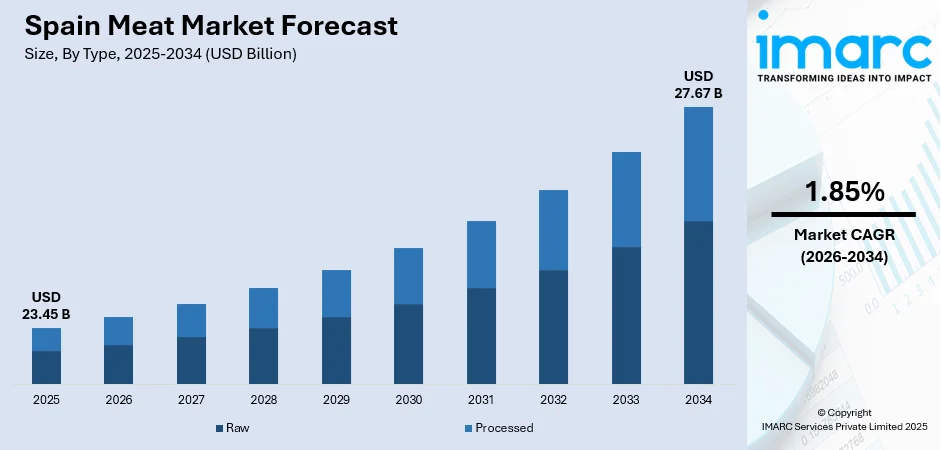

The Spain meat market size was valued at USD 23.45 Billion in 2025 and is projected to reach USD 27.67 Billion by 2034, growing at a compound annual growth rate of 1.85% from 2026-2034.

The Spain meat market is being driven by a combination of evolving consumer preferences, rising demand for protein-rich diets, and increasing awareness about quality and traceability in food products. Economic factors, such as disposable income growth and changing lifestyle patterns, are also influencing consumption. Additionally, supply chain improvements, technological advancements in processing, and sustainability concerns are shaping production and distribution. Health-conscious choices, along with regulatory standards and domestic production dynamics, further influencing market trends and growth prospects.

Key Takeaways and Insights:

- By Type: Raw dominates the market with a share of 70% in 2025, driven by strong consumer preference for fresh, unprocessed meat products aligned with traditional culinary practices emphasizing quality ingredients for home cooking and restaurant preparation.

- By Product: Pork leads the market with a share of 40% in 2025, owing to its cultural significance, versatility in cuisine, and relatively lower production costs compared to other meats, making it the most consumed and preferred option.

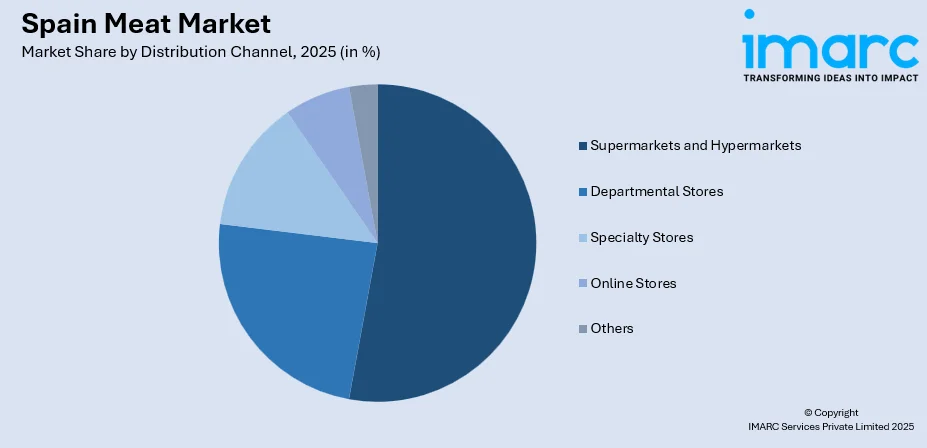

- By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 55% in 2025. This dominance is driven by comprehensive product assortments, competitive pricing strategies, modernized retail infrastructure, and convenient shopping experiences that appeal to Spanish consumers.

- Key Players: The Spain meat market exhibits moderate competitive intensity, with established family-owned enterprises competing alongside multinational corporations across diverse product categories and distribution channels, emphasizing quality, traceability, and regional authenticity.

To get more information on this market, Request Sample

The Spain meat market is being driven by several key factors, including increasing consumer demand for high-quality and premium meat products, driven by higher disposable incomes and economic growth. As purchasing power rises, consumers are more willing to spend on a broader range of meat, particularly specialty cuts and processed options. Additionally, the convenience of online shopping, combined with improved logistics and delivery systems, is significantly enhancing market accessibility. With the Spanish e-commerce market projected to reach USD 1,731.8 Billion by 2033, as per the IMARC Group, online platforms are playing a vital role in the distribution of meat products, offering consumers greater access to high-quality cuts and specialty items. Furthermore, Spain's strong culinary traditions continue to sustain demand for both traditional and high-end meat products, supporting the industry's long-term prospects.

Spain Meat Market Trends:

Growing Disposable Income

Economic growth and rising disposable incomes in Spain are crucial factors influencing the market. As the economy strengthens, consumers experience increased purchasing power, enabling them to spend more on high-quality meat products. For instance, in the second quarter of 2025, Spain’s Gross National Income reached EUR 420,503 million, as reported by the National Statistics Institute (INE), underscoring the economic conditions supporting greater meat consumption. This trend is particularly evident among the growing middle class, which demonstrates a clear preference for premium and specialty meats. With higher earnings, there is a noticeable rise in the demand for a variety of meat products, including processed options.

Strategic Acquisitions and Market Consolidation

Strategic acquisitions and market consolidation play a pivotal role in impelling the Spain meat industry growth. As larger companies acquire smaller, established producers, they strengthen their market presence, expand production capacity, and gain access to new consumer bases. This consolidation fosters greater operational efficiency, reduces competition, and enhances the ability to respond to market demand. By increasing economies of scale, businesses can also improve profitability, innovate in production processes, and leverage synergies for better market positioning. This strategy of market consolidation to enhance operational efficiency and expand capacity is illustrated by Grupo Miguel Vergara's 2024 acquisition of the Valles del Esla beef business from the El Enebro group, which significantly strengthened Miguel Vergara's position in Spain's beef sector by adding 1,600 pasture-raised cattle to its operations.

Government Support and Incentives

Government incentives and support, such as financial assistance, such as grants, tax breaks, and funding for infrastructure development, helps businesses mitigate risks and recover from setbacks. These incentives encourage companies to invest in modernizing production facilities, which improves efficiency and resilience. By reducing the financial burden on producers, government support fosters industry growth, enabling companies to scale operations, enhance competitiveness, and meet increasing consumer demand for high-quality meat products. In 2025, Sigma Alimentos announced plans to build a new packaged meats plant in Valencia and expand its La Bureba site. The EUR 157 million investment, primarily funded by insurance and government incentives, aims to restore full production capacity by 2027. The new infrastructure will improve operational resilience and efficiency in the region.

Market Outlook 2026-2034:

The Spain meat market demonstrates growth potential throughout the forecast period, underpinned by robust domestic demand and strategic export diversification initiatives. The market generated a revenue of USD 23.45 Billion in 2025 and is projected to reach USD 27.67 Billion by 2034, growing at a compound annual growth rate of 1.85% from 2026-2034. The increasing consumer preference for high-quality protein products, coupled with supportive government policies and investment in modern processing and distribution infrastructure, is expected to further bolster market growth and enhance Spain’s position in the global meat sector.

Spain Meat Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Raw | 70% |

| Product | Pork | 40% |

| Distribution Channel | Supermarkets and Hypermarkets | 55% |

Type Insights:

- Raw

- Processed

Raw dominates with a market share of 70% of the total Spain meat market in 2025.

Raw meat leads the market due to its widespread demand for traditional cooking methods. Consumers prefer fresh cuts for their versatility in a variety of dishes, ranging from home-cooked meals to restaurant offerings. This preference is deeply rooted in cultural cooking practices.

Additionally, raw meat offers better control over preparation and customization, which appeals to chefs and consumers alike. Its ability to be processed into various forms, such as steaks, chops, or ground meat, enhances its popularity. This flexibility drives significant consumer demand, solidifying raw meat market dominance.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

Pork leads with a share of 40% of the total Spain meat market in 2025.

Pork leads the market due to its versatility in cooking and broad appeal across diverse cuisines. It is a staple in many traditional dishes, offering various cuts like chops, sausages, and roasts. The market dominance of pork, driven by its versatility and broad culinary appeal, is quantitatively demonstrated by the Agriculture and Horticulture Development Board (AHDB), which reported that Pig meat production in Spain remained flat at 4.93 million tons in the 12 months to February 2025.

Furthermore, pork's relatively lower price compared to other meats makes it more accessible to a wider consumer base. Its popularity in both home cooking and the foodservice industry drives consistent demand. With strong culinary traditions and continuous innovation in pork-based products, it remains a dominant segment in the market.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 55% share of the total Spain meat market in 2025.

Supermarkets and hypermarkets lead the market owing to their extensive reach and convenience. These outlets offer a wide array of meat products, ranging from fresh cuts to processed items, allowing consumers to access various options under one roof. Their accessibility drives consistent foot traffic. The market leadership is also influenced by their extensive reach and wide product array, is supported by broader economic trends in the distribution sector, which is expected to see 3% growth in 2025, an increase from 1.8% last year, according to the national association of large distribution companies (ANGED).

Additionally, the ability to provide competitive pricing, promotions, and large-scale distribution further contribute to the market dominance of supermarkets and hypermarkets. Their strategic locations in both urban and rural areas enhance visibility and convenience for shoppers, contributing significantly to meat market growth. This comprehensive distribution model boosts consumer loyalty and repeat purchases.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain is known for its diverse meat production, particularly pork and beef, with a strong emphasis on high-quality, premium products. The region’s cooler climate supports extensive livestock farming, and its rich culinary traditions make meat a central ingredient.

Eastern Spain, with its Mediterranean climate, focuses on poultry and pork, as well as a growing preference for artisanal and cured meats. The region’s proximity to major export markets is bolstering its meat processing and distribution industries, enhancing overall market reach.

Southern Spain is renowned for its production of ham and other cured meats, driven by both its climate and rich agricultural heritage. The region's extensive livestock farming, particularly of pigs, supports a highly developed meat sector, with a focus on quality.

Central Spain serves as a hub for beef and lamb production, benefiting from vast plains and favorable farming conditions. The region plays a significant role in Spain’s meat industry, supplying both domestic markets and international exports, particularly in premium beef cuts.

Market Dynamics:

Growth Drivers:

Why is the Spain Meat Market Growing?

Investment in Processing Capacity Expansion

The growth of Spain's meat market is significantly driven by investments in processing capacity. Major players in the industry are expanding their production facilities to meet the increasing demand for processed meats. These investments enable companies to enhance production efficiency, improve product quality, and ensure supply chain reliability. By upgrading and expanding processing plants, businesses can better cater to evolving consumer preferences for convenience, quality, and variety in meat products, thereby fostering overall market growth. In 2025, Campofrío announced a €134 million investment in a new processed-meat plant in Utiel, Spain. The new plant will increase production capacity to meet the growing demand for processed meats.

Technological Advancements in Meat Processing

The integration of advanced automation and smart systems is improving efficiency, productivity, and product quality. Technologies like vacuum processing, automated handling, and improved packaging solutions address production challenges, such as consistency and waste reduction. By enhancing speed, accuracy, and flexibility in operations, these technological advancements enable meat processors to meet growing demand, reduce costs, and improve overall competitiveness in the market. This continuous effort to improve efficiency and product quality through advanced automation is clearly demonstrated by the 2024 partnership between Bizerba and Schmalz, which introduced advanced vacuum technology and automated systems to a Spanish meat plant to increase the pick rate to 96 picks per minute.

Rising Focus on Sustainable, Ethical Food Technologies

Companies are increasingly investing in innovative technologies, such as cultivated meat production, to cater to the shift towards environment-friendly and ethical food choices. These investments help meet consumer preferences for protein sources with a lower environmental footprint compared to traditional livestock farming. By diversifying product offerings and tapping into the alternative protein sector, businesses can capture new markets while responding to the rising demand for sustainable, high-quality food products. For instance, in 2024, BioTech Foods, a subsidiary of JBS, opened a new cultivated meat facility in San Sebastián, Spain, with an investment of USD 36.1 million. The plant will produce over 1,000 metric tons of cultivated beef annually, with plans to scale up to 4,000 metric tons. This move is part of JBS's strategy to expand in the alternative protein sector and meet rising consumer demand for sustainable food options.

Market Restraints:

What Challenges the Spain Meat Market is Facing?

Rising Feed Costs

One of the key challenges hindering the Spain meat market growth is the increasing cost of animal feed. As feed prices rise due to fluctuations in global grain markets, farmers face higher production costs, which can lead to reduced profit margins. This ultimately impacts meat prices, making it more expensive for consumers and creating financial pressure on producers.

Sustainability and Environmental Concerns

Environmental sustainability is becoming a major concern in the industry, with the growing pressure to reduce carbon footprints, water usage, and waste. As consumers and regulatory bodies demand more eco-friendly practices, producers must adapt to new standards and invest in sustainable practices, which can be costly and require significant changes in traditional production methods.

Animal Welfare Regulations

Stricter animal welfare regulations are challenging the industry by demanding higher standards of care and ethical practices. Compliance with these regulations often requires significant investment in infrastructure and labor, which can increase operational costs. Additionally, shifting consumer preferences for ethically produced meat products further push producers to adopt more humane methods, presenting both logistical and financial challenges.

Competitive Landscape:

The Spain meat market exhibits moderate competitive intensity characterized by established family-owned enterprises competing alongside multinational corporations across diverse product categories and distribution channels. Market dynamics reflect strategic positioning ranging from premium, innovation-driven offerings emphasizing traditional production methods and regional authenticity to value-oriented products targeting price-conscious consumers through modern retail channels. The competitive landscape is increasingly shaped by vertical integration strategies that control production from farm to consumer, export diversification efforts expanding international market presence, and sustainability initiatives responding to evolving regulatory requirements and consumer expectations regarding animal welfare and environmental impact.

Recent Developments:

- In November 2025, Anuga Select Ibérica, a collaboration between Koelnmesse and IFEMA Madrid, will take place from February 16-18, 2027 in Madrid. This event merges Meat Attraction and Bakery & Ice Cream Attraction under the Anuga brand, offering a central platform for Spain’s growing food and beverage market. It aims to strengthen trade ties between Europe, Latin America, and North Africa.

- In February 2025, Grupo Fuertes confirmed its acquisition of Spanish pork business Agropor through its livestock division, Cefusa. The deal, pending approval from Spain’s antitrust regulator, strengthens Fuertes' presence in pig farming and pork supply. Fuertes also made a takeover bid earlier this year for poultry processor Uvesa.

Spain Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain meat market size was valued at USD 23.45 Billion in 2025.

The market is expected to grow at a compound annual growth rate of 1.85% from 2026-2034 to reach USD 27.67 Billion by 2034.

The raw meat segment dominated the Spain meat market with a share of 70% in 2025, driven by strong consumer preference for fresh, unprocessed meat products aligned with traditional Spanish culinary practices.

Key factors driving the Spain meat market include economic growth and rising disposable incomes, which is supporting greater meat consumption. In Q2 2025, Spain’s Gross National Income reached EUR 420,503 million, enabling consumers, especially the middle class, to spend more on premium and specialty meat products.

Major challenges include the rising feed costs, environmental concerns, and stricter animal welfare regulations. These issues increase production expenses, pressure producers to adopt sustainable practices, and require investments in ethical practices, impacting both profitability and prices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)