Spain Mental Health Market Size, Share, Trends and Forecast by Disorder, Service, Age Group, and Region, 2026-2034

Spain Mental Health Market Overview:

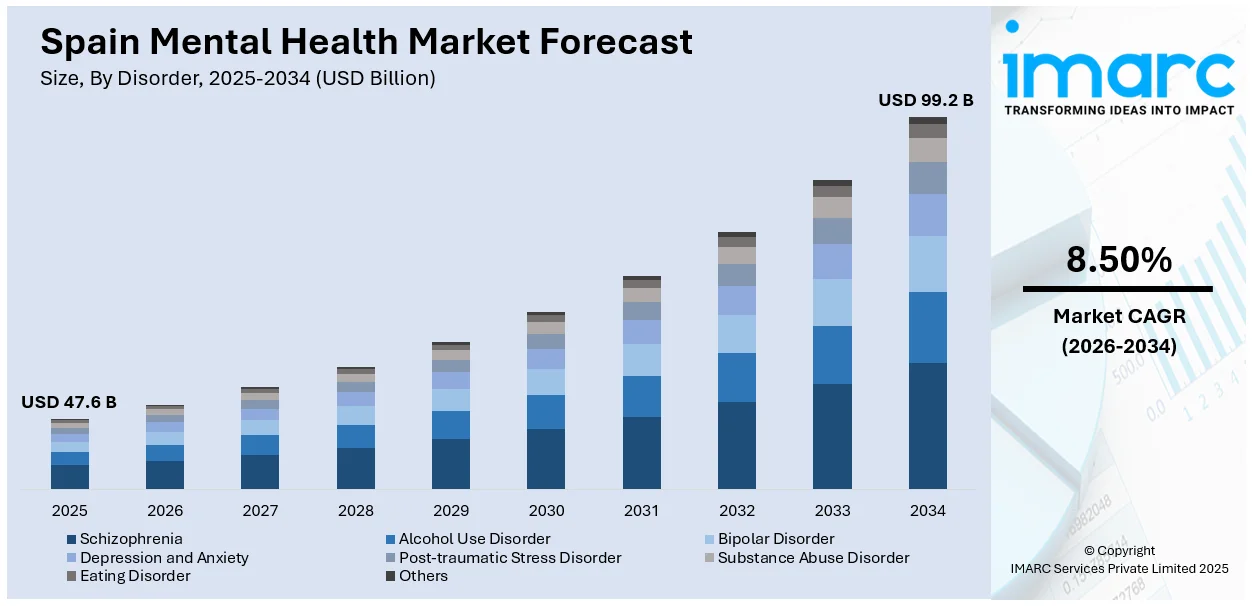

The Spain mental health market size reached USD 47.6 Billion in 2025. The market is projected to reach USD 99.2 Billion by 2034, exhibiting a growth rate (CAGR) of 8.50% during 2026-2034. The market is driven by rising demand for digital mental health solutions, fueled by post-pandemic preferences for teletherapy and AI-powered apps, alongside growing government and insurer reimbursement for these services. Workplace mental health initiatives are expanding due to stricter labor regulations, rising burnout rates, and corporate focus on employee well-being as a competitive advantage. Increased awareness, especially among younger demographics, and technological advancements in telemedicine are further augmenting the Spain mental health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 47.6 Billion |

| Market Forecast in 2034 | USD 99.2 Billion |

| Market Growth Rate 2026-2034 | 8.50% |

Spain Mental Health Market Trends:

Increasing Demand for Digital Mental Health Solutions in Spain

The market is experiencing a rise in demand for digital solutions, including teletherapy, mental health apps, and online counseling platforms. For instance, Spain's mental health industry is poised to benefit from the PRESTO platform. This novel digital intervention combines machine learning with a mobile app to provide personalized interventions for depression and anxiety in primary care. The initiative aims to reduce waiting times and improve the quality of care by integrating predictive severity models and evidence-based psychological interventions. With a 7.5 million user target population, PRESTO will revolutionize Spanish mental health care, addressing serious gaps in treatment and accessibility for mild to moderate mental illness. The COVID-19 pandemic accelerated this trend for several reasons. Lockdowns and the social distancing restrictions made it difficult to take part in 'real world' therapy sessions. Even post-COVID-19, Spaniards are increasingly turning to digital solutions, largely due to their convenience, accessibility, and affordability. Mental health apps are becoming increasingly popular, as they provide self-help applications as well as those that deploy AI-based therapy and some that connect licensed professionals with consumers. Even the Spanish government and many private payers started providing coverage for the delivery of digital mental health services, which has additionally helped facilitate the adoption of this approach. Moreover, with increasing awareness about mental health, particularly among younger generations, Spain's digital mental health market is poised for revolutionary growth, driven by advancements in AI capabilities and telemedicine technologies. Companies investing in user-friendly, secure, and culturally adapted platforms are further propelling the Spain mental health market growth.

To get more information on this market Request Sample

Workplace Mental Health Initiatives Gaining Traction in Spain

Corporate mental health programs are becoming a priority in Spain as businesses recognize the impact of employee well-being on productivity and retention. Spain still experiences a significant mental health problem, with over 18% of the population suffering from mental health issues in 2019. In response to this, the government launched a new Mental Health Strategy 2022-2026, with an emphasis on improving care and support, particularly for those at risk, including individuals with lower incomes and women. Furthermore, the strategy intends to meet the unmet mental healthcare needs, which were identified by 18% of the population during the pandemic. Anxiety, burnout, and stress have emerged as leading causes of absenteeism, and most businesses are seeking mental health initiatives such as employee assistance programs, stress prevention seminars, and mindfulness training as a potential remedy. Spain's new labor codes and enhanced occupational health procedures are prompting employers in Spain to adopt proactive programs for mental health. Multinational companies and Spanish organizations are collaborating with mental health professionals to provide confidential counseling, regular mental health assessments or screenings, and mental health support, including flexibility. Remote and hybrid work has also increased the need for mental health support as employees feel isolated and lack work-life balance; if they were staying home, overwhelmed by the issues, it is only escalating now that they have a divided environment. Talent and how the mental health of the workforce factors into their choice to remain or leave a job will be one of the main game-changers in hiring for Spain, and Spanish organizations will start to reinstate the amount of money following normalized reductions. This will provide the means for organizations and businesses related to mental health to grow and develop in the Spanish market.

Spain Mental Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on disorder, service, and age group.

Disorder Insights:

- Schizophrenia

- Alcohol Use Disorder

- Bipolar Disorder

- Depression and Anxiety

- Post-traumatic Stress Disorder

- Substance Abuse Disorder

- Eating Disorder

- Others

The report has provided a detailed breakup and analysis of the market based on the disorder. This includes schizophrenia, alcohol use disorder, bipolar disorder, depression and anxiety, post-traumatic stress disorder, substance abuse disorder, eating disorder, and others.

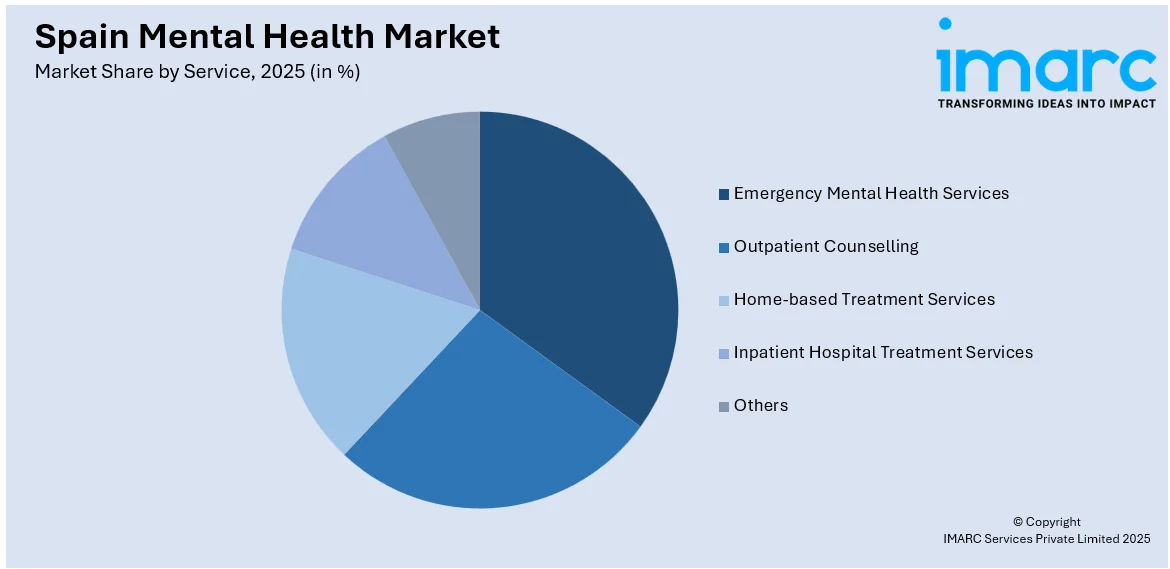

Service Insights:

Access the comprehensive market breakdown Request Sample

- Emergency Mental Health Services

- Outpatient Counselling

- Home-based Treatment Services

- Inpatient Hospital Treatment Services

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes emergency mental health services, outpatient counselling, home-based treatment services, inpatient hospital treatment services, and others.

Age Group Insights:

- Pediatric

- Adult

- Geriatric

The report has provided a detailed breakup and analysis of the market based on the age group. This includes pediatric, adult, and geriatric.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Mental Health Market News:

- June 06, 2025: Miura Partners launched a comprehensive mental healthcare platform across Spain, investing in Seville-based Centro Psicosanitario Galiani and Madrid-based Orientak to address the growing mental health issues. Treating over 4,000 patients across 1,800m² of facilities, the move prioritizes clinical excellence, cross-specialty care, and the integration of lifestyle medicine, with plans to expand services and hire best-in-class staff. This investment aligns with Miura's Impact strategy, aiming to improve mental health outcomes and reduce stigma through evidence-based, integrated care throughout Spain.

Spain Mental Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Disorders Covered | Schizophrenia, Alcohol Use Disorder, Bipolar Disorder, Depression and Anxiety, Post-traumatic Stress Disorder, Substance Abuse Disorder, Eating Disorder, Others |

| Services Covered | Emergency Mental Health Services, Outpatient Counselling, Home-based Treatment Services, Inpatient Hospital Treatment Services, Others |

| Age Groups Covered | Pediatric, Adult, Geriatric |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain mental health market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain mental health market on the basis of disorder?

- What is the breakup of the Spain mental health market on the basis of service?

- What is the breakup of the Spain mental health market on the basis of age group?

- What is the breakup of the Spain mental health market on the basis of region?

- What are the various stages in the value chain of the Spain mental health market?

- What are the key driving factors and challenges in the Spain mental health market?

- What is the structure of the Spain mental health market and who are the key players?

- What is the degree of competition in the Spain mental health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain mental health market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain mental health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain mental health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)