Spain Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2026-2034

Spain Online Travel Market Overview:

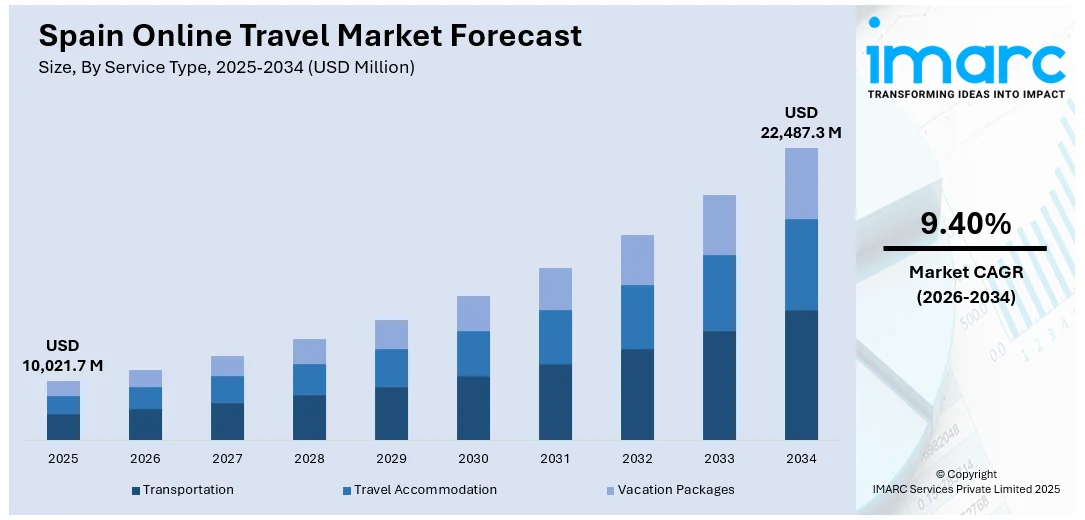

The Spain online travel market size reached USD 10,021.7 Million in 2025. The market is projected to reach USD 22,487.3 Million by 2034, exhibiting a growth rate (CAGR) of 9.40% during 2026-2034. The market is expanding steadily, driven by rising internet penetration, widespread mobile adoption, and consumer preference for digital booking solutions. The market is further supported by innovative payment systems, stronger presence of domestic OTAs, and upgraded tourism infrastructure. Combined, these trends are enhancing travel efficiency and personalization, positively impacting the Spain online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10,021.7 Million |

| Market Forecast in 2034 | USD 22,487.3 Million |

| Market Growth Rate 2026-2034 | 9.40% |

Spain Online Travel Market Trends:

Mobile-Driven Platform Innovation

In May 2025, Spain’s travel sector contributed to GDP, underscoring the strategic importance of digital engagement in tourism. Spanish online travel agencies (OTAs) have intensified their mobile-first approach by launching AI-driven itinerary builders that analyze past bookings and preferences to deliver dynamic recommendations. Advanced features such as real-time price alerts, biometric login, voice-based search, and an integrated digital wallet and QR-code checkout system simplify the booking process. Mobile apps have evolved into comprehensive travel companions, enabling users to bundle flights, accommodation, transport, and activities in one seamless interface. Enhanced tools like augmented reality city previews and automatically generated packing lists appear directly within the app, improving pre-trip planning. Cross-device synchronization ensures travelers can begin planning on mobile and finalize details on desktop, a critical feature for user retention. Data analytics platforms help OTAs optimize UX and personalize offers, driving higher engagement and revenue. These improvements reflect consumer expectations for convenience, speed, and personalization, making mobile experience optimization fundamental to Spain online travel market growth.

To get more information on this market Request Sample

Sustainable and Regional Travel Transformation

In June 2024, Spain allocated billion from EU Recovery funds toward sustainable tourism initiatives. In alignment, OTAs now feature sustainability-focused filters such as “eco‑lodge,” “wellness retreat,” and “slow travel” to elevate awareness of certified green accommodations and experiential packages in lesser-known regions like La Rioja, Navarra, and Asturias. These curated bundles often include stays in solar-powered rural hotels, vineyard tastings, guided nature hikes, and rentals for e-bikes or electric vehicles to support low-carbon mobility. Rich multimedia features such as virtual farmhouse tours, video storytelling, and influencer-created regional content enrich the user experience and support responsible tourism. Many platforms have also integrated carbon-offset purchasing options, enabling travelers to gauge and reduce their environmental impact. These enhancements not only highlight lesser-known regions but support rural economies, reduce overtourism, and align digital travel offerings with national sustainability goals. As consumer demand for authentic and eco-conscious travel intensifies, these curated regional experiences are shaping Spain online travel market trends.

Inbound Recovery via Digital Localization

In 2024, Spain recorded million international visitors, underscoring the role of digital infrastructure in tourism resilience. Spanish OTAs have responded by deploying multilingual platforms with support in Mandarin, Arabic, and Russian, along with multi-currency payment gateways to serve global travelers directly. Booking flows now seamlessly incorporate visa guidance, travel insurance options, and culturally particular itineraries, such as culinary routes, heritage hikes, and wellness escapes. 24/7 multilingual AI chatbot support further reduces friction. Customized landing pages targeted at key source markets Asia, North America, and the Middle East enhance digital engagement, while influencer partnerships and targeted social campaigns reinforce brand awareness abroad. These efforts increase trust and convert inbound traffic into bookings, while enhancing the length of stay and average spend. By investing in digital localization and tailored user journeys, Spanish platforms are reinforcing Spain’s role as a top-tier international destination. These initiatives are central to the evolving Spain online travel market.

Spain Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

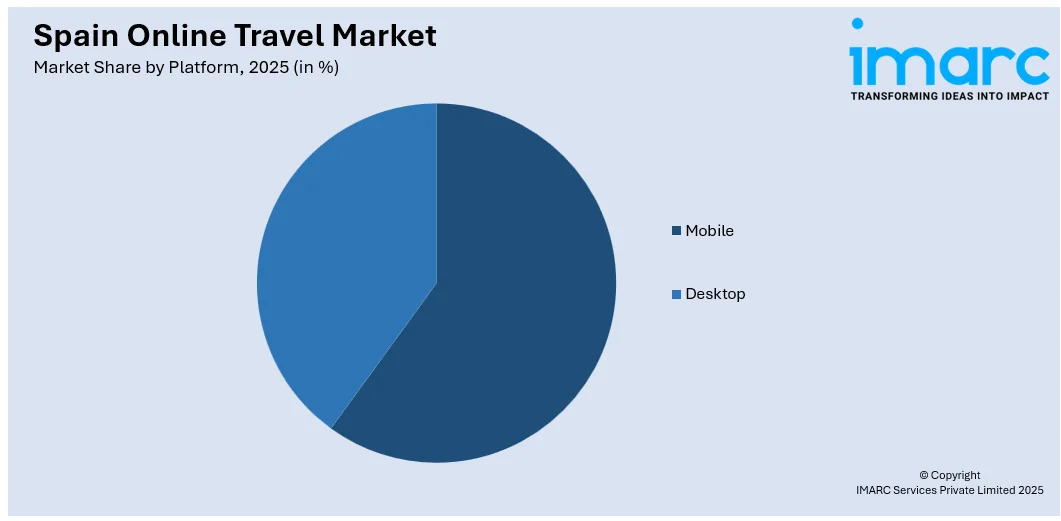

Platform Insights:

Access the comprehensive market breakdown Request Sample

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain online travel market on the basis of service type?

- What is the breakup of the Spain online travel market on the basis of platform?

- What is the breakup of the Spain online travel market on the basis of the mode of booking?

- What is the breakup of the Spain online travel market on the basis of age group?

- What is the breakup of the Spain online travel market on the basis of the region?

- What are the various stages in the value chain of the Spain online travel market?

- What are the key driving factors and challenges in the Spain online travel market?

- What is the structure of the Spain online travel market and who are the key players?

- What is the degree of competition in the Spain online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain online travel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)