Spain Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

Spain Real Estate Market Size and Share:

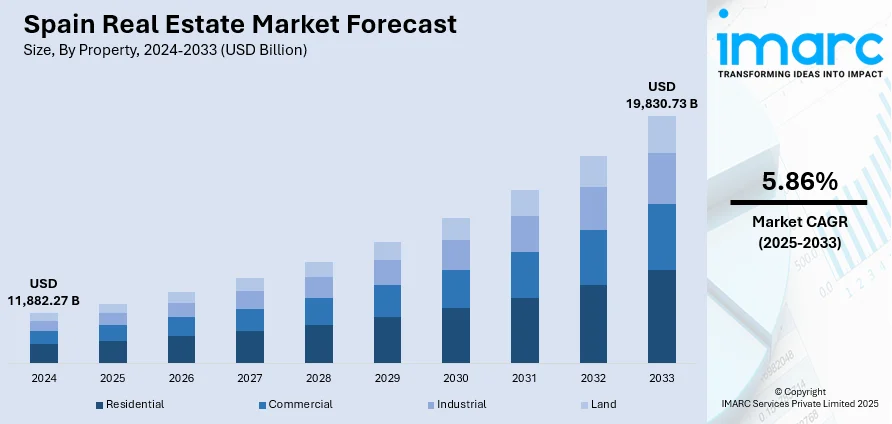

The Spain real estate market size was valued at USD 11,882.27 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19,830.73 Billion by 2033, exhibiting a CAGR of 5.86% during 2025-2033. The market is expanding due to increasing foreign investment, digital nomad migration, and rising demand for smart, sustainable housing. Moreover, government-led urban renewal projects continue to strengthen Spain real estate market share across residential, commercial, and mixed-use developments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11,882.27 Billion |

|

Market Forecast in 2033

|

USD 19,830.73 Billion |

| Market Growth Rate (2025-2033) | 5.86% |

The market is experiencing strong momentum due to a steady rise in foreign investment, particularly in urban centers and coastal regions. Buyers from Germany, the UK, France, and Nordic countries are increasingly showing interest in residential and holiday properties, driven by favorable exchange rates and relatively affordable prices compared to other European destinations. In addition, Spain's Golden Visa program, which offers residency in exchange for property investment, continues to attract high-net-worth individuals seeking long-term stays or relocation within the EU. Improved digital infrastructure and remote work flexibility are also pushing foreign professionals to consider Spain as a base, increasing demand in both prime and secondary cities.

To get more information on this market, Request Sample

Urban transformation is becoming a major trend in the Spain real estate market, with several cities investing in regeneration and sustainable development. Government initiatives are focusing on upgrading outdated neighborhoods, improving energy efficiency, and introducing green spaces, which are collectively raising the long-term value of properties in urban areas. The growing emphasis on smart cities where technology, sustainability, and livability intersect is encouraging developers to adopt intelligent infrastructure solutions. Cities like Barcelona, Valencia, and Bilbao are leading the way in integrating digital tools for traffic control, waste management, and energy conservation. Additionally, demand for mixed-use developments that combine residential, commercial, and recreational functions is rising, supported by shifting lifestyle preferences and post-pandemic urban planning. The transition toward walkable communities and eco-friendly transport solutions is also influencing construction trends.

Spain Real Estate Market Trends:

Increasing Foreign Investment in Spanish Real Estate

Foreign investment in Spain real estate market growth reached €28.21 Billion in 2023, with a 12% rise in projects focused on productivity and employment. Spain’s affordable property prices in Western Europe, combined with its appealing climate, culture, and lifestyle, have attracted international buyers. Investors from countries like the UK, Germany, France, China, and the Middle East are purchasing properties for both personal use and as investments, playing a key role in Spain’s real estate market. The Golden Visa program, which grants residency to non-EU investors, further encourages foreign investment. This influx of capital supports job creation, drives construction, and bolsters Spain’s overall economy. The real estate market benefits from the demand for both residential and commercial properties, making Spain an attractive option for international investors. As the market expands, the foreign investment surge is contributing significantly to the country’s economic growth and infrastructure development.

Urbanization and Modernization in Spain's Real Estate Market

Spain real estate market trends has been greatly impacted by rising urbanization, with 370,000 new long-term immigrants arriving in 2021, reflecting a 14% increase from the previous year. This demographic shift is fueling demand for residential, commercial, and mixed-use properties in major cities like Madrid, Barcelona, and Valencia. Immigrants, attracted by better job opportunities, education, and lifestyle, contribute to the growing demand for urban living spaces. Spain has also focused on revitalizing cities through development projects, including smart city initiatives and infrastructure upgrades. Additionally, there is a strong trend toward modernizing existing properties to meet the needs of a changing population, with a focus on energy efficiency and sustainability. As more urban dwellers seek contemporary, eco-friendly homes, this modernization is directly driving growth in the residential real estate market. Sustainability has become a central focus in the market’s evolution, shaping the future direction of urban development in Spain.

Tourism's Influence on Spain's Property Market

Spain’s thriving tourism sector is a significant driver of demand in its luxury property market, particularly for vacation homes, short-term rentals, and hospitality properties. As a top global tourist destination, Spain draws millions of visitors each year, with the tourism industry contributing approximately €249 billion to the country’s GDP in 2024. In 2025, this figure is expected to rise to €260.5 billion, representing nearly 16% of Spain's economy. The rise of platforms like Airbnb has made it easier for property owners to capitalize on the tourism boom by renting homes to visitors. High-demand areas like Costa del Sol, Balearic Islands, and Canary Islands are seeing substantial investments in holiday homes, second properties, and short-term rentals. The continuous growth in tourism expenditure is boosting the real estate market, driving the development of resorts, hotels, and leisure facilities. These trends indicate a positive outlook for Spain’s property market, as it continues to benefit from its strong tourism industry.

Vacation Home Demand in Spain

Demand for vacation homes in Spain has surged, particularly in coastal regions like Costa Brava, Costa del Sol, and the Balearic Islands. International buyers, especially from colder Northern European countries, are purchasing second homes due to Spain’s mild climate, vibrant culture, and lifestyle appeal. The rise of remote working has further fueled this trend, allowing individuals to spend extended periods in Spain. In 2023, remote working in Spain increased significantly, with 7.1% of workers opting for flexible arrangements compared to 4.3% in 2018. This shift has led to higher demand for homes offering tranquility, beach access, and proximity to amenities. As a result, vacation homes have become a major sector in Spain’s real estate market, with property prices in prime locations increasing. The demand for second homes and longer stays is expected to continue as more people seek to combine work and leisure in Spain's attractive regions, solidifying its position as a top destination for vacation properties.

Primary Residence Trends in Spain

The primary residence market in Spain has seen steady growth, driven by both local and foreign demand. Young professionals and families are increasingly drawn to city centers like Madrid, Barcelona, and Valencia, where access to work, schools, and services is essential. At the same time, many are seeking quieter suburban and rural areas for larger homes and a less crowded lifestyle post-pandemic. The rising cost of living in cities is pushing first-time homebuyers to consider smaller towns with more affordable options. There is also a growing trend toward homes that emphasize sustainability, with energy-efficient designs and smart technologies becoming increasingly popular. The Spanish government’s policies promoting affordable housing and green building practices are influencing these choices. As environmental concerns grow, buyers are prioritizing homes that are both spacious and eco-friendly. This shift is not only shaping the residential market but also affecting the commercial real estate sector, encouraging sustainable construction and development across Spain.

Spain Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Spain real estate market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on property, business,and mode.

Analysis by Property:

- Residential

- Commercial

- Industrial

- Land

As per the Spain real estate market outlook, the residential real estate market in Spain is witnessing robust demand, driven by urbanization, increased disposable income, and favorable mortgage conditions. Cities like Madrid, Barcelona, and Valencia continue to attract homebuyers due to strong infrastructure and lifestyle amenities. Additionally, the growing interest from foreign buyers, especially in coastal and tourist-friendly areas, is stimulating housing demand. Government incentives for first-time buyers and energy-efficient homes are further supporting residential development. The post-pandemic shift toward larger living spaces and remote-friendly locations is also reshaping buyer preferences. These factors collectively contribute to sustained growth in Spain’s residential real estate segment across urban and semi-urban regions.

Spain's commercial real estate sector is evolving amid increased investor focus on office modernization, flexible workspaces, and sustainable infrastructure. Demand is rising for prime commercial assets in business hubs such as Madrid and Barcelona, supported by the expansion of tech firms, startups, and multinational corporations. The hospitality and retail segments are also recovering steadily, driven by tourism resurgence and consumer spending. Furthermore, adaptive reuse of older buildings into co-working and mixed-use spaces is becoming a key trend. With ESG criteria influencing investment decisions, green-certified properties are gaining traction. These drivers continue to reshape Spain’s commercial real estate outlook toward long-term growth.

Spain’s industrial real estate market is gaining momentum, largely due to the expansion of e-commerce, last-mile logistics, and light manufacturing operations. Strategic locations near transport corridors and ports, such as Valencia and Zaragoza, are seeing rising demand for warehousing and distribution centers. Companies are increasingly seeking energy-efficient and automated facilities to streamline supply chains and reduce operational costs. The nearshoring trend and growth of regional trade within the EU further fuel investment in industrial zones. Additionally, public infrastructure projects and economic recovery incentives are supporting industrial space development. These trends position Spain as a competitive hub for industrial real estate activity.

Land availability in Spain has become a key driver in real estate planning, especially in expanding suburbs and mid-tier cities. Investors and developers are targeting undeveloped plots in high-growth regions for both residential and commercial projects. Urban regeneration initiatives and government rezoning policies are enabling the conversion of underused land into productive spaces. The demand for land has surged in logistics corridors and tourist-friendly regions, where long-term value appreciation is anticipated. Rising construction permits and infrastructure upgrades further enhance land attractiveness. With strategic land banking and municipal support, Spain’s land market remains integral to future real estate development opportunities.

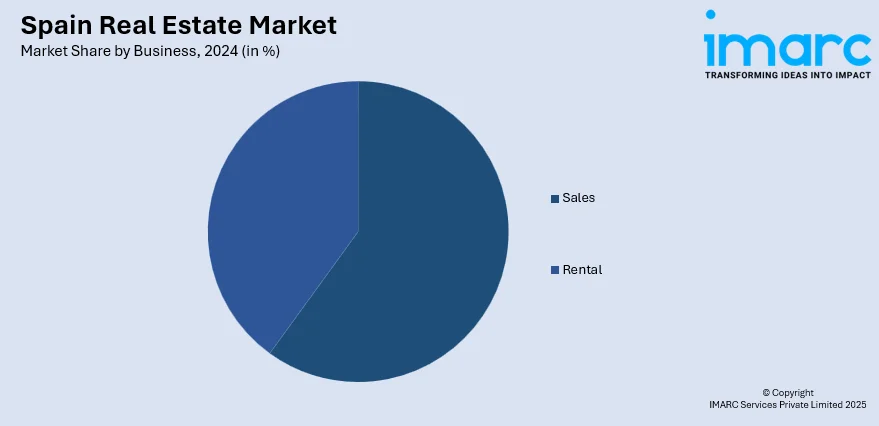

Analysis by Business:

- Sales

- Rental

Real estate sales in Spain are rising steadily, backed by strong domestic and international buyer interest. Low-interest rates, stable property prices in key regions, and flexible financing options are encouraging transactions. Coastal cities and suburban areas are experiencing higher turnover as lifestyle preferences shift post-pandemic. Foreign investment, particularly from European and Latin American buyers, is boosting luxury and second-home sales. Digital property platforms and virtual viewings have simplified the sales process, enhancing buyer confidence. Government-backed homeownership schemes and tax incentives for buyers further support market activity. These factors continue to drive Spain’s real estate sales momentum across segments.

Spain’s rental market is expanding, fueled by urban migration, increased demand for short-term accommodation, and changing homeownership trends. Major cities like Barcelona, Madrid, and Seville see strong rental activity among students, professionals, and expats. The rise of flexible working has increased interest in mid-term rental housing in secondary cities. Additionally, tourist rentals are recovering as international travel resumes. Regulations promoting affordable housing and rental transparency are influencing pricing and availability. Property owners are increasingly offering furnished, serviced, and energy-efficient rental units. These evolving renter expectations and economic shifts are shaping a resilient and dynamic rental landscape in Spain’s property market.

Analysis by Mode:

- Online

- Offline

The digital transformation of Spain’s real estate sector is accelerating due to widespread adoption of online platforms, AI-powered property tools, and virtual tours. Buyers and tenants are increasingly using real estate websites and apps to compare listings, evaluate market trends, and complete transactions remotely. The rise of digital documentation and e-signatures is simplifying property transfers and lease agreements. Online marketing strategies, including social media and targeted ads, are enhancing property visibility. PropTech innovations are also enabling real-time property management and analytics for investors. These technological shifts are not only streamlining operations but also expanding access to real estate opportunities across Spain.

Despite the rise of digital channels, offline real estate transactions remain vital in Spain, especially in high-value sales and traditional markets. Physical site visits, in-person negotiations, and broker-driven engagements continue to play a crucial role in building trust and validating property value. Local agencies and real estate fairs facilitate direct interactions, particularly among older buyers and investors preferring face-to-face consultations. Offline methods are also critical in legal verification and community-based marketing. Moreover, regional developers often rely on physical outreach to attract buyers in rural or less digitized areas. Thus, offline channels remain an essential part of Spain’s real estate ecosystem.

Regional Analysis:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Based on Spain real estate market forecast, Northern Spain’s real estate market is projected to witness steady interest, driven by its natural beauty, cooler climate, and improving infrastructure. Cities like Bilbao, Santander, and Oviedo offer growing opportunities in residential and tourism-based developments. Improved connectivity, sustainable urban projects, and quality of life enhancements are drawing both local and foreign buyers. The region's economic diversification into education, healthcare, and renewable energy is attracting a skilled workforce, increasing demand for housing. Additionally, the popularity of cultural and coastal destinations is supporting investment in vacation properties. These factors collectively contribute to Northern Spain’s growing significance in the national real estate landscape.

Eastern Spain, particularly the Valencian Community, is emerging as a vibrant real estate hotspot due to its strong coastal appeal, thriving tourism, and affordable property prices. Cities like Valencia and Alicante attract retirees, remote workers, and second-home buyers from across Europe. The region’s robust rental yield, especially in tourist zones, is enticing real estate investors. Ongoing public infrastructure development, including transport links and smart city initiatives, is boosting property demand. Additionally, economic activity in agriculture, logistics, and IT is supporting local housing markets. These growth drivers are making Eastern Spain increasingly important within the country’s broader real estate framework.

Southern Spain, known for its warm climate and Mediterranean lifestyle, continues to draw strong interest from domestic and international property buyers. Regions like Andalusia and Costa del Sol are especially popular for holiday homes, retirement residences, and rental investments. The post-pandemic work-from-anywhere culture has further increased demand in coastal towns. Tourism recovery and improved transport networks are revitalizing local economies and housing demand. Government incentives to promote energy-efficient construction are also attracting eco-conscious investors. The area’s mix of traditional charm and modern living contributes to consistent market activity, making Southern Spain a vital segment of the country’s real estate market.

Central Spain, anchored by Madrid, remains a pivotal region for real estate development and investment. The capital city offers high liquidity, stable returns, and a diversified property market covering residential, commercial, and mixed-use spaces. Urban regeneration projects and transit-oriented developments are reshaping city districts, drawing interest from both institutional and individual investors. Educational institutions, financial hubs, and multinational headquarters contribute to sustained rental demand. Surrounding provinces like Toledo and Guadalajara are also gaining traction as more people seek affordability within commuting distance. This balance of urban opportunity and suburban expansion ensures that Central Spain plays a central role in shaping national real estate dynamics.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- June 2025: Spain's CaixaBank launched Facilitea Casa, a new real estate marketplace through its subsidiary Building Center. The platform initially offered over 40,000 residential listings, providing an accessible and streamlined way for buyers and sellers to engage, enhancing the country's real estate market efficiency.

- May 2025: PATRIZIA and Urbania launched the joint venture Sustainable Communities Spain, investing over EUR 130 Million in sustainable and affordable housing across Spain. The project aimed to address the housing shortage, focusing on energy-efficient homes and social inclusion, thereby enhancing the accessibility of Spain's real estate market.

- April 2025: Greystar acquired a development site in Madrid for 458 apartments, expanding its Be Casa flexible living brand. The project, scheduled for completion by 2027, will provide high-quality, sustainable living spaces with extensive amenities, thereby enhancing rental housing options and supporting Madrid's growing demand for innovative housing solutions.

- March 2025: LandCo and Patron Capital launched five residential projects across Spain, aiming to develop 1,350 homes and achieve €475 Million in turnover over five years. This initiative, which covers cities such as Madrid, Seville, and Barcelona, has boosted Spain's housing supply and urban development.

- January 2025: Chilean real estate company Property Partners expanded into Spain, opening offices in Madrid, Barcelona, Mallorca, and Menorca, and plans for Valencia. With an investment of over €3 Million, the company aims to acquire 500 properties in Madrid, boosting Spain's real estate market and creating jobs.

- February 2023: Aviva Investors purchased its second build-to-rent property in Spain, located in Terrassa, Catalonia, in partnership with Layetana Living. With a focus on sustainability, the project will comprise 85 units with lots of amenities. This marks Aviva's continued focus on the Spanish market, aiming to address chronic housing shortages with quality, sustainable solutions.

Spain Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real estate market in Spain was valued at USD 11,882.27 Billion in 2024.

The Spain real estate market is projected to exhibit a CAGR of 5.86% during 2025-2033, reaching a value of USD 19,830.73 Billion by 2033.

Strong demand for second homes, recovering tourism, favorable interest rates, and infrastructure improvements are key forces behind Spain’s real estate market growth. Additionally, investor confidence, rental yield potential, and increasing digitalization in property transactions continue to support overall expansion across both urban and coastal areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)