Spain Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2026-2034

Spain Steel Market Summary:

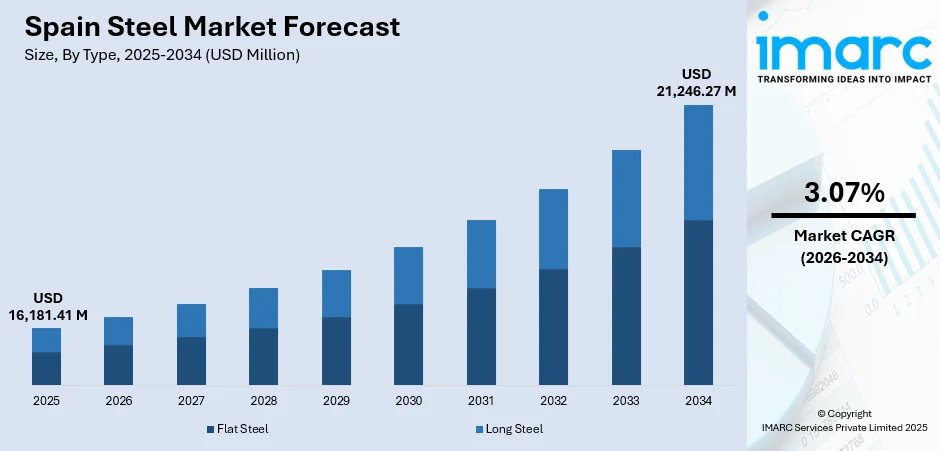

The Spain steel market size was valued at USD 16,181.41 Million in 2025 and is projected to reach USD 21,246.27 Million by 2034, growing at a compound annual growth rate of 3.07% from 2026-2034.

The market is driven by robust infrastructure development projects, sustained demand from the automotive and manufacturing sectors, and ongoing investments in renewable energy installations requiring substantial steel inputs. Spain's strategic position as a major European producer supports strong domestic consumption while enabling significant export activities. The transition toward sustainable production methods, including electric arc furnace technology and green hydrogen initiatives, continues to enhance the industry's competitiveness. Growing urbanization and construction activities further reinforce steel demand, positioning the nation as a key player holding notable Spain steel market share.

Key Takeaways and Insights:

- By Type: Flat steel dominates the market with a share of 45% in 2025, driven by its extensive utilization in automotive body panels, construction cladding, roofing applications, and appliance manufacturing where its formability and surface quality characteristics are essential for industrial production.

- By Product: Structural steel leads the market with a share of 40% in 2025, owing to its superior load-bearing capacity, durability, and versatility in supporting large-scale commercial buildings, bridges, industrial facilities, and infrastructure frameworks.

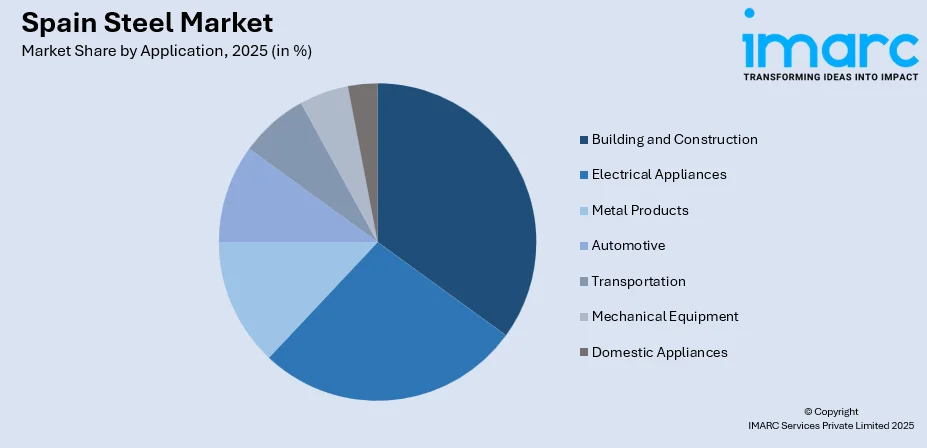

- By Application: Building and construction represents the largest segment with a market share of 35% in 2025, driven by ongoing residential developments, commercial real estate expansion, infrastructure modernization projects, and government-funded public works programs.

- Key Players: The market compete through advanced production capabilities, strong distribution networks, and a growing focus on sustainable manufacturing. Companies prioritize product diversification, quality consistency, and strategic partnerships to strengthen market presence and meet evolving industrial and construction sector requirements.

To get more information on this market Request Sample

Spain’s steel industry benefits from a longstanding manufacturing base supported by well-developed facilities located across both northern and southern regions. The sector continues to show resilience as producers adopt modern production technologies, embrace digital process improvements, and advance sustainable manufacturing practices that reflect national and European priorities. According to UNESID, Spain’s steel consumption in 2024 rose by 6.5% to reach 13.5 million tonnes, the highest level since 2007. Government programs encouraging infrastructure renewal, renewable energy development, and industrial competitiveness help create stable demand conditions for a wide range of steel products. The strong presence of the automotive industry, which supplies both domestic and international markets, ensures a consistent requirement for high quality steel. The construction sector’s steady recovery, supported by European funding and private investment, further stimulates demand across structural and specialized applications, reinforcing positive market momentum for the industry.

Spain Steel Market Trends:

Green Steel Production and Decarbonization Initiatives

Spanish steel manufacturers are increasingly adopting low-carbon production technologies to align with European Union environmental targets and sustainability mandates. The transition from traditional blast furnace operations toward electric arc furnace technology enables significant reduction in carbon emissions while maintaining production efficiency. A notable example, ArcelorMittal Spain, one of the country’s largest steel producers, is investing in a new hybrid EAF at its Gijón mill, combined with a direct-reduced iron (DRI) facility; this is expected to yield 1.1 million tonnes per year of low-carbon steel, reducing its CO₂ emissions by about 35%. Major industry participants are investing in direct reduced iron facilities powered by renewable energy sources, including green hydrogen derived from solar and wind installations. These decarbonization efforts position Spanish producers favorably within the evolving European regulatory landscape while meeting growing customer demand for environmentally responsible steel products.

Digital Transformation and Industry Automation

Steel producers across Spain are embracing advanced manufacturing technologies to enhance operational efficiency and product quality. Artificial intelligence, machine learning algorithms, and digital twin technologies are being integrated into production processes for predictive maintenance, quality control, and resource optimization. In 2024, Hydnum Steel partnered with Siemens to develop Spain’s first fully digitalized steel plant in Puertollano, integrating AI-driven automation and digital-twin systems across production lines. Automation of material handling, process monitoring, and logistics operations reduces operational costs while improving workplace safety standards. These technological advancements enable manufacturers to respond rapidly to changing market demands, customize product specifications, and maintain competitive positioning within the European marketplace through enhanced productivity and operational flexibility.

Circular Economy and Scrap Recycling Expansion

Spain's steel industry is strengthening its commitment to circular economy principles through expanded scrap metal recycling infrastructure and improved collection systems. In 2024 the country recycled about 9.4 Million Tonnes of scrap steel, roughly 80% of its total steel production, highlighting how recycling already underpins much of the sector’s output. The increased utilization of post-consumer and industrial scrap as primary feedstock reduces dependence on imported raw materials while supporting environmental sustainability objectives. Advanced sorting technologies and quality control measures ensure recycled materials meet specifications for high-grade steel production. This circular approach provides cost advantages through reduced raw material expenses, minimizes waste generation, and supports compliance with stringent European environmental regulations governing industrial resource utilization.

Market Outlook 2026-2034:

The Spain steel market is anticipated to witness steady revenue expansion throughout the forecast period, supported by sustained infrastructure investments and growing demand from end-use industries. Renewable energy installations, including solar parks and wind farms requiring substantial steel components, will provide consistent demand drivers. The automotive sector's gradual transition toward electric vehicle production will maintain steel consumption while shifting product requirements toward specialized grades. Construction activity growth, particularly in residential and commercial segments supported by European recovery funds, will reinforce market expansion. Revenue growth trajectories remain positive as domestic consumption increases alongside maintained export competitiveness. The market generated a revenue of USD 16,181.41 Million in 2025 and is projected to reach a revenue of USD 21,246.27 Million by 2034, growing at a compound annual growth rate of 3.07% from 2026-2034.

Spain Steel Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Flat Steel | 45% |

| Product | Structural Steel | 40% |

| Application | Building and Construction | 35% |

Type Insights:

- Flat Steel

- Long Steel

The flat steel dominates with a market share of 45% of the total Spain steel market in 2025.

Flat steel products constitute the dominant type of segment within Spain's steel market, driven by their versatile applications across multiple industrial sectors. The automotive manufacturing industry represents a primary consumer, utilizing flat steel for body panels, chassis components, and structural reinforcements requiring precise dimensional tolerances and surface quality. Construction applications include roofing sheets, wall cladding, and flooring systems where flat steel's uniform thickness and corrosion-resistant coatings provide durability advantages. The product category encompasses hot-rolled coils, cold-rolled sheets, and coated steel variants serving diverse end-user requirements. In 2025, exports of flat rolled steel products from Spain, particularly flat products of carbon steel, hot-rolled and coated, saw a sharp rebound: flat products exports increased 45.5% year-on-year, underscoring robust external demand for Spanish flat steel despite global headwinds.

Manufacturing facilities across Spain produce flat steel products meeting stringent quality specifications for domestic consumption and export markets throughout Europe. Continuous investments in rolling mill technologies enable production of advanced high-strength grades meeting automotive lightweighting requirements while maintaining structural integrity. The growing emphasis on energy efficiency drives demand for coated flat steel products utilized in appliance manufacturing, renewable energy installations, and building envelope systems. Flat steel consumption patterns correlate strongly with automotive production volumes and construction activity levels.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

The structural steel leads with a share of 40% of the total Spain steel market in 2025.

Structural steel products including beams, columns, channels, and angles provide the load-bearing framework essential for modern building construction and civil engineering applications. The inherent strength-to-weight ratio advantages enable architects and engineers to design taller buildings, longer bridge spans, and more efficient industrial facilities while optimizing material consumption. Spanish construction projects increasingly specify structural steel for commercial buildings, industrial warehouses, transportation infrastructure, and public facilities requiring rapid construction timelines and design flexibility.

The product category serves both new construction and renovation projects where structural steel's adaptability supports building modifications and expansion requirements. Manufacturing processes including hot rolling and fabrication enable production of standardized sections alongside custom profiles meeting specific project specifications. Structural steel's recyclability aligns with sustainability objectives while its fire resistance and seismic performance characteristics support building code compliance. Ongoing infrastructure modernization programs and commercial real estate development sustain consistent demand across regional markets.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The building and construction exhibit a clear dominance with a 35% share of the total Spain steel market in 2025.

The construction sector consumes substantial steel volumes for residential buildings, commercial complexes, industrial facilities, and infrastructure projects throughout Spain. Urbanization trends and housing demand generate consistent requirements for structural steel, reinforcing bars, and flat products utilized in concrete reinforcement, facade systems, and roofing applications. In 2025, Spanish crude steel output rose to 3.28 million tons in Q1, driven by strong demand for flat products and structural steel. Large-scale infrastructure projects including transportation networks, energy installations, and public facilities create concentrated demand periods requiring coordinated supply chain management and inventory positioning.

Government infrastructure programs funded through European Union recovery mechanisms provide sustained project pipelines supporting steel consumption growth. The renovation and rehabilitation of existing building stock represents an expanding market segment as energy efficiency regulations mandate building envelope upgrades utilizing steel cladding and structural components. Commercial construction activity in logistics, warehousing, and data center segments drives demand for long-span structural solutions where steel's flexibility and rapid erection capabilities provide competitive advantages over alternative construction materials.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain represents the traditional heartland of Spanish steel production, hosting major integrated manufacturing facilities with substantial production capacities. The region benefits from established industrial infrastructure, skilled workforce availability, and proximity to raw material supply routes. Historical development of heavy industry created concentrated manufacturing clusters supporting efficient production operations and logistics networks.

Eastern Spain demonstrates strong steel consumption patterns driven by automotive manufacturing, construction activities, and port-related industrial operations. The region's economic dynamism supports diverse demand sources while proximity to Mediterranean shipping routes facilitates import and export logistics. Manufacturing activities and commercial construction projects generate consistent steel requirements.

Southern Spain features growing steel consumption supported by renewable energy project development, construction expansion, and agricultural infrastructure investments. The region benefits from significant solar energy potential driving photovoltaic installation projects requiring steel mounting structures. Tourism-related construction and residential development create additional demand drivers.

Central Spain serves as a major consumption center driven by construction activities, manufacturing operations, and distribution logistics serving national markets. The capital region concentrates commercial development, infrastructure projects, and industrial operations generating diverse steel product requirements across multiple application segments.

Market Dynamics:

Growth Drivers:

Why is the Spain Steel Market Growing?

Infrastructure Modernization and Public Investment Programs

Spain's commitment to infrastructure modernization through significant public investment programs creates sustained demand conditions for steel products across multiple application segments. In 2025, the Spanish government reported that over €53.6 billion had been disbursed under the Recovery, Transformation and Resilience Plan to fund transportation, energy, and urban development projects. Government initiatives funded through European Union recovery mechanisms prioritize transportation network expansion, renewable energy installations, and urban development projects requiring substantial steel inputs. High-speed rail network extensions, highway improvements, and port facility upgrades generate concentrated demand for structural steel, rail products, and construction materials. These multi-year infrastructure programs provide visibility into future steel consumption patterns while supporting employment and economic development objectives across regional markets.

Automotive Manufacturing and Industrial Activity

The automotive manufacturing sector's significant presence within Spain sustains consistent steel demand while driving innovation in product specifications and quality requirements. In April 2024, Hyundai Mobis broke ground on a new battery‑assembly plant in Noáin, Navarra, its first in Western Europe, to supply electric‑vehicle battery systems to Volkswagen for upcoming EV models, underlining continued demand for high‑strength, lightweight steel components in EV production. Multiple vehicle assembly plants operated by international manufacturers produce vehicles for domestic consumption and European export markets, requiring flat steel products, specialized components, and structural materials. The gradual transition toward electric vehicle production maintains overall steel consumption while shifting demand toward lighter-weight high-strength grades meeting battery enclosure and safety structure requirements. Broader industrial manufacturing activities including machinery production, appliance manufacturing, and equipment fabrication provide additional demand sources.

Renewable Energy Expansion and Sustainability Initiatives

Spain's aggressive renewable energy expansion program generates growing demand for steel products utilized in solar installations, wind farm construction, and electrical grid infrastructure. In 2024, Spain added 7.3 GW of new photovoltaic (PV) and wind capacity, the largest annual increase ever recorded, boosting its total renewables output to 148,999 GWh and accounting for 56.8% of the country’s electricity mix. Solar photovoltaic mounting structures, wind turbine towers, and transmission equipment require specialized steel grades meeting performance specifications under demanding operating conditions. Government targets for renewable energy capacity additions create predictable project pipelines supporting steel consumption forecasting and production planning. Sustainability initiatives across industrial sectors drive demand for steel products with verified environmental credentials, supporting adoption of recycled content materials and low-carbon production processes.

Market Restraints:

What Challenges the Spain Steel Market is Facing?

High Energy Costs and Operating Expenses

Elevated electricity and natural gas prices significantly impact steel production economics, compressing manufacturer margins and affecting competitive positioning against international producers. Energy-intensive processes including electric arc furnace operation and rolling mill activities face cost pressures that fluctuate with wholesale energy market conditions. These operating cost challenges constrain investment capacity while influencing production scheduling decisions and capacity utilization rates across manufacturing facilities.

Import Competition and Trade Pressures

Spanish steel producers face intensifying competition from imported products, particularly from regions with lower production costs and less stringent environmental regulations. Price-competitive imports capture market share in commodity product segments while pressuring domestic manufacturers to differentiate through quality, service, and specialized product offerings. Trade defense measures provide partial protection, though ongoing competition requires continuous efficiency improvements and cost management initiatives.

Raw Material Price Volatility and Supply Uncertainties

Fluctuating prices for iron ore, scrap metal, and alloying materials create cost planning challenges while affecting profitability across the steel value chain. Supply chain disruptions, geopolitical factors, and demand variations in global commodity markets generate price volatility requiring sophisticated procurement strategies and hedging approaches. Dependence on imported raw materials exposes manufacturers to currency fluctuations and logistics cost variations affecting delivered material costs.

Competitive Landscape:

The Spain steel market demonstrates a moderately concentrated competitive structure characterized by established domestic producers, subsidiaries of multinational corporations, and specialized manufacturers serving distinct market segments. Market participants compete across product quality, pricing, delivery reliability, and technical service capabilities tailored to specific customer requirements. Vertical integration strategies enable larger players to control costs through raw material access and downstream processing operations. The competitive environment encourages continuous operational improvement, technology adoption, and customer relationship development. Smaller specialized producers maintain market positions through niche product focus, regional service advantages, and flexible production capabilities meeting customized order requirements. Industry consolidation activities and strategic partnerships shape competitive dynamics while investments in sustainable production technologies differentiate environmentally progressive manufacturers.

Recent Developments:

- In November 2025, ArcelorMittal received an environmental permit for a new steel‑powder plant in Avilés, producing ~1,800 t/year of high-quality powders for 3D printing, aerospace, automotive, medical, and energy sectors using scrap, renewable energy, and electric‑arc furnaces. The company also began green hydrogen use at Olaberria and signed a €1 billion MoU with the government to decarbonize its Spanish plants.

- In May 2025, Hydnum Steel secured €60 million from the Spanish Government under PERTE to build Southern Europe’s first clean-energy steel plant in Puertollano. The facility will produce green flat steel, supplying firms like Kingspan Group, as part of Spain’s broader push to decarbonize steel production using renewable energy, scrap-based electric-arc furnaces, and green hydrogen.

Spain Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain steel market size was valued at USD 16,181.41 Million in 2025.

The Spain steel market is expected to grow at a compound annual growth rate of 3.07% from 2026-2034 to reach USD 21,246.27 Million by 2034.

Flat steel held the largest market share at 45%, driven by strong demand from automotive manufacturing, construction cladding, and appliance production. Their versatility, uniform quality, and suitability for precision forming processes support broad industrial adoption and reinforce their position as the preferred steel category.

Key factors driving the Spain steel market include infrastructure modernization programs funded through European recovery mechanisms, sustained automotive manufacturing activity, renewable energy expansion, construction sector growth, and increasing adoption of sustainable production technologies.

Major challenges include elevated energy costs affecting production economics, increasing import competition from lower-cost regions, raw material price volatility, stringent environmental compliance requirements, and workforce availability constraints in specialized manufacturing roles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)