Spain Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2026-2034

Spain Vegetable Oil Market Overview:

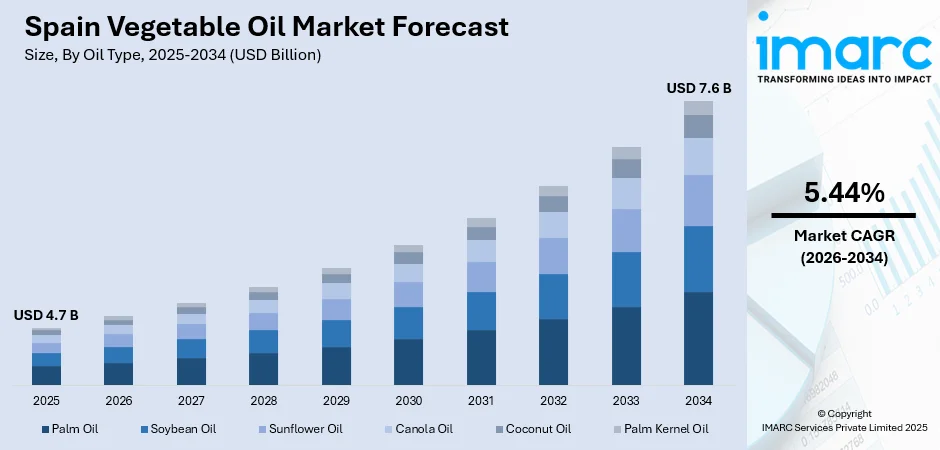

The Spain vegetable oil market size reached USD 4.7 Billion in 2025. Looking forward, the market is projected to reach USD 7.6 Billion by 2034, exhibiting a growth rate (CAGR) of 5.44% during 2026-2034. The market is driven by Spain’s dominant olive oil production and cultural integration across regional cuisines and dietary habits. Rising global demand for authentic, traceable oils fuels export growth and value-added product development. Urban consumers embracing diversified, health-oriented oils are further augmenting the Spain vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.7 Billion |

| Market Forecast in 2034 | USD 7.6 Billion |

| Market Growth Rate 2026-2034 | 5.44% |

Spain Vegetable Oil Market Trends:

Olive Oil Heritage and Culinary Integration

Spain is globally recognized as the leading producer and exporter of olive oil, anchoring its vegetable oil market in centuries-old agricultural and culinary traditions. Olive oil is not only a staple in home kitchens but a symbol of the Mediterranean diet, emphasized for its flavor, antioxidant content, and cardiovascular benefits. From sautéing seafood and vegetables to preparing gazpacho and alioli, Spanish cuisine relies heavily on extra virgin olive oil for both taste and nutritional integrity. Regional variants such as Picual, Arbequina, and Hojiblanca offer consumers a rich diversity of flavor profiles. Domestic consumption is reinforced by cultural pride, food education campaigns, and growing interest in traceable, artisanal food products. The Protected Designation of Origin (PDO) scheme supports small and medium olive growers, enhancing quality perception and local value retention. Olive oil is also a favored gift item, frequently marketed in premium packaging and featured in gourmet stores. Despite increasing prices, loyalty to local oil remains high, particularly among older generations and health-conscious households. However, according to recent industry reports, in the 2024/25 crop year, Spain produced 1.38 million metric tons of olive oil, a significant increase from 665,800 tons in 2022/23 and 852,600 tons in 2023/24. Olive oil stocks rose to 865,176 tons, and prices dropped substantially, with extra virgin olive oil falling from €8.99 to €3.93 per kilogram. The increase in olive oil production and the subsequent drop in prices are likely to make olive oil more affordable and accessible to a wider range of consumers. As prices fall from record highs, consumption is likely to rise, particularly in households that previously struggled with the higher costs. This cultural and dietary integration, deeply rooted in agricultural history and culinary pride, forms the core of Spain vegetable oil market growth and sustains its prominence in domestic and international markets.

To get more information on this market Request Sample

Diversification into Alternative and Functional Oils

While olive oil dominates, Spanish consumers, particularly younger urban populations, are experimenting with other vegetable oils driven by health, cooking diversity, and dietary trends. In the first half of 2024, Spaniards bought 179 million liters of sunflower oil, a 25% increase in sales, while olive oil consumption fell 18%, with 107 million liters purchased. Sunflower oil remains a key alternative due to its affordability and neutral taste, especially in deep-frying and baking applications. Canola, grapeseed, and avocado oils have also gained traction, marketed for their omega-3 content, light texture, and functional benefits. Retail shelves now reflect a broader mix of oils offered in health stores, organic markets, and mainstream supermarkets. Influenced by global wellness movements, Spanish food bloggers, chefs, and nutritionists promote the idea of oil rotation for nutritional balance. The foodservice industry has adapted by offering menus that specify the type of oil used, aligning with consumer transparency expectations. Producers have responded with blended oils that combine olive oil’s flavor with sunflower’s high-heat stability or canola’s mild profile. This trend is not replacing olive oil but enriching the overall market by appealing to diverse preferences and cooking needs. The result is a more sophisticated, layered oil market that merges tradition with functional innovation, expanding choice and supporting premiumization across categories.

Spain Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

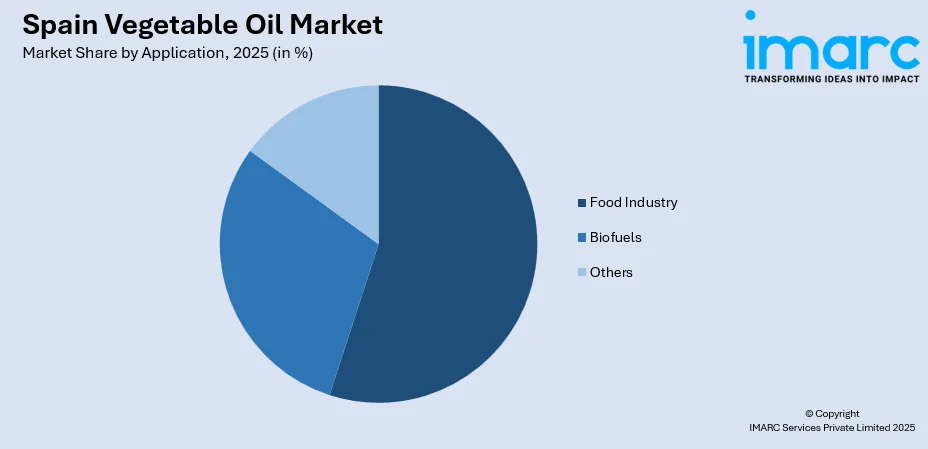

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain vegetable oil market on the basis of oil type?

- What is the breakup of the Spain vegetable oil market on the basis of application?

- What is the breakup of the Spain vegetable oil market on the basis of region?

- What are the various stages in the value chain of the Spain vegetable oil market?

- What are the key driving factors and challenges in the Spain vegetable oil market?

- What is the structure of the Spain vegetable oil market and who are the key players?

- What is the degree of competition in the Spain vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain vegetable oil market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)