Specialty Paper Market Size, Share, Trends and Forecast by Type, Raw Material, Application, and Region, 2025-2033

Specialty Paper Market Size and Share:

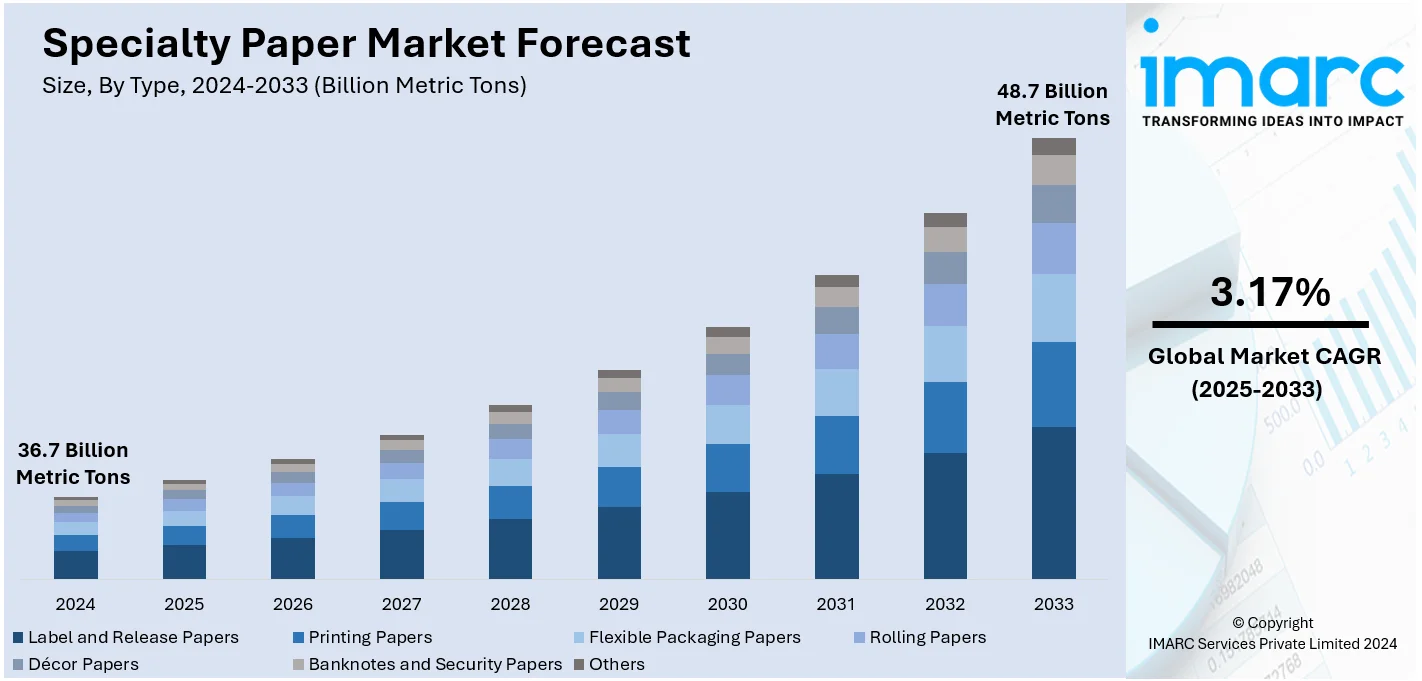

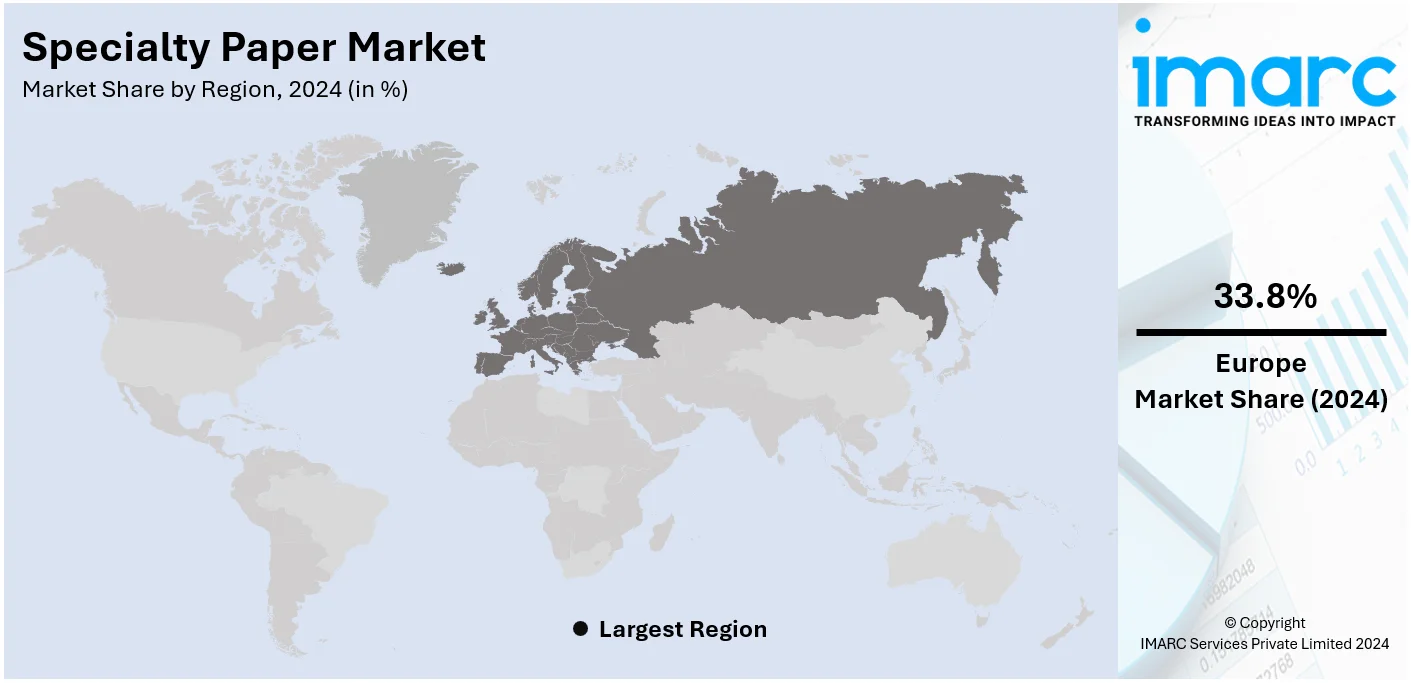

The global specialty paper market size reached 36.7 Billion Metric Tons in 2024. Looking forward, IMARC Group estimates the market to reach 48.7 Billion Metric Tons by 2033, exhibiting a CAGR of 3.17% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 33.8% in 2024. The increasing demand for high-quality packaging material, growing adoption in the food and beverage industry, the rapid expansion of the construction industry, and rising need in the production of masking tapes are some of the factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

36.7 Billion Metric Tons |

|

Market Forecast in 2033

|

48.7 Billion Metric Tons |

| Market Growth Rate 2025-2033 | 3.17% |

The global specialty paper market growth is primarily driven by the rising demand for eco-friendly and sustainable packaging solutions across industries such as food and beverage, personal care, and retail. The rising preference for biodegradable and recyclable materials is encouraging the adoption of specialty papers. The expanding e-commerce sector is also driving demand for specialty papers in packaging and wrapping solutions. According to the IMARC Group, the global e-commerce market size reached USD 26.8 Trillion in 2024 and is projected to reach USD 214.5 Trillion by 2033, exhibiting a CAGR of 25.83% during 2025-2033. In addition to this, advancements in printing technologies and the increasing use of specialty papers in high-quality printing, labeling, and graphics applications are significantly supporting market growth.

The United States has emerged as a key regional market for specialty paper, driven by the rising demand for sustainable and biodegradable packaging solutions across industries such as food and beverage, retail, and healthcare. The expansion of e-commerce is further boosting demand for specialty papers in packaging, wrapping, and cushioning applications. As per a report published by the IMARC Group, the United States e-commerce market is forecasted to reach USD 2,083.97 Billion by 2032, exhibiting a CAGR of 6.80% during 2024-2032. Additionally, innovations in coatings and finishes are improving paper durability and functionality, supporting diverse applications. Favorable government regulations promoting environmental sustainability and recyclable materials are also contributing to industry expansion.

Specialty Paper Market Trends:

Increasing need for secure and tamper-evident packaging

The increasing requirement for secure and tamper-evident packaging is a significant driver of the specialty paper market. As product authenticity and safety concerns intensify, pharmaceuticals, electronics, and food industries are turning to specialty paper solutions to address these challenges. These papers, with unique security features such as holograms, UV-reactive inks, and microprinting, provide a visible and reliable means to deter counterfeiting and tampering. These advanced security measures protect products and build consumer trust by ensuring the integrity of the items purchased. As a result, manufacturers and brands are increasingly incorporating specialty paper into their packaging strategies to maintain the authenticity of their products throughout the supply chain. This growing emphasis on secure and tamper-evident packaging is further boosting demand for specialty paper and driving innovation in the industry to meet evolving security needs.

Rise in premium product offerings

The rise in premium product offerings is contributing substantially to industry expansion. With consumers seeking elevated experiences, brands are introducing high-end and luxury products that demand distinctive packaging. Specialty papers, renowned for their unique textures, finishes, and visual appeal, align perfectly with the aesthetics of premium goods. For instance, in 2024, UPM Specialty Papers and Eastman co-developed an advanced biopolymer paper packaging solution tailored for food applications that require oxygen and grease barriers. Specialty papers lend an air of sophistication and exclusivity to packaging, enhancing the perceived value of the product. They also offer customization options, embossing, and foil stamping that contribute to an exquisite and memorable unboxing experience. As brands vie for consumer attention in competitive markets, the utilization of specialty paper to create luxurious and premium packaging is driving market growth.

Emergence of biodegradable packaging materials

The emergence of biodegradable packaging materials is creating a positive outlook for the specialty paper market share. With increasing environmental concerns and a global emphasis on sustainability, industries are shifting toward eco-friendly solutions. Specialty papers, known for their versatility and adaptability, are being increasingly utilized as biodegradable packaging alternatives. As consumers demand greener options, businesses are turning to this paper to align their packaging strategies with eco-conscious values. These papers are produced from renewable sources, featuring biodegradable coatings or additives that offer a solution that combines functionality with environmental responsibility. This reduces the ecological footprint of packaging and also resonates with environmentally conscious consumers. The market is, therefore, benefitting from this shift as brands seek to incorporate biodegradable materials into their packaging while maintaining the quality and visual appeal these papers provide.

Specialty Paper Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global specialty paper market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on type, raw material, and application.

Analysis by Type:

- Label and Release Papers

- Printing Papers

- Flexible Packaging Papers

- Rolling Papers

- Décor Papers

- Banknotes and Security Papers

- Others

Label and release papers stand as the largest component in 2024. These papers are indispensable in packaging, branding, and product identification across various industries. With the increasing demand for customized and visually appealing packaging, label papers offer versatility in design, texture, and printability, enhancing product aesthetics and consumer engagement. Furthermore, the rise of e-commerce and retail sectors has boosted the demand for labels, driving the growth of this segment. As brands seek to differentiate themselves on crowded shelves, label papers provide an avenue for creative and informative packaging. Moreover, the inclusion of release liners in this segment, which are vital for adhesive applications, underscores its significance. The ability of label and release papers to cater to diverse packaging needs, from food to cosmetics, pharmaceuticals to consumer goods, ensures a sustained demand, making this segment a key growth driver in the market.

Analysis by Raw Material:

- Pulp

- Fillers and Binders

- Additives

- Coatings

- Others

Pulp leads the market in 2024. Pulp dominates the specialty paper market because of its versatility, sustainability, and availability. A primary raw material, pulp offers strength, texture, and adaptability to enable the production of a range of specialty papers, such as packaging, labels, and high-quality printing materials. Its biodegradable and recyclable nature also goes well with the demand of environmentally conscious consumers. For industries that need alternatives for plastics, pulp-based specialty paper is a great solution. Furthermore, improvements in pulping technologies make it possible to tailor fiber properties to enhance specialty paper performance while meeting the specific requirements of various applications, making pulp a preferred choice for manufacturers.

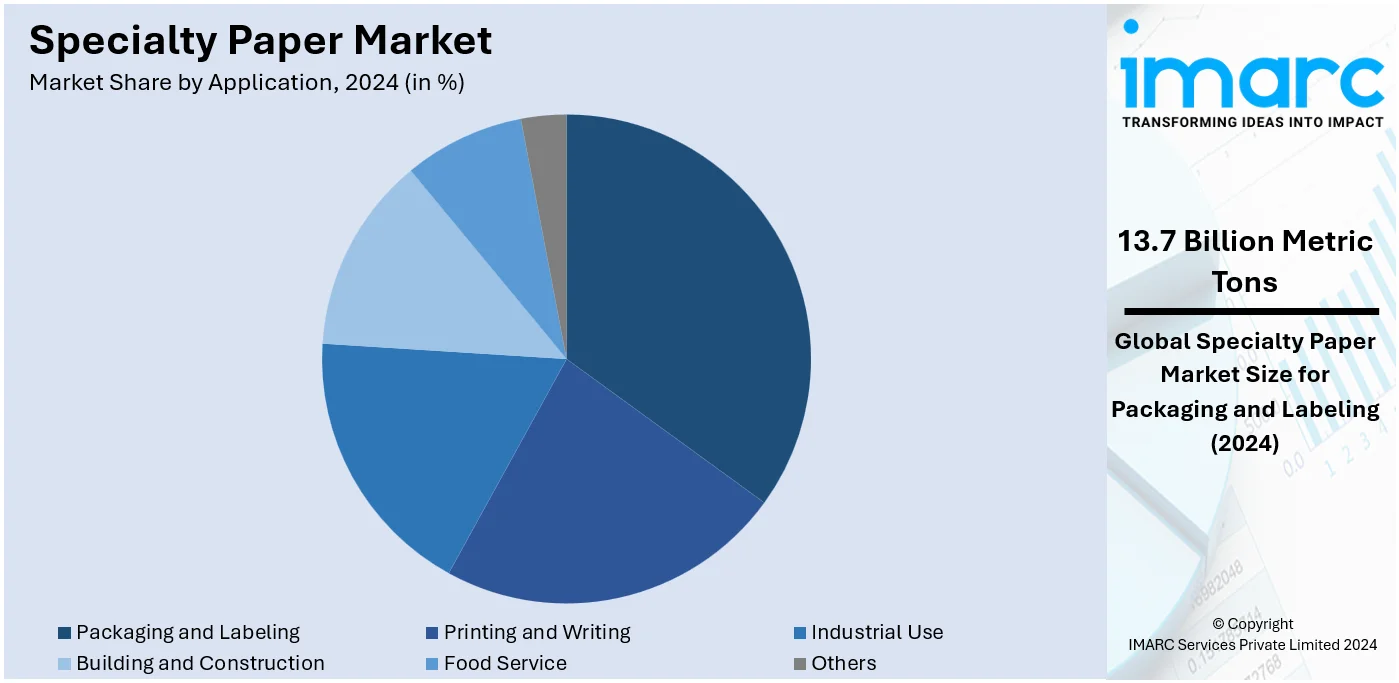

Analysis by Application:

- Packaging and Labeling

- Printing and Writing

- Industrial Use

- Building and Construction

- Food Service

- Others

Packaging and labeling represent the leading market segment with around 37.2% of market share in 2024. This dominance is largely due to the high demand for sustainable and visually attractive solutions across industries. Specialty paper offers versatility, durability, and printability and, hence, is perfect for premium packaging and quality labels. There is also an emphasis on eco-friendly packaging in the food, beverage, and personal care sectors. This is what drives specialty papers as alternatives to plastics. Apart from that, e-commerce also has stimulated demand for more protective as well as presentable package solutions. In addition, new developments related to water-proof and non-toxic-coatings are improving functionality and propelling the widespread adoption of these papers.

Analysis by Region:

- Europe

- Asia-Pacific

- North America

- Latin America

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 33.8%. Europe leads the specialty paper market primarily because of its strong focus on sustainability, advanced manufacturing infrastructure, and robust demand across key sectors. The region also has strict environmental laws that drive specialty paper adoption as an alternative to plastic packaging and labeling. The well-established food, beverages, and personal care sectors in the region also significantly support market demand. Moreover, the focus of Europe on innovation promotes the development of advanced products such as high-performance specialty papers with added functionalities. Leading market players and a mature recycling structure further strengthen the global specialty paper market growth.

Key Regional Takeaways:

United States Specialty Paper Market Analysis

In 2024, the United States accounts for over 80.00% of the specialty paper market in North America. The specialty paper market in the United States is experiencing rapid growth due to increasing demand from the packaging sector, as companies are focusing on sustainable and eco-friendly materials. According to the U.S. Environmental Protection Agency, in 2018, the recycling rate for generated packaging and containers was 53.9%. In line with this, manufacturers are investing in innovative paper solutions to cater to the growing preference for recyclable and biodegradable packaging options. Additionally, the expanding e-commerce industry is boosting the demand for protective packaging papers, as companies are emphasizing product safety during shipping. According to a survey conducted by the United States Department of Agriculture (USDA), in 2022, approximately 19.3% of U.S. consumers who frequently purchased groceries engaged in online shopping at least once within the past 30 days. Furthermore, there is a significant rise in the adoption of smart paper technologies, with manufacturers incorporating sensors and RFID capabilities into specialty papers to cater to the logistics and healthcare sectors.

Asia Pacific Specialty Paper Market Analysis

The specialty paper market in Asia Pacific is growing rapidly because of the increased focus on industrialization, with significant advancements in the manufacturing sector. In addition, various Asia-Pacific countries are investing heavily in advanced paper production technologies to meet the increasing demand in sectors such as automotive and electronics packaging. Improvements are also being made in the range and quality of specialty papers, such as barrier-coated and conductive papers, tailored for certain industrial applications such as food packaging and electronic items. According to IBEF, the packing industry accounts for the fifth largest industry in India, thus stressing its essential role in industrial growth and innovation. With an annual growth rate of 22% to 25%, the industry today stands as one of the key destinations for packaging solutions, driven by technological advancements and strong infrastructures.

Europe Specialty Paper Market Analysis

The specialty paper market in Europe is experiencing growth due to the increasing focus of industries on sustainability and environmentally friendly materials. Additionally, European manufacturers are working toward increasing the recyclability of specialty papers, particularly in the packaging and labeling industry. Increasing consumer preference for environmentally friendly products is further boosting this trend. The automotive industry is yet another factor that increases demand for specialty paper in protecting packaging as it is less in weight, durable, and has high performance. According to the Office for National Statistics, in 2018, organizations manufacturing motor vehicles within the UK had more than 169,000 persons employed at a share of 0.5% of the overall workforce within the country. Furthermore, according to the UK Government's report in 2022, motor vehicle and parts production contributed £13.3 Billion (USD 176.89 Billion) in that year, making up 0.6% of the UK's overall economic output. The regulatory environment for waste management and recycling has further facilitated sustainable production and encouraged manufacturers to move forward with eco-friendly productions, hence propelling the market forward.

Latin America Specialty Paper Market Analysis

The Latin America specialty paper market is driven by the growing demand for eco-friendly and green packaging due to heightened awareness about environmental degradation and strict regulations against single-use plastics. The expanding food and beverage sectors, both in Brazil and Mexico, are propelling the need for specialty papers in packaging and label applications. According to industry reports, the food and beverage sector remains the primary consumer of packaging machinery in Mexico, accounting for approximately 50% of the nation’s total demand. Specialty papers are also in demand due to the agriculture sector in the region, which has high usage for storage and transport packaging. E-commerce is another notable driver as it increases the requirement for sturdy and attractive packaging solutions. Innovations in specialty paper coatings, such as water-resistant and greaseproof options. also support their use in a wide range of industries. Urbanization, with its trend of high-quality and aesthetic products, further augments the Latin America specialty paper market.

Middle East and Africa Specialty Paper Market Analysis

Growth in the food and beverages sector is a key driver of the specialty paper market in the Middle East and Africa. Some other important growth drivers are the growing environmental issues coupled with the increased use of specialty papers as alternatives to plastics. Besides this, urbanization and lifestyle change also contribute toward raising the demand for premium and attractive packaging in retail, cosmetics, and personal care segments. The specialty paper market in this region is also expanding due to the development of the construction and industrial industries, as these papers are now used for insulation, lamination, and even as a form of decorative finish in these sectors. Apart from this, improvements in papermaking and printability have upgraded the functionality and aesthetical characteristics of specialty papers, thus gaining broader applications. Governments also provide incentives for investments in sustainable and local production. Increased e-commerce and online retail further augment the demand for specialty papers used in protective and functional packaging applications.

Competitive Landscape:

Key market players are fueling growth by way of strategic actions such as investing in research and development (R&D) for developing innovative, high-performance products. Companies are emphasizing the production of eco-friendly and biodegradable specialty papers to fulfill the rising demand for sustainable solutions in packaging and labeling. The growth of production capacity and partnerships with end-use industries such as food, beverage, and personal care are further boosting the accessibility of this market. Advanced manufacturing technologies are being adopted by key players in order to enhance paper quality and reduce production costs. Furthermore, partnerships and acquisitions are enabling businesses to increase their global reach and offer a diverse product range, contributing to the steady growth and competitiveness of the specialty paper market.

The report provides a comprehensive analysis of the competitive landscape in the specialty paper market with detailed profiles of all major companies, including:

- Billerud AB

- Domtar Corporation

- Fedrigoni S.p.A.

- ITC Limited

- Lintec Corporation

- Mondi plc

- Munksjo

- Nippon Paper Industries Co., Ltd.

- Nordic Paper AS

- Stora Enso

- Twin Rivers Paper Company

Latest News and Developments:

- November 2024: UPM Specialty Papers and Eastman have jointly developed an innovative biopolymer-coated paper packaging solution tailored for food applications requiring effective grease and oxygen barriers. This solution combines biobased and compostable Solus™ performance additives with BioPBS™ polymer, creating a thin, sustainable coating on compostable and recyclable barrier base papers.

- August 2023: Amcor, one of the leading companies in responsible packaging solutions, unveiled the North American launch of its recyclable AmFiber performance paper packaging, a key addition to the AmFiber portfolio. This performance paper, prequalified by How2Recycle®, meets curbside recycling repulpability standards, enabling companies to provide more sustainable packaging end-of-life options to consumers.

Specialty Paper Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion Metric Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Label and Release Papers, Printing Papers, Flexible Packaging Papers, Rolling Papers, Décor Papers, Banknotes and Security Papers, Others |

| Raw Materials Covered | Pulp, Fillers and Binders, Additives, Coatings, Others |

| Applications Covered | Packaging and Labeling, Printing and Writing, Industrial Use, Building and Construction, Food Service, Others |

| Regions Covered | Europe, Asia Pacific, North America, Latin America, Middle East and Africa |

| Companies Covered | Billerud AB, Domtar Corporation, Fedrigoni S.p.A., ITC Limited, Lintec Corporation, Mondi plc, Munksjo, Nippon Paper Industries Co., Ltd., Nordic Paper AS, Stora Enso, Twin Rivers Paper Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the specialty paper market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the specialty paper market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the global specialty paper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The specialty paper market was valued at 36.7 Billion Metric Tons in 2024.

IMARC estimates the specialty paper market to exhibit a CAGR of 3.17% during 2025-2033, reaching a volume of 48.7 Billion Metric Tons by 2033.

The specialty paper market is driven by the increasing demand for eco-friendly and biodegradable packaging solutions, rising adoption in food and beverage applications, the growth of e-commerce requiring high-quality packaging, and advancements in printing technologies for premium packaging and labeling.

Europe currently dominates the specialty paper market, accounting for a share exceeding 33.8% in 2024. This dominance is fueled by strong sustainability practices, a mature recycling infrastructure, and high demand in sectors such as food, beverages, and personal care.

Some of the major players in the specialty paper market include Billerud AB, Domtar Corporation, Fedrigoni S.p.A., ITC Limited, Lintec Corporation, Mondi plc, Munksjo, Nippon Paper Industries Co., Ltd., Nordic Paper AS, Stora Enso, and Twin Rivers Paper Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)