Specialty Polymers Market Report by Product Type (Specialty Elastomers, Specialty Composites, Specialty Thermoplastics, Specialty Thermosets, and Others), End Use Industry (Automotive and Transportation, Consumer Goods, Building and Construction, Coatings, Adhesives, and Sealants, Electrical and Electronics, Healthcare, and Others), and Region 2026-2034

Market Overview:

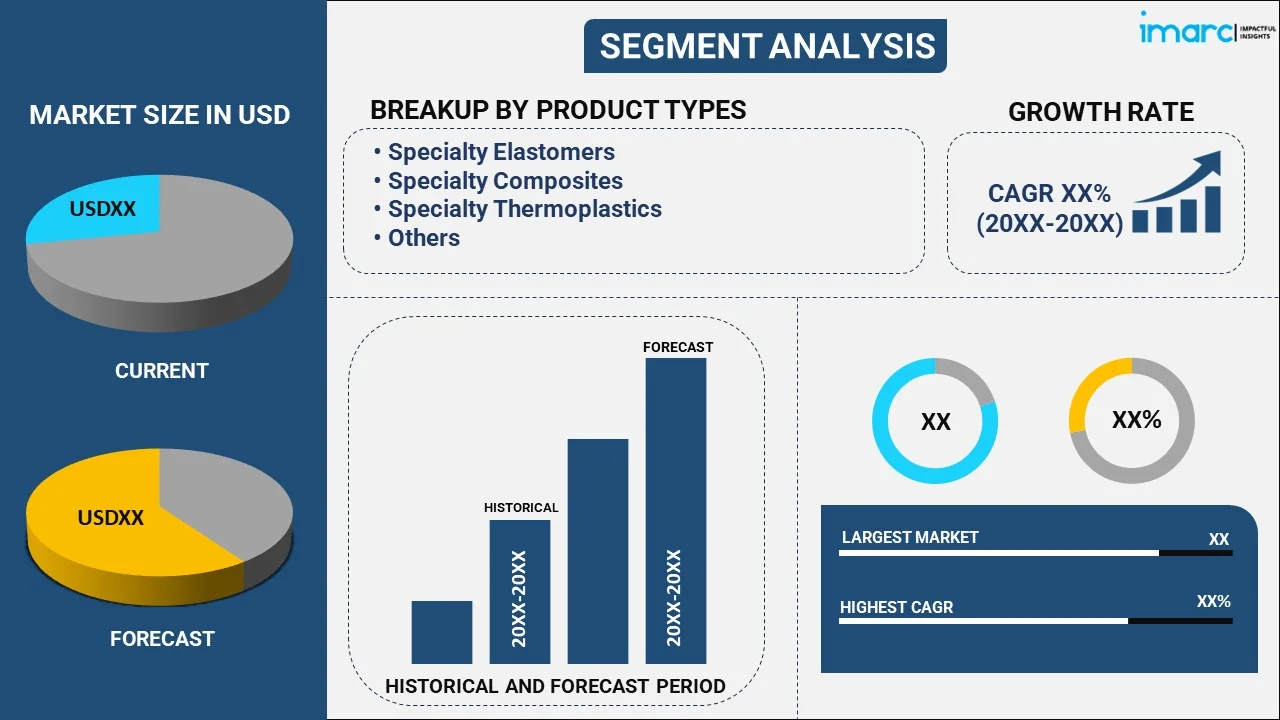

The global specialty polymers market size reached USD 92.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 159.3 Billion by 2034, exhibiting a growth rate (CAGR) of 5.74% during 2026-2034. The rising automotive demand, increased product use in electronics, emerging need for high-performance materials, elevated packaging applications, and broad adoption in the renewable energy sector are some of the factors contributing to the market growth. Asia Pacific currently represents the largest region in the market owing to the heightened need for polymers in various end-user industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 92.2 Billion |

|

Market Forecast in 2034

|

USD 159.3 Billion |

| Market Growth Rate 2026-2034 | 5.74% |

Specialty polymers refer to a class of synthetic materials that have been designed and engineered to possess specific properties and functions for a wide range of industrial and commercial applications. These polymers are typically produced by modifying the chemical structure of the base polymer or by blending two or more different polymers to achieve the desired properties. A variety of distinctive properties, including high strength, durability, chemical resistance, thermal stability, and electrical conductivity, can be seen in specialty polymers. Some commonly used specialty polymers include thermoplastic elastomers (TPEs), fluoropolymers, liquid crystal polymers (LCPs), high-performance polyamides (HPAs), and polyetheretherketones (PEEKs). Specialty polymers are in high demand since they can be employed in many applications where regular polymers aren't appropriate because of processing or performance constraints.

To get more information on this market Request Sample

Specialty Polymers Market Trends:

Increased Demand from Automotive Industry

The automotive sector is increasingly turning to specialty polymers to meet evolving regulatory and consumer demands. These materials offer significant advantages in terms of reducing vehicle weight, which is crucial for improving fuel efficiency and lowering emissions. Specialty polymers, such as high-performance thermoplastics and elastomers, are used in various automotive components, including fuel systems, interiors, exteriors, and under-the-hood applications. They are the perfect alternative to conventional metals because of their resistance to mechanical stress, exposure to chemicals, and extremely high temperatures. As electric vehicles (EVs) gain momentum, the demand for specialty polymers is further accelerating. EVs require lightweight materials to offset the weight of heavy batteries, and specialty polymers provide the necessary strength and flexibility. Moreover, these materials improve vehicle safety by enhancing impact resistance and reducing noise and vibration, thereby impelling the specialty polymer market growth.

Rising Use in Electronics

The electronics industry relies heavily on these materials for producing advanced devices with higher performance and longer life spans, which, in turn, is boosting the specialty polymers market share. These materials are crucial for insulating and protecting sensitive components in smartphones, tablets, computers, and other consumer electronics. Polymers like polyimides, polycarbonates, and polyethylene terephthalate (PET) offer excellent electrical insulation, thermal stability, and resistance to harsh environmental conditions. With the demand for miniaturization of electronic devices, specialty polymers play a critical role in ensuring that smaller components can function without overheating or becoming damaged. They also enhance the durability and flexibility of wearable devices, sensors, and other emerging technologies. The shift towards fifth-generation (5G) technology and the Internet of Things (IoT) is driving the need for more advanced materials to handle increased data processing speeds, power demands, and connectivity.

Growing Demand for High-performance Materials

According to the latest specialty polymers market report, various industries, including aerospace, medical, and construction, are increasingly relying on these materials for high-performance applications where standard materials fall short. Aerospace, in particular, demands materials that are lightweight yet incredibly strong and resistant to extreme temperatures and corrosive environments. Specialty polymers such as polyether ether ketone (PEEK) and polyphenylene sulfide (PPS) meet these requirements, offering durability without adding excessive weight. In the medical sector, specialty polymers are used in the manufacturing of devices like catheters, implants, and surgical instruments. Their biocompatibility, flexibility, and resistance to chemicals make them ideal for medical applications where precision and safety are paramount. Specialty polymers also find widespread use in construction, where they are favored for their durability, resistance to moisture, and ability to withstand harsh weather conditions.

Technological Advancements to Improve Polymer Performance

Emerging technological changes are playing a key role in offering a favorable specialty polymers market outlook as industries have been demanding materials with superior performance traits. Specialty polymers are becoming more highlighted by their outstanding properties like elevated thermal stability, mechanical strength, chemical resistance, and electrical insulation. These properties make them essential in high-technology applications, especially in industries such as electronics, where miniaturization and thermal management are essential. The increasing use of electric vehicles (EVs) further enhances demand since specialty polymers play a critical role in battery parts, insulation systems, and light structural components. In addition, the improvement of nanotechnology and biotechnology is creating new opportunities for specialty polymers, where accuracy materials are needed to back up complicated functionalities in medical devices, drug delivery systems, and nanoscale engineering. This intersection of innovation and requirements for performance is anticipated to support strong market growth in the years ahead.

Specialty Polymers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global specialty polymers market, along with forecasts at the global, regional, and country levels from 2026-2034. Our report has categorized the market based on the product type and end use industry.

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Specialty Elastomers

- Fluoroelastomers

- Fluorosilicone Rubber

- Liquid Silicone Rubber

- Natural Rubber

- Others

- Specialty Composites

- Particle Reinforced Composites

- Fiber Reinforced Composites

- Structural Composites

- Specialty Thermoplastics

- Polyolefins

- Polyimides

- Vinyl Polymer

- Polyphenols

- Others

- Specialty Thermosets

- Epoxy

- Polyester

- Vinyl Ester

- Polyimides

- Others

- Others

The report has provided a detailed breakup and analysis of the specialty polymers market based on the product type. This includes specialty elastomers (fluoroelastomers, fluorosilicone rubber, liquid silicone rubber, natural rubber, and others), specialty composites (particle reinforced composites, fiber reinforced composites, and structural composites), specialty thermoplastics (polyolefins, polyimides, vinyl polymer, polyphenols, and others), specialty thermosets (epoxy, polyester, vinyl ester, polyimides, and others), and others. According to the report, specialty elastomers (fluoroelastomers, fluorosilicone rubber, liquid silicone rubber, natural rubber, and others) represented the largest segment.

End Use Industry Insights:

- Automotive and Transportation

- Consumer Goods

- Building and Construction

- Coatings, Adhesives, and Sealants

- Electrical and Electronics

- Healthcare

- Others

A detailed breakup and analysis of the specialty polymers market based on the end use industry has also been provided in the report. This includes automotive and transportation, consumer goods, building and construction, coatings, adhesives, and sealants, electrical and electronics, and healthcare, and others. According to the report, automotive and transportation accounted for the largest market share.

Regional Insights:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for specialty polymers. Some of the factors driving the Asia Pacific specialty polymers market included growing product demand from end-use industries, expanding disposable income levels, and rapid urbanization.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global specialty polymers market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- 3M Company

- A. Schulman Inc. (LyondellBasell Industries N.V.)

- Arkema S.A.

- Ashland Inc.

- Avient Corporation

- BASF SE

- Croda International Plc

- Dow Inc.

- Evonik Industries AG

- Koninklijke DSM N.V.

- Solvay S.A.

- Specialty Polymers Inc. (The Sherwin-Williams Company)

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Specialty Polymers Market News:

- March 2025: Syensqo, which is a world leader in high-performance chemicals and materials, reported the completion of a major capacity upgrade at its Changshu facility. This latest move is a strategic move to ensure that the company becomes even better positioned to service the fast-changing needs of the Chinese market, especially in electric mobility, semiconductors, smart devices and healthcare. The upgrade adds more compounding lines meant to produce innovative specialty polymers.

- May 2025: By acquiring APN Plastics Holdings Pty Ltd Group and APN Plastics Pty Ltd (collectively also known as "APN Plastics") as a part of its business, DKSH Performance Materials is embracing a singularly positioned company with 20 years of operation as a valued distributor, providing an excellent addition to its Business Line Specialty Chemicals in Malaysia and Australia.

- March 2025: Gulbrandsen, a worldwide leader in the manufacture of specialty polyethylene waxes and polymers, announced its intention to add more polyethylene wax production capacity and a new functional polymers facility to its Dahej, India, site.

- February 2025: Lone Star Funds declared that an affiliate of Lone Star Fund XII, L.P. has signed a definitive agreement to acquire RadiciGroup's Specialty Chemicals and High Performance Polymers Business Areas, which are among the world leaders in their respective markets.

- March 2025: RadiciGroup High Performance Polymers has opened its new production facility in Brazil, a strategic move to further consolidate the business sector's position in the country, where it has been successfully operating for over 25 years. The new facility, which is within a short distance from the original location, provides a quantum leap in quality when it comes to efficiency, safety and environmental responsibility and is poised to supply many markets, including automotive, electrical and electronics, and consumer and industrial products.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Product Types Covered |

|

| End Use Industries Covered | Automotive and Transportation, Consumer Goods, Building and Construction, Coatings, Adhesives, and Sealants, Electrical and Electronics, Healthcare, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, A. Schulman Inc. (LyondellBasell Industries N.V.), Arkema S.A., Ashland Inc., Avient Corporation, BASF SE, Croda International Plc, Dow Inc., Evonik Industries AG, Koninklijke DSM N.V., Solvay S.A., Specialty Polymers Inc. (The Sherwin-Williams Company), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the specialty polymers market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global specialty polymers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the specialty polymers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Specialty polymers represent a category of designed synthetic substances created to display particular physical, chemical, and mechanical characteristics appropriate for designated industrial and commercial uses. These materials are characterized by attributes like exceptional strength, longevity, thermal stability, resistance to chemicals, and electrical conductivity. They are frequently produced via chemical alterations or by combining various polymers to improve performance traits.

As of 2025, the global specialty polymers market is valued at USD 92.2 Billion.

The compound annual growth rate (CAGR) for the specialty polymers market during the forecast period 2026-2034 is expected to be 5.74%.

Specialty polymers are used in automotive, electronics, healthcare, construction, consumer goods, and adhesives. They offer durability, heat resistance, and chemical stability, making them ideal for lightweight parts, medical devices, electronic insulation, structural components, and protective coatings.

Key trends include rising demand in automotive and electronics, growth of high-performance materials, technological advancements, and sustainability initiatives. These factors drive the adoption of specialty polymers across industries, especially with the rise of electric vehicles, 5G, and renewable energy applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)