Specialty Silica Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Specialty Silica Market Size and Share:

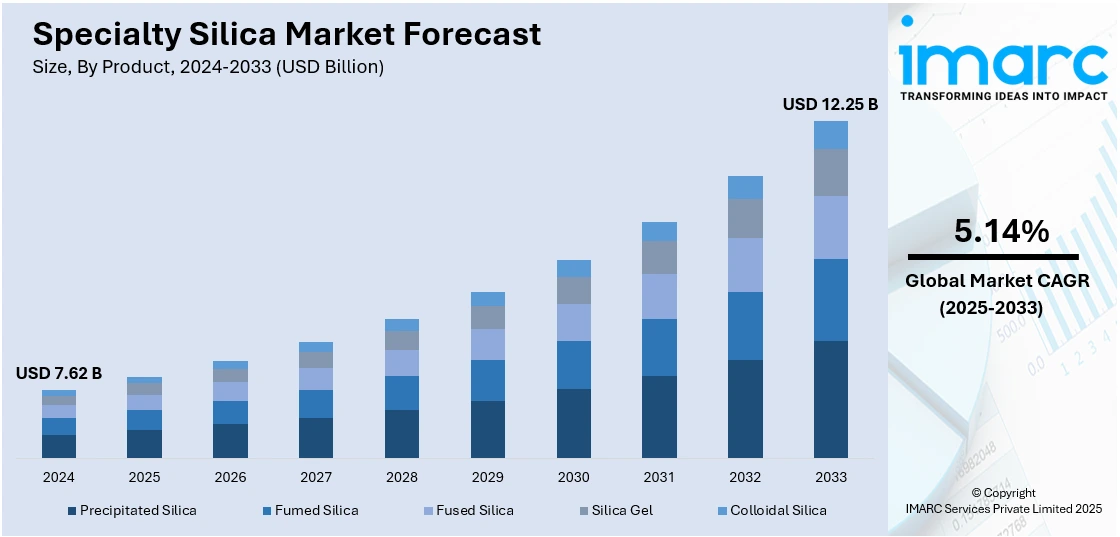

The global specialty silica market size was valued at USD 7.62 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.25 Billion by 2033, exhibiting a CAGR of 5.14% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 70.5% in 2024. The dominance is attributed to quick industrialization, robust manufacturing capabilities, and strong demand from industries including automotive, electronics, and construction. The region's increasing focus on sustainability combined with growing demand for high-performance materials in emerging economies like China and India also fuels specialty silica market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.62 Billion |

|

Market Forecast in 2033

|

USD 12.25 Billion |

| Market Growth Rate (2025-2033) | 5.14% |

The specialty silica market is influenced by several factors, such as growing demand for high-performance materials in automotive, electronics, and construction sectors. Growing use of specialty silica in tires, owing to its improved characteristics such as better fuel economy and greater traction, is one of the major drivers for the market. Moreover, the increasing emphasis on sustainability and eco-friendly products has encouraged the application of silica in different green technologies like solar panels and electric vehicle parts.

In the U.S., specialty silica market growth is largely supported by its critical role in improving tire performance and vehicle fuel efficiency. The growing trend of electrification in the automotive industry also promotes the need for high-quality silica in electric vehicle components, driving market growth. For instance, according to the US Energy Information Administration, in Q2 2024, electric and hybrid vehicles made up 18.7% of U.S. light-duty vehicle sales, up from 17.8% in Q1. Hybrid sales rose 30.7% year over year, increasing market share from 8.6% to 9.6%, while plug-in hybrids grew from 1.7% to 2.0%. Battery electric vehicles (BEVs) held steady at 7.1%. Additionally, the rising emphasis on sustainability and energy-efficient products in various industries, including construction, paints, and coatings, is fueling the demand for specialty silica. Advances in silica production technology and its increasing applications in health and wellness products are also contributing significantly to the market's expansion in the United States.

Specialty Silica Market Trends:

Growth in Automotive Industry

Automotive applications remain central to specialty silica growth. From tires to engine components, silica helps improve durability, lower rolling resistance, and enhance overall efficiency, features increasingly valued by automakers. The compound’s contribution to reducing tire wear and enhancing fuel efficiency has boosted its demand. The India Brand Equity Foundation reports that the automobile sector in India saw cumulative equity FDI inflows of USD 36.21 billion from April 2000 to September 2024, indicating a flourishing automotive industry. This inflow of foreign investment has positively impacted the specialty silica market, with increasing use in tires, automotive parts, and other key components. The demand for high-performance materials, particularly for tires, is expected to grow, further creating a lucrative specialty silica market outlook.

Expansion in Pharmaceuticals Sector

Specialty silica plays a crucial role in the pharmaceutical industry, serving as a drug delivery system and an excipient that enhances the physical properties of various medications. As demand for innovative and efficient drug formulations rises, so does the need for specialized ingredients like silica. According to the India Brand Equity Foundation, the drugs and pharmaceuticals industry in India attracted FDI equity inflows of USD 23.04 billion from April 2000 to September 2024. This growth reflects the increasing investments and development of the pharmaceutical sector, where specialty silica is vital for producing high-quality drug products. Its usage in controlled release and bioavailability optimization has fueled a positive market outlook for silica in pharmaceuticals.

Versatility in Personal Care and Electronics

The versatility of specialty silica across several industries contributes significantly to market growth. In personal care, it is utilized in products like toothpaste, antiperspirants, lipsticks, and sunscreen. Additionally, in food and beverage, it serves as an anti-caking agent, viscosity modifier, or carrier for flavors and fragrances. The product’s use in the electronics industry is also on the rise, particularly in the production of flat, defect-free surfaces for semiconductors, optical lenses, and sapphire wafers. Investments in infrastructure and large-scale utilization in paints and coatings to enhance durability, scratch resistance, and gloss are further driving demand. This broad adoption across industries is creating a solid foundation for market expansion. For instance, in January 2025, Evonik launched "Smart Effects", a new business line formed by merging its Silica and Silanes divisions. This strategic consolidation aimed to enhance innovation and sustainability in specialty silica applications across industries, such as automotive, electronics, and construction.

Specialty Silica Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global specialty silica market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Precipitated Silica

- Fumed Silica

- Fused Silica

- Silica Gel

- Colloidal Silica

Precipitated silica stands as the largest component in 2024, holding around 34.7% of the market. The precipitated silica segment dominates the specialty silica market due to its wide range of industrial applications, cost-effectiveness, and versatile properties. It is extensively used in the automotive industry for tire manufacturing, where it enhances fuel efficiency and wet traction. Additionally, precipitated silica is valued in the personal care sector for its use in toothpaste and cosmetics, and in the food industry as an anti-caking agent. Its high surface area, excellent adsorption properties, and ease of dispersion make it suitable for diverse formulations. The growing demand across these sectors, especially in emerging economies, continues to drive its market leadership.

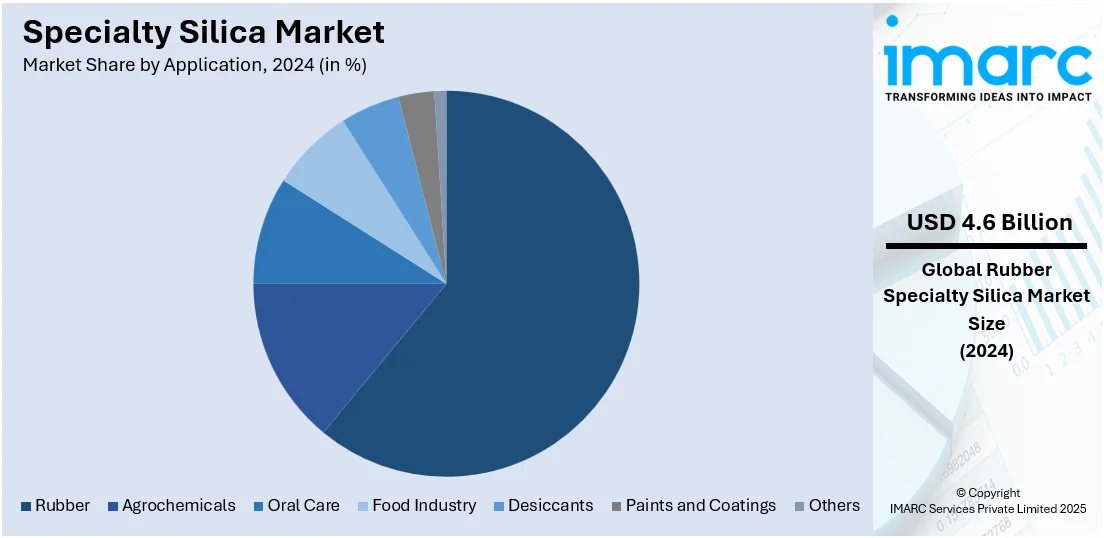

Analysis by Application:

- Rubber

- Agrochemicals

- Oral Care

- Food Industry

- Desiccants

- Paints and Coatings

- Others

Rubber leads the market with around 60.8% of market share in 2024. The market underscores the dominant role of the rubber segment, driven by its critical function in enhancing tire and rubber product performance. Specialty silica, especially precipitated silica, is widely used in tire formulations to improve rolling resistance, durability, and wet traction—features that directly support better fuel efficiency and road safety. Beyond tires, it reinforces the mechanical strength and wear resistance of rubber components such as belts, hoses, and gaskets. Growing demand for high-performance and eco-friendly tires, spurred by regulatory pressure and evolving consumer expectations, continues to drive adoption. As automakers prioritize sustainability and energy efficiency, the integration of specialty silica in rubber compounds is expected to expand, solidifying this segment’s leadership in the global market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 70.5%. Asia Pacific dominates the specialty silica market due to its robust industrial base, rapid urbanization, and strong demand from key end-use industries such as automotive, electronics, construction, and personal care. Countries like China, India, and Japan are major manufacturing hubs, driving high consumption of specialty silica in tire production, paints and coatings, and cosmetics. For instance, in November 2024, PQ announced the successful expansion of its specialty silica production facility in Pasuruan, Indonesia, featuring a new advanced micronizer. Completed on time and within budget, the upgrade boosts production capacity to meet rising demand in Asia, particularly for high-quality silicas in paints, coatings, personal care, and pharmaceuticals. The expansion strengthens PQ’s position in the Asian market and supports product innovation. Additionally, the region benefits from low production costs, favorable government policies, and increasing investments in infrastructure and industrial development. Rising disposable incomes and a growing middle class further boost demand for consumer goods that use specialty silica, reinforcing Asia Pacific's leadership in the global market.

Key Regional Takeaways:

United States Specialty Silica Market Analysis

In 2024, the United States held a market share of 86.7% in North America. The United States is experiencing increased specialty silica adoption due to growing investment in automobile manufacturing. For instance, since the beginning of 2021, auto manufacturers have announced investments of more than USD 75 Billion in the country. As the demand for fuel-efficient and durable vehicles rises, automakers are leveraging specialty silica to enhance tire performance, reduce rolling resistance, and improve vehicle safety. This material's contribution to lightweight components further supports industry targets for emission reduction. The regional expansion of production facilities by tire and automotive parts manufacturers is also contributing to consistent specialty silica utilization. Additionally, specialty silica's role in coatings, adhesives, and sealants tailored for automotive applications is supporting wider usage. The focus on sustainable and high-performance materials aligns with shifting consumer expectations and regulatory standards. Ongoing research and development efforts in automotive material sciences are boosting the integration of specialty silica into next-generation vehicle systems.

North America Specialty Silica Market Analysis

As per specialty silica market forecast, the North American market is expected to maintain strong growth momentum, fueled by rising demand from key sectors such as automotive, construction, and electronics. In the automotive sector, specialty silica enhances tire performance by improving fuel efficiency and traction, aligning with the region's focus on sustainability and regulatory standards. The construction industry contributes significantly, utilizing fumed silica to enhance concrete strength and durability, thereby supporting infrastructure development. Additionally, the electronics sector's expansion, particularly in semiconductor manufacturing, fuels the need for specialty silica in advanced materials. The market is also witnessing a shift towards eco-friendly products, with manufacturers investing in sustainable production methods to meet environmental regulations. Strategic collaborations and technological advancements further bolster market growth, positioning North America as a key player in the global specialty silica landscape. For instance, in November 2024, PPG completed the sale of its silicas products business to QEMETICA for approximately $310 million. The deal included manufacturing sites in the U.S. and the Netherlands, with QEMETICA also leasing PPG’s R&D and production facilities in Ohio and Pennsylvania. PPG’s divestment aligns with its focus on core operations in coatings and specialty materials.

Asia Pacific Specialty Silica Market Analysis

Asia-Pacific is witnessing increased specialty silica adoption due to growing demand for electronic devices such as smartphones and tablets. According to India Brand Equity Foundation, India, considered a popular manufacturing hub, has grown its domestic electronics production from USD 29 Billion in 2014-15 to USD 101 Billion in 2022-23. The electronics sector of India contributes around 3.4% of the country's GDP. The rapid pace of technological advancements and a rising tech-savvy population are fueling this demand, driving manufacturers to seek materials that offer reliability, insulation, and miniaturization compatibility. Specialty silica provides crucial properties such as moisture resistance and dielectric strength, making it integral in semiconductors, displays, and circuit boards. As consumer electronics production intensifies, so does the requirement for high-purity and consistent specialty silica grades. This demand is further supported by local manufacturing hubs and favorable policies promoting electronics sector expansion. Specialty silica's adaptability in device miniaturization and heat management continues to secure its relevance in emerging digital technologies, thereby strengthening its presence across the region's electronics ecosystem.

Europe Specialty Silica Market Analysis

Europe is increasing its specialty silica adoption due to growing widespread product adoption across the food and beverage (F&B) sector. According to reports, in 2020, there were around 291,000 enterprises in the EU processing food and beverages. Specialty silica functions as a versatile additive in the F&B industry, especially as an anti-caking, clarifying, and stabilizing agent in powdered and liquid consumables. This functional role supports extended shelf life and improved product texture, aligning with strict food quality and safety standards. Manufacturers are utilizing specialty silica in processing lines to meet growing consumer expectations for convenience and consistency. With a steady rise in demand for processed and packaged foods, specialty silica's role becomes central in ensuring product integrity. Regulatory compliance and innovation in food-grade materials are further encouraging adoption. Investments in food manufacturing technologies that incorporate specialty silica are contributing to the sector’s operational efficiency and consumer trust.

Latin America Specialty Silica Market Analysis

Latin America is seeing growing specialty silica adoption due to expanding personal care products demand driven by growing disposable income. For instance, the beauty and personal care market in Mexico is estimated to advance with a CAGR of 5.42% over the forecasting period from 2025 to 2033, according to IMARC Group. As consumers prioritize skincare, haircare, and grooming, manufacturers are incorporating specialty silica for its absorbent, texturizing, and mattifying qualities. This trend is further amplified by the emergence of beauty-focused lifestyle preferences. Specialty silica supports product performance in creams, powders, and gels while enhancing user experience through smoother applications.

Middle East and Africa Specialty Silica Market Analysis

The Middle East and Africa are showing rising specialty silica adoption due to growing pharmaceuticals industry expansion. For instance, Saudi Arabia is the largest pharmaceutical market in the Middle East, accounting for 60% of region's pharmaceutical sales. Specialty silica plays a critical role in drug formulation by acting as a carrier, stabilizer, and glidant. Its functional properties contribute to enhanced product stability, bioavailability, and shelf life, making it essential for oral dosage forms. As pharmaceutical production scales up, specialty silica continues to find increased utility across the value chain.

Competitive Landscape:

The competitive landscape of the specialty silica market is characterized by innovation, strategic expansion, and strong regional presence. Market participants focus on research and development to enhance product performance and meet evolving industry requirements, particularly in sectors like automotive, personal care, and construction. There is intense competition driven by the demand for high-performance, eco-friendly silica products, prompting players to invest in sustainable manufacturing technologies. Companies are also forming strategic partnerships, expanding production capacities, and entering emerging markets to strengthen their global footprint. Additionally, customization of products for specific applications gives firms a competitive edge, making innovation and adaptability key differentiators in this dynamic and evolving market. For instance, in October 2024, Evonik announced that the European Food Safety Authority (EFSA) reaffirmed the safety of silica (E 551) as a food additive, including for infants under 16 weeks. Used globally as an anti-caking agent, silica ensures better flow and storage of powdered foods. EFSA’s conclusion reinforces consumer confidence and supports sustainable food production. Evonik’s synthetic amorphous silica (SAS), developed for food applications, meets stringent purity standards and enhances efficiency throughout the food value chain. This approval confirms silica’s continued safe use in the European Union.

The report provides a comprehensive analysis of the competitive landscape in the specialty silica market with detailed profiles of all major companies, including

- 3M Company

- Cabot Corporation

- Ecolab Inc.

- Evonik Industries AG

- Imerys S.A.

- Madhu Silica Pvt. Ltd.

- Nouryon Holding B.V.

- PPG Industries Inc.

- Solvay S.A

- Tosoh Corporation

- W. R. Grace & Co

- Wacker Chemie AG

Latest News and Developments:

- April 2025: Nouryon introduced Adsee® Flex 960 at the ISAA Symposium 2025 in Rio de Janeiro, Brazil. This patented innovation combines specialty colloidal silica with a tailored surfactant blend to enhance crop protection via tank mix applications. Global field trials demonstrated improved fungicide performance through enhanced deposition, adhesion, and rain-fastness of active ingredients.

- March 2025: LANXESS launched Aflux SD, a specialty silica processing aid developed to improve dispersion in high-silica rubber compounds. The company also debuted Rhenocure DR/S, an amine accelerator that enhances silica dispersion and silanization—resulting in superior fuel efficiency and dynamic properties in silica-filled SBR/BR tire formulations.

- February 2025: Cabot Corporation released CAB-O-SIL® MT-6460, a new fumed silica product engineered as a matting agent for wood and leather coatings. It delivers improved matting efficiency, a smooth surface finish, and high clarity at lower loadings. Compatible with water-based acrylic, polyurethane, and epoxy systems, it offers environmental and cost advantages by reducing solvent and material usage.

- January 2025: PQ Corporation finalized the acquisition of Sibelco’s specialty silicate operations at its Lödöse facility in Sweden. This strategic move enhances PQ’s footprint in the Nordic region and further solidifies its standing in the specialty silica market.

Specialty Silica Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Precipitated Silica, Fumed Silica, Fused Silica, Silica Gel, Colloidal Silica |

| Applications Covered | Rubber, Agrochemicals, Oral Care, Food Industry, Desiccants, Paints and Coatings, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Cabot Corporation, Ecolab Inc., Evonik Industries AG, Imerys S.A., Madhu Silica Pvt. Ltd., Nouryon Holding B.V., PPG Industries Inc., Solvay S.A, Tosoh Corporation, W. R. Grace & Co, Wacker Chemie AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the specialty silica market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global specialty silica market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the specialty silica industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The specialty silica market was valued at USD 7.62 Billion in 2024.

The specialty silica market is projected to exhibit a CAGR of 5.14% during 2025-2033, reaching a value of USD 12.25 Billion by 2033.

The specialty silica market is driven by growing demand in automotive, personal care, electronics, and construction industries. Increasing focus on sustainability, enhanced product performance, and regulatory support for eco-friendly materials further fuel growth. Advancements in technology and rising applications in emerging economies also contribute significantly to market expansion.

Asia Pacific currently dominates the specialty silica market, holding a market share of 70.5% in 2024. This can be attributed to its strong manufacturing base, high demand from automotive and electronics industries, and rapid urbanization. Low production costs, favorable government policies, and rising consumption of consumer goods further boost the region’s leadership in the market.

Some of the major players in the specialty silica market include 3M Company, Cabot Corporation, Ecolab Inc., Evonik Industries AG, Imerys S.A., Madhu Silica Pvt. Ltd., Nouryon Holding B.V., PPG Industries Inc., Solvay S.A, Tosoh Corporation, W. R. Grace & Co, Wacker Chemie AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)