Specialty Spirits Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Specialty Spirits Market Size and Share:

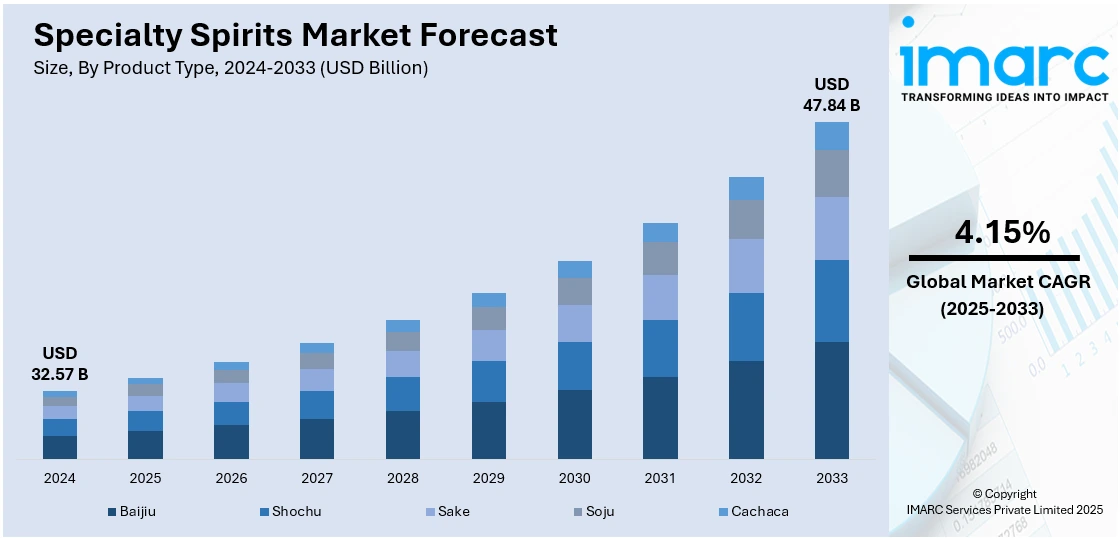

The global specialty spirits market size was valued at USD 32.57 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 47.84 Billion by 2033, exhibiting a CAGR of 4.15% during 2025-2033. North America currently dominates the market, holding a significant market share of 46.5% in 2024. The rising preference for healthy alcoholic drinks across the globe, increasing expenditure capacities of consumers, and introduction of low alcohol by volume (ABV) specialty spirits represent some of the key factors driving the market. Moreover, the growing consumer interest in premium, craft, and small-batch products, along with a desire for unique flavor experiences further supports the specialty spirits market share and its evolving consumer preferences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 32.57 Billion |

|

Market Forecast in 2033

|

USD 47.84 Billion |

| Market Growth Rate 2025-2033 | 4.15% |

The specialty spirits industry is being driven by a combination of cultural, social, and industrial forces that are transforming the way consumers interact with alcoholic drinks. Perhaps the single most important force is the demand for authenticity and uniqueness. Consumers these days are looking for products that taste distinct and also have a story attached to it—about the singular terroir under which the ingredients are harvested, the tradition of the distillery, or the innovative procedure of the making of the spirit. This search for experience is challenging producers to become more open, innovative, and customer oriented. Another significant driver is the increased role of mixology and cocktail culture, which has inspired consumers to try a wider variety of spirits with pronounced flavor profiles and rich character. Furthermore, the trend toward conscious consumerism is prompting drinkers to make sustainability and localism a priority, hence brands are forced to adopt their production principles in line.

The United States stands out as a key market disruptor, driven by a powerful combination of innovation, consumer inquisitiveness, and an entrenched culture of craft. The American marketplace is fueled by a drive for difference, resulting in a proliferation of artisan and small-batch distilleries that are resetting the definition of quality and authenticity in spirits. In contrast to mainstream markets, America celebrates experimentation, enabling distillers to experiment with out-of-the-box ingredients, unorthodox aging, and cross-category fusions that challenge traditional categorizations. Consumers' tastes shift strongly toward individualized, experience-driven products, forcing brands to rethink the way they approach everything from packaging to narrative. America’s regulatory environment has also enabled niche players to identify the right spaces for innovation. Consequently, the nation is a significant user of specialty spirits but also a trendsetter that drives worldwide changes in the production, marketing, and consumption of spirits.

Specialty Spirits Market Trends:

Changing Consumer Trends and Craftsmanship Orientation

Specialty spirits business is increasingly defined by changing consumer preferences, with a marked preference for products that highlight authenticity, craftsmanship, and differentiation in terms of flavor profiles. Consumers today are more knowledgeable and adventurous, with a strong inclination toward small-batch, craft spirits versus mass-market offerings. While this is more than a desire for a premium drinking experience, it is also closely linked to a larger cultural shift that emphasizes origin stories, artisanal production, and sustainable sourcing. Consumers are moving toward brands that can share a compelling story about how their spirits are produced—who produces them, where the ingredients come from, and what traditional or innovative techniques are employed. This demand for authenticity has resulted in a resurgence of ancient techniques and renewed interest in locally sourced botanicals and alternative distillation techniques. Consequently, companies that are able to successfully blend heritage and innovation are securing loyal followings in an increasingly crowded marketplace, further fueling the specialty spirits market growth.

Emergence of Niche Flavors and Experimental Spirits

Flavor and experimental spirits are also gaining immense popularity, with distillers experimenting with traditional spirits. Consumers today are open to trying new, bold, and unorthodox flavor profiles, which has created an increase in spirits flavored with exotic herbs, smoked ingredients, florals, or even culinary items such as truffles and seaweed. This trend is indicative of a need for more individualized and memorable drinking experiences, where the spirit could be more of a conversation starter, than a mere drink. The charm of these specialty products hence lies in the fact that they can blend in an element of surprise and amazement in a market filled with familiar options. Bartenders and mixologists are also using these spirits to create innovative cocktails that highlight their unique characteristics. As the distinction between food and beverage blurs further, the specialty spirits market outlook is shifting toward prioritizing sensory explorations, fueled by consumer interest and a new generation of bold distillers. Recently, Buffalo Trace Distillery revealed the 26th release of its groundbreaking Experimental Collection: Spirits Distilled from Grain and Hops. An illustration of the Distillery’s dedication to “Honor Tradition, Embrace Change,” this innovative addition explores how an ingredient typically found in beer brewing influences a spirit's ultimate flavor profile. Although hops are mainly linked to beer, they are sometimes utilized in the production of spirits. In general, a hopped beer or wash adds bitterness and occasionally undesirable flavors to a distillate. Hops can be utilized as a flavoring component for a current distillate.

Premiumization and Brand Storytelling in the Digital Age

Premiumization in the world of specialty spirits is increasingly becoming associated with perception and experience. Brands are paying great attention to storytelling, packaging, and online engagement to craft a strong emotional relationship with consumers. Social media and e-commerce websites have created new avenues through which smaller brands have been able to connect their product to an international market based on quality, source, and exclusivity-focused carefully crafted message. Visual content storytelling, where they display distillation processes or point out the limited-edition launches, works effectively toward the brand reaffirming their premium status. Consumers who are tech-savvy are attracted to content that allows them a higher level of attachment and ownership. For example, The Confederation of Indian Alcoholic Beverage Companies has pointed out that this change is most noticeable in India. Premium spirits priced over Rs 2,000 are seeing a growth rate of 48%. However, this phenomenon is not exclusive to India, as it is a worldwide trend in which buyers are increasingly motivated to buy luxurious and premium alcoholic beverages. Specialty spirits today are thus perceived as lifestyle products as opposed to mere alcoholic beverages. Hence, according to the specialty spirits market forecast, brands that excel at storytelling and experience creation are at the forefront of the market.

Specialty Spirits Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global specialty spirits market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Baijiu

- Shochu

- Sake

- Soju

- Cachaca

Baijiu stands as the largest component in 2024, holding around 47.8% of the market. Baijiu has established itself as the top product type in the specialty spirits market by blending cultural heritage, production intricacy, and changing global popularity. Baijiu is a traditional Chinese liquor with centuries of history and is deeply rooted in Chinese society, and it frequently takes center stage in ceremonies, celebrations, and business receptions. Its unique aroma profiles and wide range of flavor categories, from strong to light, sauce to rice, provide a rich fabric that distinguishes it from other spirits. The process of production, including solid-state fermentation and unusual microbial ecosystems, is responsible for its complexity and strength, rendering it a connoisseur's treat and a novelty for beginners. In recent times, baijiu has started to penetrate international markets due to an emerging diaspora, progressive consumers, and a general global demand for craft and heritage spirits. Its leadership in the specialty spirits category is not just a measure of volume, but also one of cultural and artisanal stature gaining universal popularity.

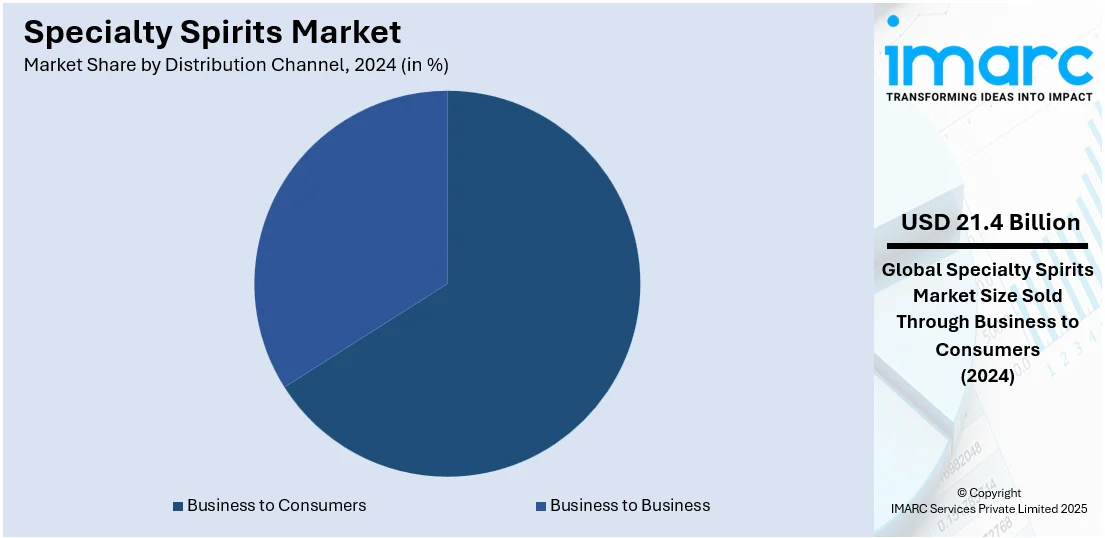

Analysis by Distribution Channel:

- Business to Business

- Business to Consumers

Business to consumer leads the market with around 65.7% of market share in 2024. Business-to-consumer (B2C) is the dominant distribution channel in the specialty spirits industry, driven by changes in consumer behavior and increased popularity of direct engagement models. Consumers today are more educated, experience-oriented, and keen on connecting directly with brands they support. This has caused specialty spirit manufacturers to focus on B2C channels, which allow them to narrate their stories better, make customer experiences more personalized, and determine how their offerings are showcased and perceived. Online sites, tasting rooms, distillery tours, and private memberships are now crucial touchpoints where brands get to create loyal communities and gain beneficial feedback and insights. The B2C strategy also enables smaller producers to avoid retail limitations, producing distinctive, small-batch, or innovative goods that may not get shelf space with big retailers. Therefore, this route is a sales tool and also an ever-changing, brand-building system that enhances consumer attachment and creates lasting growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 46.5%. Some of the factors driving the North America specialty spirits market included rising expenditure capacities of consumers, increasing health consciousness among the masses, and rapid product innovations. The region's diverse demographic and cultural profile creates a setting in which innovation can thrive, leading to a broad range of distinctive and locally inspired spirits. From traditional bourbon distilleries of heritage to contemporary craft producers exploring botanicals and barrel aging, North America has developed a market that balances tradition and innovation. North American consumers are extremely active, looking for premium, craft, and small-batch products that express craftsmanship and story complexity. This demand for differentiated products has motivated producers to spend on storytelling, sustainable sourcing, and experiential marketing, fostering more profound brand relationships. Apart from this, North America's strong e-commerce platform and helpful regulatory changes helped make specialty spirits available across a broader set of consumers, reinforcing its position as a powerhouse in shaping global trends within the category.

Key Regional Takeaways:

United States Specialty Spirits Market Analysis

In 2024, the United States accounted for over 88.30% of the specialty spirits market in North America. The United States experiences a significant rise in specialty spirits adoption driven by a growing preference for healthy alcoholic drinks. Consumers are hence becoming increasingly health-conscious, seeking beverages with low sugar, fewer additives, and comprising of natural ingredients. This shift in consumer mindset is pushing manufacturers to reformulate traditional spirits into healthier versions or introduce new specialty variants. Health trends influence product development, marketing strategies, and consumption patterns across the alcohol segment. As awareness about the impact of alcohol on well-being expands, more people are gravitating toward specialty spirits perceived as healthier options. These products align with evolving lifestyle preferences, catering to both taste and wellness concerns. In response, brands are leveraging transparency in labeling and highlighting beneficial ingredients, further promoting the healthy alcoholic drinks trend and supporting specialty spirits growth in the United States.

Asia Pacific Specialty Spirits Market Analysis

Asia-Pacific is witnessing increasing specialty spirits adoption fueled by growing alcohol consumption across its diverse markets. As disposable incomes rise and urban lifestyles evolve, there is an upsurge in social drinking and premiumization of alcoholic beverages. Specialty spirits benefit from this trend, appealing to consumers seeking distinctive flavors, heritage craftsmanship, and unique production techniques. With a large population base and increasing interest in personalized drinking experiences, the market sees heightened demand for niche offerings. Alcohol consumption in Asia-Pacific supports the expansion of varied spirit categories, encouraging innovation and experimentation. New product launches are tailored to regional tastes, incorporating local ingredients to attract evolving palates. Specialty spirits are positioned as premium alternatives, and their alignment with cultural and celebratory occasions further boosts consumption. Alcohol consumption trends directly strengthen the demand for specialty spirits across Asia-Pacific.

Europe Specialty Spirits Market Analysis

Europe shows an upward trend in the adoption of specialty spirits and exports, attributed to rising preference for specialty spirits that are produced from natural ingredients. For instance, spirit drinks are produced in all EU countries, both for domestic consumption and export. Consumers are increasingly prioritizing authenticity and ingredient transparency, which drives demand for spirits crafted using organic, locally sourced, and additive-free components. Sustainability and health awareness influence purchasing behaviors, with many turning to artisanal options that promise cleaner production and traceability. Craft distilleries respond to these preferences by offering spirits that reflect regional terroir and natural origins. The preference for natural ingredients aligns with broader movements toward responsible consumption and eco-conscious lifestyles. European markets value tradition as well as innovation in flavor, leading to the popularity of botanical-infused and naturally fermented specialty spirits.

Latin America Specialty Spirits Market Analysis

Latin America is witnessing growing specialty spirits adoption due to increasing demand for international specialty spirits. For instance, in 2023, around 577.7 million liters (or 64 million nine-liter cases) of specialty spirits were sold in Brazil. Consumers in the region are becoming more adventurous and globally influenced in their drinking habits, seeking out premium and unique products from international markets. As global travel and cultural exposure expand, so does the curiosity toward specialty spirits from abroad. This demand contributes to greater product availability and wider brand portfolios in the region’s alcoholic beverage sector.

Middle East and Africa Specialty Spirits Market Analysis

Middle East and Africa are witnessing growing restaurants, bars, and lounges, which is boosting the specialty spirits sector. For instance, in 2023, Dubai’s gastronomy industry today encompasses more than 13,000 cafes and restaurants. Increasing hospitality venues are expanding consumer access to diverse alcoholic options. Specialty spirits are being featured more frequently in curated menus and mixology-based experiences. This expansion of nightlife infrastructure is amplifying product visibility and encouraging trial among younger demographics.

Competitive Landscape:

Several major players in specialty spirits are making a variety of strategic and innovative attempts to fuel expansion and preserve competitive edge in an ever more dynamic environment. Most of them are investing on product innovation, launching distinctive blends, flavors, and limited releases that resonate with changing palates and the increasing demand for authenticity and craftsmanship. Collaborations with domestic artisans, native ingredients, and testing of aging methods are becoming common techniques to make brands stand out. Beyond the beverage itself, companies are also creating an engaging consumer experience through experiential marketing tactics—using storytelling, virtual tastings, and interactive social media marketing to create emotional bonds and allegiance. Apart from this, sustainability is another significant area of emphasis, with brands embracing sustainable packaging, lowering water and energy consumption, and sourcing ingredients sustainably to appeal to environment-conscious consumers. Distribution models are also shifting, with a strong emphasis on direct-to-consumer channels, such as branded e-commerce sites and limited club memberships. Partnerships with high-end restaurants, luxury department stores, and international influencers are also being leveraged to advance brand positioning.

The report provides a comprehensive analysis of the competitive landscape in the specialty spirits market with detailed profiles of all major companies, including:

- Craft Distillers

- HiteJinro Co. Ltd

- Kirishima Shuzo Co. Ltd

- Takara Shuzo Co. Ltd

- Lotte

- Sanwa Shurui Co.ltd.

Latest News and Developments:

- February 2025: Japanese distilled spirits maker Hamada Syuzou Co., Ltd. launched its second product in the botanical shochu series, “CHILL GREEN bitter & tropical”. The new release featured a rare Galaxy hop that delivered a zesty pink grapefruit flavor, blending bitter and tropical notes.

- December 2024: Viña Concha y Toro and China's Wuliangye baijiu signed a memorandum of understanding to establish a long-term cooperative relationship. The agreement aimed to strengthen collaboration in sales channels, market promotion, and brand building across Asian markets.

- November 2024: The Chinese Liquor Culture Canada Association (CLCCA) officially launched in Toronto, aiming to promote baijiu across Canada. CLCCA also outlined plans to open the country's first Chinese Liquor Experience Centre and host the Third Chinese Aged Liquor Exhibition and Charity Auction in 2025.

- January 2024: QuantaSing Group Ltd. unveiled its first private labeled Chinese Baijiu brand, YUNTING. The craft liquor was reportedly fermented using ancient 12897 techniques in Maotai, a Baijiu production hub.

Specialty Spirits Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Baijiu, Shochu, Sake, Soju, Cachaca |

| Distribution Channels Covered | Business to Business, Business to Consumers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Craft Distillers, HiteJinro Co. Ltd, Kirishima Shuzo Co. Ltd, Lotte, Sanwa Shurui Co.ltd., Takara Shuzo Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the specialty spirits market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global specialty spirits market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the specialty spirits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The specialty spirits market was valued at USD 32.57 Billion in 2024.

The specialty spirits market is projected to exhibit a CAGR of 4.15% during 2025-2033, reaching a value of USD 47.84 Billion by 2033.

The specialty spirits market is driven by rising consumer demand for premium, authentic experiences, growing interest in craft and artisanal products, and evolving taste preferences. Innovation in flavor profiles, cultural influences, and direct-to-consumer sales channels further fuel market growth, along with a strong emphasis on storytelling and brand transparency.

North America currently dominates the specialty spirits market, driven by a thriving craft distillation scene, consumer preference for premium and locally sourced products, and a strong culture of innovation. E-commerce growth, experiential marketing, and sustainability initiatives also play key roles, along with a discerning audience seeking unique, small-batch, and high-quality spirit offerings.

Some of the major players in the specialty spirits market include Craft Distillers, HiteJinro Co. Ltd, Kirishima Shuzo Co. Ltd, Lotte, Sanwa Shurui Co.ltd., Takara Shuzo Co. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)