Sports Nutrition Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channel, and Region, 2025-2033

Sports Nutrition Market Size, Share & Statistics:

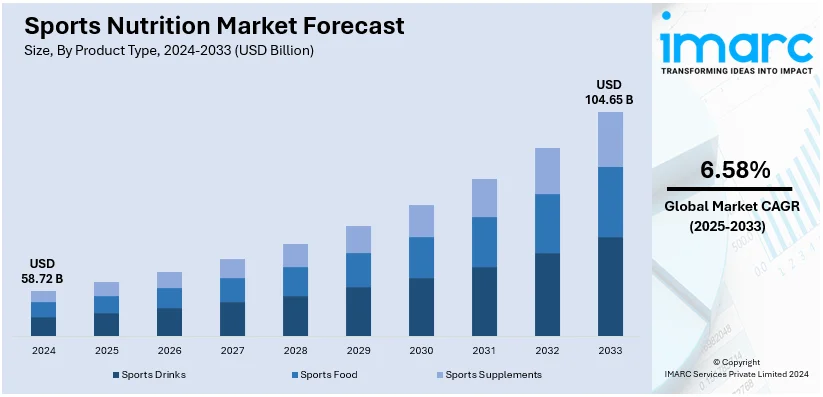

The global sports nutrition market size was valued at USD 58.72 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 104.65 Billion by 2033, exhibiting a CAGR of 6.58% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.2% in 2024. The market is witnessing steady growth due to a growing emphasis on health and fitness lifestyles, heightened awareness of the significance of protein intake and supplementation for muscle recovery and overall performance and the swift expansion of ecommerce platforms and online retail channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 58.72 Billion |

|

Market Forecast in 2033

|

USD 104.65 Billion |

| Market Growth Rate (2025-2033) | 6.58% |

The sports nutrition market is expanding due to the rising popularity of fitness activities and an increasing focus on health and performance among consumers. The demand for protein supplements, energy drinks and functional foods is driven by growing awareness of their role in enhancing strength, endurance, and recovery. The influence of fitness influencers and digital marketing is boosting product visibility while the expansion of ecommerce ensures easy accessibility. Additionally, the incorporation of vegan ingredients and clean label products aligns with consumer preferences for sustainable and healthy options. For instance, in July 2024, NotCo launched its "Not Shake Protein" a line of zero sugar protein drinks featuring unique flavors like Banana Pancakes with Cinnamon and Strawberry with Dates. Each drink contains 16g of protein and is lactose, cholesterol, and gluten free targeting the growing sports nutrition market in Brazil.

The United States sports nutrition market is witnessing trends such as a surge in plant-based and clean-label products catering to health-conscious consumers. Personalization in nutrition, enabled by advancements in technology, is gaining traction, with tailored supplements addressing individual fitness goals. For instance, in October 2024, Reebok announced its partnership with Generation Joy to launch a new line of sports nutrition products including protein supplements and vitamins. This collaboration aims to enhance fitness for all combining Reebok's athletic heritage with Generation Joy's expertise in wellness. The rise of ecommerce platforms is reshaping purchasing habits offering convenience and a broad product range. Additionally, younger demographics are driving the demand for functional foods and ready to drink formulations. Innovations in sustainable packaging and ecofriendly production methods are also influencing consumer choices. These trends reflect the evolving preferences of the United States market emphasizing health, convenience, and environmental responsibility.

Sports Nutrition Market Trends:

Increasing health and fitness awareness

The growing awareness of health and fitness is a major factor driving the sports nutrition market share. In today's environment, when well-being and physical fitness are critical individuals are discovering how important good nutrition may be for sports performance, muscle recovery and general health leading to an increased demand for sports nutrition products. Additionally, the heightened understanding about the need for optimal nutrition that might be the key to accomplishing fitness objectives, such as gaining lean muscle, increasing endurance or living an active lifestyle is favoring the market growth. Furthermore, the widespread awareness of the health and fitness movement among elite athletes, fitness enthusiasts, and those just beginning out in fitness is expanding the demand for sports nutrition. According to reports, in 2022, 77.6% of Americans participated in at least one physical activity during 2022.

Expanding athlete and fitness enthusiast demographics

The rapid increase of the athlete and fitness enthusiast populations is a major driver boosting the sports nutrition market growth. In line with this, the widespread popularity of sports nutrition products beyond professional athletes is contributing to the market growth. It includes a wide spectrum of individuals including weekend warriors, amateur athletes, fitness fanatics and those commencing on their fitness adventures. In 2021, 232.6 million Americans took part in sports and fitness activities enhancing the need for sports nutrition solutions that cater to their special demands. As more individuals embrace active lifestyles engage in various sports and exercises and seek athletic objectives they comprehend the importance of nutrition in accomplishing peak performance and post-exercise recovery.

Product innovation and diversification

Continual innovations and modifications are key drivers driving the sports nutrition market toward growth. Manufacturers within the industry are serving the changing consumer preferences and demands ensuing a steady stream of new products and formulations. These innovations extend across multiple aspects of sports nutrition. Manufacturers are consistently developing new formulations to meet specific performance and recovery needs. For instance, Coca-Cola launched Powerade Ultra, a sports drink with creatine, branched-chain amino acids (BCAAs), vitamins B3, B6 and B12 and +50% more ION4 electrolytes compared to original POWERADE. Apart from this, flavors play a pivotal role in consumer acceptance and companies are actively exploring innovative flavor profiles to enhance the appeal of their products. Unique and enticing flavors make sports nutrition products more enjoyable and cater to individual taste preferences.

Sports Nutrition Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sports nutrition market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, raw material, and distribution channel.

Analysis by Product Type:

- Sports Drinks

- Sports Food

- Sports Supplements

Sports drinks stand as the largest product type in 2024, holding around 66.3% of the market. According to the report, sports drinks represented the largest segment. According to the sports nutrition market trends, sports drinks is the dominant product in the market as they are widely consumed by athletes and fitness enthusiasts. These beverages are designed to replace fluids, electrolytes, and carbohydrates lost during physical activity, enhancing hydration and energy replenishment. Moreover, ready-to-drink (RTD) sports drinks are popular due to their ease of use and appeal during and after exercises. Furthermore, sports drinks are essential for athletes to maintain performance and avoid dehydration. Along with this, the growing customer preference for effective and convenient hydration solutions owing to their busy lives, is promoting the sports nutrition market demand.

Analysis by Raw Material:

- Animal Derived

- Plant-Based

- Mixed

Animal derived leads the market with around 72.1% of market share in 2024. According to the report, animal derived accounted for the largest market share. Animal-derived raw materials play a prominent role in the sports nutrition market, primarily due to their high-quality protein content and essential amino acids. Ingredients like whey protein, casein, and collagen derived from sources like milk, eggs, and animal tissue are favored by athletes for muscle recovery and growth. These sources offer fast-absorbing proteins that are readily utilized by the body. Whey protein, in particular, is a popular choice due to its complete amino acid profile. Its rapid digestion makes it suitable for post-workout supplementation. The high biological value and efficacy of animal-derived raw materials make them a dominant force in sports nutrition.

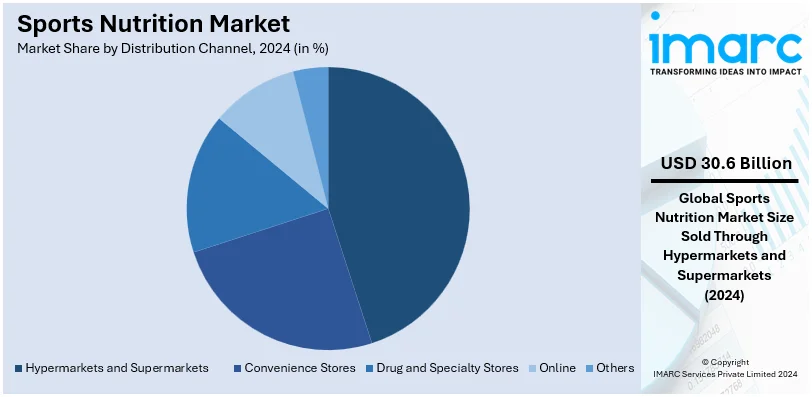

Analysis by Distribution Channel:

- Hypermarkets and Supermarkets

- Convenience Stores

- Drug and Specialty Stores

- Online

- Others

Hypermarkets and supermarkets leads the market with around 52.1% of market share in 2024. According to the report, hypermarkets and supermarkets represented the largest segment. According to the sports nutrition industry research report, hypermarkets and supermarkets represented the largest market share due to their broad reach and diversified product offerings. They provide a diverse selection of sports nutrition commodities, including supplements, beverages, and snacks, making them available to a wide spectrum of consumers. Moreover, the rising benefits of shopping from hypermarkets and supermarkets owing to the ease of shopping, which allows them to explore and compare several brands and items in one destination, is catalyzing the global sports nutrition market demand. Along with this, the heightened opportunity to physically check and purchase things, along with the availability of in-store discounts, increases their attractiveness.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 40.2%. According to the sports nutrition industry statistics, North America leads the sports nutrition market, driven by a strong fitness culture, high prevalence of health-conscious consumers, and well-established sports nutrition industry. Moreover, the growing demand among athletes and fitness enthusiasts for products that enhance their performance and recovery, contributing to the demand for sports nutrition supplements, drinks, and foods, is stimulating the market growth. A robust retail infrastructure, including specialized stores and online platforms, is supporting the market growth. Additionally, rapid innovations in product formulations and the growing focus on clean labels that align with consumer preferences, thereby supporting the market growth.

Key Regional Takeaways:

United States Sports Nutrition Market Analysis

In 2024, United States accounted for a share of 79.60% of the North America market. The sports nutrition business in the US is expanding rapidly owing to a combination of distinct and changing circumstances. Personalized nutrition is becoming increasingly significant to consumers and customized products made to achieve particular fitness objectives like weight loss, endurance or muscle recovery are growing more and more popular. Clean-label and vegan substitutes are becoming more and more sought after by fitness enthusiasts and elite athletes indicating a trend toward ethical and transparent consumption. The popularity of ecommerce platforms is constantly growing allowing for greater accessibility and direct-to-consumer interaction especially through influencer led marketing and subscription models. According to the Census Bureau, most U.S. households had at least one type of computer (95%) and had a broadband internet subscription (90%) in 2021. Manufacturers are persistently investing in research and development to enhance product efficacy, taste and convenience including ready-to-drink shakes, protein bars and functional powders. Regulatory clarity on permissible claims and ingredient safety is further encouraging innovation while partnerships with fitness centers and sports organizations are reinforcing consumer trust. Additionally, the rise of hybrid fitness trends, including high-intensity interval training (HIIT) and endurance sports is consistently driving demand for pre-workout supplements and hydration solutions. This dynamic market is also leveraging digital tools to educate and engage health-conscious consumers fueling sustained interest and adoption.

Asia Pacific Sports Nutrition Market Analysis

The Asia-Pacific sports nutrition market is currently witnessing growth driven by increasing investments by manufacturers in localized product innovation tailored to regional tastes and dietary preferences. Companies are actively leveraging traditional Asian ingredients such as green tea extract and turmeric in formulations to appeal to health-conscious consumers. The market is benefiting from the rising adoption of ecommerce platforms with brands continuously enhancing their digital presence and offering subscription-based models to ensure convenience and customer retention. According to Invest India, between 2023-2024, India had over 950 million smartphone users. Additionally, fitness apps and wearable technologies are fostering real-time awareness about nutrition needs prompting consumers to seek performance enhancing products. Sports nutrition companies are also forming strategic partnerships with fitness centers and athletic events to promote their offerings directly to the target audience. Governments across the region are promoting fitness initiatives which is encouraging consumers to adopt healthier lifestyles and consequently sports nutrition products. The market is also seeing the inclusion of plant-based proteins and clean-label products to meet the growing demand from vegan and environmentally conscious consumers. Furthermore, manufacturers are actively addressing price sensitivity in developing economies by offering smaller packaging sizes and affordable formulations making these products more accessible. This combination of strategic innovation and tailored approaches is significantly driving the market forward in the Asia-Pacific region.

Europe Sports Nutrition Market Analysis

Several major trends are propelling the growth of the sports nutrition market in Europe. To meet the growing demand for individualized nutrition from health-conscious customers manufacturers are launching clean-label goods with organic, plant-based and functional ingredients. Firms are employing ecommerce platforms to drive sales directly to clients boosting fitness enthusiasts' accessibility and convenience. Online sales in the UK surged by 36% in 2022. This information is obtained from the International Trade Administration (ITA). To cater to the region's active lifestyles brands are concentrating on expanding their product lines to include ready-to-drink protein drinks, snack bars and dietary supplements. Fitness centers and gyms are consistently collaborating with nutrition brands to promote tailored products directly to active consumers. Additionally, brands are actively targeting older demographics by marketing products emphasizing muscle maintenance and recovery. Regulatory bodies across Europe are increasingly tightening standards for product labeling and claims compelling manufacturers to innovate with transparency and quality assurance. Simultaneously, advancements in nutritional science are enabling the development of precise formulations attracting professional athletes and serious fitness enthusiasts. As social media platforms are continuously amplifying awareness and endorsements from influencers the visibility of sports nutrition products is significantly improving. These combined efforts are shaping the market’s expansion aligning with evolving consumer expectations and fitness trends.

Latin America Sports Nutrition Market Analysis

Due to a number of variables unique to the region the sports nutrition industry in Latin America is growing. As customers' awareness of fitness and health grows manufacturers are increasingly creating locally tailored formulas that address the different dietary requirements and cultural customs of Latin American consumers. Urban consumers are actively looking for practical and easy-to-use products that fit into their hectic schedules such as energy bars and protein shakes that are ready to drink. According to UN Habitat, around 80% of Mexicans reside in cities making Mexico a highly urbanized country. In order to connect with younger audiences that are adopting healthier lives and engaging with fitness influencers more frequently sports nutrition firms are turning to digital platforms and social media. The market is also being driven by the expanding availability of vegan and plant-based protein sources which are in line with the growing demand in nations like Mexico and Brazil for environmentally friendly and sustainable products. The market for sports nutrition products is also being indirectly increased by regional governments implementing initiatives that encourage wellness and physical activity. While businesses are engaging in strategic partnerships with gyms, fitness centers and athletes to increase visibility and credibility the growth of ecommerce is making a wide range of items more accessible particularly in distant and underserved areas. These factors collectively are reshaping the sports nutrition market in Latin America driving consistent growth across the region.

Middle East and Africa Sports Nutrition Market Analysis

The market for sports nutrition is growing all over the Middle East and Africa due to a number of locally distinctive variables. High-performance diets are growing more and more important to athletes and fitness fanatics which is driving up demand for protein supplements and energy boosting products that are suited to local tastes. Taking advantage of the growing digital penetration and online buying preferences the region's emerging ecommerce platforms are expanding the accessibility of premium and worldwide sports nutrition brands. Moreover, sports nutrition products are becoming necessary as a result of government-led programs supporting physical fitness and healthy lives especially in nations like Saudi Arabia and the UAE. In order to ensure a steady supply chain and break into the dispersed retail marketplaces in sub-Saharan Africa multinational brands are deliberately working with local distributors. Furthermore, the advantages of specific nutrition for different sports activities are being actively promoted by the rise in fitness influencers and social media campaigns. Clean-label and organic sports supplements are becoming increasingly popular among urban customers and producers are creating new formulas to meet this demand. Reports state that 63% of South Africans currently reside in cities. The market's congruence with changing consumer behaviour and lifestyle trends in the region is highlighted by this diversified growth.

Competitive Landscape:

The sports nutrition market is characterized by intense competition with numerous players offering a diverse range of products to cater to varying consumer needs. Key areas of focus include innovation in product formulations, such as plant-based and clean-label options, to meet the demands of health-conscious buyers. Companies are leveraging digital platforms and influencer partnerships to strengthen brand visibility and connect with younger demographics. Ecommerce has become a vital channel providing convenience and broad reach. Price competitiveness and product quality remain critical differentiators while sustainability in packaging and sourcing gains importance. The market also sees growing investments in research to develop performance specific and personalized nutrition solutions further intensifying the competitive landscape. For instance, in January 2024, Abbott Laboratories launched Protality a new protein shake aimed at adults seeking weight loss while preserving muscle mass. This initiative responds to growing demand for GLP-1 weight-loss drugs like Wegovy and Ozempic.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Abbott Laboratories

- Clif Bar & Company (Mondelēz International Inc)

- Glanbia plc

- Herbalife Nutrition Inc.

- Iovate Health Sciences International Inc.

- MusclePharm Corporation

- Otsuka Pharmaceutical Co., Ltd. (Otsuka Holdings Co. Ltd.)

- The Simply Good Foods Company

- True Nutrition

- Ultimate Nutrition

Latest News and Developments:

- March 2023: With Aaron Donald and Giannis Antetokounmpo as co-owners and Ready Athletes, Ready, one of the fastest-growing sports nutrition companies in America, announced the release of a lighter version of Ready Sports Drink, their cutting-edge, scientifically based line of performance products that maximize energy production and hydration replenishment.

- June 2023: With its initial line of beverages that include electrolytes and vital vitamins and minerals, Launch Hydrate made its debut in the sports drink industry featuring electrolytes, vitamins and minerals.

- September 2023: The new Limca Sportz ION4 edition of Limca Sportz, the sports drink from Coca-Cola India's in-house Limca brand, will be available in India. According to the drink's claims, it was scientifically created using cutting-edge ION4 technology to meet the hydration and energy requirements of athletes and fitness enthusiasts.

- June 2024: Mas+ is a new sports drink that Lionel Messi has introduced. The beverage is also low in sugar, contains vitamins and electrolytes, and is available in four distinct flavors.

Sports Nutrition Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sports Drinks, Sports Food, Sports Supplements |

| Raw Materials Covered | Animal Derived, Plant-Based, Mixed |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Drug and Specialty Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Abbott Laboratories, Clif Bar & Company (Mondelēz International Inc), Glanbia plc, Herbalife Nutrition Inc., Iovate Health Sciences International Inc., MusclePharm Corporation, Otsuka Pharmaceutical Co., Ltd. (Otsuka Holdings Co. Ltd.), The Simply Good Foods Company, True Nutrition, Ultimate Nutrition, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sports nutrition market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global sports nutrition market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sports nutrition industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sports nutrition market was valued at USD 58.72 Billion in 2024.

The sports nutrition market is projected to exhibit a CAGR of 6.58% during 2025-2033, reaching a value of USD 104.65 Billion by 2033.

The market is driven by increasing health and fitness awareness, a rising athlete and fitness enthusiast population, product innovation, the growing influence of e-commerce platforms, and demand for plant-based and clean-label products.

North America currently dominates the sports nutrition market, accounting for a share of 40.2% in 2024. The dominance is fueled by high consumer awareness, increasing fitness trends, rising demand for performance-enhancing products, and strong distribution networks in the region.

Some of the major players in the sports nutrition market include Abbott Laboratories, Clif Bar & Company (Mondelez International Inc), Glanbia plc, Herbalife Nutrition Inc., Iovate Health Sciences International Inc., MusclePharm Corporation, Otsuka Pharmaceutical Co., Ltd. (Otsuka Holdings Co. Ltd.), The Simply Good Foods Company, True Nutrition, and Ultimate Nutrition, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)