Steel Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Steel Price Trend, Index and Forecast

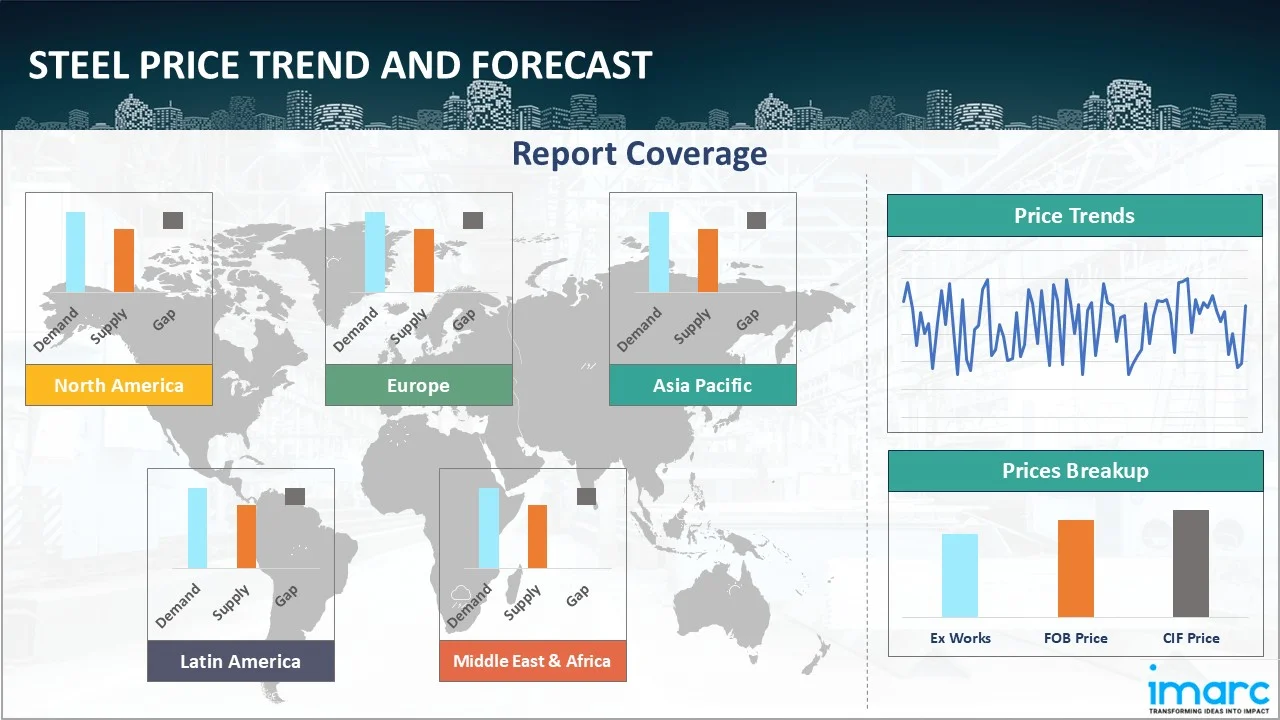

Track the latest insights on steel price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Steel Prices Outlook Q2 2025

- USA: US$ 885/MT

- Germany: US$ 806/MT

- Malaysia: US$ 558/MT

- Canada: US$ 883/MT

- Brazil: US$ 770/MT

Steel Price Chart

Get real-time access to monthly/quaterly/yearly prices, Request Sample

During the second quarter of 2025, steel prices in the USA reached 885 USD/MT in June. Steel prices in the U.S. during the second quarter of 2025 experienced moderate fluctuations, primarily influenced by shifts in raw material costs, especially iron ore and coking coal. Energy pricing and freight rates also contributed to the overall variability in production costs. Demand from the construction, automotive, and manufacturing sectors remained stable, supporting a balanced pricing environment. Although minor supply chain disruptions were observed due to logistical delays, domestic steel output stayed consistent. Overall, the market reflected a cautiously firm sentiment, with prices responding to both trends in input costs and steady downstream demand.

During the second quarter of 2025, steel prices in Germany reached 806 USD/MT in June. Steel prices held a steady course, supported by firm demand from the manufacturing, automotive, and construction sectors. While European import volumes increased, domestic production and robust logistics operations mitigated potential price volatility. Upstream input costs, including energy and raw materials, remained within a manageable range. Market sentiment was cautiously optimistic, with consistent consumption ensuring a stable pricing environment. Overall, Germany’s steel market-maintained equilibrium, showing resilience despite broader European trade fluctuations and global material trends.

During the second quarter of 2025, steel prices in Malaysia reached 558 USD/MT in June. Steel prices in Malaysia remained consistent, supported by steady demand from the construction and manufacturing sectors. Domestic production levels were sufficient, and supply chains remained functional without major disruptions. Input cost movements, including those of raw materials and energy, exerted a minimal influence on pricing. Imports remained balanced, helping maintain market equilibrium. The overall pricing environment was stable, with manufacturers and end-users operating under predictable conditions. Market sentiment stayed firm, driven by continued infrastructure activity and reliable access to steel products.

During the second quarter of 2025, steel prices in Canada reached 883 USD/MT in June. Steel prices remained stable through the second quarter of 2025, supported by solid demand across infrastructure, construction, and energy-related sectors. Domestic mills maintained steady output, and distribution networks operated efficiently, limiting significant volatility. Minor fluctuations in raw material and freight costs were observed, but they did not disrupt the overall market equilibrium. The Canadian market reflected a cautiously firm tone, aligning with broader North American trends. Stable end-user demand and reliable supply contributed to a balanced pricing environment throughout the quarter.

During the second quarter of 2025, steel prices in Brazil reached 770 USD/MT in June. Steel prices experienced mild fluctuations but remained largely stable. Elevated inventory levels slightly pressured spot pricing, though consistent demand from the construction and automotive sectors helped maintain market balance. Domestic production continued to operate steadily, with minimal disruptions to supply chains. While some cost variations arose from raw materials and logistics, overall sentiment stayed firm. The market reflected a cautiously balanced environment, with pricing responding predictably to input trends and localized trade conditions across Brazil’s industrial and infrastructure segments.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the steel prices.

Global Steel Price Trend

The report offers a holistic view of the global steel pricing trends in the form of steel price charts, reflecting the worldwide interplay of supply-demand balances, international trade policies, and overarching economic factors that shape the market on a macro level. This comprehensive analysis not only highlights current price levels but also provides insights into historical price of steel, enabling stakeholders to understand past fluctuations and their underlying causes. The report also delves into price forecast models, projecting future price movements based on a variety of indicators such as expected changes in supply chain dynamics, anticipated policy shifts, and emerging market trends. By examining these factors, the report equips industry participants with the necessary tools to make informed strategic decisions, manage risks, and capitalize on market opportunities. Furthermore, it includes a detailed steel demand analysis, breaking down regional variations and identifying key drivers specific to each geographic market, thus offering a nuanced understanding of the global pricing landscape.

Europe Steel Price Trend

Q2 2025:

In Europe, steel prices showed a cautiously optimistic recovery, supported by stabilization in the construction sector and steady manufacturing output. Despite persistent headwinds, including high energy costs, rising imports, and tariff-related uncertainties, domestic production and reduced imports helped reinforce price supports. Industry sentiment remained guarded but positive, bolstered by modest demand upturns and anticipated trade policy adjustments aimed at protecting local producers. Overall, European steel pricing in Q2 reflected a market beginning to rebound from earlier softness.

This analysis can be extended to include detailed steel price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Steel Price Trend

Q2 2025:

Steel prices in North America remained relatively stable during the second quarter of 2025. Supportive demand from construction, automotive manufacturing, and energy infrastructure projects helped maintain steady pricing. While fluctuations in raw material costs—such as iron ore and coking coal—and transportation challenges introduced minor variability, production output and inventories remained balanced. Overall, market sentiment was cautiously optimistic, with prices reflecting a well-aligned supply and demand environment across the U.S. and Canada.

Specific steel historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Steel Price Trend

Q2 2025:

The report explores the steel trends and steel price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on steel prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Steel Price Trend

Q2 2025:

In the Asia-Pacific region, steel prices exhibited moderate firmness, driven by steady urban infrastructure development and robust manufacturing activity in China, India, and Southeast Asia. While costs for raw materials and energy exerted some pressure, local production levels absorbed much of the volatility. Export activity remained active and well-managed, contributing to stable trade flows. The overall pricing trend reflected positive sentiment, underpinned by sustained industrial expansion and balanced supply chains.

This steel price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Steel Price Trend

Q2 2025:

Steel prices in Latin America remained steady through the second quarter of 2025, with minor fluctuations influenced by regional supply dynamics and infrastructure-driven demand. Brazil, Mexico, and Argentina maintained healthy consumption in the construction and energy sectors, supporting price stability. Although raw material and logistics costs posed occasional pressure, domestic production and import balancing helped stabilize the market. Overall, the region experienced a firm pricing environment, characterized by consistent end-user demand and resilient domestic steel operations, which supported a steady market outlook.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Steel Price Trend, Market Analysis, and News

IMARC's latest publication, “Steel Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the steel market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of steel at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents a detailed steel price trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting steel pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Steel Industry Analysis

The global steel market size reached US$ 335.23 Billion in 2024. By 2033, IMARC Group expects the market to reach US$ 513.71 Billion, at a projected CAGR of 5.46% during 2025-2033.

- The global steel industry continues to evolve in tandem with the macroeconomic recovery, infrastructure investment, and ongoing industrialization in emerging markets. Demand remains strong across key sectors, including construction, automotive, energy, shipbuilding, etc. The push for urban development, particularly in Asia and the Middle East, continues to support consumption, while industrial activities in North America and Europe maintain a steady baseline. Steel's versatility, recyclability, and structural strength ensure its continued dominance in both core infrastructure and advanced manufacturing applications.

- Shifts in energy sources, decarbonization goals, and the availability of raw materials are shaping production trends. Many producers are transitioning from traditional blast furnace operations to electric arc furnace (EAF) methods to reduce carbon emissions and improve energy efficiency. This transformation is influencing capacity planning, investment strategies, and regional competitiveness. Additionally, supply chain restructuring and nearshoring efforts are impacting trade flows, encouraging greater domestic production in regions previously reliant on imports.

- Technological innovation, sustainability regulations, and trade dynamics are playing an increasing role in shaping the steel market. Governments and industry leaders are emphasizing green steel initiatives, circular economy models, and stricter compliance with emissions regulations. Digitalization and automation are enhancing productivity and cost efficiency across the value chain. Meanwhile, geopolitical developments and logistics disruptions continue to influence raw material sourcing and steel availability globally. The market outlook remains resilient, with stable demand and a shift toward more sustainable and technologically integrated steelmaking practices defining the industry's next phase.

Steel News

The report covers the latest developments, updates, and trends impacting the global steel industry, providing stakeholders with timely and relevant information. This segment covers a wide array of news items, including the inauguration of new production facilities, advancements in steel production technologies, strategic market expansions by key industry players, and significant mergers and acquisitions that impact the steel price trend.

Latest developments in the Steel industry:

- June 2025: Nippon Steel completed its $14.9 billion acquisition of U.S. Steel, marking a major development in the global steel industry. As part of the deal, U.S. Steel is set to receive $11 billion in investments through 2028, including $1 billion earmarked for a new U.S. mill, with an additional $3 billion planned for future expansion. The acquisition enables Nippon Steel to tap into a surge of American infrastructure projects, gaining a competitive edge.

- January 2025: JFE Steel Corporation initiated the sale of its JGreeX green steel to JFE Shoji Pipe & Fitting Corporation (JKK), marking a key milestone in Japan’s steel industry. This is the first time JGreeX is being distributed in the steel pipe sector by a Japanese steel distributor. Through this collaboration, JFE Steel and JKK aim to establish a flexible sales system focused on small-lot shipments and quick delivery. The initiative will enable JFE Steel to expand the reach of its green steel offerings to a broader range of customers.

Product Description

Steel is a strong, durable, and versatile alloy primarily composed of iron and a small percentage of carbon, which enhances its strength and hardness. Depending on the application, it may also contain other elements, such as manganese, chromium, nickel, or vanadium, to enhance corrosion resistance, flexibility, and toughness.

Steel is widely used across industries due to its excellent mechanical properties, high tensile strength, and ability to be molded, welded, and recycled. It is a critical material in construction, automotive manufacturing, shipbuilding, appliances, tools, pipelines, and machinery. Various types of steel—such as carbon steel, alloy steel, stainless steel, and tool steel—are engineered to meet specific performance criteria. Its recyclability makes steel an environmentally sustainable material, widely integrated into green building and circular economy practices. With ongoing innovations in production methods and coatings, steel remains a foundational material in modern infrastructure and advanced engineering applications worldwide.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Steel |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonia Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of steel pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting steel price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The steel price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)