Structural Insulated Panels Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Structural Insulated Panels Market Size and Share:

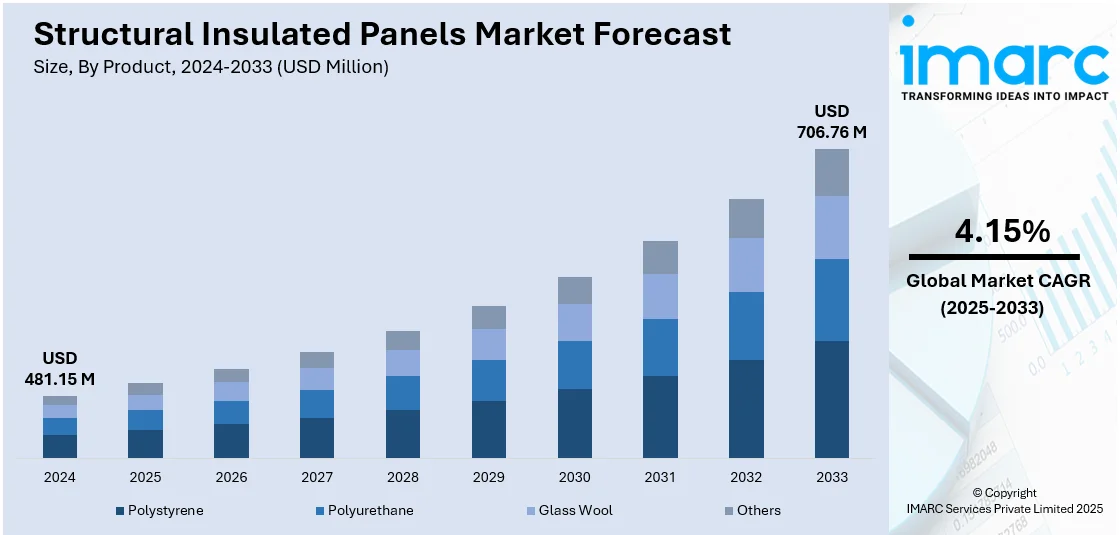

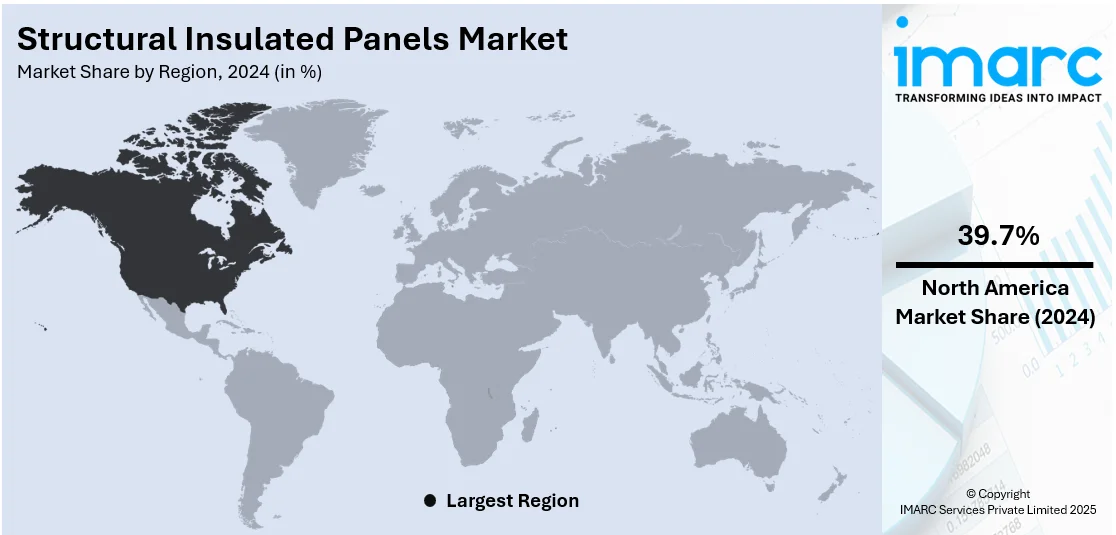

The global structural insulated panels market size was valued at USD 481.15 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 706.76 Million by 2033, exhibiting a CAGR of 4.15% from 2025-2033. North America currently dominates the market, holding a market share of over 39.7% in 2024. The market is witnessing steady growth driven by growing demand for energy-efficient and fast-build construction solutions. Furthermore, rising infrastructure investments, advancements in insulation materials, and increasing adoption in residential and commercial projects are driving market growth globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 481.15 Million |

|

Market Forecast in 2033

|

USD 706.76 Million |

| Market Growth Rate 2025-2033 | 4.15% |

The structural insulated panels (SIPs) market is driven by the rising demand for energy-efficient buildings, growing emphasis on green construction, and stringent building codes promoting sustainable materials. SIPs offer superior thermal performance, faster installation, and reduced labor costs, making them attractive for residential and commercial construction. Increasing investments in infrastructure and the need for cost-effective, lightweight materials are further boosting adoption. Technological advancements and growing awareness of environmental impact are also pushing the shift toward SIP-based construction solutions. For instance, in April 2024, Hemsec announced the launch of a new £4m factory in Knowsley, Merseyside, dedicated to manufacturing structural insulated panels (SIPs). The facility features advanced technology aimed at enhancing efficiency and precision, enabling the production of affordable social housing.

The United States structural insulated panels (SIPs) market is propelled by rising energy efficiency standards, strong growth in green building certifications, and a shift toward prefabricated construction methods. Homebuilders and commercial developers are adopting SIPs to meet tight project timelines and reduce long-term energy costs. Government incentives for sustainable construction and increasing consumer demand for high-performance homes are also encouraging SIP usage. Additionally, the push for disaster-resilient buildings in hurricane- and wildfire-prone regions supports market expansion across various states.

Structural Insulated Panels Market Trends:

Rising Use in Residential and Commercial Projects

Structural Insulated Panels (SIPs) are gaining popularity across residential and commercial sectors for their efficient construction benefits. Builders are using SIPs in walls, roofs, and floors to speed up assembly and achieve superior thermal insulation. The reduced on-site labor and shorter build times are especially appealing in markets facing labor shortages. Increased infrastructure spending is also expected to boost demand for fast, energy-efficient building materials. According to the report published by India Brand Equity Foundation, in the Interim Budget 2024-25, India's capital investment for infrastructure rises 11.1% to Rs. 11.11 lakh crore (US$ 133.86 billion), 3.4% of GDP. In commercial settings, SIPs support high-performance building goals, while in housing, they help meet energy codes and enhance occupant comfort, making them a practical and cost-effective choice.

Material Innovation

Ongoing advancements in core materials like Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), and polyurethane are driving performance improvements in Structural Insulated Panels (SIPs). These innovations are boosting panel strength, improving fire resistance, and enhancing thermal insulation, making SIPs more reliable and versatile across building types. Manufacturers are also exploring eco-friendly and recyclable materials to align with sustainability goals. Improved material formulations contribute to longer panel lifespan, better structural integrity, and compliance with evolving building codes, reinforcing SIPs as a future-ready construction solution.

Integration with Modular and Prefabricated Construction

Structural Insulated Panels (SIPs) are increasingly being integrated into modular and prefabricated construction due to their precision, ease of assembly, and consistency in quality. These panels are manufactured off-site and quickly assembled on-site, significantly reducing construction time and minimizing material waste. Their compatibility with factory-built systems makes them ideal for modular housing, commercial buildings, and remote projects. As demand grows for scalable, cost-effective building solutions, SIPs offer a streamlined approach that supports efficiency, repeatability, and faster project completion across various applications. This is further influencing the structural insulated panels market forecast.

Structural Insulated Panels Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global structural insulated panels market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Polystyrene

- Polyurethane

- Glass Wool

- Others

Polystyrene stand as the largest product in 2024, holding around 45.1% of the market. According to the report, polystyrene represented the largest segment, as it provides higher insulation values as compared to other insulation materials used in traditional stud-wall construction. In addition to this, various benefits offered by structural insulated panels, such as enhanced optical clarity and higher chemical resistant properties, are strengthening the growth of the segment. These performance advantages and material efficiencies are creating a positive structural insulated panels market outlook across both residential and commercial sectors.

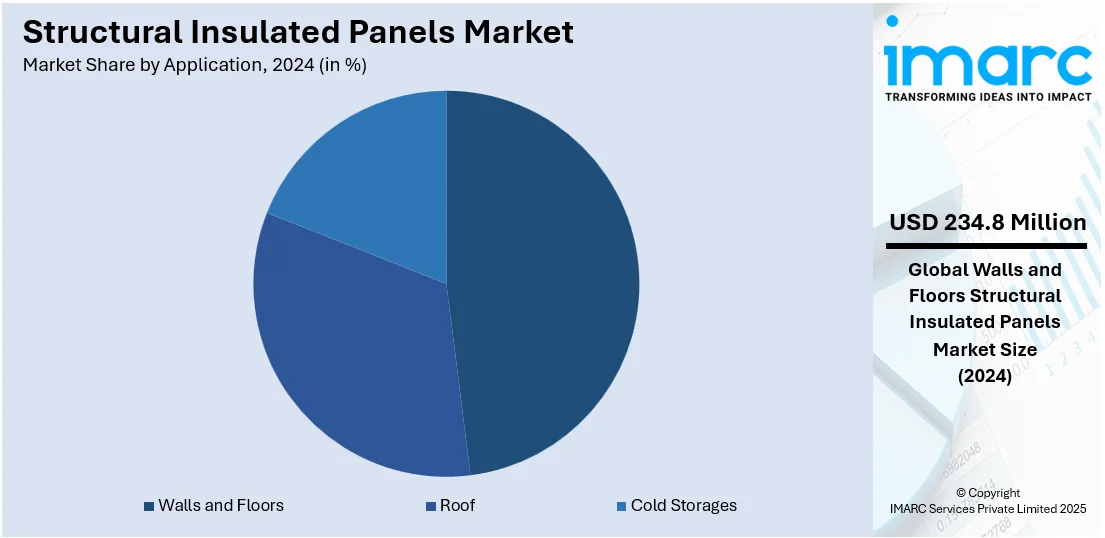

Analysis by Application:

- Walls and Floors

- Roof

- Cold Storages

Walls and floors lead the market with around 48.8% of market share in 2024. According to the report, walls and floors accounted for the largest market share, as they provide a tighter building envelope with higher insulating properties and decrease operating costs. In line with this, the rising utilization of structural insulated panels in manufacturing walls and floors, as they are quieter than traditional construction materials, such as framing lumber and insulations, is propelling the growth of the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest structural insulated panels market share of over 39.7%. According to the report, North America (United States and Canada) was the largest market for structural insulated panels. Some of the factors driving the North America structural insulated panels market included the growing number of construction activities, thriving cold chain and logistics industry, and favorable government initiatives. In addition, the rising utilization of structural insulated panels in green buildings is supporting the growth of the market in the region.

Key Regional Takeaways:

United States Structural Insulated Panels Market Analysis

In 2024, the United States accounted for over 87.40% of the structural insulated panels market in North America. The United States structural insulated panels market is experiencing steady growth due to increasing demand for energy-efficient construction solutions. Rising emphasis on sustainable building materials, coupled with advancements in insulation technology, is driving adoption across the residential and commercial sectors. Government initiatives promoting energy-efficient structures and green building certifications further support market expansion. The residential segment remains a key driver, benefiting from the growing preference for prefabricated housing solutions. Additionally, the commercial sector is witnessing increased adoption due to the need for cost-effective insulation solutions. The market is further supported by rising construction activities across the country. According to the U.S. Census Bureau, construction spending in February 2025 was estimated at a seasonally adjusted annual rate of USD 2,195.8 Billion, marking a 0.7% increase from January’s revised estimate of USD 2,179.9 Billion. This sustained investment in infrastructure and building projects is expected to reinforce the structural insulated panels market demand, particularly as energy-efficient construction solutions gain prominence. Continuous innovations in panel composition and manufacturing processes are enhancing product efficiency, further accelerating market penetration. The market for sustainable energy products (SIPs) is expected to grow due to the shift toward net-zero energy buildings, increased construction activities, and escalating applications across industrial and institutional projects.

Europe Structural Insulated Panels Market Analysis

The Europe structural insulated panels market is witnessing notable expansion, driven by stringent energy efficiency regulations and growing sustainability initiatives. The push toward reducing carbon footprints in construction is fostering increased adoption of SIPs in both residential and commercial buildings. Prefabrication trends, coupled with advancements in insulation technologies, are further strengthening market demand. The region’s focus on near-zero energy buildings and sustainable construction practices is accelerating the integration of SIPs in modern architecture. Additionally, improved thermal performance and structural integrity make these panels a preferred choice for new developments. The European Commission has set a target to achieve at least 42.5% renewable energy by 2030 and aims to reduce the EU’s overall energy consumption by 11.7% compared to projected levels for the same year. These targets are expected to drive further adoption of energy-efficient building materials like SIPs, aligning with the region’s focus on sustainability and reduced energy consumption. Expanding applications in non-residential construction, including commercial and institutional projects, is also adding to market momentum.

Asia Pacific Structural Insulated Panels Market Analysis

The Asia Pacific structural insulated panels market is expanding due to increasing urbanization and rising demand for cost-effective, energy-efficient building materials. The growing adoption of prefabricated and modular construction methods is fueling market growth, particularly in residential and commercial applications. Advancements in insulation technology and improved thermal efficiency are enhancing product acceptance across the region. Additionally, the push for sustainable construction is encouraging the use of SIPs in new developments. Rising construction activities, along with increasing awareness about energy conservation, are expected to drive continued market expansion. According to the National Bureau of Statistics, China's investment in infrastructure expanded by 4.4% year-on-year in 2024, reflecting strong construction activity that is likely to boost demand for energy-efficient materials, including SIPs. This trend, along with similar infrastructure developments across other countries in the region, is expected to further accelerate market growth.

Latin America Structural Insulated Panels Market Analysis

The Latin America structural insulated panels market is experiencing growth due to rising construction activities and increasing awareness about energy-efficient materials. The adoption of prefabricated building solutions is contributing to market expansion, particularly in residential and commercial applications. Advancements in insulation technology are further enhancing the appeal of SIPs in modern construction. Additionally, sustainability initiatives are playing a crucial role in shaping market trends. According to Brazil’s National Renewable Energy (NR) plan, the Ministry of Mines and Energy and the Energy Research Company aims to reduce Brazil’s energy consumption by 7% by 2034 through energy efficiency improvements. This push for enhanced energy performance is driving the demand for high insulation building materials like SIPs. The emphasis on cost-effective and sustainable building practices is expected to support continued market growth in the coming years.

Middle East and Africa Structural Insulated Panels Market Analysis

The structural insulated panels (SIPs) market in the Middle East and Africa is gaining traction, driven by increasing demand for energy-efficient construction solutions. The adoption of prefabricated building materials is supporting market expansion, particularly in residential and commercial projects. Advancements in insulation technology and growing awareness about sustainability are further contributing to market growth. Ongoing construction developments across the region are reinforcing demand, with a strong focus on energy conservation. According to the International Trade Administration, Saudi Arabia's construction market is leading the Middle East and North Africa, valued at approximately USD 70.33 Billion in 2024 and expected to reach USD 91.36 Billion by 2029. The rise in large-scale infrastructure projects and sustainable building initiatives is expected to drive further adoption of SIPs across various sectors, ensuring steady market growth.

Competitive Landscape:

The Structural Insulated Panels (SIPs) market is moderately fragmented, with several regional and global players competing on product quality, thermal performance, cost efficiency, and material innovation. Companies are focusing on expanding production capacity, enhancing distribution networks, and offering customized panel solutions to cater to diverse construction needs. Strategic collaborations with builders, architects, and green building initiatives are helping firms strengthen their market presence. Leading players are also investing in R&D to develop eco-friendly materials and improve fire resistance and structural integrity. Continuous product advancements and growing demand for energy-efficient solutions are intensifying competition across residential and commercial construction segments.

The report provides a comprehensive analysis of the competitive landscape in the structural insulated panels market with detailed profiles of all major companies, including:

- All Weather Insulated Panels

- American Insulated Panel

- Enercept Inc.

- Ingreen Systems Corp.

- Isopan (Manni Group S.p.A)

- Kingspan Group plc

- KPS Global

- Metl-Span Llc (Cornerstone Building Brands)

- Owens Corning

- PFB Corporation

- Premier Building Systems Inc

- Structural Panels Inc.

Latest News and Developments:

- February 2025: Kingspan Insulated Panels launched PowerPanel, an integrated roofing and solar solution for pitched roofs. It combined QuadCore insulation with advanced PV technology, achieving U-values as low as 0.11 W/m²K and 475 Wp energy output.

- February 2025: Alexandria Insulated Panels opened a new factory in Egypt’s Suez Canal Economic Zone, investing EGP 700 million (USD 13.8 million). The 31.3m² facility had an annual capacity of 1 million square meters polyurethane and 1.1 million square meters of rockwool panels, employing 120 people.

- December 2024: AWIP launched FASSADE with Bellara, an insulated panel system developed with Vicwest. Featuring the FW40 panel, it provided thermal, water, air, and vapor protection in one system.

- October 2024: Invespanel launched a new sandwich panel range using ArcelorMittal’s XCarb® recycled steel, becoming the first producer in Spain and Portugal to do so. The panels, made with 75% scrap steel and 100% renewable electricity, aimed to reduce environmental impact while maintaining high performance and quality standards in construction.

- January 2024: James Hardie launched an 11mm Hardie® Panel, offering a solution for education, healthcare, and public sector projects. Up to 50% cheaper than competitors, it met EAD Category I impact and A2 fire-rating.

Structural Insulated Panels Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Polystyrene, Polyurethane, Glass Wool, Others |

| Applications Covered | Walls and Floors, Roof, Cold Storages |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | All Weather Insulated Panels, American Insulated Panel, Enercept Inc., Ingreen Systems Corp., Isopan (Manni Group S.p.A), Kingspan Group plc, KPS Global, Metl-Span Llc (Cornerstone Building Brands), Owens Corning, PFB Corporation, Premier Building Systems Inc and Structural Panels Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the structural insulated panels market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global structural insulated panels market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the structural insulated panels industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The structural insulated panels market was valued at USD 481.15 Million in 2024.

IMARC estimates the structural insulated panels market to reach USD 706.76 Million by 2033, exhibiting a CAGR of 4.15% from 2025-2033.

Key factors driving the structural insulated panels market include growing demand for energy-efficient buildings, faster construction timelines, and rising adoption of prefabricated methods. Supportive government regulations, rising infrastructure investments, and advancements in insulation materials are further boosting the market across residential, commercial, and industrial construction segments.

North America currently holds the largest share in the structural insulated panels market, driven by strict energy efficiency regulations, widespread adoption of green building practices, and strong demand for prefabricated construction. The region benefits from advanced construction technologies, favorable government policies, and increasing investments in sustainable infrastructure.

Some of the major players in the structural insulated panels market include All Weather Insulated Panels, American Insulated Panel, Enercept Inc., Ingreen Systems Corp., Isopan (Manni Group S.p.A), Kingspan Group plc, KPS Global, Metl-Span Llc (Cornerstone Building Brands), Owens Corning, PFB Corporation, Premier Building Systems Inc and Structural Panels Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)