Supply Chain Security Market Report by Component (Hardware, Software, Services), Security Type (Data Locality and Protection, Data Visibility and Governance, and Others), Organization Size (Small and Medium-sized Enterprises, Large Enterprises), Industry Vertical (Healthcare and Pharmaceuticals, FMCG, Chemicals, Retail and E-commerce, Automotive, and Others), and Region 2025-2033

Market Overview:

The global supply chain security market size reached USD 2.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.2 Billion by 2033, exhibiting a growth rate (CAGR) of 9.64% during 2025-2033. The growing demand for real-time tracking and monitoring shipments, rising cases of cyber threats and data breaches, and increasing e-commerce and online transactions among the masses are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.6 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Market Growth Rate (2025-2033) | 9.64% |

Supply chain security is designed to protect and safeguard the flow of goods and materials throughout the supply chain. It comprises the implementation of various processes and controls, such as risk assessment, physical and digital security measures, secure transportation, and information sharing. Besides this, it assists in ensuring the safety and reliability of the movement of goods from raw material suppliers to end consumers. As it mitigates risks, prevents disruptions, and combats emerging threats, the demand for supply chain security is increasing across the globe.

At present, the rising cross-border interconnectedness of supply chains around the world is strengthening the growth of the market. Additionally, the growing demand for supply chain security for efficient risk management is offering a positive market outlook. Apart from this, the increasing emergence of the Internet of Things (IoT) and artificial intelligence (AI) in supply chain security for enhanced traceability is bolstering the growth of the market. In line with this, the rising demand for advanced security solutions among businesses to safeguard their supply chains and ensure the uninterrupted flow of goods is contributing to the growth of the market. Furthermore, the increasing adoption of supply chain security due to the rising demand for supply chain visibility and transparency among individuals is offering lucrative growth opportunities to industry investors.

Supply Chain Security Market Trends/Drivers:

Rising number of cyber threats and data breaches is propelling the market growth

There is a rise in the prevalence of cyber threats and data breaches in the supply chain. Cybercriminals are increasingly targeting supply chains to gain unauthorized access to sensitive data, such as customer information, intellectual property, and financial records. This information can be further exploited for financial gain or used for identity theft and other malicious activities. Cybercriminals can also alter the packaging of goods and create fake certifications that cause dissatisfaction among consumers. In addition, there is an increase in the demand for supply chain security, as cyberthreats and data breaches disrupt the supply chains. Apart from this, various organizations are adopting security solutions to check and maintain data accuracy in businesses, which is positively influencing the market.

Growing demand for real-time tracking and monitoring shipments is positively influencing the market

There is a rise in the demand for real-time tracking and monitoring of shipments among business organizations to increase their operational efficiency and productivity. Real-time monitoring provides detailed information about the location, status, and conditions of the goods that allow businesses to identify any potential delays or issues and take proactive measures accordingly. It also assists in improving decision-making and reducing the risk of lost or damaged shipments. Besides this, it aids in streamlining supply chain operations by improving resource allocation. Companies are rapidly adopting tracking and monitoring supply chain security solutions to provide enhanced customer experience and satisfaction, attract a wide consumer base, and build loyalty.

Increasing number of e-commerce and online transactions stimulating the market growth

People are increasingly shifting toward purchasing a wide range of products through e-commerce websites due to their convenience. E-commerce platforms provide easy access to a variety of products as compared to physical stores. Consumers can easily compare prices, read reviews, and choose from various options. They also prefer to purchase products through online transaction methods. Besides this, e-commerce transactions involve multiple parties, such as buyers, sellers, and logistics providers. Moreover, there is a rise in the demand for supply chain security to authenticate and verify the identities of these participants. Online transactions require secure payment systems to protect financial information and prevent fraud.

Supply Chain Security Industry Segmentation:

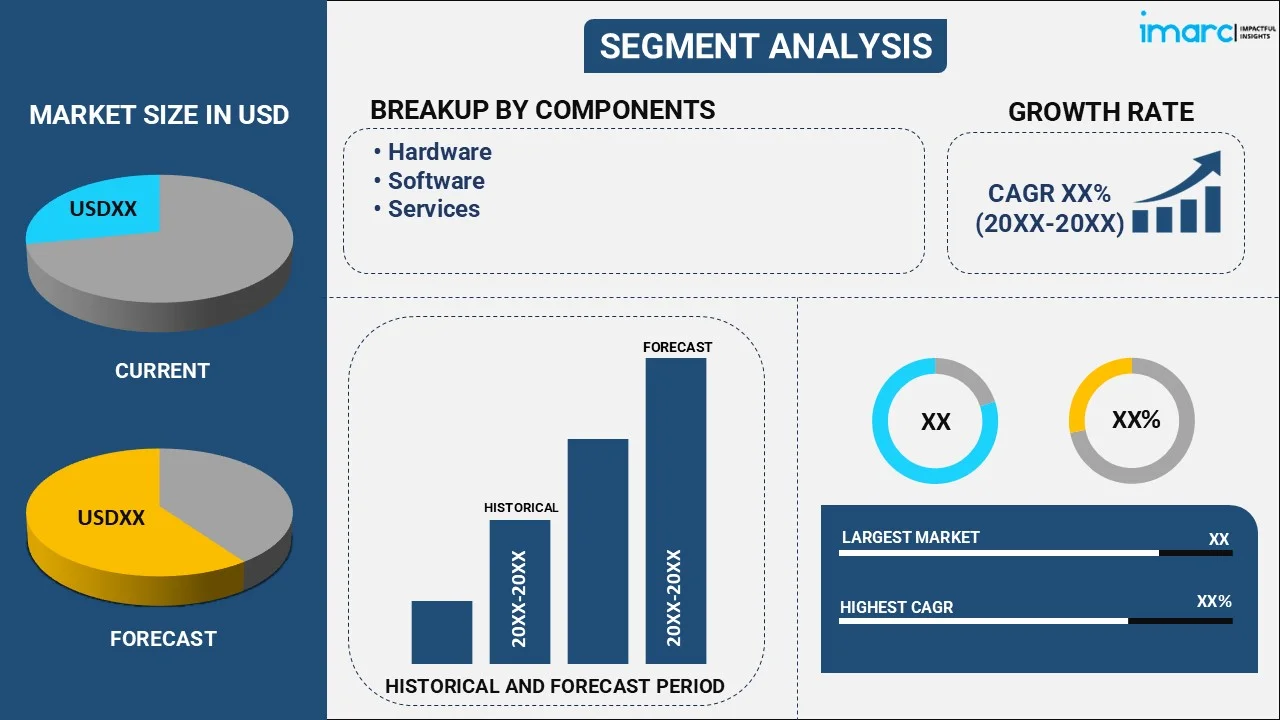

IMARC Group provides an analysis of the key trends in each segment of the global supply chain security market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on component, security type, organization size, and industry vertical.

Breakup by Component:

- Hardware

- Software

- Services

Hardware represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services. According to the report, hardware represented the largest segment.

The rising adoption of hardware to lower the complexities of international trade of goods and services is contributing to the growth of the market. In line with this, the increasing utilization of hardware for improving the security of the supply chain process through real-time visibility and traceability capabilities is bolstering the growth of the market.

Apart from this, the growing demand for supply chain security services, as they allow businesses to detect, access, and overcome cybersecurity threats during the flow of the process, is offering a positive market outlook. In addition, the rising adoption of supply chain security, as they offer security audits and compliance, risk assessment and consulting, and supplier and vendor management services, is supporting the growth of the market.

Breakup by Security Type:

- Data Locality and Protection

- Data Visibility and Governance

- Others

Data locality and protection accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the security type. This includes data locality and protection, data visibility and governance, and others. According to the report, data locality and protection represented the largest segment.

The rising adoption of data locality and protection, as it assists in reducing exposure to unauthorized access of data, is contributing to the growth of the market. In line with this, the increasing utilization of data locality and protection for enhanced data privacy among businesses is propelling the growth of the market. Apart from this, the growing demand for data locality and protection, as it facilitates faster incident response and data recovery and maintains data integrity, is strengthening the growth of the market.

Breakup by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises hold the biggest market share

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises and large enterprises. According to the report, large enterprises represented the largest segment.

Large enterprises have more complex supply chains, such as multiple suppliers, distributors, and global operations. In addition, the increasing adoption of supply chain security among large enterprises, as they have a higher risk exposure, is contributing to the growth of the market.

The rising adoption of supply chain security among small and medium-sized enterprises to protect customer data and safeguard customer trust is propelling the growth of the market. In addition, the increasing demand for supply chain security in small and medium-sized enterprises to minimize financial losses and maintain stable business operations is contributing to the growth of the market. Furthermore, the growing employment of supply chain security in small and medium-sized enterprises, as it allows them to identify, access, and mitigate risks, is bolstering the growth of the market.

Breakup by Industry Vertical:

- Healthcare and Pharmaceuticals

- FMCG

- Chemicals

- Retail and E-commerce

- Automotive

- Others

Healthcare and pharmaceuticals dominate the market share

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes healthcare and pharmaceuticals, FMCG, chemicals, retail and e-commerce, automotive, and others. According to the report, healthcare and pharmaceuticals represented the largest segment.

The rising adoption of supply chain security in the healthcare and pharmaceuticals industry to ensure the integrity and safety of healthcare and pharmaceutical products is supporting the growth of the market. Apart from this, the increasing employment of supply chain security in the healthcare and pharmaceutical sector to safeguard patient health and well-being is bolstering the growth of the market. In addition, the rising utilization of supply chain security for reducing the risk of tampered packaging and counterfeit or substandard medicines is contributing to the growth of the market.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest supply chain security market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

North America held the biggest market share due to the presence of major supply chain security vendors. In addition, the rising adoption of advanced technologies is propelling the growth of the market. Apart from this, governing agencies of the region are encouraging the adoption of supply chain solutions that provide enhanced security and prevent cyberattacks, which is positively influencing the market. In line with this, the increasing demand for supply chain security among small and medium-sized enterprises is contributing to the growth of the market in the region.

Competitive Landscape:

Key players are engaging in partnerships and collaborations to enhance the supply chain solutions and provide improved visibility and safety of goods to attract a large consumer base. They are also introducing real-time cold chain monitoring solutions that assist in offering safe and effective delivery of medications to patients. Apart from this, major industry players are integrating in-cab and asset tracking solutions to monitor a fleet of trucks, dry vans, and refrigerated trailers. In line with this, various manufacturers are focusing on introducing the Internet of Things (IoT) supply chain monitoring devices for real-time tracking of shipments, which is offering a positive market outlook. Moreover, they are providing a supply chain risk monitoring service that integrates varied customizable data sources into calculations.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Check Point Software Technologies Ltd.

- Controlant

- NXP Semiconductors N.V.

- Omega Compliance Limited

- Orbcomm Inc.

- Roambee Corporation

- Safetraces Inc.

- SailPoint Technologies Inc.

- Sensitech Inc. (Carrier Global Corporation)

Supply Chain Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Security Types Covered | Data Locality and Protection, Data Visibility and Governance, Others |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | Healthcare and Pharmaceuticals, FMCG, Chemicals, Retail and E-commerce, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Check Point Software Technologies Ltd., Controlant, NXP Semiconductors N.V., Omega Compliance Limited, Orbcomm Inc., Roambee Corporation, Safetraces Inc., SailPoint Technologies Inc., Sensitech Inc. (Carrier Global Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global supply chain security market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global supply chain security market?

- What is the impact of each driver, restraint, and opportunity on the global supply chain security market?

- What are the key regional markets?

- Which countries represent the most attractive supply chain security market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the supply chain security market?

- What is the breakup of the market based on the security type?

- Which is the most attractive security type in the supply chain security market?

- What is the breakup of the market based on the organization size?

- Which is the most attractive organization size in the supply chain security market?

- What is the breakup of the market based on the industry vertical?

- Which is the most attractive industry vertical in the supply chain security market?

- What is the competitive structure of the global supply chain security market?

- Who are the key players/companies in the global supply chain security market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the supply chain security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global supply chain security market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the supply chain security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)