Swine Feed Market Size, Share, Trends and Forecast by Product Type, Feed Essence, Feed Additive Type, and Region, 2025-2033

Swine Feed Market Size and Share:

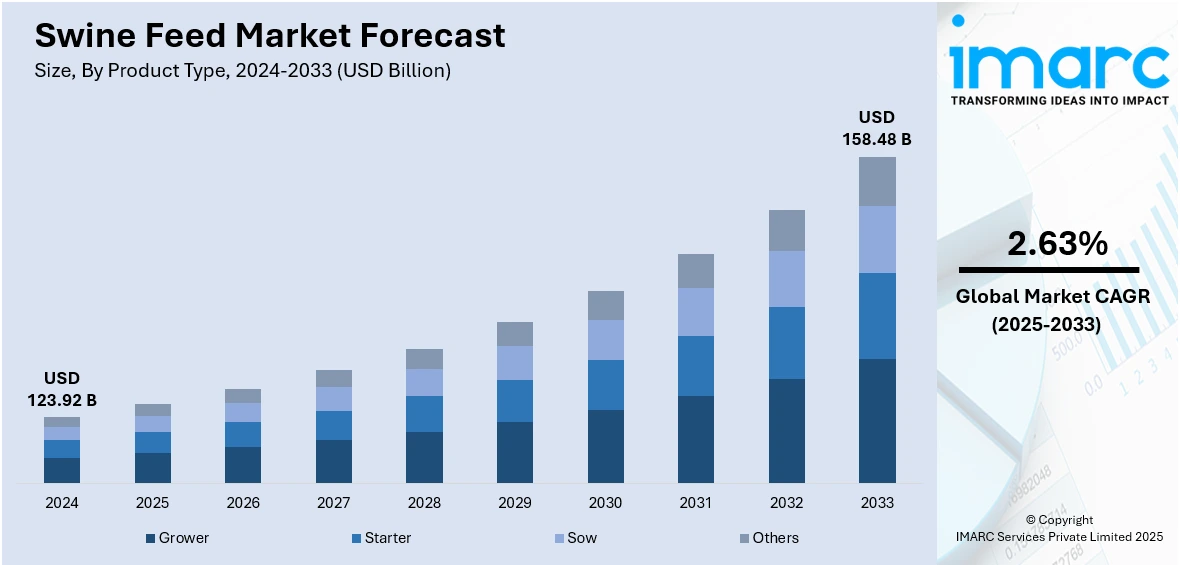

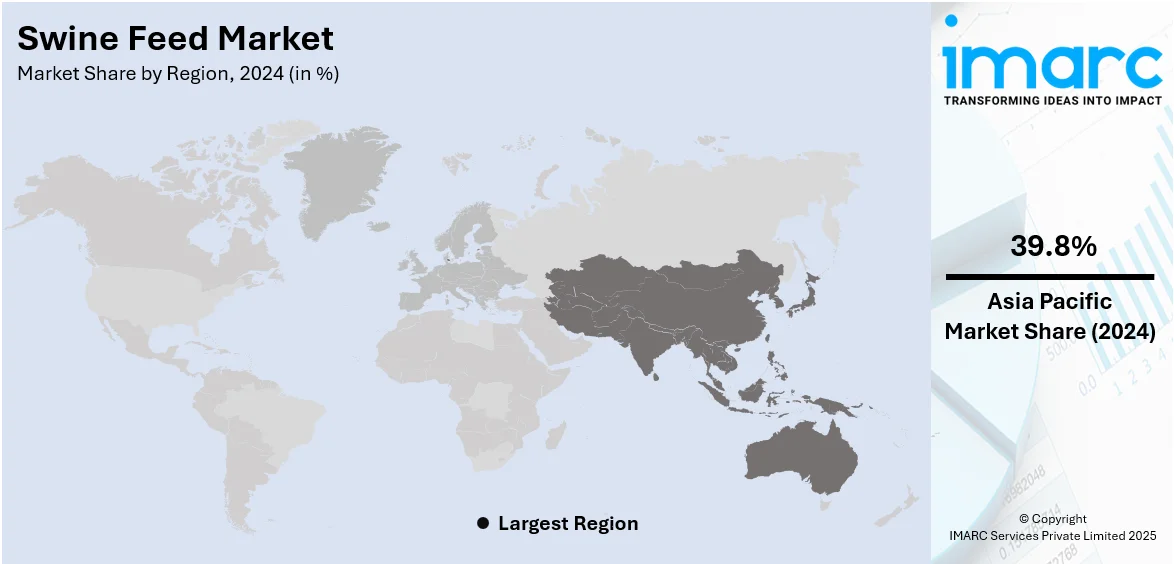

The global swine feed market size was valued at USD 123.92 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 158.48 Billion by 2033, exhibiting a CAGR of 2.63% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 39.8% in 2024. The heightened global demand for pork and pork products stands as a pivotal driver for the market. Apart from this, the continuous advancement of feed technology and formulation techniques is propelling the growth of the market. Furthermore, the rising focus on environmental concerns and the pursuit of sustainable livestock production practices is expanding the swine feed market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 123.92 Billion |

| Market Forecast in 2033 | USD 158.48 Billion |

| Market Growth Rate (2025-2033) | 2.63% |

The market for swine feed is growing steadily, driven by numerous major trends and factors that determine its dynamics. Among the most important drivers is the rising worldwide consumption of pork meat, especially in emerging economies. As the world population increases and the demand for animal protein rises, pork is ranking as the most consumed meat globally, thus catalyzing the demand for high-quality swine feed. This increased consumption exerts pressure on pork producers to maximize production efficiency, thereby creating the need for efficient and high-quality feed solutions. Moreover, the swine feed industry is experiencing innovation in ingredient sourcing and production methods. The heightened popularity of alternative protein sources like insect meal and plant proteins is aiding in the solution of feed cost and sustainability issues.

The United States swine feed market is witnessing high growth owing to different prevailing trends. There is a high demand for feed-grade pork, especially because consumers prefer animal protein more, which is driving the demand for effective swine feed. The National Agricultural Statistics Service (NASS) of the U.S. Department of Agriculture advertised its Quarterly Hogs and Pigs report, displaying a 1% rise in the U.S. hog and pig population from December 2023. As of December 1, 2024, there were 75.8 million hogs and pigs on U.S. farms, indicating a minor reduction from September 1, 2024. With an increase in the consumption of pork, feed-grade producers in the US are looking forward to showcasing productivity, thereby driving the need for high-performance and nutrient-packed feed grades. The market is also seeing an increased focus on sustainability and animal well-being. With rising worries about antibiotic overuse, pig farmers are turning towards feed solutions that benefit gut health and immunity in a natural way. The trend is inspiring the application of probiotics, prebiotics, and other substitute feed additives, favoring overall animal well-being. Consequently, feed producers are constantly coming up with new ingredients and additives to address these health-focused needs.

Swine Feed Market Trends:

Increasing global demand for pork

The escalating global demand for pork and pork products stands as a pivotal driver for the swine feed market. According to the National Institutes of Health, global consumption of pork reached 113 Million Tons in 2022, recording a growth of 77% from 63.5 million tons in 1990. By 2032, pork consumption is expected to reach 129 Million Tons. This surge in demand is particularly pronounced in emerging economies, where rising incomes and changing dietary preferences have led to a greater consumption of meat, including pork. As a result, swine farmers are under pressure to optimize production and enhance the growth rates of their pigs, necessitating the use of high-quality, nutritionally balanced swine feed. The sheer magnitude of this demand has a significant impact on the growth of the swine feed market, driving producers to seek innovative feed solutions that improve swine performance and meat yield, thereby impelling the swine feed market growth.

Technological advancements in feed formulation

Another critical factor fueling the growth of the global swine feed market is the continuous advancement of feed technology and formulation techniques. Modern science and research have enabled the development of specialized swine feed recipes that are tailored to meet the precise nutritional requirements of pigs at various stages of growth and production. These formulations enhance feed efficiency, resulting in improved weight gain, reduced feed wastage, and overall higher productivity within swine farms. For instance, in February 2025, Netherlands-based Trouw Nutrition announced the launch of science-based nutrition and digital solutions to assist various farms and animal feed mills, including swine feed, in promoting feed safety, improving livestock performance, and reducing their carbon footprint. The utilization of such innovative feed solutions attracts swine producers looking to optimize their operations, which, in turn, offers a favorable swine feed market outlook.

Environmental and health considerations

Growing environmental concerns and the pursuit of sustainable livestock production practices have spurred changes in swine feed formulations. According to industry reports, livestock production makes up for over 25% of greenhouse gas emissions globally, highlighting the critical need for sustainable livestock production practices. As a result, the swine industry is increasingly focusing on environmentally friendly and sustainable feed solutions, such as those with reduced carbon footprints and lower environmental impacts. Moreover, the growing emphasis on animal health and welfare has led to the development of disease-resistant swine feed that supports the overall well-being of the animals. Concurrent with this, the expanding awareness of these factors among both producers and consumers has led to a shift towards higher-quality swine feed products that align with sustainable and ethical practices, thus boosting the global swine feed market.

Swine Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global swine feed market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, feed essence, and feed additive type.

Analysis by Product Type:

- Grower

- Starter

- Sow

- Others

Grower stands as the largest component in 2024. The demand for swine feed, specifically the grower feed, is primarily driven by the increasing focus on maximizing the growth potential and efficiency of pigs during the crucial growth phase. Grower feed is formulated to provide the necessary nutrients and support rapid development in young swine, optimizing their transition from the starter stage to adulthood. Swine farmers recognize the importance of this phase in determining the overall performance and eventual meat yield of their pigs. As such, there is a growing emphasis on utilizing specialized grower feed that enhances growth rates, improves feed conversion ratios, and ensures uniformity among the swineherd, which is strengthening the market’s growth. Furthermore, the increasing desire to achieve optimal results during the grower stage, ultimately contributing to higher productivity and profitability in the swine farming industry is presenting lucrative opportunities for market expansion.

Analysis by Feed Essence:

- Vitamins

- Antioxidants

- Feed Acidifiers

- Feed enzymes

- Amino acids

- Others

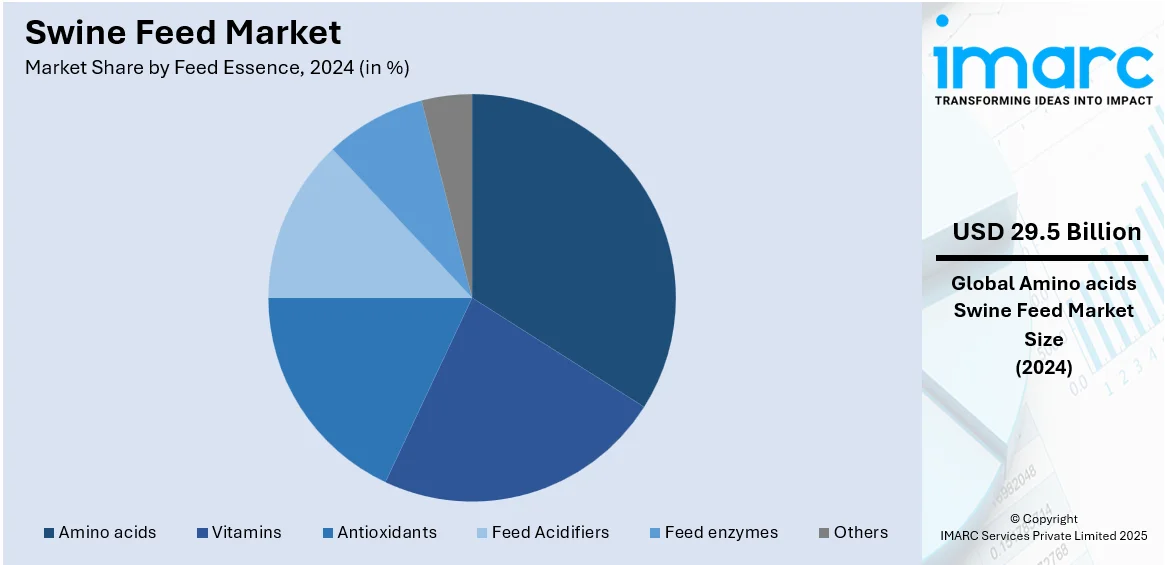

Amino acids lead the market with 23.8% of market share in 2024. The expanding product adoption owing to the imperative role that amino acids play in swine nutrition and overall growth represents one of the key factors bolstering the market growth. Amino acids are the building blocks of proteins, which are essential for muscle development and overall swine health. With an increasing emphasis on optimizing feed efficiency and meat quality in swine production, there is a growing recognition that providing precise and balanced amino acids in swine feed is crucial, which is contributing to the surging inclusion of amino acids in swine feed. Concurrent with this, swine farmers and feed manufacturers are increasingly turning to amino acid supplements to ensure that pigs receive the specific amino acids they require for optimal growth and performance. Additionally, as the swine industry seeks to reduce the environmental impact of feed production, amino acid supplementation allows for more efficient utilization of protein sources, further propelling the demand for swine-feed amino acids.

Analysis by Feed Additive Type:

- Zootechnical Feed Additives

- Sensory Feed Additives

- Nutritional Feed Additives

Nutritional feed additives lead the market in 2024. The demand for nutritional feed additives in the swine industry is driven by the need for enhanced animal health, performance, and sustainable production. Swine farmers are increasingly recognizing the pivotal role of nutritional feed additives in improving feed efficiency, disease resistance, and overall well-being of their pigs. These additives include vitamins, minerals, probiotics, and enzymes, among others, which contribute to optimized nutrition and digestion in swine. Apart from this, the growing consumer awareness of food safety and quality has prompted swine producers to seek feed additives that can help reduce the need for antibiotics and improve meat quality, aligning with evolving industry standards and regulations. This demand for nutritional feed additives underscores their significance in modern swine farming practices.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of 39.8%. The rapid population growth in countries across Asia is driving the demand for protein-rich diets, with pork being a staple source of meat. This rise in demand has driven the expansion of the swine farming sector, thereby creating the need for high-quality swine feed to meet the requirements of pigs. Moreover, the adoption of advanced farming practices and technology in the Asia Pacific is playing a pivotal role. Swine farmers in the region are increasingly recognizing the benefits of specialized feed formulations and feed additives to improve pig health, growth rates, and meat quality. This shift towards modernization is further driving the demand for innovative swine feed solutions. Apart from this, growing environmental concerns and the push for sustainable agriculture are leading to a greater emphasis on eco-friendly swine feed options in the Asia Pacific region. Producers are seeking feed formulations that reduce the environmental footprint of swine farming, aligning with the region's sustainability goals.

Key Regional Takeaways:

United States Swine Feed Market Analysis

The United States holds 82.80% share in North America. The United States market is primarily driven by the growing demand for pork products, advancements in animal nutrition, and increasing awareness about the importance of livestock health. The rising global demand for high-quality meat, particularly in developing countries, has bolstered pork production in the U.S., increasing the need for efficient feeding practices to maintain production levels. According to the U.S. Department of Agriculture (USDA), the United States accounts for 11% of global pork production, reaching 12.61 Million Metric Tons in 2024/2025. Furthermore, innovations in feed formulations, such as the inclusion of probiotics, enzymes, and high-quality grains, are enhancing feed efficiency and supporting better growth rates, contributing to overall industry expansion. The increasing emphasis on sustainable and cost-effective farming practices is also prompting the adoption of alternative ingredients such as plant-based proteins and by-products, which offer nutritional benefits while reducing costs. Additionally, rising concerns about animal diseases and welfare are driving the need for nutritionally balanced, disease-resistant feeds. Government regulations and support, along with technological advancements in precision farming and feed management, are also shaping the market by improving operational efficiencies. Other than this, the expansion of the U.S. pork export market is also supporting market growth as global trade agreements and economic growth in export destinations increase demand for U.S. pork, consequently boosting swine feed requirements.

Asia Pacific Swine Feed Market Analysis

The Asia Pacific market is expanding due to the rising demand for pork, a key protein source in numerous countries across the region, particularly in China and Southeast Asia. As population growth and urbanization continue, consumer preference for pork products has increased, leading to higher production and feed consumption. For instance, China accounts for 49% of global pork production, reaching 57.06 Million Metric Tons in 2024/2025. Additionally, the region's swine feed market is significantly supported by the availability of locally sourced raw materials, reducing feed costs and improving cost-effectiveness for farmers. The trend toward nutritionally balanced and customized feed solutions, designed to meet specific growth stages and health needs of pigs, is also gaining popularity. Besides this, increasing awareness about food safety standards and regulations is promoting the use of premium, safe ingredients in swine feed, promoting widespread adoption, and supporting overall market growth.

Europe Swine Feed Market Analysis

The Europe market is experiencing robust growth, fueled by increasing pork consumption and growing export demand. According to industry reports, consumption of pork in the EU-28 is expected to reach 31.70 kg per capita by 2027. As consumer preferences shift toward lean meat, pork remains a staple protein source in numerous European countries, fueling the need for efficient swine feed production. The expansion of pork exports to non-EU markets, particularly in Asia, is also contributing substantially to market growth. According to the European Commission, the EU is the largest exporter of pork and pork products globally, exporting approximately 13% of its total production. Additionally, growing concerns around livestock health and disease management are also encouraging the use of advanced nutritional supplements, such as vitamins, minerals, and probiotics, to enhance the overall well-being and productivity of pigs. This trend is linked to rising consumer demand for meat with fewer antibiotics, prompting feed manufacturers to develop healthier and more sustainable formulations. Furthermore, the shift toward more sustainable farming practices is significantly propelling industry expansion, with feed producers increasingly utilizing alternative ingredients such as plant-based proteins, reducing reliance on conventional feedstuffs such as soy. Other than this, technological advancements in feed formulation and precision farming are improving feed efficiency, reducing waste, and lowering production costs.

Latin America Swine Feed Market Analysis

The Latin America market is significantly influenced by rising meat exports and the subsequent growing demand for efficient, high-quality feed. For instance, total exports of pig meat from Brazil recorded a growth of 5% from January to September 2024 in comparison to the same period in 2023, equating to 53,000 Tons and registering as the highest volume exported by Brazil on record, as per the Agriculture and Horticulture Development Board (AHDB). As the region experiences economic growth and a rising middle class, the demand for pork, particularly in countries such as Brazil and Mexico, is expanding. Farmers are focusing on improving feed efficiency to increase productivity and reduce costs, with a growing emphasis on the use of high-quality, nutritionally balanced feed formulations. Government policies supporting the agricultural sector and investments in animal health are also contributing to market growth.

Middle East and Africa Swine Feed Market Analysis

The Middle East and Africa market is being increasingly propelled by the region’s growing focus on improving animal welfare and feed quality to meet international standards. As demand for high-quality pork rises, there is a rising shift toward advanced swine feed formulations that promote faster growth, disease resistance, and overall health. Moreover, regional developments in animal husbandry, driven by both private and government investments in agriculture, are also fostering an environment for the expansion of swine farming and feed production. For instance, the animal husbandry market in Saudi Arabia reached USD 0.37 Trillion in 2024 and is expected to grow at a CAGR of 6.12% during 2025-2033, according to IMARC Group. Besides this, the adoption of alternative ingredients, such as locally sourced grains and plant-based proteins, is also reducing feed costs and enhancing sustainability.

Competitive Landscape:

Key market players in the global market are actively pursuing several strategies to improve their business and strengthen their market positions. Many companies are focusing on expanding their product portfolios by developing innovative and specialized feed formulations that meet the growing demand for high-performance and nutritionally balanced swine feed. These formulations are incorporating natural additives, probiotics, and prebiotics to promote animal health and productivity, in response to consumer and regulatory pressures on antibiotic use. Several leading players are also investing heavily in research and development to enhance the quality and sustainability of their products. They are experimenting with alternative protein sources, such as insect meal and algae, to address concerns related to feed costs and environmental sustainability. As per the swine feed market forecast, this expected to help them offer more eco-friendly and cost-effective feed solutions in the future to the global market.

The report provides a comprehensive analysis of the competitive landscape in the swine feed market with detailed profiles of all major companies, including:

- Chr Hansen

- Royal DSM Holdings Limited

- Lallemand Inc.

- BASF Limited

- Novus International Inc.

- Kent foods

- Archer Daniels Midland Company

- Cargill Inc.

- ABF Plc.

- Alltech Inc.

Latest News and Developments:

- March 2025: Kemin Industries launched PROSIDIUM, a novel method for controlling feed pathogens and managing foodborne illness-causing microorganisms, such as viruses, that affect swine production. PROSIDIUM is based on potent and innovative peroxy acids and is intended to assist producers of animal feed and raw materials in creating safe animal feed.

- March 2025: IFF expanded its Enviva PRO probiotic range to include swine feed, aiming to enhance piglet welfare during the critical post-weaning phase. This three-strain Bacillus probiotic supports gut health, leading to a 2.5% increase in average daily weight gain and a 6.3% reduction in diarrhea frequency, as demonstrated in IFF's studies.

- January 2025: Novus International and Resilient Biotics partnered to develop an innovative microbial feed solution targeting respiratory diseases in pigs, such as PRRS and PRDC. Leveraging Resilient Biotics' microbiome discovery platform and Novus's nutritional expertise, the collaboration aims to enhance swine immune health and reduce industry losses.

- January 2025: Layn Natural Ingredients introduced water-soluble polyphenol feed additives for swine and poultry. Delivered via drinking water, these additives offer immediate bioavailability, bypassing feed mill delays. Notably, TruGro MYC mitigates mycotoxin toxicity in swine, enhancing health and productivity. This approach ensures consistent nutrient intake, especially during heat stress when feed consumption drops.

- January 2025: Godrej Agrovet introduced 'Pride Hog', a pig feed range comprising Starter, Grower, and Finisher variants, tailored to each stage of a pig's lifecycle. This initiative aims to enhance pig health and immunity, particularly in India's Northeast, where pig farming is vital.

Swine Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Grower, Starter, Sow, Others |

| Feed Essences Covered | Vitamins, Antioxidants, Feed Acidifiers, Feed Enzymes, Amino Acids, Others |

| Feed Additive Types Covered | Zootechnical Feed Additives, Sensory Feed Additives, Nutritional Feed Additives |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Chr Hansen, Royal DSM Holdings Limited, Lallemand Inc., BASF Limited, Novus International Inc., Kent foods, Archer Daniels Midland Company, Cargill Inc., ABF Plc., Alltech Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the swine feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global swine feed market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the swine feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The swine feed market was valued at USD 123.92 Billion in 2024.

The swine feed market is projected to exhibit a CAGR of 2.63% during 2025-2033, reaching a value of USD 158.48 Billion by 2033.

The swine feed market is primarily driven by the increasing global demand for pork, technological advancements in feed formulations, and the rising focus on sustainability and animal health. Additionally, the adoption of alternative protein sources and efficient feeding practices are accelerating market growth.

Asia Pacific currently dominates the swine feed market, accounting for a share of 39.8%. This is driven by the region's rising pork consumption, population growth, and increasing adoption of advanced farming practices.

Some of the major players in the swine feed market include Chr Hansen, Royal DSM Holdings Limited, Lallemand Inc., BASF Limited, Novus International Inc., Kent foods, Archer Daniels Midland Company, Cargill Inc., ABF Plc., Alltech Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)