Switzerland Carbon Black Market Report by Type (Furnace Black, Channel Black, Thermal Black, Acetylene Black, and Others), Grade (Standard Grade, Specialty Grade), Application (Tire, Non-Tire Rubber, Plastics, Inks and Coatings, and Others), and Region 2026-2034

Switzerland Carbon Black Market Overview:

The Switzerland carbon black market size reached USD 41.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 53.8 Million by 2034, exhibiting a growth rate (CAGR) of 2.86% during 2026-2034. The market is experiencing growth due to an increased demand in tire manufacturing, industrial rubber products, and plastics. Advancements in technology and rising automotive production are significant drivers contributing to the market growth further.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 41.2 Million |

| Market Forecast in 2034 | USD 53.8 Million |

| Market Growth Rate (2026-2034) | 2.86% |

Access the full market insights report Request Sample

Switzerland Carbon Black Market Trends:

Rising Demand in Automotive Sector

The rising product demand in automotive sector is significantly boosting the Switzerland carbon black market mainly due to its important role in tire and rubber production. Carbon black enhances the durability, strength and lifespan of tires making it indispensable for automotive manufacturers. According to a report published by International Trade Administration, in Switzerland, over 6.3 million vehicles were registered in 2021 marking a 38% increase since year 2000. As vehicle production and sales rise there is a parallel increase in demand for high performance tires that can endure various road conditions. In line with this, carbon black is integral to other rubber automotive components as well like belts, hoses and gaskets. This trend is propelled by advancements in tire technology and rising focus on vehicle safety and performance. Manufacturers nowadays are continuously innovating to produce higher quality carbon black to meet these demands ensuring that automotive sector remains a key driver growth in the market. Furthermore, environmental regulations and the push for sustainability are leading to the development of eco friendlier carbon black production methods further influencing the market dynamics. The automotive industry's expansion along with the technological advancements and regulatory influences underscores the importance of carbon black in modern vehicle manufacturing.

Increasing Adoption of Sustainability Initiatives

In Switzerland, sustainability initiatives are gaining traction focusing on ecofriendly production methods and sustainable practices. Manufacturers nowadays are increasingly adopting cleaner production technologies to minimize environmental impact. This includes the use of alternatives, less polluting feedstocks and improving energy efficiency and manufacturing processes. For instance, the BlackCycle Consortium recently announced the world's first production of sustainable carbon blacks for tire applications. These sustainable carbon blacks are produced from oils derived from end-of-life tire pyrolysis, making the process truly circular. The use of pyrolysis oil as carbon black feedstock has been successfully evaluated, maintaining the high-performance properties of rubber compounds. This innovative approach, funded by the European Union's Horizon 2020 programme, marks a significant leap towards a more sustainable rubber industry. In line with this, efforts are being made to recycle and reclaim carbon black from end-of-life products, reducing waste and promoting circular economy principles. Compliance with stringent environmental regulations is also driving innovation in sustainable practices, ensuring that the carbon black industry reduces its carbon footprint and aligns with global sustainability goals. These initiatives not only enhance the environmental profile of carbon black production but also cater to the growing demand from industries for sustainable materials, thus positioning the market for future growth in an eco-conscious world.

Expansion of Plastic and Coatings Sector

The plastics and coatings sectors in Switzerland are experiencing a significant growth significantly driving the demand for carbon black. In plastics industry, carbon black serves as a pigment providing essential color and UV protection to a wide range of plastic products ranging from consumer goods to industrial materials. Its use as a performance enhancer improves the mechanical properties including the tensile strength and the durability of these products. In the coatings industry, carbon black plays an important role in advancing product quality and meeting strict performance standards. This versatile material is important for formulating high quality paints and coatings which offers exceptional pigmentation enhanced gloss and superior wear resistance. In December 2023, AkzoNobel Powder Coatings, and a Swiss startup, CoatingAI, collaborated to develop Flightpath, an innovative software that utilizes artificial intelligence to enhance the application process and sustainability efforts. This technology optimizes equipment settings, reduces defects and overspray, and improves powder consumption, thereby reducing costs and energy usage. The exclusivity agreement signed by both parties reflects their commitment to revolutionizing the coatings industry. This collaboration aims to accelerate the adoption of sustainable and efficient solutions for customers. As the Swiss coatings industry continues to focus on technological advancements and sustainability, the demand for high-quality carbon black is expected to grow. This demand is further amplified by the trend towards more environmentally friendly coatings that require advanced, non-toxic materials like carbon black to meet ecological and health standards.

Switzerland Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, grade, and application.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, channel black, thermal black, acetylene black, and others.

Grade Insights:

- Standard Grade

- Specialty Grade

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes standard grade and specialty grade.

Application Insights:

- Tire

- Non-Tire Rubber

- Plastics

- Inks and Coatings

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes tire, non-tire rubber, plastics, inks and coatings, and others.

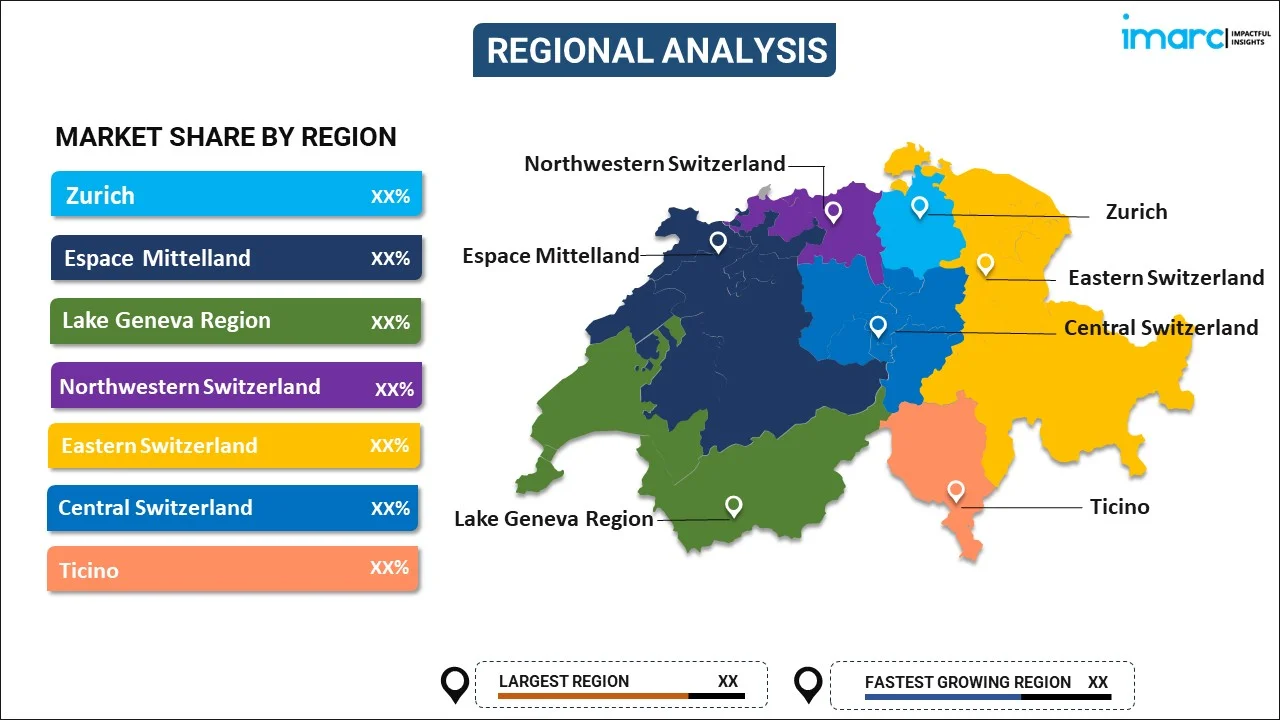

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

The report has also provided a comprehensive analysis of all the major regional markets, which include Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, and Ticino.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Switzerland Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others |

| Grades Covered | Standard Grade, Specialty Grade |

| Applications Covered | Tire, Non-Tire Rubber, Plastics, Inks and Coatings, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Switzerland carbon black market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Switzerland carbon black market?

- What is the breakup of the Switzerland carbon black market on the basis of type?

- What is the breakup of the Switzerland carbon black market on the basis of grade?

- What is the breakup of the Switzerland carbon black market on the basis of application?

- What are the various stages in the value chain of the Switzerland carbon black market?

- What are the key driving factors and challenges in the Switzerland carbon black?

- What is the structure of the Switzerland carbon black market and who are the key players?

- What is the degree of competition in the Switzerland carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Switzerland carbon black market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Switzerland carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Switzerland carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)