Switzerland Life & Non-Life Insurance Market Report by Insurance Type (Life Insurance, Non-Life Insurance), Distribution Channel (Direct, Agency, Banks, Online, and Others), and Region 2026-2034

Switzerland Life & Non-Life Insurance Market Overview:

The Switzerland life & non-life insurance market size reached USD 193.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 373.5 Billion by 2034, exhibiting a growth rate (CAGR) of 7.23% during 2026-2034. The increasing consumer awareness, economic stability, favorable regulatory environment, ongoing technological advancements, growing health and retirement needs, and the presence of strong global insurance companies ensuring comprehensive coverage and innovative solutions are some of the key factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 193.0 Billion |

| Market Forecast in 2034 | USD 373.5 Billion |

| Market Growth Rate (2026-2034) | 7.23% |

Access the full market insights report Request Sample

Switzerland Life & Non-Life Insurance Market Trends:

Digital transformation

Insurers are increasingly leveraging advanced digital technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics to enhance their service offerings and improve operational efficiency. These technologies enable insurers to assess risks better, streamline claims processing, and personalize insurance products for customers. For example, chatbots and virtual assistants driven by AI are now commonly used to offer immediate customer support, whereas big data analytics aids in fraud detection and the analysis of customer behavior patterns. Moreover, the use of blockchain technology is also gaining value, promising more secure and transparent transactions and policy management. Digital platforms are enhancing customer experience by providing seamless online policy purchasing and management options, thus strengthening the market growth.

Regulatory changes

The regulatory landscape in Switzerland is undergoing significant changes, impacting the life and non-life insurance sectors. Swiss financial regulators, such as the Swiss Financial Market Supervisory Authority (FINMA), are implementing stricter regulatory frameworks to ensure the stability and integrity of the insurance market. These regulations often focus on capital adequacy, risk management practices, and consumer protection. The Solvency II directive, for instance, has impacted Swiss regulatory practices by stressing risk-based capital requirements and improved disclosure standards. It offers a unified set of European Union (EU) insurance regulations. Compliance with these regulations necessitates insurers to enhance their risk assessment capabilities and maintain higher levels of capital reserves. Furthermore, the growing emphasis on climate risk and sustainability is resulting in the introduction of guidelines requiring insurers to incorporate environmental, social, and governance (ESG) factors into their business strategies, thereby supporting the market growth.

Demographic shifts

Demographic shifts, particularly the aging population and changing consumer preferences are significantly influencing the Swiss insurance market. Switzerland has one of the highest life expectancies in the world, leading to an aging population that requires more comprehensive life and health insurance products. This demographic trend is boosting demand for retirement planning and long-term care insurance. Insurers are developing specialized products to cater to the needs of older adults, including annuities and health policies with extended coverage. Additionally, the younger, tech-savvy generation is influencing market dynamics with their preference for digital interactions and personalized services. This demographic prefers online platforms for purchasing and managing insurance policies, pushing insurers to enhance their digital presence and offer more customizable products, which is further contributing to the market expansion.

Switzerland Life & Non-Life Insurance Market News:

- In June 2023, International insurance broker Howden acquired two insurance brokers: Argenius Risk Experts AG (argenius) and RVA Versicherungsbroker AG (RVA). Born Consulting AG, which joined Howden Switzerland in 2022, is handling the acquisition of RVA.

- In October 2023, Appian partnered with Swiss Re and launched Connected Underwriting for Life Insurance. Connected Underwriting Life Workbench is designed to assist insurers in unifying workflows and data through an automated, end-to-end process.

Switzerland Life & Non-Life Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on insurance type and distribution channel.

Insurance Type Insights:

To get detailed segment analysis of this market Request Sample

- Life Insurance

- Individual

- Group

- Non-Life Insurance

- Home

- Motor

- Health

- Rest of Non-Life Insurance

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes life insurance (individual and group) and non - life insurance (home, motor, health, and rest of non-life insurance).

Distribution Channel Insights:

- Direct

- Agency

- Banks

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct, agency, banks, online, and others.

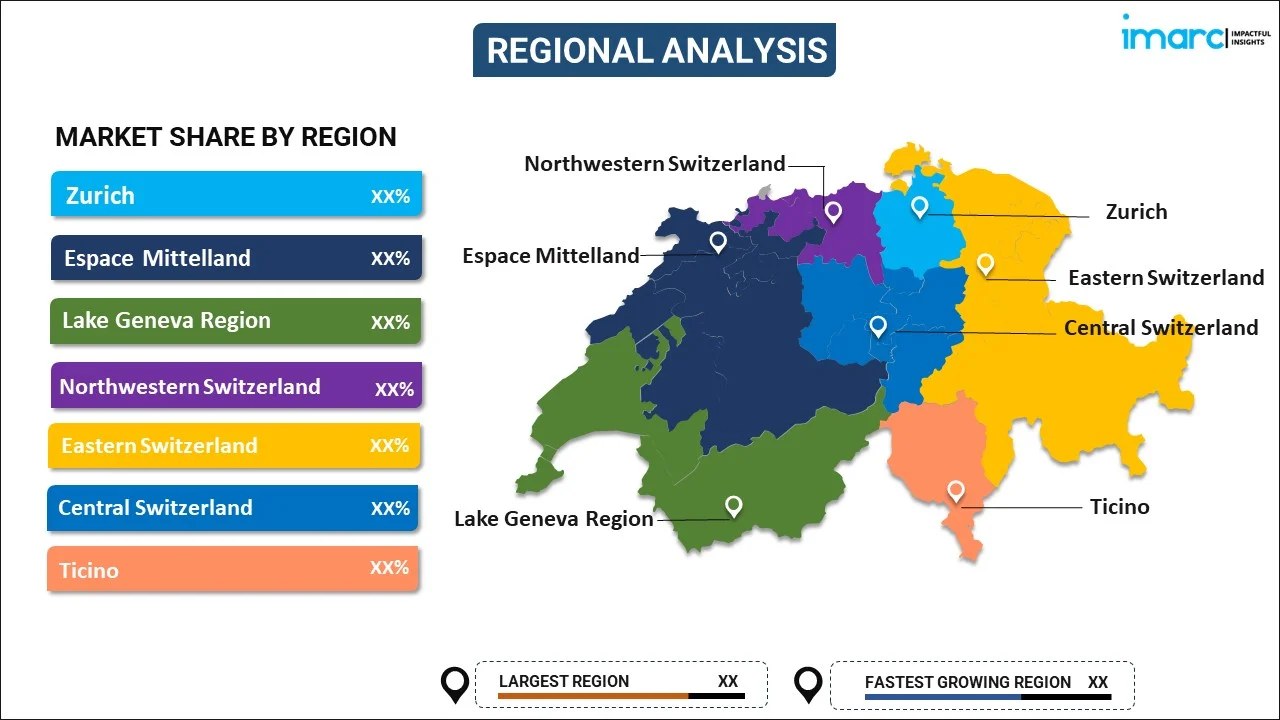

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Zurich

- Espace Mittelland

- Lake Geneva Region

- Northwestern Switzerland

- Eastern Switzerland

- Central Switzerland

- Ticino

The report has also provided a comprehensive analysis of all the major regional markets, which include Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, and Ticino.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Switzerland Life & Non-Life Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered |

|

| Distribution Channels Covered | Direct, Agency, Banks, Online, Others |

| Regions Covered | Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, Ticino |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Switzerland life & non-life insurance market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Switzerland life & non-life insurance market?

- What is the breakup of the Switzerland life & non-life insurance market on the basis of insurance type?

- What is the breakup of the Switzerland life & non-life insurance market on the basis of distribution channel?

- What are the various stages in the value chain of the Switzerland life & non-life insurance market?

- What are the key driving factors and challenges in the Switzerland life & non-life insurance?

- What is the structure of the Switzerland life & non-life insurance market and who are the key players?

- What is the degree of competition in the Switzerland life & non-life insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Switzerland life & non-life insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Switzerland life & non-life insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Switzerland life & non-life insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)