Synchronous Condenser Market Report by Type (New, Refurbished), Cooling Technology (Hydrogen-Cooled, Air-Cooled, Water-Cooled), Starting Method (Static Frequency Converter, Pony Motor, and Others), Reactive Power Rating (Up to 100 MVAr, 101 - 200 MVAr, Above 200 MVAr), End Use (Electrical Utilities, Industrial), and Region 2026-2034

Synchronous Condenser Market Size:

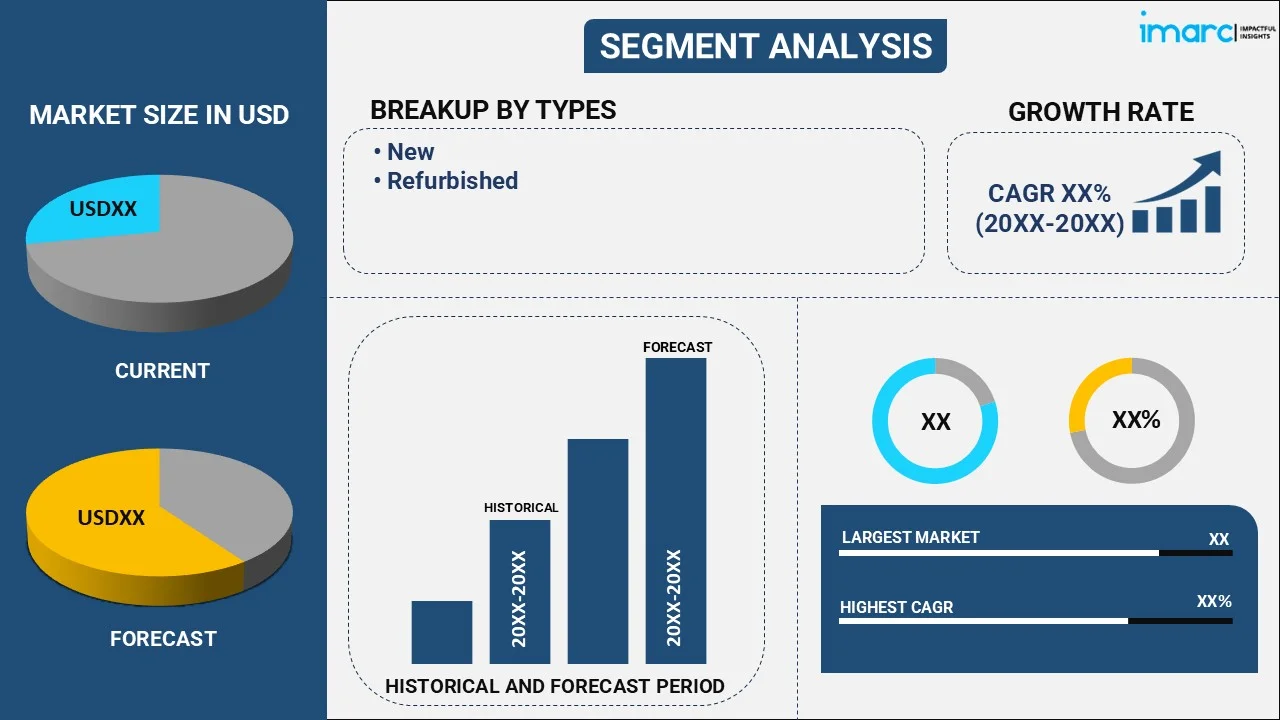

The global synchronous condenser market size reached USD 692.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 851.0 Million by 2034, exhibiting a growth rate (CAGR) of 2.31% during 2026-2034. The increasing focus on grid stability and reliability, the global push towards renewable energy sources, the aging power infrastructure, considerable rise in investments in grid modernization and upgrades, and the growing awareness regarding mitigation of voltage fluctuations are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 692.7 Million |

| Market Forecast in 2034 | USD 851.0 Million |

| Market Growth Rate (2026-2034) | 2.31% |

A synchronous condenser is a specialized electrical device designed to provide reactive power support and enhance the stability of electrical grids. Unlike traditional synchronous generators, these condensers operate without an attached mechanical load or the need to generate real power. Instead, their primary function is to supply or absorb reactive power to regulate voltage levels and power factors in the grid. The core of a synchronous condenser consists of a synchronous machine, typically with a wound rotor and excitation system. When connected to the grid, this condenser generates a magnetic field and can either produce or absorb reactive power by adjusting its excitation level. This dynamic capability makes these condensers invaluable in maintaining grid stability, especially in the presence of variable and intermittent renewable energy sources. These condensers are deployed strategically within power systems to address issues such as voltage control, power factor correction, and damping of system oscillations.

To get more information on this market, Request Sample

The global market is majorly driven by the increasing product demand in modernizing and stabilizing electrical grids. In line with this, the significant increase in the integration of renewable energy sources such as wind and solar into the power grid is also providing an impetus to the market. Furthermore, with the rising complexity of power grids and the escalating number of potential disruptions, maintaining stability and reliability is paramount, which is catalyzing the market. Besides, the rising number of aging infrastructure replacement activities across emerging economies is further propelling the market growth. Additionally, the growing urbanization and industrialization in various parts of the world are leading to higher electricity consumption, which in turn is bolstering the demand for more sophisticated and reliable electrical grids. Moreover, the advancements in smart grid technologies, including smart meters and grid automation, are significantly contributing to the efficiency and reliability of power distribution, thus fueling the market expansion.

Synchronous Condenser Market Trends/Drivers:

Increasing requirement for grid resilience

The increasing requirement for grid resilience is a significant driver behind the growing demand for these condensers in the market. Grid resilience has become a critical priority as power systems face diverse challenges, including extreme weather events, cyber threats, and other unexpected disruptions. These condensers play a pivotal role in enhancing grid resilience by providing inherent stability features. During disturbances or faults in the grid, they offer inertia, damping capabilities, and short-circuit power. This enables them to absorb and mitigate sudden changes in power demand or supply, helping to stabilize the grid rapidly. In regions prone to natural disasters or those facing potential security risks, the deployment of these condensers becomes crucial for minimizing the impact of disruptions and ensuring a swift recovery of the power system. Utilities and grid operators are increasingly recognizing the value of these condensers in fortifying grid resilience, thereby reducing the risk of prolonged outages and improving the overall reliability of power supply. As a result, the market is experiencing growth driven by the imperative to strengthen grid resilience in the face of a challenging operating environment.

Rising reactive power compensation needs

The escalating demand for reactive power compensation is a key driver fueling the growth of the market. As power systems strive for optimal efficiency and power quality, the management of reactive power becomes paramount. These condensers address this need by providing dynamic reactive power support, aiding in power factor correction and voltage stability. Power factor correction is essential for maintaining the balance between active power (real power) and reactive power in the grid. Synchronous condensers, with their ability to generate or absorb reactive power as required, play a vital role in optimizing power factors and ensuring efficient energy transmission. This capability becomes particularly critical in industrial settings and power networks where inductive loads and fluctuations in power demand are prevalent. Utilities and industries seeking to enhance the reliability and performance of their power systems are increasingly turning to these condensers as an effective solution for reactive power compensation. The rising awareness of the importance of power quality, coupled with regulatory standards emphasizing efficient power transmission, is driving the adoption of these condensers across diverse applications. Consequently, the market is witnessing growth propelled by the imperative to meet the increasing reactive power compensation needs in modern power infrastructures.

Growing awareness regarding the mitigation of voltage fluctuations

The growing awareness of the importance of mitigating voltage fluctuations is a pivotal factor propelling market growth. Voltage stability is critical for the reliable operation of electrical grids, and fluctuations can lead to performance issues and equipment damage. These condensers play a crucial role in addressing this concern by providing rapid reactive power support to stabilize voltage levels. As industries and power utilities become more aware of the impact of voltage fluctuations on the overall health of power systems, the demand for these condensers is rising. These devices offer a dynamic solution to maintain grid voltage within acceptable limits, especially during sudden changes in load or disturbances. Their ability to respond swiftly to variations in power demand contributes to grid stability and ensures the consistent delivery of electricity. The increased adoption of renewable energy sources, which can introduce variability into the grid, further accentuates the need for technologies that can effectively mitigate voltage fluctuations. Consequently, the growing awareness of the critical role these condensers play in stabilizing grid voltage is driving their market growth, with industries and utilities recognizing them as essential components for ensuring a reliable and resilient power supply.

Synchronous Condenser Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, cooling technology, starting method, reactive power rating, and end use.

Breakup by Type:

To get detailed segment analysis of this market, Request Sample

- New

- Refurbished

New accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes new and refurbished. According to the report, new represented the largest segment.

The global expansion and modernization of power infrastructure fuels the demand for new condensers. As countries strive to accommodate increasing energy demands and integrate renewable sources, there is a growing need for new, technologically advanced condensers. These units often feature the latest innovations in design, materials, and control systems, meeting the requirements of modern grid applications. Utilities and industries, especially in regions witnessing substantial infrastructural development, are investing in new condensers to enhance grid stability and support the integration of renewable energy.

On the other hand, the refurbished segment addresses the need for cost-effective solutions and the revitalization of existing power infrastructure. As multiple power systems grapple with aging components, refurbishing condensers offers a viable alternative to complete replacements. Refurbished units undergo thorough upgrades, incorporating new technologies and materials while leveraging the existing infrastructure. This approach is particularly attractive for utilities and industries seeking to enhance the performance of their power systems with reduced capital expenditure. The refurbished market segment plays a crucial role in sustainable practices by extending the lifespan of these condensers and aligning with the broader industry trend towards circular economy principles.

Breakup by Cooling Technology:

- Hydrogen-Cooled

- Air-Cooled

- Water-Cooled

Air-cooled holds the largest share of the industry

A detailed breakup and analysis of the market based on the cooling technology have also been provided in the report. This includes hydrogen-cooled, air-cooled, and water-cooled. According to the report, air-cooled accounted for the largest market share.

Air-cooled synchronous condensers are mostly preferred because they utilize ambient air for cooling purposes. This technology is particularly well-suited for applications where the availability of hydrogen may pose logistical challenges or safety concerns. Air-cooled systems are often more compact and easier to install, making them suitable for a range of settings, including industrial facilities and distributed power generation. While they may require more frequent maintenance compared to hydrogen-cooled counterparts, air-cooled condensers offer simplicity and operational flexibility.

On the contrary, hydrogen-cooled synchronous condensers are characterized by their use of hydrogen gas as a cooling medium for the generator. This cooling technology offers several advantages, including high thermal conductivity, low windage losses, and efficient heat dissipation. Hydrogen-cooled systems are often preferred in large power plants and applications where space constraints are not a limiting factor. The use of hydrogen minimizes the risk of electrical insulation issues, making these condensers suitable for high-power and high-voltage applications. Additionally, hydrogen-cooled systems are known for their reduced maintenance needs and extended operational lifespans.

Breakup by Starting Method:

- Static Frequency Converter

- Pony Motor

- Others

Static frequency converter represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the starting method. This includes static frequency converter, pony motor, and others. According to the report, static frequency converter represented the largest segment.

Synchronous condensers employing static frequency converters for starting are characterized by a solid-state electronic device that converts the incoming electrical power to an intermediate frequency. This intermediate frequency is then converted back to the desired power frequency, facilitating the gradual and controlled startup of the condenser. SFC starting methods are known for their precision and flexibility, allowing for smooth synchronization with the grid and precise control over the startup process. This method is often favored in applications where a high degree of control and accuracy is required during the starting phase.

On the other hand, the pony motor starting method involves the use of a separate, smaller induction motor (pony motor) to initially bring the condenser to synchronous speed before connecting it to the electrical grid. The pony motor is disconnected once the synchronous condenser reaches synchronization. This method is known for its simplicity and reliability, making it suitable for various applications, especially in scenarios where a cost-effective and straightforward starting solution is desired.

Breakup by Reactive Power Rating:

- Up to 100 MVAr

- 101 - 200 MVAr

- Above 200 MVAr

Up to 100 MVAr represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the reactive power rating. This includes up to 100 MVAr, 101 - 200 MVAr, and above 200 MVAr. According to the report, up to 100 MVAr represented the largest segment.

These condensers with a reactive power rating of up to 100 MVAr cater to applications with moderate power demands and where a lower level of reactive power compensation is sufficient. These units find utility in smaller-scale power systems, industrial facilities, or distribution networks where precise voltage control and stabilization are essential but do not require extremely high levels of reactive power support.

On the other hand, these condensers falling within the 101 - 200 MVAr category offer increased reactive power compensation capacity. This range is suitable for medium to large-scale power systems, substations, and industrial complexes with higher power demands. These units are chosen when a more substantial level of reactive power support is necessary to maintain grid stability and meet the dynamic requirements of the electrical network.

Moreover, these condensers with a reactive power rating above 200 MVAr are deployed in large-scale power plants, major substations, and extensive industrial facilities with substantial power consumption. These high-capacity units provide robust reactive power compensation, making them suitable for grid applications with significant loads, diverse power generation sources, and complex electrical configurations.

Breakup by End Use:

- Electrical Utilities

- Industrial

Electrical utilities represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use. This includes electrical utilities and industrial. According to the report, electrical utilities represented the largest segment.

Electrical utilities extensively use these condensers to enhance the stability, reliability, and efficiency of power grids. In this segment, these devices play a critical role in maintaining voltage levels, providing reactive power support, and ensuring grid resilience. Electrical utilities deploy these condensers in substations and at key points in the transmission and distribution network to address challenges associated with variable power generation, load fluctuations, and overall grid stability. As electrical grids evolve to accommodate renewable energy integration and modernize their infrastructure, the demand for these condensers from electrical utilities is expected to grow.

On the other hand, the industries deploy these condensers to optimize their power systems and address specific operational requirements. In industrial settings, these condensers contribute to power factor correction, voltage stability, and reactive power compensation. These applications are diverse and can include sectors such as manufacturing, mining, chemical processing, and more. Industries often utilize these condensers to improve the overall efficiency of their electrical systems, minimize power quality issues, and comply with regulatory standards. The industrial segment's demand for these condensers is influenced by factors such as the scale of industrial operations, the complexity of the electrical network, and the need for reliable power supply.

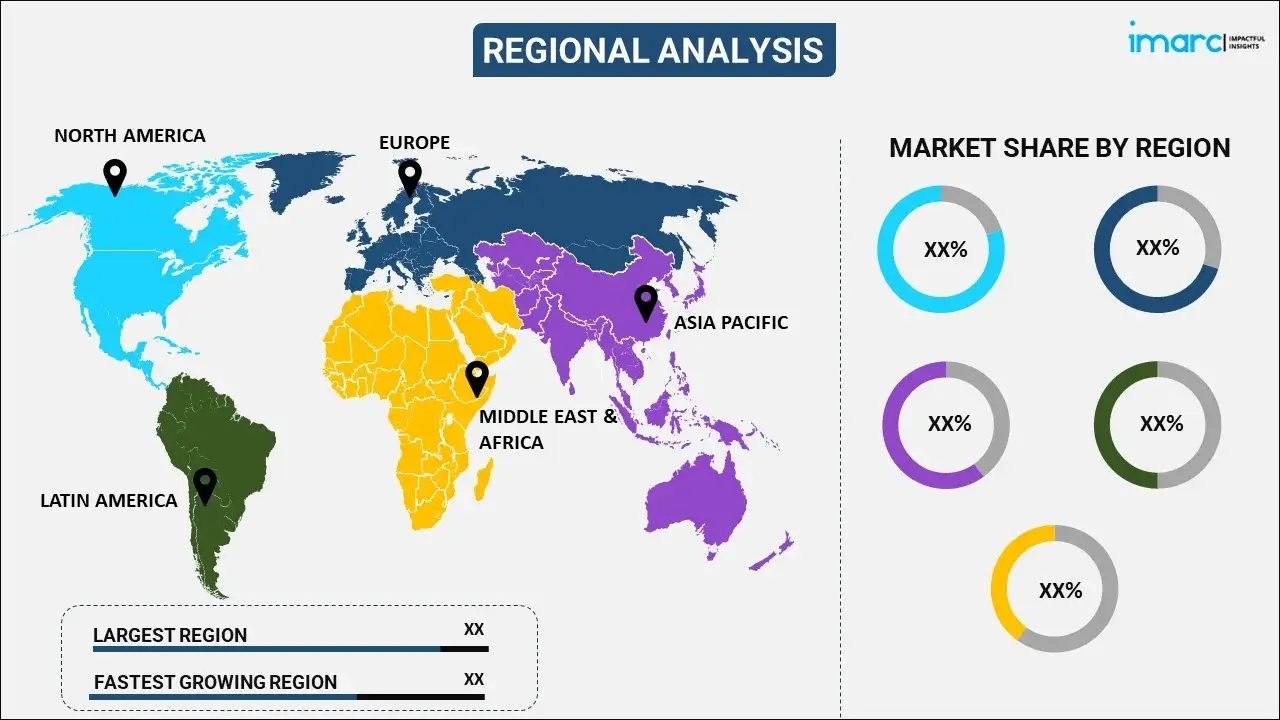

Breakup by Region:

To get more information on the regional analysis of this market, Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest synchronous condenser market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.

Europe is a significant market for these condensers, driven by the region's commitment to renewable energy, grid modernization, and sustainability. The integration of a high share of renewable energy sources, such as wind and solar, necessitates advanced grid stability solutions, making these condensers vital components in the European power infrastructure. Additionally, efforts to improve energy efficiency and reduce carbon emissions contribute to the demand for these condensers. European countries are investing in these technologies to enhance the flexibility and resilience of their power grids, aligning with the broader goals of a clean energy transition.

Furthermore, the increasing decommissioning of fossil fuel-based power plants in Europe accelerates the need for alternative solutions to maintain grid stability, positioning these condensers as essential tools. The European Union's stringent regulatory frameworks and incentives for clean energy adoption also play a significant role in promoting the use of synchronized condensers. The growing urbanization and industrialization across various European countries necessitate more robust and reliable energy systems, where these condensers can provide critical support.

Competitive Landscape:

Top companies are playing a pivotal role in propelling the growth of the market through innovative strategies and investments. They are leveraging their technological expertise to develop advanced synchronous condenser solutions that address the evolving needs of the power sector. Moreover, top players are focusing on strategic collaborations and partnerships to expand their market presence. Collaborative efforts with utilities and grid operators allow these companies to deploy these condensers in critical locations, optimizing their impact on overall grid performance. Investments in research and development also play a crucial role in market growth as companies strive to enhance the efficiency and reliability of condenser technology. As top companies continue to demonstrate the effectiveness of these devices in maintaining grid stability, the adoption of these condensers is expected to accelerate further.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABB Ltd.

- Andritz AG

- Ansaldo Energia S.p.A.

- Doosan Škoda Power (Doosan Power Systems S.A.)

- Eaton Corporation plc

- General Electric Company

- Ideal Electric Power Co.

- Ingeteam Corporación S.A.

- Mitsubishi Electric Power Products Inc. (Mitsubishi Electric Corporation)

- Power Systems & Controls Inc.

- Siemens Energy AG (Siemens)

- WEG Industries

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Synchronous Condenser Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | New, Refurbished |

| Cooling Technologies Covered | Hydrogen-Cooled, Air-Cooled, Water-Cooled |

| Starting Methods Covered | Static Frequency Converter, Pony Motor, Others |

| Reactive Power Ratings Covered | Up to 100 MVAr, 101 - 200 MVAr, Above 200 MVAr |

| End Uses Covered | Electrical Utilities, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Andritz AG, Ansaldo Energia S.p.A., Doosan Škoda Power (Doosan Power Systems S.A.), Eaton Corporation plc, General Electric Company, Ideal Electric Power Co., Ingeteam Corporación S.A., Mitsubishi Electric Power Products Inc. (Mitsubishi Electric Corporation), Power Systems & Controls Inc., Siemens Energy AG (Siemens), WEG Industries, etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global synchronous condenser market performed so far, and how will it perform in the coming years ?

- What are the drivers, restraints, and opportunities in the global synchronous condenser market ?

- What is the impact of each driver, restraint, and opportunity on the global synchronous condenser market ?

- What are the key regional markets ?

- Which countries represent the most attractive synchronous condenser market ?

- What is the breakup of the market based on the type ?

- Which is the most attractive type in the synchronous condenser market ?

- What is the breakup of the market based on the cooling technology ?

- Which is the most attractive cooling technology in the synchronous condenser market ?

- What is the breakup of the market based on the starting method ?

- Which is the most attractive starting method in the synchronous condenser market ?

- What is the breakup of the market based on the reactive power rating ?

- Which is the most attractive reactive power rating in the synchronous condenser market ?

- What is the breakup of the market based on the end use ?

- Which is the most attractive end use in the synchronous condenser market ?

- What is the competitive structure of the global synchronous condenser market ?

- Who are the key players/companies in the global synchronous condenser market ?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the synchronous condenser market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global synchronous condenser market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the synchronous condenser industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)