System Integration Market Report by Service (Infrastructure Integration, Application Integration, Consulting), End Use Industry (BFSI, Government, Manufacturing, Telecommunications, Retail, Oil and Gas, Healthcare, and Others), and Region 2026-2034

System Integration Market Size:

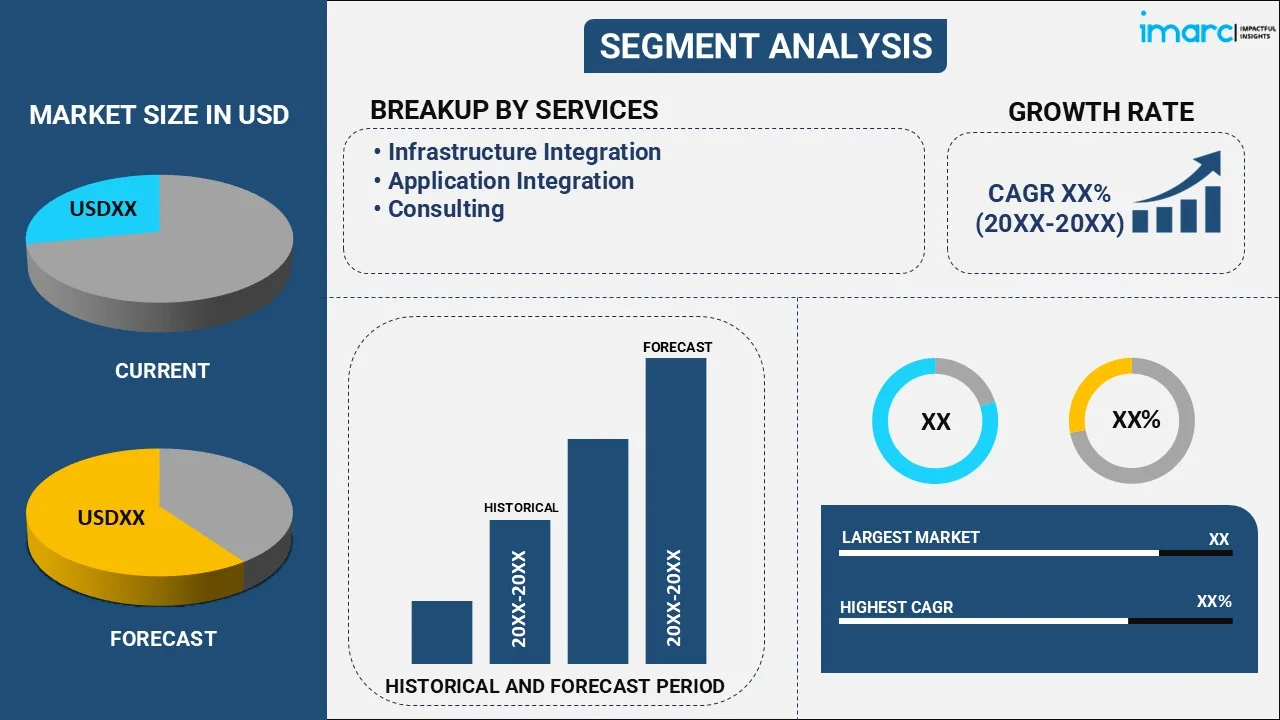

The global system integration market size reached USD 482.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 853.6 Billion by 2034, exhibiting a growth rate (CAGR) of 6.34% during 2026-2034. North America currently dominates the market on account of the technologically advanced infrastructure. The market is experiencing significant growth because of the rising demand for efficient business processes, swift technological progress, increasing complexity of information technology (IT) systems, greater emphasis on data security and compliance, and the urgent necessity to improve client experiences.

Market Size & Forecasts:

- System integration market was valued at USD 482.7 Billion in 2025.

- The market is projected to reach USD 853.6 Billion by 2034, at a CAGR of 6.34% from 2026-2034.

Dominant Segments:

- Service: Infrastructure integration leads the system integration market because it ensures seamless connectivity between hardware, networks, and storage systems, enabling reliable performance, scalability, and efficient operations, which are essential for supporting modern enterprise applications.

- End Use Industry: Telecommunications dominate the system integration market since it requires seamless coordination of networks, data centers, and communication systems to manage high data volumes, ensure real-time connectivity, and deliver uninterrupted services across various digital and mobile platforms.

- Region: North America leads the system integration market due to advanced IT infrastructure, high adoption of emerging technologies, strong presence of key players, and continuous investments by businesses in digital transformation, automation, and cloud-based solutions across various industries and sectors.

Key Players:

- The leading companies in system integration market include Accenture Plc., BAE Systems Plc., Capgemini SA., Cisco Systems Inc., Dell Inc., Fujitsu Limited (Furukawa Group), HCL Technologies Limited, Hewlett Packard Enterprise Company, IBM Corporation, Infosys Limited, Oracle Corporation, Tata Consultancy Service Limited, Wipro Limited, etc.

Key Drivers of Market Growth:

- Growing Use of Automation: Businesses are streamlining processes, reducing manual tasks, and connecting systems to enable faster, more accurate, and automated workflows.

- Focus on Business Continuity: Organizations are aiming to maintain seamless operations during disruptions by connecting critical systems, enabling data backups, ensuring real-time access, and supporting disaster recovery strategies across integrated IT environments.

- Improved Collaboration across Departments: Connected systems enable seamless data sharing, real-time communication, and coordinated workflows, helping organizations break down silos, enhance productivity, and make faster, more informed decisions across all business functions.

- Modernization of Legacy Systems: Businesses are upgrading outdated infrastructure, enabling efficient integration with modern applications and improving performance, scalability, and compatibility across operations.

- Cloud Computing Adoption: Organizations are migrating to cloud, requiring integration between cloud services and on-premises systems for smooth data flow, scalability, and optimized operations.

Future Outlook:

- Strong Growth Outlook: The system integration market is expected to see sustained expansion, driven by increasing digital transformation, rising cloud adoption, and the growing need for real-time data, automation, and seamless coordination across complex enterprise systems and diverse technology platforms.

- Market Evolution: The sector is anticipated to shift from basic hardware and software linking to advanced integration of cloud, artificial intelligence (AI), and enterprise systems, as businesses are seeking unified, scalable, and intelligent solutions to streamline operations and improve digital efficiency.

The system integration market is growing steadily due to increasing demand for automation, operational efficiency, and digital transformation across industries. The rise of hybrid work environments is creating the need for secure, integrated solutions that support collaboration, remote access, and real-time data sharing. System integration also supports compliance, security, and centralized monitoring by enabling unified control over complex IT environments. Businesses are aiming to streamline processes and improve productivity by connecting various software, hardware, and communication systems into unified platforms. The need to modernize legacy infrastructure is catalyzing the demand for system integration tools, as companies are seeking to upgrade outdated systems while maintaining continuity. Cloud computing adoption plays a major role, with organizations requiring seamless integration between on-premises systems and multiple cloud environments. The demand for faster decision-making and refined customer experience is encouraging businesses to unify systems for better data flow and analytics. Additionally, the rising use of machine learning (ML) and business intelligence tools requires integration for optimal performance.

To get more information on this market Request Sample

System Integration Market Trends:

Increasing Internet of Things (IoT) adoption

As industries are deploying more IoT-enabled tools and equipment, the complexity of managing and coordinating data from different sources is growing. System integration helps bring together these varied systems, ensuring seamless communication, real-time data exchange, and centralized control. It allows businesses to gain actionable insights from IoT data by linking it with analytics and enterprise applications. This connectivity supports smarter decision-making, predictive maintenance, and automation. Without integration, IoT systems remain isolated and underutilized. As more sectors like manufacturing, healthcare, and utilities are employing IoT, the demand for skilled system integration continues to grow, making it essential for achieving efficiency, visibility, and value from connected technologies. As per the IMARC Group, the IoT market is set to attain USD 3,486.8 Billion by 2033, exhibiting a growth rate (CAGR) of 14.6% during 2025-2033.

Expansion of data centers

The expansion of data centers is fueling the market growth. As per industry reports, by March 2024, there were around 11,800 data centers globally. As businesses are generating and storing increasing volumes of data, they are building more data centers to support digital operations and real-time processing. These data centers consist of diverse systems, including servers, storage, networks, and software platforms, which must work together seamlessly. System integration ensures that all components within and across data centers communicate effectively, maintain security, and perform reliably. It also aids in automating workflows, improving data management, and enabling centralized monitoring. Integration supports hybrid environments, where on-premises and cloud-based data centers operate simultaneously. As the demand for scalability, uptime, and speed is increasing, companies are turning to system integration solutions to streamline data center operations and ensure continuous, coordinated performance across multiple IT assets.

Broadening of e-commerce portals

The broadening of e-commerce sites is positively influencing the market. As more businesses are entering online retail, they must connect inventory management, payment gateways, customer relationship tools, logistics, and order processing systems to deliver smooth and efficient user experiences. System integration allows e-commerce platforms to synchronize real-time data across different departments, reducing errors, delays, and manual efforts. It also enables better tracking of customer behavior, personalized marketing, and faster response to market changes. With rising user expectations for quick delivery and consistent service, integration is becoming essential to ensure operations run efficiently from click to delivery. As e-commerce continues to expand into new regions and product categories, companies continue to rely on integrated systems to scale operations, manage complexity, and stay competitive in a fast-paced digital marketplace. According to the IBEF, the Indian e-commerce market is set to grow from USD 125 Billion in FY24 to USD 345 Billion in FY30.

Key Growth Drivers of System Integration Market:

Increasing demand for automation and operational efficiency

The growing demand for automation and operational efficiency is offering a favorable market outlook. Businesses are looking for smarter ways to streamline tasks, eliminate redundancies, and ensure faster decision-making. System integration plays a crucial role in this transformation by linking various independent systems, software, and applications into a unified framework. This seamless connectivity allows data to move smoothly across departments, supports automated workflows, and minimizes the need for manual intervention. Integrated systems improve visibility, coordination, and speed across operations, which helps companies respond quickly to market changes and customer requirements. As enterprises are adopting digital transformation and aiming for more agile operations, the utilization of system integration solutions is growing steadily, making it a key enabler of modern business automation.

Modernization of Legacy Systems

Modernization of legacy systems is propelling the market growth. Many businesses continue to depend on old systems that are hard to manage and incompatible with current technologies, making operations inefficient and limiting innovation. System integrators play a key role in addressing this challenge by helping companies transform these legacy systems. They either migrate them to advanced platforms or develop integration layers that enable smooth interaction between old and new applications. This approach ensures that businesses can preserve critical data and processes while still using modern capabilities like analytics. By modernizing legacy systems through effective integration, companies are improving agility, reducing maintenance costs, and enhancing overall performance, which is significantly catalyzing the demand for system integration services across various industries.

Cloud computing adoption

Businesses are transitioning to cloud, multi-cloud, and hybrid cloud settings to enhance adaptability, scalability, and cost-effectiveness. The rapid transition to cloud-based infrastructure is creating the need for seamless connectivity between various cloud services and existing on-premises systems. Organizations rely on system integrators to guide them through smooth cloud migrations, ensuring that applications and data are transferred securely and without disruption. These experts also help integrate different cloud platforms with legacy systems, allowing consistent workflows and centralized management. Managing complex cloud environments requires skilled integration to ensure compatibility, performance, and security. As more companies are employing cloud strategies to support digital transformation, collaboration, and remote access, the demand for system integration services continues to grow.

System Integration Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on service and end use industry.

Breakup by Service:

To get detailed segment analysis of this market Request Sample

- Infrastructure Integration

- Application Integration

- Consulting

Infrastructure integration accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the service. This includes infrastructure integration, application integration, and consulting. According to the report, infrastructure integration represented the largest segment.

Infrastructure integration accounts for the biggest percentage as it emphasizes the integration of different core information technology (IT) building blocks such as networking, hardware, and data storage solutions. Additionally, the rising demand for strong, scalable, and efficient IT environments within firms is benefiting the market growth. With this, the growing penetration of the Internet of Things (IoT) and cloud computing technologies necessitating the seamless interconnection of physical and virtual infrastructure is fueling the market expansion. In addition, infrastructure integration provides compatibility and connectivity services to ensure various IT components work effectively together, optimizing the overall performance, security, and reliability of the IT infrastructure.

Application integration is concerned with integrating different software applications in an organization's IT environment. It overcomes the issue of disparate application systems, allowing them to operate harmoniously and exchange data easily. Additionally, increasing demands for application integration as a result of extensive applications of specialty software solutions across various business functions, including CRM, ERP, and SCM, are supporting the market expansion.

Consulting is aimed at providing specialized advice and guidance to organizations regarding how to consolidate their different IT systems and applications. It is necessary for companies that require additional in-house resources or expertise to successfully handle intricate integration projects. In addition, consulting services encompass different activities, including evaluating the current IT infrastructure, determining integration requirements, and developing and executing an overall integration plan.

Breakup by End Use Industry:

- BFSI

- Government

- Manufacturing

- Telecommunications

- Retail

- Oil and Gas

- Healthcare

- Others

Telecommunications holds the largest share in the industry

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, government, manufacturing, telecommunications, retail, oil and gas, healthcare, and others. According to the report, telecommunications accounted for the largest market share.

Telecommunications is the biggest segment, as an indication of the large dependency of the industry on integrated systems for administering enormous networks, data, and customer services. Furthermore, the rapid development of telecommunications technologies, such as fifth-generation (5G), IoT, and cloud services, which necessitate robust integration for orderly functioning and service delivery, are assisting market growth. Additionally, increased focus in the telecommunications sector toward integrating various subsystems like network management, CRM, and bill systems to offer standardized, top-notch services is propelling growth in the marketplace. Apart from this, telecommunications companies extensively apply system integration in order to increase efficiency, offer improved network capability, efficiently address mounting data streams, and provide enhanced customer services.

The banking, financial services, and insurance (BFSI) industry is heavily dependent on system integration to execute complicated financial operations, maintain regulatory requirements, and provide secure customer services. Further, integration within the industry encompasses combining banking systems, insurance platforms, and financial applications to allow for real-time data access, reduce transactional processes, and increase risk management.

Government agencies utilize system integration for efficient public service delivery and internal administration. It includes integrating various government databases, e-governance platforms, and public service applications to facilitate data sharing, improve transparency, and enhance citizen services. Moreover, the rising need for secure and reliable IT systems in government operations is favoring the market growth.

The manufacturing sector employs system integration for automating production processes, integrating supply chain management systems, and enabling real-time monitoring of operations. Along with this, the widespread adoption of manufacturing execution systems (MES), ERP, and IoT devices to facilitate efficient resource management, quality control, and predictive maintenance is boosting the market growth.

The retail industry utilizes system integration in order to improve customer shopping experiences, optimize inventory management, and consolidate e-commerce websites with store operations. It encompasses integrating point-of-sale systems (POSS), customer relationship management (CRM) software, and supply chain management software for guaranteeing customer satisfaction and business efficiency.

In the oil and gas sector, system integration is required to oversee complicated exploration, production, and distribution processes. System integration comprises bringing together geographic information systems (GIS), production control systems, and logistics management in order to optimize the utilization of resources, ensure safety, and oversee environmental impacts.

The healthcare industry is dependent on system integration to automate patient care, handle medical records, and consolidate hospital management systems. Further, the increasing integration of electronic health records, telemedicine platforms, and diagnostic equipment to enable effective healthcare delivery and better patient outcomes is driving the market growth.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest system integration market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America represents the largest share in the market, attributed to the region's advanced technological infrastructure, high adoption of cutting-edge technologies, and substantial investments in the IT sector across various industries. Moreover, the presence of leading technology companies and a strong focus on innovation is providing a thrust to the market growth. Besides this, the widespread adoption of system integration solutions in sectors, including healthcare, finance, telecommunications, and retail, to enhance operational efficiency, data management, and customer service is bolstering the market growth. Furthermore, the region's strong emphasis on cybersecurity and compliance with regulatory standards, encouraging the demand for system integration services, is supporting the market growth.

The Asia Pacific market is catalyzed by rapid economic development, increasing digitalization, and the growing adoption of new technologies in various countries. In addition to this, the region's expanding IT infrastructure, rising tech enthusiast population, and implementation of various government initiatives promoting digital transformation are enhancing the market growth.

Europe's system integration market is characterized by a strong focus on innovation, adherence to regulatory standards, and the rising need for efficient IT solutions across various industries. Additionally, the region's emphasis on data protection, driving the integration of secure and compliant IT systems, is boosting the market growth. Furthermore, the increasing reliance of the manufacturing sector on system integration to optimize production processes and supply chains is catalyzing the market growth.

In Latin America, the system integration market is growing steadily, supported by the region's digital transformation initiatives and the increasing need for technological modernization in sectors like banking, telecommunications, and government. Besides this, the increasing demand for integrated IT solutions to improve business processes, enhance customer experiences, and increase competitiveness is fostering the market growth.

The Middle East and Africa (MEA) region market is fueled by the growing economic diversification efforts. Moreover, the increasing investment in sectors, such as oil and gas, healthcare, and public infrastructure, fostering the demand for integrated IT systems, is propelling the market growth. Additionally, the region's focus on smart city initiatives and digitalization projects, contributing to the growing relevance of system integration services, is fueling the market growth.

Leading Key Players in the System Integration Industry:

Market leaders are making various strategic initiatives to improve their market positions and meet the evolving technological requirements of various industries. They are investing in research and development (R&D) to design and enhance their integration platforms, following the latest technological advancements such as cloud computing, AI, and big data analytics. In addition, major corporations are expanding their service offerings to include niche services like cybersecurity integration, data analytics integration, and cloud migration solutions. In addition, they are forming strategic partnerships and collaborations with other technology firms to expand their geographic reach and enhance their capabilities and market presence.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Accenture Plc

- BAE Systems plc

- Capgemini Services SAS

- CISCO SYSTEMS INC.

- Dell Technologies, Inc.

- Fujitsu Limited

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Company (HPE)

- IBM Corporation

- Infosys Limited

- Oracle Corporation

- Tata Consultancy Services Limited (TCS)

- Wipro Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

System Integration Market News:

- April 2025: Razorpay introduced the initial MCP server to enhance AI integration. The MCP server enabled companies to link their AI agent/assistant straight to Razorpay’s infrastructure. It would cut down the AI agent integration time to only 15 minutes, minimizing the waiting duration by months. It aimed to provide smooth multi-provider connections, streamlined payment processes across various systems, improved security with standardized protocols, and a base prepared to drive the next generation of innovations.

- November 2024: Wipro announced the launch of its Google Gemini Experience Zone in collaboration with Google Cloud, aimed at accelerating AI-based innovation for companies. The experience zone in Silicon Valley allowed businesses to explore generative AI applications and work alongside experts from Wipro and Google Cloud to develop tailored solutions for their industries. This initiative supported industries like retail, healthcare, and finance by offering tailored AI solutions to drive business transformation.

- November 2024: HCLTech introduced the AI Force extension for GitHub Copilot, created in collaboration with Microsoft. This developer tool, driven by AI, sought to advance software development, automate processes, and boost code efficiency, aiding sectors, such as legacy system modernization and DevOps.

- October 2024: NTT DATA revealed the introduction of the ‘SAP integration with SiGREEN’ solution within the Siemens Xcelerator framework. Essential master data about products was held in ERP systems. This data must be communicated to SiGREEN, and a seamless data flow could be created by linking SiGREEN to the ERP systems.

- October 2024: Boomi™, a leader in intelligent integration and automation, unveiled a new specialized connector aimed at simplifying the integration process between external systems and the Veeva Vault platform. This enhanced Boomi's partnership with Veeva Systems to integrate content and data for shared clients.

- September 2024: Confluent introduced an OEM channel program to attract cloud service providers, managed service providers, and independent software vendors to integrate the Confluent platform into their software and service solutions. The updated program granted MSPs, CSPs, and ISVs a license to distribute or integrate Confluent’s technology worldwide, while also providing design review and development support and product certification. The firm also made investments in two regional systems integrators, Onibex and Psyncopate, which offered data integration and system migration services related to the Confluent data streaming platform.

System Integration Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure Integration, Application Integration, Consulting |

| End Use Industries Covered | BFSI, Government, Manufacturing, Telecommunications, Retail, Oil and Gas, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture Plc., BAE Systems Plc., Capgemini SA., Cisco Systems Inc., Dell Inc., Fujitsu Limited (Furukawa Group), HCL Technologies Limited, Hewlett Packard Enterprise Company, IBM Corporation, Infosys Limited, Oracle Corporation, Tata Consultancy Service Limited, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the system integration market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global system integration market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the system integration industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The system integration market was valued at USD 482.7 Billion in 2025.

The system integration market is projected to exhibit a CAGR of 6.34% during 2026-2034, reaching a value of USD 853.6 Billion by 2034.

As organizations are adopting multiple information technology (IT) solutions, the demand for integrating hardware, software, networks, and storage systems is increasing. The rise of digital transformation, cloud computing, and industrial automation is further strengthening the market, as companies are seeking seamless coordination between legacy systems and new technologies. Additionally, the growing cybersecurity concerns are motivating businesses to employ integrated solutions that provide better monitoring and control.

North America currently dominates the system integration market driven by its advanced IT infrastructure, high adoption of new technologies, and strong presence of leading tech companies. The region’s focus on digital transformation, cybersecurity, and automation across industries is fueling the market growth.

Some of the major players in the system integration market include Accenture Plc., BAE Systems Plc., Capgemini SA., Cisco Systems Inc., Dell Inc., Fujitsu Limited (Furukawa Group), HCL Technologies Limited, Hewlett Packard Enterprise Company, IBM Corporation, Infosys Limited, Oracle Corporation, Tata Consultancy Service Limited, Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)