Taiwan Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033

Taiwan Air Freight Market Overview:

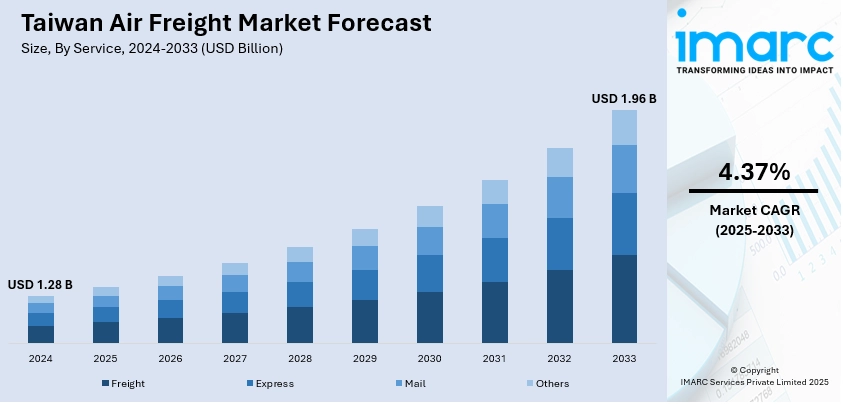

The Taiwan air freight market size reached USD 1.28 Billion in 2024.The market is projected to reach USD 1.96 Billion by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033. The market is propelled by its global electronics and semiconductor exports, efficient terminal operations at Taoyuan International, increasing e‑commerce and same‑day delivery demand, and trade data digitalization. These factors enhance logistics efficiency and global reach, consolidating Taiwan air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.28 Billion |

| Market Forecast in 2033 | USD 1.96 Billion |

| Market Growth Rate 2025-2033 | 4.37% |

Taiwan Air Freight Market Trends:

Digitization and Technological Integration

Taiwanese cargo terminals and air freight frms are embracing AI, automation, and blockchain to streamline operations and improve transparency. Taoyuan's terminals implement automated sorting, robotic cargo handling, and real‑time tracking, reducing errors and transit times. Airlines use AI for predictive demand forecasting and dynamic pricing, optimizing routing and capacity. Blockchain and e‑AWB deployment enhance documentation and security compliance. These digital transformations strengthen Taiwan air freight market growth by improving efficiency, resilience, and service reliability in volatile global trade environments. For instance, in March 2025, EVA Air became the first airline in Taiwan to adopt IATA’s ONE Record digital standard for air cargo, marking a major step toward smart logistics and sustainability. In collaboration with Evergreen Air Cargo and Trade-Van, the pilot confirmed real-time, secure data exchange and reduced reliance on paper. ONE Record enhances cargo transparency, efficiency, and environmental performance. EVA Air aims to expand the system’s scope and support IATA’s global rollout by 2026, reinforcing its leadership in Taiwan’s digital air freight transformation.

To get more information on this market, Request Sample

Sustainability and Green Logistics

Environmental concerns are pushing Taiwan’s air freight industry toward sustainable aviation fuels (SAF) and carbon reduction strategies. Leading carriers are integrating SAF blends, optimizing flight routes to reduce emissions, and exploring hybrid aircraft for regional transport. Cargo facilities invest in energy‑efficient systems and eco‑friendly ground operations. These green initiatives also align with international environmental regulations in Europe and North America. Emphasizing eco‑responsibility not only meets global standards but enhances brand value, underpinning Taiwan air freight market growth through differentiation and regulatory compliance. For instance, in October 2024, Taiwan’s China Airlines, partnering with Morrison Express, launched the first Taiwanese freighter flight using Sustainable Aviation Fuel (SAF), reducing carbon emissions by 80%. This marks a milestone in Taiwan’s air cargo sustainability efforts, supporting the goal of Net Zero emissions by 2050. China Airlines leads SAF adoption in Taiwan, promoting eco-friendly cargo operations and supply chain sustainability. Morrison Express became the first company to join China Airlines’ SAF partnership program for green logistics solutions.

Taiwan Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

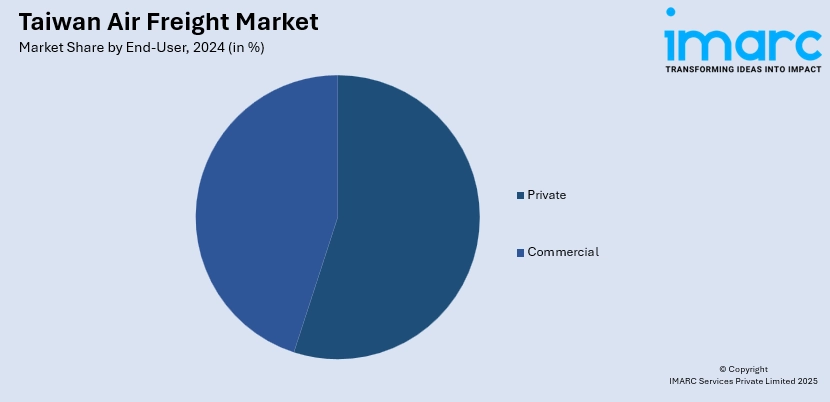

End-User Insights:

- Private

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes private ad commercial.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Air Freight Market News:

- In May 2025, Atlas Air Worldwide entered a long-term ACMI agreement with Turkish Cargo to operate a Boeing 747-400 freighter. The partnership supports Turkish Cargo’s global network expansion and enhances cargo capacity through Atlas Air’s expertise in widebody operations. With over 110 metric tons of payload, the aircraft will serve key trade routes. This strategic collaboration reflects growing demand for long-haul cargo solutions and reinforces both companies’ positions in the global air logistics industry.

- In April 2025, Hong Kong Air Cargo and Turkish Cargo signed a Memorandum of Understanding (MoU) to enhance collaboration in global air cargo operations. The agreement focuses on potential codeshare arrangements, joint freighter use, and expanded route connectivity. Both airlines aim to integrate their operational strengths to offer more efficient and customer-centric cargo solutions. Turkish Cargo also plans to expand its network to 150 cargo destinations and grow its freighter fleet to 44 aircraft by 2033.

- In March 2025, Air Transport Services Group (ATSG) will deliver its first Airbus A330-300 converted freighter to Turkey’s ULS Airlines Cargo, followed by a second in April. The move marks a shift from ATSG’s historic reliance on Boeing 767s as it diversifies its fleet amid declining availability. The A330s are significantly larger than ULS's current A310s. ATSG plans to convert 29 A330s over time, despite past delays and market challenges. ATSG also continues expanding operations for Amazon, now managing 51 Boeing 767s.

Taiwan Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan air freight market on the basis of service?

- What is the breakup of the Taiwan air freight market on the basis of destinations?

- What is the breakup of the Taiwan air freight market on the basis of end-user?

- What is the breakup of the Taiwan air freight market on the basis of region?

- What are the various stages in the value chain of the Taiwan air freight market?

- What are the key driving factors and challenges in the Taiwan air freight?

- What is the structure of the Taiwan air freight market and who are the key players?

- What is the degree of competition in the Taiwan air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan air freight market and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)