Taiwan Cement Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Taiwan Cement Market Overview:

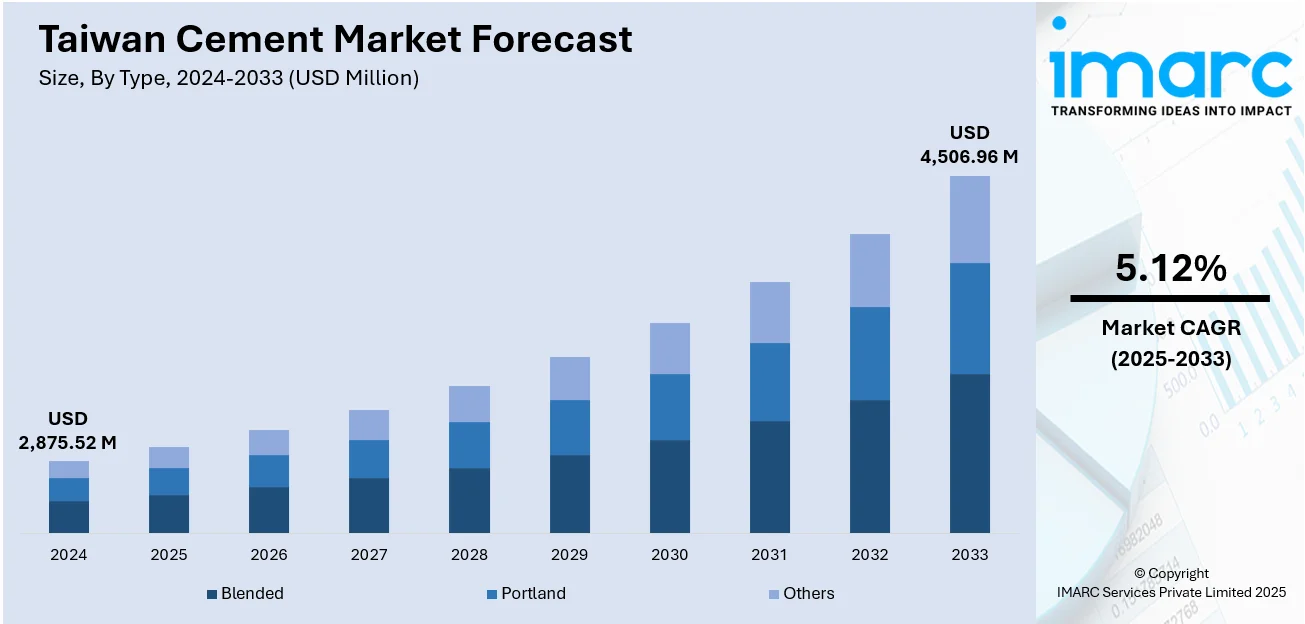

The Taiwan cement market size reached USD 2,875.52 Million in 2024. The market is projected to reach USD 4,506.96 Million by 2033, exhibiting a growth rate (CAGR) of 5.12% during 2025-2033. The market is driven by ongoing infrastructure development, urban renewal, and residential construction, which sustain strong demand for cement products. Growing environmental awareness is pushing the adoption of green and blended cements that offer sustainability and improved performance. Additionally, intense market competition and the influence of cheaper imports compel domestic producers to enhance efficiency, invest in cleaner technologies, and optimize operations is influencing the Taiwan cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,875.52 Million |

| Market Forecast in 2033 | USD 4,506.96 Million |

| Market Growth Rate 2025-2033 | 5.12% |

Taiwan Cement Market Trends:

Sustainability and Green Cement Adoption

Growing environmental awareness and sustainable practices are reshaping Taiwan’s cement market growth, with companies like Taiwan Cement Corporation (TCC) leading this transformation. Developers and builders are increasingly using eco-friendly cement products that lower carbon footprints and incorporate recycled materials such as slag and fly ash. By providing improved performance and durability, these mixed cements help achieve sustainable building objectives. Adoption is further accelerated by green building certifications and encouraging government regulations. TCC's achievement of a 5.4% reduction in Scope 1 and 2 emissions intensity between 2016 and 2022, together with its ambitious targets of 11% and 32% reductions by 2025, demonstrates the industry's commitment to energy efficiency and cleaner production practices. This aligns with the global shift towards low-carbon building materials and positions Taiwan’s cement market for long-term sustainability, meeting both environmental regulations and rising consumer demand for greener construction solutions.

To get more information on this market, Request Sample

Infrastructure and Construction Demand

Another major Taiwan cement market trends is the nation's continuous infrastructure and real estate construction. Large projects like roads, bridges, railways, and urban infrastructure constantly stimulate cement consumption. Moreover, the demand for repairing and maintaining aging structures continues to ensure constant consumption. Trends of urbanization, along with redevelopment of old buildings in cities, also increase cement consumption, especially in residential and commercial construction. The strength and durability remain provided with cement. The government as well as the private sector are developing new technologies and becoming modern, so stable demand in reliable cement products are expected to come out. This trend is enhanced through national policies and urban growth and maintained construction activities as a core driver of cement consumption in Taiwan's market.

Market Competition and Trade Influence

Competitive pressures significantly shape Taiwan’s cement market, driven by both domestic rivalry and the influx of lower-cost imports. Taiwan relied heavily on inexpensive foreign supplies, sourcing 30% of its cement from China, 20% from Brazil, and 17% from Vietnam as of mid-2024. This import pressure forces local producers to improve operational efficiency, product quality, and supply chain management to maintain market share. Trade policies, including anti-dumping measures and import regulations, directly influence market competitiveness by attempting to protect domestic manufacturers from unfair pricing practices. In response, companies are pursuing strategies like technological upgrades, partnerships, and even market consolidation to remain competitive. Balancing cost control, innovation, and evolving market demand is crucial for survival in this challenging environment, as the dynamic between international trade and local industry competition continues to drive key business decisions in Taiwan’s cement sector.

Taiwan Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

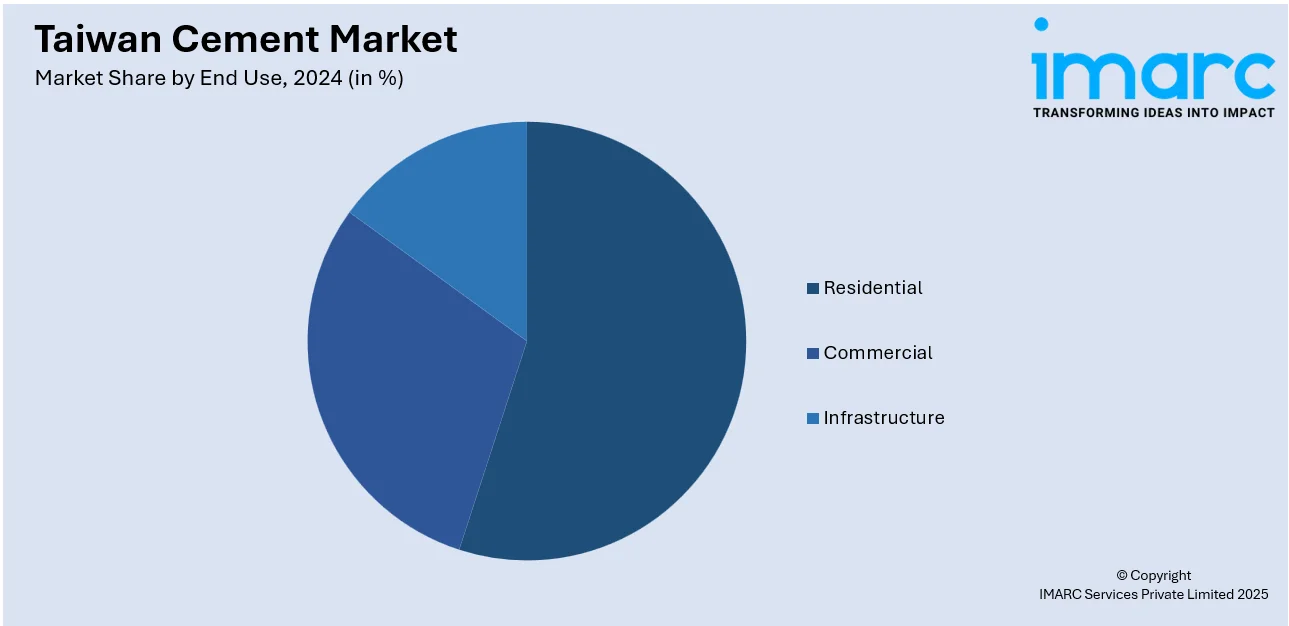

End Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Cement Market News:

- In December 2024, Taiwan Cement Corporation (TCC) issued Taiwan’s first Sustainability-Linked Convertible Bond (SLCB), worth NTD 8 billion, marking its entry into the sustainable bond market. Listed on the Taipei Exchange, the 5-year bond ties returns to TCC’s greenhouse gas reduction goals. As the first cement firm in Greater China with Science-Based Targets, TCC reinforces its commitment to carbon neutrality by 2050 and leads the industry’s green transformation.

- In November 2024, The Low Carbon Construction Pioneer Alliance was established by Taiwan Cement Corporation (TCC) and 100 construction companies to encourage sustainable building. Since November 2024, members have cut 146,000t of CO₂ emissions by using low-carbon materials, including 800,000m³ of TCC’s Portland limestone cement (PLC) concrete. TCC's PLC offers up to 24% lower emissions than traditional cement, setting a new benchmark for low-carbon construction in Taiwan.

Taiwan Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan cement market on the basis of type?

- What is the breakup of the Taiwan cement market on the basis of end use?

- What is the breakup of the Taiwan cement market on the basis of region?

- What are the various stages in the value chain of the Taiwan cement market?

- What are the key driving factors and challenges in the Taiwan cement market?

- What is the structure of the Taiwan cement market and who are the key players?

- What is the degree of competition in the Taiwan cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)