Taiwan E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2025-2033

Taiwan E-Invoicing Market Overview:

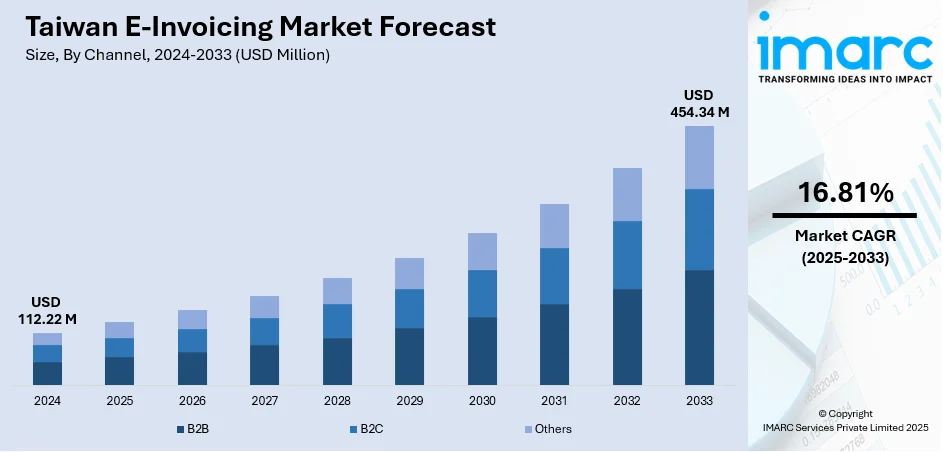

The Taiwan e-invoicing market size reached USD 112.22 Million in 2024. The market is projected to reach USD 454.34 Million by 2033, exhibiting a growth rate (CAGR) of 16.81% during 2025-2033. The market is developing its digital fiscal framework with the extensive use of e-invoicing, characterized by standardized procedures, real-time data transmission, and cross-sector integration. Such initiatives are simplifying tax compliance, increasing transparency, and enhancing operational effectiveness in the public and private sectors. The extension to cross-border transactions and sector-specific applications further highlights the country's drive for digitalization and fiscal modernization. Moreover, all these efforts are causing a substantial and ongoing rise in Taiwan e-invoicing market share of the digital economy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 112.22 Million |

| Market Forecast in 2033 | USD 454.34 Million |

| Market Growth Rate 2025-2033 | 16.81% |

Taiwan E-Invoicing Market Trends:

Digital Fiscal Infrastructure Nationwide Integration

Taiwan is embarking on an overarching integration of e-invoicing within its national fiscal system, a major transition towards complete digital regulation. By integrating electronic invoicing systems within public and private domains, the government is simplifying the tax collection mechanism and enhancing fiscal transparency. As per the reports, in September 2024, Taiwan updated its Business Tax Act to enforce more rigid e-invoice filing deadlines and penalties, ensuring compliance and digitization in the new Taiwan e-invoicing environment. Furthermore, e-invoicing is increasingly being taken up across sectors, ranging from retail and services to utilities and professional services, making tax reporting simpler and lowering administrative costs. These platforms are real-time connected with regulatory bodies, enabling automated validation and quick issue resolution. This system integration assists in decreasing discrepancies in data, enhancing record accuracy, and achieving uniformity in complying with regulatory norms. As the digital backbone becomes more mature, so too does it facilitate data-driven policy making through offering a transparent, integrated snapshot of national business activity. This strategic upgrade is supporting Taiwan e-invoicing market growth, and positioning Taiwan as a model for efficient, scalable, and transparent fiscal digitalization across the wider Asia-Pacific.

To get more information on this market, Request Sample

Standardization and Real-Time Synchronization of Data

The Taiwan e-invoicing industry is transforming at a fast rate with the rollout of standardized invoice models and real-time data sharing features. Standardized invoice templates, secure digital signatures, and synchronized protocols have been made institutionalized, providing consistency and interoperability across systems. This consistency allows for easy integration with enterprise resource planning (ERP) systems and tax agency databases, removing inconsistencies and minimizing human intervention. Real-time synchronization of data makes it possible to verify transactions immediately, with improved traceability and compliance. It further enhances audit readiness and minimizes financial reconciliation delays. Through the verification of all financial transactions digitally and in real time within a single platform, the nation makes it easier for its regulatory enforcements and back-end operations for businesses and the government. These advancements are a significant milestone in fiscal digitalization, supporting confidence and trust in financial reporting. Consequently, Taiwan e-invoicing market trends are witnessing an increasing dependence on digital transparency and precision as fundamental drivers of public and private sector evolution.

Scaling into Sectoral and Cross-Border Use Cases

Taiwan's e-invoicing development is breaking out of conventional commerce, making strides in industry-specific sectors and cross-border trade applications. Industry sectors like healthcare, logistics, education, and digital services are increasingly adopting e-invoicing systems suited to their business and regulatory idiosyncrasies. According to the sources, in February 2024, Taiwan's Chi Mei Medical Center employed a software robot to automate cloud e-invoice audits, enhancing accuracy, lowering costs, and showcasing human-robot collaboration in the Taiwan e-invoicing ecosystem. Moreover, industry-specific deployments guarantee that documentation, compliance, and payment history are correctly kept and automatically disclosed, supporting more effective monitoring. Concurrently, cross-border usage is also on the rise, as Taiwan aligns its invoicing standards with international models, making international transactions smoother and boosting trade efficiency. E-invoicing is therefore facilitating efficient customs procedures, easier taxation of imported products, and more transparent audit trails for cross-border financial flows. This cross-sector and international adoption constitutes a strategic diversification of Taiwan's digital finance infrastructure. It underlines a national effort at enhancing competitiveness and fiscal transparency at the global level. These developments are cementing Taiwan e-invoicing market growth, solidifying its position as an inherent component of Taiwan's digital economy and global financial interoperability.

Taiwan E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

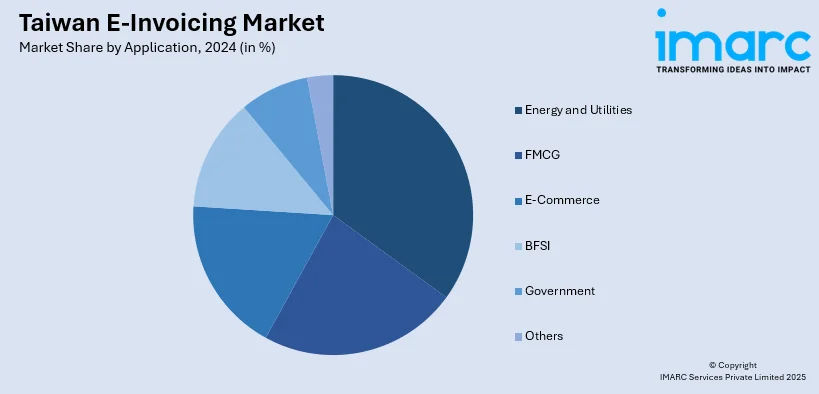

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan E-Invoicing Market News:

-

In April 2024, logistics giant Maersk implemented an Instant Invoice solution using SAP S/4HANA in Taiwan generating invoices immediately upon fulfillment, with exchange rates locked in at invoice creation demonstrating how timely, sector‑tailored e‑invoicing can enhance operational consistency and international trade efficiency.

Taiwan E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan e-invoicing market on the basis of channel?

- What is the breakup of the Taiwan e-invoicing market on the basis of deployment type?

- What is the breakup of the Taiwan e-invoicing market on the basis of application?

- What is the breakup of the Taiwan e-invoicing market on the basis of region?

- What are the various stages in the value chain of the Taiwan e-invoicing market?

- What are the key driving factors and challenges in the Taiwan e-invoicing?

- What is the structure of the Taiwan e-invoicing market and who are the key players?

- What is the degree of competition in the Taiwan e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)