Taiwan EdTech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2025-2033

Taiwan EdTech Market Overview:

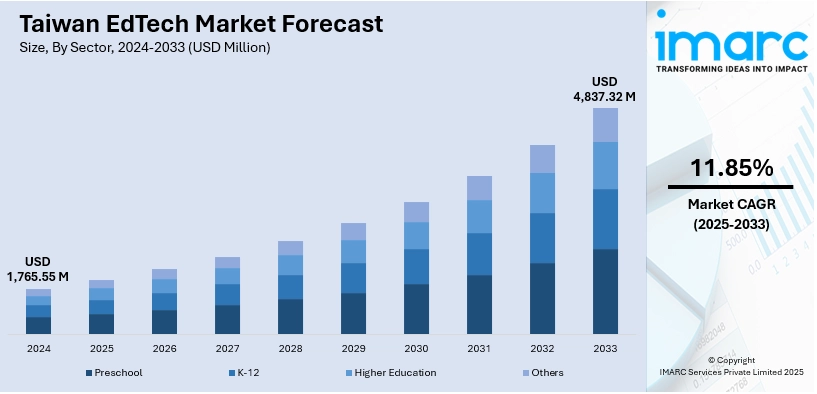

The Taiwan EdTech market size reached USD 1,765.55 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,837.32 Million by 2033, exhibiting a growth rate (CAGR) of 11.85% during 2025-2033. Government funding, strong ICT infrastructure, rising demand for personalized learning, high digital penetration, public-private partnerships, a push for bilingual education, and tech adoption in vocational training are some of the factors contributing to Taiwan EdTech market share. Local startups and global players both contribute to market innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,765.55 Million |

| Market Forecast in 2033 | USD 4,837.32 Million |

| Market Growth Rate 2025-2033 | 11.85% |

Taiwan EdTech Market Trends:

Private Supplementary Platforms Outpacing Formal Education Tech

In Taiwan, after-school education has long held more sway than regular classrooms. That trend is only deepening in the digital space. Local edtech startups and cram school franchises have pivoted hard to mobile-first, interactive platforms that cater to K-12 students outside school hours. These aren’t just digitized textbooks—they’re adaptive learning engines with gamified quizzes, personalized diagnostics, and AI tutors fine-tuned to the high-pressure demands of Taiwan’s entrance exams. What sets this trend apart is its independence from government edtech policy. Many of these platforms avoid public school partnerships altogether. Instead, they build directly for parents who expect academic performance. Monetization is subscription-based, with mid-tier pricing targeting middle-class families willing to pay for a competitive edge. With public schools slow to adopt new tech and curricula, this shadow education sector is setting the pace. Platforms like Hahow and AmazingTalker aren’t just filling gaps—they’re defining the main learning experience for tens of thousands of students. These factors are intensifying the Taiwan EdTech market growth. For example, in November 2024, HiTeach was named one of Taiwan’s Best Teaching Software of 2024, recognized for its AI-powered classroom tools. With generative AI, GPT-enhanced mind maps, and speech scoring, it supports smart lesson delivery and student diagnostics. Already active in 10,000+ classrooms, HiTeach helps teachers customize plans and analyze learning needs, cementing its role in Taiwan’s growing EdTech sector focused on AI integration and personalized education.

To get more information on this market, Request Sample

University-Led Innovation in AI-Integrated Learning Environments

Taiwan’s universities are turning into testbeds for experimental edtech systems that combine AI, IoT, and student behavior analytics. These aren’t just LMS upgrades—they’re fully integrated digital ecosystems that track participation across hybrid classrooms, recommend academic resources, and nudge students with personalized feedback. NTU and NCKU have piloted machine learning models to predict course dropouts based on attendance patterns and assignment timing. This isn’t just about better grades. The real goal is identifying early warning signs of disengagement, something faculty and staff often miss. These experiments are often funded by the Ministry of Education’s digital transformation grants, giving institutions the freedom to build their own tech stacks or partner with homegrown startups. Unlike B2C platforms that dominate primary education, this trend is institutional, slow-moving, and deeply embedded in Taiwan’s public research system. But its impact could be longer-lasting, reshaping how higher education supports student success, not just through content, but through data-informed intervention.

Taiwan EdTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

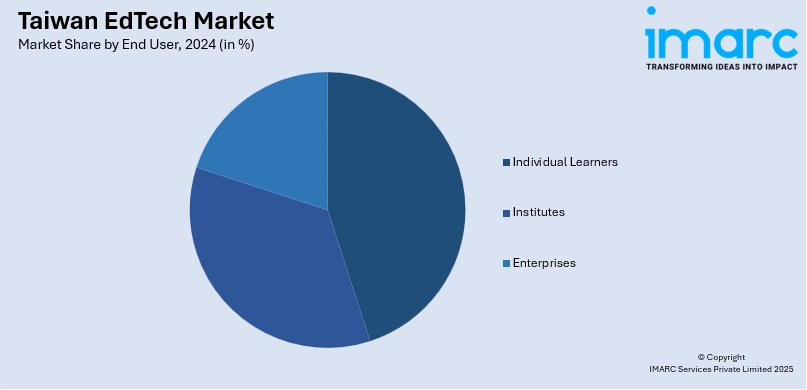

End User Insights:

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan EdTech Market News:

- In January 2025, Leap, an edtech company, raised USD 65 Million in a funding round led by Apis Partners. The funding would support expansion into Taiwan, China, and Malaysia, with Taiwan identified as a key growth market due to rising demand. Founded in 2019, Leap operates platforms like LeapScholar and LeapFinance, offering services including international test prep, admissions support, visa counselling, and student loans.

Taiwan EdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan EdTech market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan EdTech market on the basis of sector?

- What is the breakup of the Taiwan EdTech market on the basis of type?

- What is the breakup of the Taiwan EdTech market on the basis of deployment mode?

- What is the breakup of the Taiwan EdTech market on the basis of end user?

- What is the breakup of the Taiwan EdTech market on the basis of region?

- What are the various stages in the value chain of the Taiwan EdTech market?

- What are the key driving factors and challenges in the Taiwan EdTech market?

- What is the structure of the Taiwan EdTech market and who are the key players?

- What is the degree of competition in the Taiwan EdTech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan EdTech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan EdTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan EdTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)