Taiwan IT Training Market Size, Share, Trends and Forecast by Application, End-User, and Region, 2025-2033

Taiwan IT Training Market Overview:

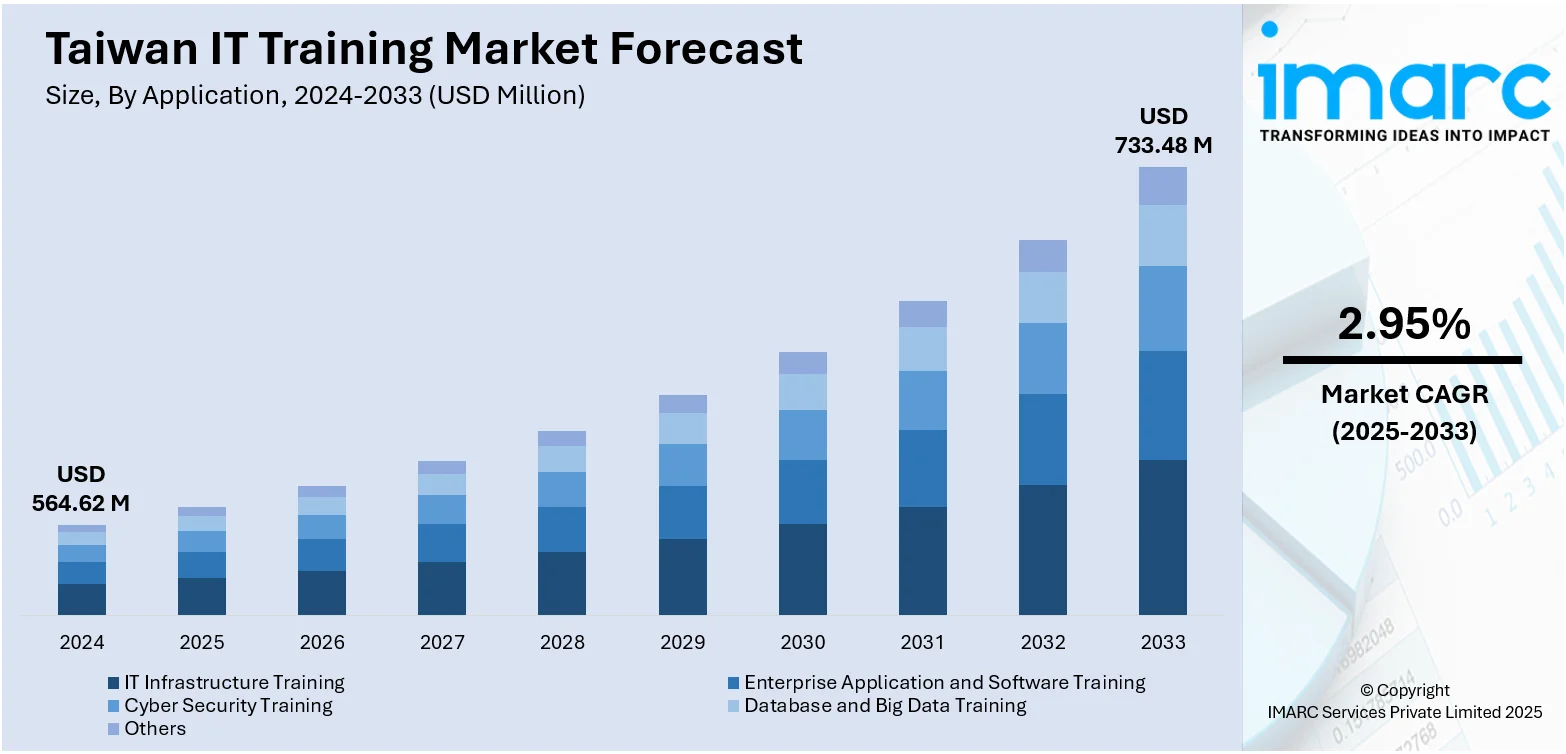

The Taiwan IT training market size reached USD 564.62 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 733.48 Million by 2033, exhibiting a growth rate (CAGR) of 2.95% during 2025-2033. Rising demand for digital transformation, government initiatives like Taiwan's DIGI+ program, a strong semiconductor industry, and tech-savvy youth are some of the factors contributing to Taiwan IT training market share. Companies seek skilled talent in AI, cloud, and cybersecurity, creating ongoing demand for specialized training programs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 564.62 Million |

| Market Forecast in 2033 | USD 733.48 Million |

| Market Growth Rate 2025-2033 | 2.95% |

Taiwan IT Training Market Trends:

Corporate Upskilling and Industry Certifications Surge

Taiwanese companies, particularly in finance, semiconductors, and manufacturing, are investing heavily in internal IT upskilling. There’s been a clear shift toward structured training programs tied to recognized certifications like AWS, Microsoft Azure, Cisco, and CompTIA. Mid-career professionals are taking advantage of company-sponsored programs that emphasize cloud infrastructure, network security, and DevOps. This trend is largely driven by digital transformation goals and the demand for globally recognized IT standards. Companies are no longer relying on informal workshops or ad hoc skill development. Instead, they’re working with established IT training vendors and integrating learning paths into employee KPIs and performance reviews. Local training providers are partnering with global certification bodies to offer hybrid formats that mix online content with live lab sessions. There's also a measurable rise in government-supported workforce development grants that subsidize these upskilling efforts for SMEs. The overall effect is a more professionalized and measurable IT training ecosystem, with employers seeking verifiable outcomes and credentials rather than informal knowledge transfer. These factors are intensifying the Taiwan IT training market growth.

To get more information on this market, Request Sample

Maker Culture and Self-Led Learning Expand in Youth Segment

In contrast to the formalization seen in corporate settings, younger learners and early-stage developers in Taiwan are driving a grassroots movement built around self-taught coding, open-source collaboration, and maker culture. Tech-savvy high school and university students are teaching themselves Python, JavaScript, and C++ through YouTube, GitHub, and Discord communities. Instead of waiting for structured coursework, they’re jumping into projects like web app development, game design, or hardware tinkering with Arduino and Raspberry Pi. Hackathons, startup bootcamps, and student-led developer meetups are becoming central to how new talent gets trained. Formal degrees are still valued, but this trend shows a growing disconnect between what’s offered in traditional classrooms and how young learners prefer to acquire skills. Online platforms like Udemy, Coursera, and locally built tools are filling the gap. This rise in self-directed learning is influencing training providers to adjust their formats, offering more project-based and modular content, with flexible pacing. The appetite for creative freedom and real-world application is driving this trend, reshaping the pipeline for junior developers and early tech entrepreneurs in Taiwan.

Taiwan IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end-user.

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes IT infrastructure training, enterprise application and software training, cyber security training, database and big data training, and others.

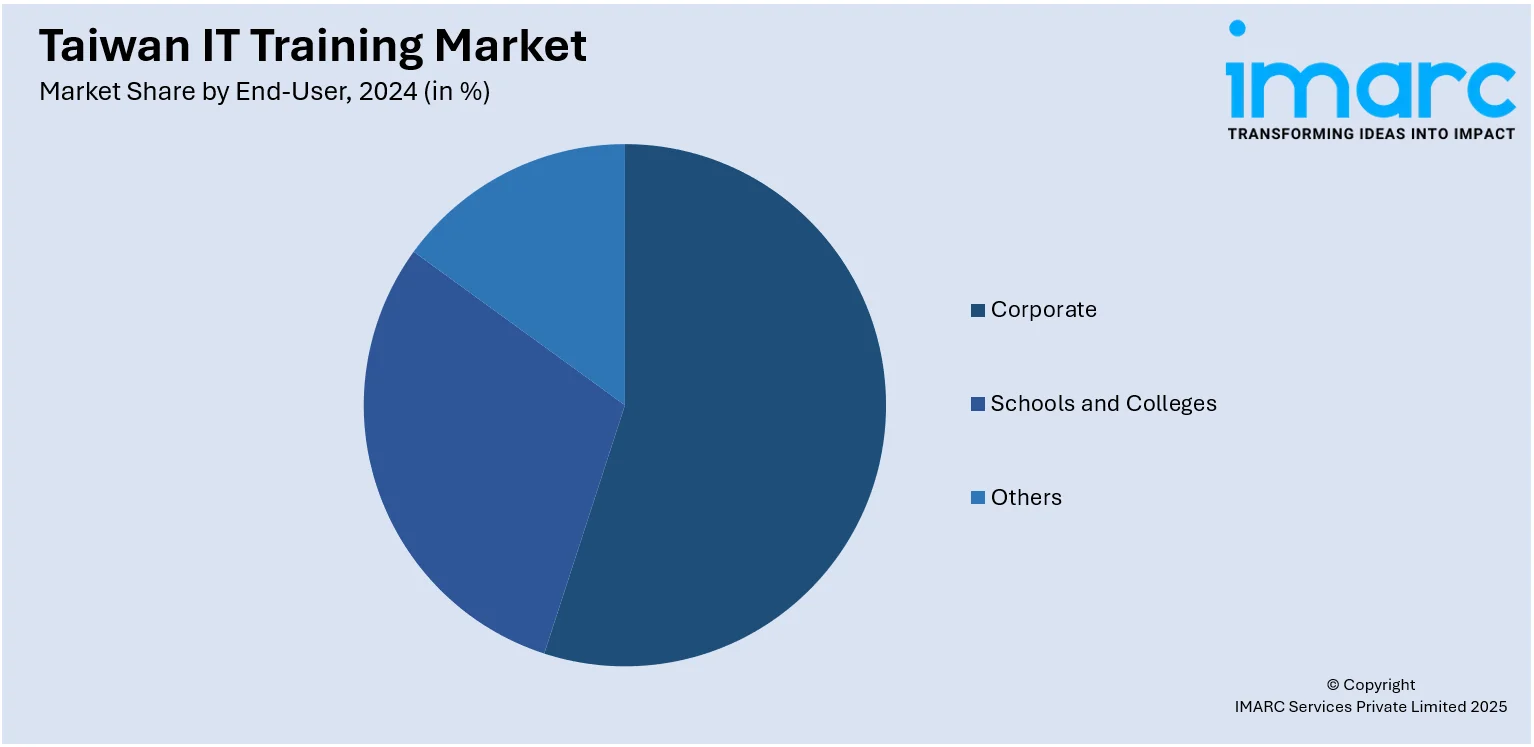

End-User Insights:

- Corporate

- Schools and Colleges

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes corporate, schools and colleges, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan IT Training Market News:

- In June 2025, Tata Electronics sent over 200 employees to Taiwan for advanced training at Powerchip Semiconductor Manufacturing Corporation (PSMC), its technical partner. This highlights Taiwan’s growing role in upskilling global semiconductor talent. As India ramps up its AI-driven chip manufacturing, Taiwan’s training infrastructure and expertise are becoming essential in addressing skill gaps and supporting large-scale projects like Tata’s upcoming Dholera semiconductor fab.

Taiwan IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporate, Schools and Colleges, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the Taiwan IT training market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan IT training market on the basis of application?

- What is the breakup of the Taiwan IT training market on the basis of end-user?

- What is the breakup of the Taiwan IT training market on the basis of region?

- What are the various stages in the value chain of the Taiwan IT training market?

- What are the key driving factors and challenges in the Taiwan IT training market?

- What is the structure of the Taiwan IT training market and who are the key players?

- What is the degree of competition in the Taiwan IT training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan IT training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)