Taiwan Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

Taiwan Logistics Market Overview:

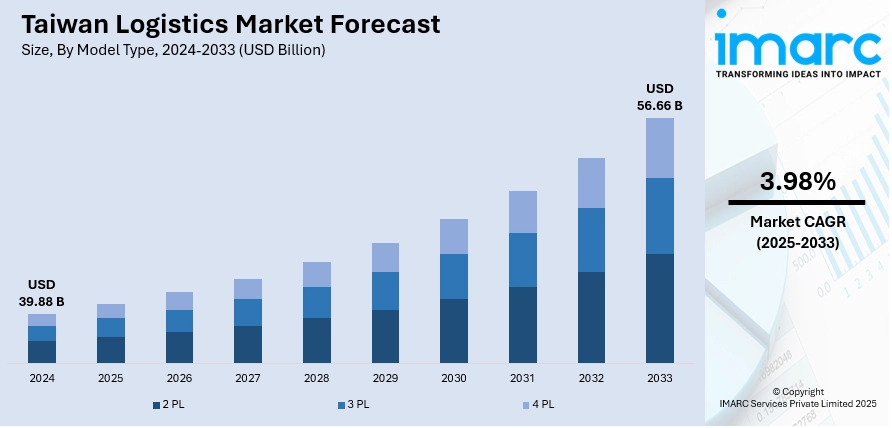

The Taiwan logistics market size reached USD 39.88 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 56.66 Billion by 2033, exhibiting a growth rate (CAGR) of 3.98% during 2025-2033. The market is driven by Taiwan’s critical role in Asia-Pacific trade flows and its advanced port infrastructure supporting high-volume freight movement. The growth of e-commerce platforms is generating sustained demand for integrated fulfillment and technologically advanced logistics services. Furthermore, active government initiatives promoting infrastructure upgrades and smart logistics integration are reshaping the competitive landscape, further augmenting the Taiwan logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 39.88 Billion |

| Market Forecast in 2033 | USD 56.66 Billion |

| Market Growth Rate 2025-2033 | 3.98% |

Taiwan Logistics Market Trends:

Strategic Role in Asia-Pacific Trade Networks

Taiwan’s role as a critical node in Asia-Pacific trade stems from its advanced manufacturing base, export-oriented economy, and proximity to major regional markets. The country’s well-developed ports, particularly the Port of Kaohsiung, serve as essential gateways for containerized freight flowing to and from global markets. Taiwan’s deep integration into global electronics, semiconductor, and machinery supply chains requires highly efficient logistics systems. With increasing trade volumes and tight production schedules, logistics providers are investing in digitalization and automation to maintain operational efficiency. Taiwan is also strengthening ties with Southeast Asian and Pacific trade partners through targeted diplomatic and commercial engagements. Ongoing improvements to customs processes, bonded warehouse facilities, and multimodal transport options further elevate Taiwan’s logistical competitiveness. These combined factors support the continued expansion of international and domestic supply chains connected to the island’s industrial hubs. Collectively, these dynamics are contributing to Taiwan logistics market growth.

To get more information on this market, Request Sample

Expansion of E-Commerce and Demand for Integrated Fulfillment Solutions

The growth of Taiwan’s e-commerce sector is creating sustained demand for advanced logistics services, particularly in warehousing, fulfillment, and last-mile delivery. Online shopping platforms are increasingly investing in automated sorting systems, inventory optimization technologies, and integrated distribution networks to streamline customer order processing. Domestic logistics companies are rapidly expanding urban fulfillment centers to reduce delivery lead times for consumers across metropolitan areas. Additionally, partnerships between local firms and global e-commerce giants are fostering technological upgrades within Taiwan’s logistics infrastructure. Value-added services, such as packaging, labeling, and returns management, are becoming standard offerings to support the evolving expectations of online shoppers. The use of real-time data analytics and artificial intelligence is enhancing logistics precision, reducing errors, and improving delivery speed. Furthermore, growing consumer expectations for rapid, trackable deliveries are encouraging logistics firms to refine operational efficiency. This expanding e-commerce ecosystem continues to reshape Taiwan’s logistics industry, integrating warehousing with technology-driven delivery operations.

Government Policies and Infrastructure Modernization Initiatives

Government-backed initiatives to modernize Taiwan’s logistics sector are accelerating the industry’s structural transformation. Taiwan’s Forward-looking Infrastructure Development Program emphasizes the development of smart logistics parks, improved port facilities, and digitalized customs clearance processes. These projects are enhancing the country’s ability to handle increasing trade volumes while streamlining transportation processes for both imports and exports. Infrastructure developments such as intermodal freight terminals, highway expansions, and port automation systems are contributing to seamless freight movement across the country. The government also incentivizes logistics companies to adopt energy-efficient technologies and sustainable practices, aligning operations with broader environmental goals. Further, the integration of blockchain-based platforms for transparent supply chain management is gaining traction within Taiwan’s logistics community. Collaboration between the public sector, academic institutions, and industry leaders is supporting the development of logistics-focused R&D initiatives. With institutional backing and clear modernization objectives, Taiwan’s logistics industry is becoming more competitive and aligned with future trade dynamics.

Taiwan Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, seaways, railways, and airways.

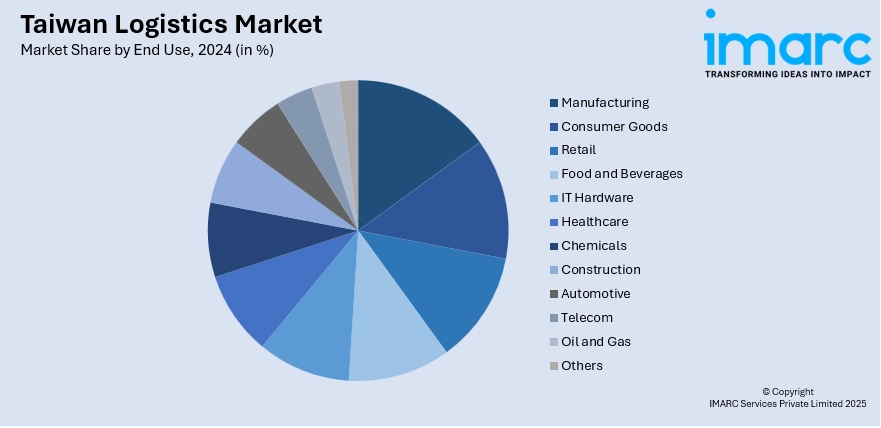

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Logistics Market News:

- September 27, 2024: Nippon Express (Taiwan) Co., Ltd. inaugurated its new NEXT 7 International Logistics Center (ILC) in Changhua County, Central Taiwan, further enhancing the company's supply chain network across the country. The facility, spanning 5,354 square meters, addresses rising logistics demand driven by Taiwan’s flourishing semiconductor, biotechnology, and precision equipment sectors. As NX Taiwan’s third ILC, NEXT 7 supports optimized logistics with bonded storage, reduced delivery costs, and faster lead times, strengthening its role in Taiwan's growing logistics sector.

Taiwan Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan logistics market on the basis of model type?

- What is the breakup of the Taiwan logistics market on the basis of transportation mode?

- What is the breakup of the Taiwan logistics market on the basis of end use?

- What is the breakup of the Taiwan logistics market on the basis of region?

- What are the various stages in the value chain of the Taiwan logistics market?

- What are the key driving factors and challenges in the Taiwan logistics market?

- What is the structure of the Taiwan logistics market and who are the key players?

- What is the degree of competition in the Taiwan logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)