Taiwan Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

Taiwan Real Estate Market Overview:

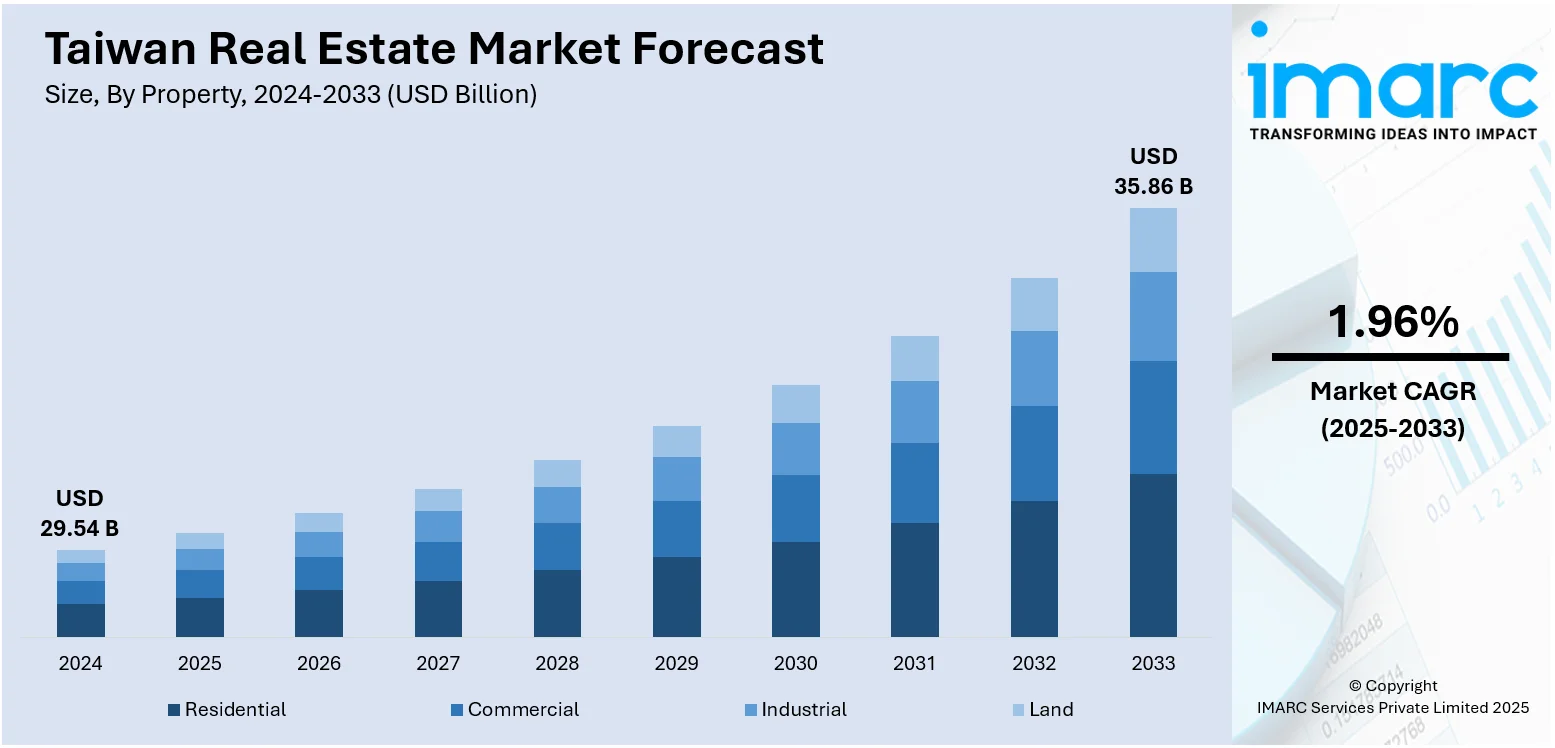

The Taiwan real estate market size reached USD 29.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 35.86 Billion by 2033, exhibiting a growth rate (CAGR) of 1.96% during 2025-2033. At present, the Taiwan property market is presently witnessing consistent demand from local purchasers. Moreover, the ongoing development of urban centers and increasing infrastructure are propelling the market growth. Apart from this, overseas investment is playing an active role in expanding Taiwan real estate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.54 Billion |

| Market Forecast in 2033 | USD 35.86 Billion |

| Market Growth Rate 2025-2033 | 1.96% |

Taiwan Real Estate Market Trends:

Massive Demand from Local Buyers

The Taiwan property market is presently witnessing consistent demand from local purchasers. The requirement is driven by a few factors, such as low interest rates and growth in household savings. Local purchasers are still investing in real estate, considering it a safe asset in periods of economic unpredictability. Further, the need for more spacious living arrangements, particularly as more people are working from home, is also increasing this demand. As remote working gains traction, many residents and families are looking to purchase larger homes or properties in rural and suburban areas, which provide a quality of life superior to that of highly populated urban areas. This increasing demand for residential property is stabilizing market values and is encouraging builders to keep developing new residential projects to address the continuous demand. In 2025, MVRDV unveiled pictures of "Out of the Box," a 12,025 sqm residential skyscraper located in Tianmu, one of the northernmost districts of Taipei. Created for Win Sing Development Company, the initiative started in 2019 and was built using a system of standardized components digitally allocated according to factors like habitability, efficiency, and access to local services. These features are represented in the tower's uneven, grid-like exterior, which showcases a multi-layered marble covering.

To get more information on this market, Request Sample

Rising Focus on Infrastructure Development

The ongoing development of urban centers and increasing infrastructure are propelling the Taiwan real estate market growth. Mega transportation projects like new metro lines and highways are improving intercity connectivity and rural areas. These initiatives are opening up hitherto relatively less accessible areas to real estate investment. Furthermore, urban developments are driving the demand for commercial and residential properties in urban areas such as Taipei and Kaohsiung. With the government still investing in public facilities like parks, schools, and hospitals, the general quality of life within these places is increasing, thus catalyzing property demand. In addition, commercial property is experiencing expansion as companies are opening up and establishing offices in newly developed cities, competing for top real estate.

Foreign Investment and International Demand

Overseas investment is playing an active role in expanding the Taiwan property market, particularly in the commercial and high-end residential segments. Overseas purchasers, especially those from mainland China, Hong Kong, and Southeast Asia, are increasingly looking at Taiwan as a secure investment place because of its political stability, high-standard infrastructure, and robust economy. These buyers are now looking to take advantage of the appreciation value of Taiwanese properties, which remain underpriced relative to those in other local markets. Policies from the government, including providing foreign buyers with tax incentives and making it easier to access property ownership, are also motivating international demand. The rising number of foreign nationals in Taiwan is creating a more diversified property market, with demand for luxury properties, office space, and residential properties still on the rise in prime city areas. Moreover, the government has initiated the Trillion NT Dollar Investment National Development Plan (2025-2028) to draw private investments from local and international sources into Taiwan's industrial growth and public infrastructure. By implementing creative partnership frameworks that merge private sector pledges with governmental backing, the initiative aims to channel trillions in capital investment into Taiwan.

Taiwan Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

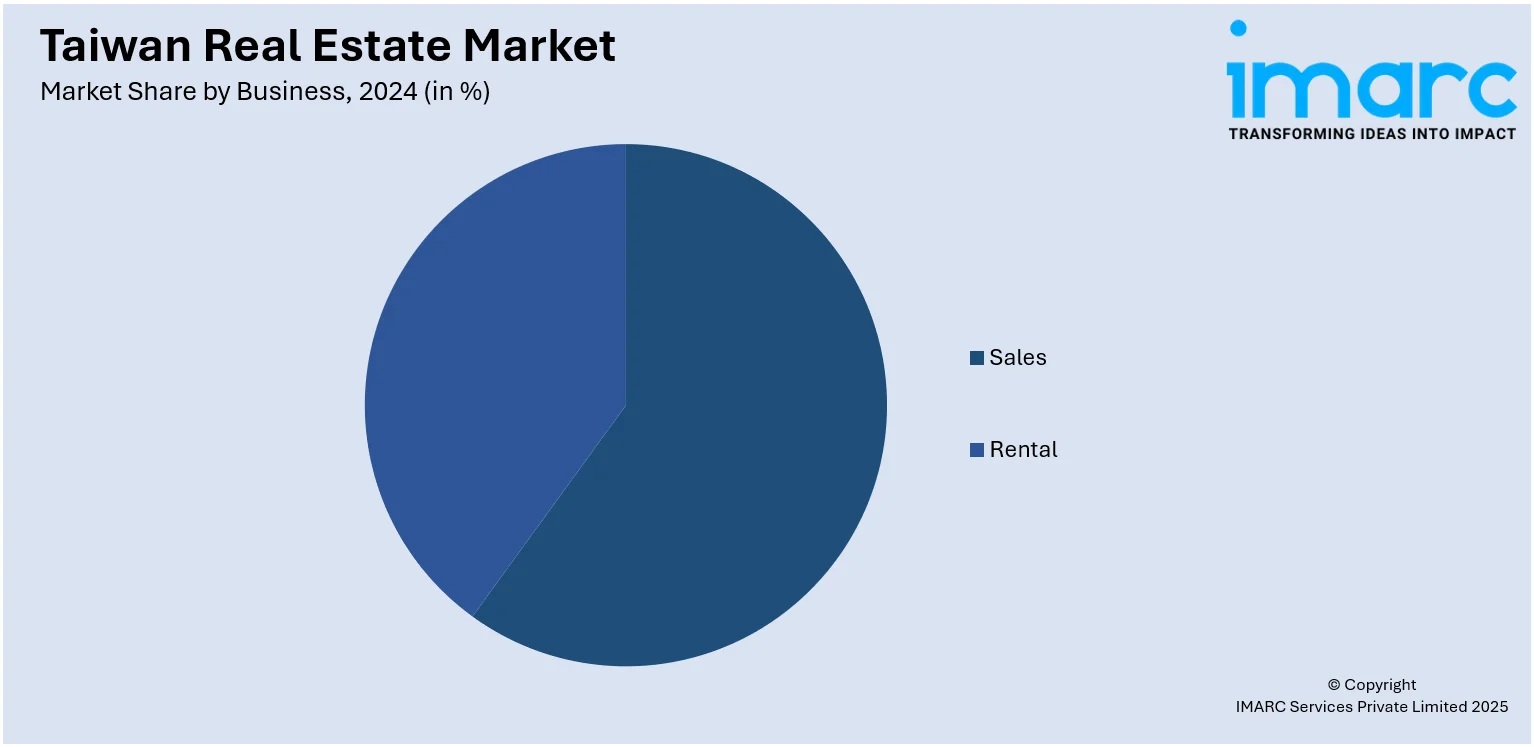

Business Insights:

- Sales

- Rental

The report has provided a detailed breakup and analysis of the market based on the business. This includes sales and rental.

Mode Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the mode have also been provided in the report. This includes online and offline.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan real estate market on the basis of property?

- What is the breakup of the Taiwan real estate market on the basis of business?

- What is the breakup of the Taiwan real estate market on the basis of mode?

- What is the breakup of the Taiwan real estate market on the basis of region?

- What are the various stages in the value chain of the Taiwan real estate market?

- What are the key driving factors and challenges in the Taiwan real estate market?

- What is the structure of the Taiwan real estate market and who are the key players?

- What is the degree of competition in the Taiwan real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)