Tea Market Size, Share, Trends and Forecast by Product Type, Packaging, Distribution Channel, Application, and Region, 2026-2034

Tea Market Size and Trends:

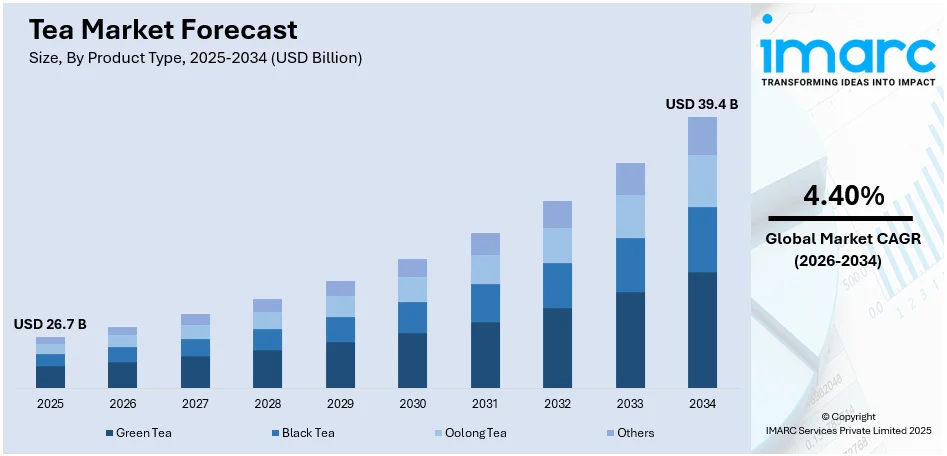

The global tea market size was valued at USD 26.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 39.4 Billion by 2034, exhibiting a CAGR of 4.40% from 2026-2034. China currently dominates the market, holding a tea market share of over 14.3% in 2025. The growth of China is driven by its vast production capabilities, rich tea heritage, diverse native tea varieties, deeply rooted tea culture, and increasing demand for quality tea products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 26.7 Billion |

|

Market Forecast in 2034

|

USD 39.4 Billion |

| Market Growth Rate (2026-2034) | 4.40% |

The growing demand for ready-to-drink (RTD) tea products, which accommodate the hectic lifestyles of modern consumers looking for convenience while maintaining health advantages, is offering a favorable tea market outlook. These items come in different flavors and are frequently enhanced with vitamins and minerals, making them a favored option for health-aware shoppers. Furthermore, innovations in tea brewing technology and the introduction of new flavors are making tea more appealing to a broader audience. Ranging from cold brews to artisan blends, the innovations in how tea is prepared and consumed are attracting new demographics and encouraging the exploration of new tea types. Additionally, the rise of online shopping is making a variety of teas more accessible to consumers worldwide. Specialty teas, previously available only in select stores or regions, can now be purchased from anywhere, expanding the global user base for premium and niche tea products.

To get more information on this market Request Sample

The United States plays a crucial role in the market, driven by the launch of innovative tea blends and targeted marketing initiatives. By presenting unique flavors and highlighting health advantages, businesses can satisfy the increasing consumer desire for varied and health-oriented choices. Focusing on particular demographics, like younger audiences via digital content and collaborations on social media, enables brands to successfully connect with and shape new market trends. This strategy rejuvenates brand products and corresponds with the changing preferences of key consumer demographics. In 2024, Lipton unveiled a fresh collection of green teas in the US, featuring five varieties: Signature Blend, Decaf, Lemon, Peach, and Honey Ginger, all abundant in flavonoids. These new varieties seek to blend excellent flavor with health advantages, supporting the "2 Cups to Goodness" initiative to motivate daily intake among Gen Z. The introduction is part of a 36-week comprehensive marketing strategy that includes digital content, collaborations with influencers, and events.

Tea Market Trends:

Rising Health Awareness

The growing tea demand due to the consumers' growing awareness regarding its health advantages is influencing the market growth. According to a survey by Aditya Birla Health Insurance, 84% of people believe that their health awareness has increased as a result of the pandemic. For instance, green tea has a high content of antioxidants called catechins and polyphenols, which have been associated with several health advantages such as a lower risk of heart disease, stroke, and some forms of cancer. Moreover, more people are choosing tea over sugary beverages or coffee as a healthier beverage option due to the growing public health awareness. Besides, the development of a wide range of flavored and specialty teas, which appeal to a wider audience seeking health advantages and new sensory experiences, is supported by the proliferation of health-focused marketing across the globe, thus contributing to the tea market outlook.

Growing Population

The global increase in population is affecting the demand for tea globally. As per estimates from the United Nations (UN), the world population is projected to grow by nearly 2 Billion over the next 30 years, hitting 9.7 Billion by 2050, with a potential peak of 10.4 Billion in the mid-2080s. According to the UN, by mid-November 2022, the worldwide population hit 8.0 Billion people, up from roughly 2.5 Billion in 1950. Moreover, the increasing demand for food and drinks, especially tea, is predicted to grow along with the growing global population. In addition, there is a growing trend toward urban lives, which frequently value easy-to-use, health-conscious products among them, including numerous kinds of tea. Furthermore, the growing middle class in developing nations is fueling this trend as these new customers are more inclined to take up tea drinking due to its supposed health advantages and social features. Thus, the global consumption of tea is steadily increasing due to this demographic and economic change positively generating the tea market revenue.

Climate and Agricultural Advancements

The global tea industry’s increased production efficiency owing to numerous improvements in climatic resistance and cultivation practices. For instance, precision agriculture is one of the more recent innovations that uses of Internet of Things (IoT) and global positioning system (GPS) sensors to optimize nutrient delivery and water use, improving production and quality of the product. Additionally, climate-resilient cultivars have been created to endure unpredictable weather patterns, minimizing crop failures and guaranteeing a steady supply. Moreover, the areas used for tea planting have been sustainably expanded owing to several advancements, even in locations that were previously unsuitable due to climate limits. As per reports from the Food and Agriculture Organization (FAO), tea production rose from 4.3 Million Tons (Mt) in 2008 to 6.3 Mt in 2020, grown across 5 Million hectares. Therefore, it is expected that this trend will continue as agricultural technology improves and stabilizes tea production in light of the ongoing global climate change worldwide.

Tea Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global tea market, along with forecast at the global and country levels from 2026-2034. The market has been categorized based on product type, packaging, distribution channel, and application.

Analysis by Product Type:

- Green Tea

- Black Tea

- Oolong Tea

- Others

Black tea stands as the largest component in 2025, holding 38.5% of the market share. Black tea holds the biggest market share owing to its immense popularity and deep-rooted cultural importance in many parts of the globe. It is renowned for having more caffeine than other varieties and a strong taste. Additionally, the widespread consumption of black tea in the West and several regions of Asia is due to its adaptable characteristics which allow it to be enjoyed cold or hot. According to Gitnux, Lapsang Souchong, Chinese black tea called Lapsang Souchong may cost up to USD 200 per kilogram (KG). Moreover, black tea is also sold in a variety of formats, such as loose leaves, tea bags, and instant powder, providing customers with convenience and a selection of options that support its marketability across the globe.

Analysis by Packaging:

- Plastic Containers

- Loose Tea

- Paper Boards

- Aluminium Tin

- Tea Bags

- Others

Paper boars exhibit a clear dominance in the market as they are preferred by manufacturers and individual due to their economical and environmentally favorable qualities. These materials, used in the production of cartons and paper-based containers, are recyclable and biodegradable, aligning with the growing user demand for sustainable packaging solutions amid increasing environmental concerns. Paper board packaging effectively maintains the freshness, aroma, and quality of tea, making it an ideal choice for preserving product integrity. Additionally, its superior printability and ability to adapt to various patterns enhance brand visibility, creating attractive and impactful designs that capture user attention on retail shelves. The thin structure of paper boards lowers transportation expenses and energy usage, enhancing their sustainability. As governments around the globe promote the adoption of sustainable materials via regulations and incentives, the demand for paper boards keeps increasing, reinforcing their dominance in the sector.

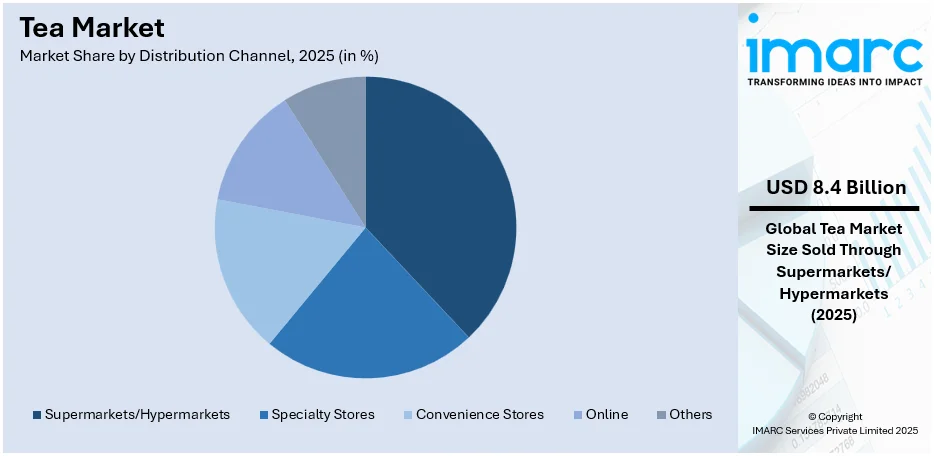

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

Supermarkets and hypermarkets lead the market with 32.8% of market share in 2025. According to the tea market overview, supermarkets and hypermarkets are the largest segment due to their extensive reach and the convenience they offer to consumers seeking diverse tea varieties under one roof. Additionally, supermarkets and hypermarkets typically provide a wide range of tea options, from basic blends to premium, specialty teas, catering to a broad spectrum of consumer preferences. For instance, as per the Government of Canada in 2021, tea retail sales in the U.S. hit USD 2.9 Billion, with projections to rise to USD 3.4 Billion by 2026. Moreover, organic tea sales in the United States reached USD 0.4 Billion in 2021, and projections indicate that they will grow to USD 0.5 Billion by 2026. Furthermore, organic products made up 13.3% of total tea retail sales in the US in 2021. Furthermore, the positioning of supermarkets and hypermarkets guarantees convenient access for many shoppers, enhancing their attractiveness due to their strategic sites in urban and suburban regions. Additionally, the capability to examine products in person, along with attractive pricing and regular promotional efforts, draws a broader audience, strengthening their role as major contributors in tea distribution.

Analysis by Application:

- Residential

- Commercial

Residential represents the largest segment, accounting 62.0% of market share in 2025. The residential segment holds the largest share due to the growing consumption of tea in households globally. It benefits from the deep-rooted cultural significance of tea drinking in many regions, coupled with the increasing preference for specialty teas among consumers seeking diverse flavors and health benefits. Additionally, the easy availability of a wide range of products, including organic, herbal, and green teas, are strengthening the tea market growth. Additionally, the trend of health consciousness and the shift toward natural beverages is catalyzing the demand for tea in residential settings, positioning it as a staple in daily routines. Hence, this dominance is supported by innovations in packaging and marketing strategies tailored to attract the residential consumer.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- China

- India

- Kenya

- Sri Lanka

- Turkey

- Vietnam

- Others

In 2025, China accounted for the largest market share of 14.3% in the global tea industry. As per the tea market forecast, China stands as the largest tea market, significantly influencing global supply and demand due to its extensive production capabilities and rich cultural heritage in tea cultivation and consumption. According to Worldmetrics, China produces about 40% of the world's total tea, making it the leading nation in tea production. Additionally, other regions like India also play a crucial role in the Asia-Pacific tea market. China's dominant position is further reinforced by its diverse range of native tea varieties and a deeply ingrained tea-drinking culture that resonates throughout the region. This cultural tradition not only boosts local consumption but also enhances China's export potential, positioning it as a pivotal player in shaping global tea trends and preferences.

Key Regional Takeaways:

United States Tea Market Analysis

In North America, the United States represented 86.30% of the overall market share. The US tea market is driven by a growing health-conscious population, with over 159 Million Americans drinking tea on any given day, according to the Census. This shift towards healthier beverage options has led many consumers to favor tea over sugary drinks. The demand for herbal, green, and functional teas, known for their antioxidant and health benefits, continues to rise. Wellness trends and a focus on self-care have also boosted interest in specialty teas, such as matcha and adaptogenic blends. Additionally, the rise in popularity of organic and premium tea options, supported by both retail and e-commerce channels, is propelling the market growth. The increasing consumer preference for sustainability is also contributing to the market, with ethical sourcing, eco-friendly packaging, and organic certifications gaining importance. The expansion of ready-to-drink (RTD) tea, catering to on-the-go lifestyles, is widening the market's appeal. As brands innovate with new flavors and blends, they continue to diversify offerings to meet varying consumer preferences, ensuring continued growth in the sector.

Europe Tea Market Analysis

The European tea market is witnessing growth, supported by the rising emphasis on health and wellness. As per the CBI, individuals in Europe drink as much as 2 kg of tea annually, indicating the area's robust and steady tea consumption. An increasing inclination towards high-quality and specialty teas is evident, especially green, herbal, and organic types, which are appreciated for their health benefits like antioxidant effects and stress reduction. Furthermore, sustainability is emerging as a vital factor, with consumers seeking ethically sourced, organic, and environmentally friendly tea products. The rising wellness trend is encouraging innovations in functional teas designed to address particular health requirements, including enhancing immunity and promoting detoxification. The UK, Germany, and France are particularly experiencing high tea market demand for both conventional and emerging types such as iced and ready-to-drink (RTD) variants.

Asia Pacific Tea Market Analysis

The Asia Pacific region, the largest consumer of tea globally, is driven by cultural traditions and growing health-consciousness. According to the National Sample Survey Organization, India consumes 15 times more tea than coffee, highlighting the region's strong preference for tea. Countries like China and India, with their deep-rooted tea heritage, continue to dominate the market. Rising middle-class populations and a growing focus on health and wellness are driving demand for green, herbal, and functional teas, known for their health benefits. Additionally, increased availability of premium and organic tea products through modern retail and e-commerce channels has expanded consumer access. The trend of ready-to-drink (RTD) tea is also gaining momentum, particularly among younger consumers seeking convenience. As tea consumption rises across the region, the market continues to grow, driven by a preference for natural, functional beverages.

Latin America Tea Market Analysis

The Latin American tea market is experiencing growth driven by rising health consciousness and an increasing preference for healthier beverage alternatives. According to an article published in Novo Capsule, over 70% of the tea consumed in South America is black tea, reflecting its popularity in the region. Additionally, the demand for green, herbal, and organic teas is on the rise as consumers seek natural, functional beverages known for their health benefits. E-commerce and modern retail channels are improving accessibility, and the growing availability of premium tea options is expanding the market, attracting a wider audience across Latin America.

Middle East and Africa Tea Market Analysis

The tea industry in the Middle East and Africa is experiencing significant growth, supported by traditional tea drinking and a move towards healthier drink options. Industry reports indicate that 81% of individuals in the United Arab Emirates (UAE) desire healthier food and drink choices in vending machines, underscoring a regional shift towards wellness-oriented products. This inclination is driving the demand for herbal, green, and functional teas, recognized for their health advantages. Additionally, the rise of ready-to-drink (RTD) teas and increasing disposable incomes are driving market expansion, with modern retail channels facilitating greater accessibility to diverse tea offerings.

Competitive Landscape:

Key players in the market are focusing on product diversification to cater to changing consumer preferences, including introducing organic and specialty blends. They are leveraging advanced packaging techniques to enhance product shelf life and appeal. Investments in sustainable sourcing and eco-friendly practices are being prioritized to meet growing environmental concerns. Companies are also exploring innovative marketing strategies, such as digital campaigns and influencer partnerships, to strengthen brand visibility. Expansion into emerging markets through localized products and distribution channels is another key focus. Additionally, partnerships with hospitality and retail sectors are being fostered to widen reach. Research and development (R&D) efforts are being ramped up to create functional teas with added health benefits, addressing the rising demand for wellness-oriented products. In January 2024, Chai Sutta Bar, a prominent tea chain introduced its new tea brand, Maatea. The announcement was made via a press release in New Delhi, India. Maatea aims to improve the tea-drinking experience by offering a natural, premium tea that steers clear of additives and artificial colors often found in other brands.

The report provides a comprehensive analysis of the competitive landscape in the tea market with detailed profiles of all major companies, including:

- Associated British Foods plc

- Barry's Tea

- Bigelow Tea

- Caraway Tea

- Dilmah Ceylon Tea Company PLC

- Harris Freeman

- Ito En, Ltd.

- LIPTON Teas and Infusions

- TAETEA Group Co., Ltd.

- Tata Consumer Products Limited (Tata Group)

- The Hain Celestial Group, Inc

- The Republic of Tea

- Unilever plc

- Yorkshire Tea

Latest News and Developments:

- July 2024: Aideobarie Tea Estates launched its "Rujani Tea" brand in Assam, offering two CTC variants. Initially available in Guwahati and Jorhat, the tea was set to be in stores the following month. The company expanded into retail to address rising costs and sustain growth.

- March 2024: Pansari Group, renowned as India's leading FMCG brand, is poised to impress attendees with the debut of TVOY Green Tea at Aahar 2024. In addition, with the successful launch of its new tea line Pansari Chai, which features four unique flavors delivering a remarkable tea experience, the brand has decided to introduce its green tea range in response to positive customer feedback.

- April 2024: China has launched the One Country One Priority Product (OCOP) China Tea Program and the International Tea Day Campaign 2024, kicking off the event on April 12 in Dongguan, Guangdong province. The OCOP is a leading initiative by the Food and Agriculture Organization of the United Nations (FAO), aimed at helping countries highlight their distinctive agricultural products with unique attributes on international, regional, and local levels.

Tea Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Green Tea, Black Tea, Oolong Tea, Others |

| Packagings Covered | Plastic Containers, Loose Tea, Paper Boards, Aluminium Tin, Tea Bags, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | China, India, Kenya, Sri Lanka, Turkey, Vietnam, Others |

| Companies Covered | Associated British Foods plc, Barry's Tea, Bigelow Tea, Caraway Tea, Dilmah Ceylon Tea Company PLC, Harris Freeman, Ito En, Ltd., LIPTON Teas and Infusions, TAETEA Group Co., Ltd., Tata Consumer Products Limited (Tata Group), The Hain Celestial Group, Inc, The Republic of Tea, Unilever plc, Yorkshire Tea, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the tea market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global tea market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the tea industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Tea is prepared by steeping the leaves of the Camellia sinensis plant in hot water. It is one of the most widely consumed drinks globally and comes in various types, including black, green, white, and oolong, depending on how the leaves are processed. It is often associated with health benefits due to its antioxidants, vitamins, and minerals.

The tea market was valued at USD 26.7 Billion in 2025.

IMARC estimates the global tea market to exhibit a CAGR of 4.40% during 2026-2034.

The global tea market is driven by rising health consciousness, with consumers seeking antioxidant-rich beverages. Increasing demand for specialty teas like green and herbal varieties adds momentum. Expanding tea-based product innovations and the growing popularity of ready-to-drink options are also offering a favorable market outlook.

In 2025, black tea represented the largest segment by product type, driven by its bold flavor, high caffeine content, versatility in blends, and widespread popularity in both traditional and modern tea markets.

Paper boards lead the market by packaging owing to their eco-friendly, recyclable nature, excellent printability for branding, cost-effectiveness, and ability to preserve the freshness and aroma of tea effectively.

Supermarkets/hypermarkets are the leading segment by distribution channel due to their extensive product variety, convenient shopping experience, competitive pricing, and widespread presence, making them accessible to a large consumer base.

Residential is the leading segment by application attributed to the growing demand for tea as a daily beverage, its convenience for home consumption, and increasing preference for at-home tea preparation rituals.

On a regional level, the market has been classified into China, India, Kenya, Sri Lanka, Turkey, Vietnam, and others, wherein China currently dominates the global market.

Some of the major players in the global tea market include Associated British Foods plc, Barry's Tea, Bigelow Tea, Caraway Tea, Dilmah Ceylon Tea Company PLC, Harris Freeman, Ito En, Ltd., LIPTON Teas and Infusions, TAETEA Group Co., Ltd., Tata Consumer Products Limited (Tata Group), The Hain Celestial Group, Inc, The Republic of Tea, Unilever plc, Yorkshire Tea, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)