Telecom Cable Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Telecom Cable Market Size and Share:

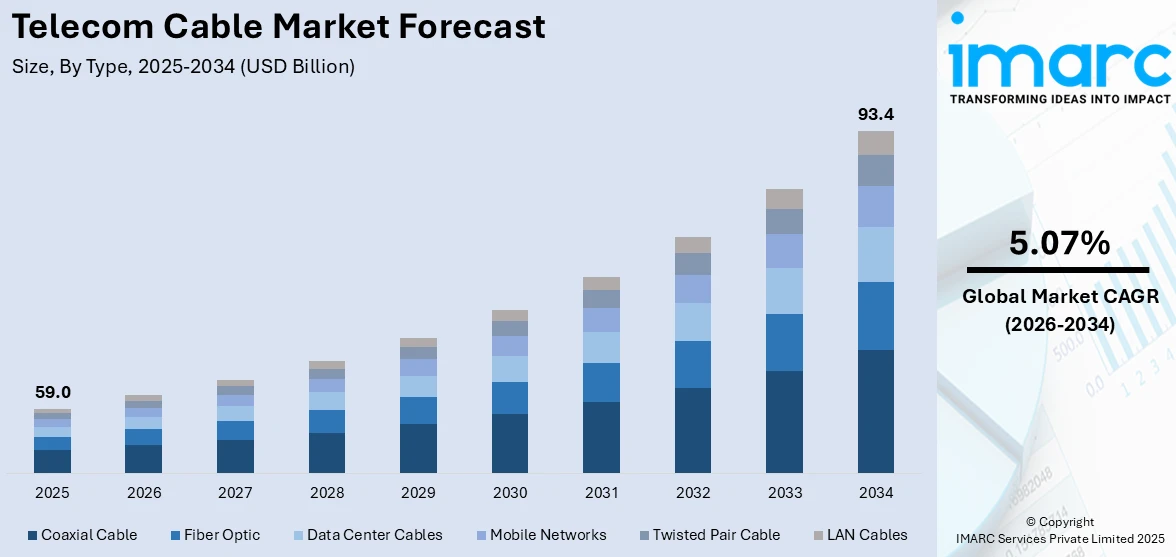

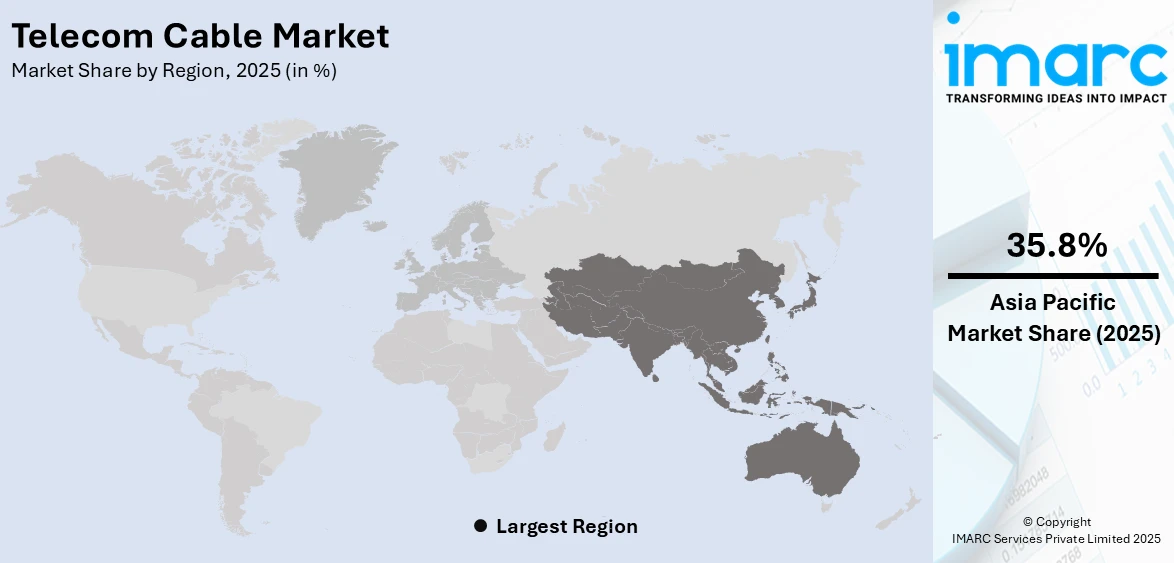

The global telecom cable market size was valued at USD 59.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 93.4 Billion by 2034, exhibiting a CAGR of 5.07% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of 35.8% in 2025. The market is driven by several key factors, including the rising demand for high-speed and reliable connectivity to support modern communication needs. The growing use of smart devices and the Internet of Things (IoT) requires robust infrastructure to handle increased data flow. Additionally, the rapid expansion of the telecommunications industry and widespread adoption of cloud computing services are pushing providers to upgrade and expand their cable networks, ensuring faster, more efficient, and scalable data transmission across diverse applications thus surging the global telecom cable market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 59.0 Billion |

|

Market Forecast in 2034

|

USD 93.4 Billion |

| Market Growth Rate 2026-2034 | 5.07% |

One of the major drivers in the telecom cable industry is the rising demand across the world for broadband internet connectivity. With accelerating digitalization, more remote working, e-learning, and growth in streaming services, individuals and businesses need higher speeds and more secure data transfer. This demand has resulted in a strong demand for the installation of fiber optic cables, providing greater bandwidth and lower latency over conventional copper cables. Governments and private industries are making significant investments in broadband infrastructure to close the digital divide, especially in developing parts of the world, further increasing demand for cutting-edge telecom cabling solutions.

To get more information on this market Request Sample

The U.S telecom cable market is transforming at a fast pace because of rising demand for high-speed and high-reliability connectivity networks with a market size of 87.80%. The demand for end-to-end national digital connectivity, rural broadband growth, and fifth generation (5G) deployment is spurring infrastructure growth at the large-scale level. Telecom operators are putting huge investment in next-generation cabling technologies, especially fiber optics, for backing rising data usage and new technologies such as IoT and smart cities. Government incentives and private sector innovation are colliding to upgrade the country's telecommunications infrastructure. In spite of difficulties such as regulatory issues and the expense of installing, the market continues to expand due to the nation's transition towards a digital-first economy.

Telecom Cable Market Trends:

5G-Driven Fiber Expansion

The deployment of 5G technology is having a profound impact on the telecom cable industry. In order to accommodate increased data speeds and reduced latency, telecom operators are adding fiber-optic cables to their networks, providing improved bandwidth and performance. In contrast to earlier wireless generations, 5G necessitates a high-density network of connections, driving demand for high-capacity, high-quality fiber infrastructure. Telecommunications companies are building out their cable infrastructures to support this transition, particularly in urban areas and high-density regions. The trend also enables wider ambitions such as smart cities and the internet of things. As mobile networks get faster, strong cabling becomes necessary to support greater amounts and speeds of data transmission, leading to fiber deployment being a cornerstone element of 5G infrastructure.

Sustainability & Smart Cable Innovation

Telecom cable market trends reflect a dynamic shift driven by environmental concerns and the move toward intelligent infrastructure. With the telecommunications and ICT sectors contributing approximately 1.43% of global carbon emissions, about 61% of operators are now committed to science-based targets aimed at significantly reducing emissions by 2030. In response, manufacturers are focusing on eco-friendly materials and energy-efficient production processes to lower environmental impact without compromising cable performance or durability. Simultaneously, the industry is advancing the development of “smart cables” equipped with embedded sensors that monitor conditions like temperature, stress, or wear. These capabilities enable real-time diagnostics, proactive maintenance, and improved system reliability. This integration of sustainability and intelligence signals a broader industry shift toward greener, more adaptive telecom networks. As global data demands grow, such forward-looking innovations help reduce long-term operational costs while supporting environmental goals and network resilience.

Long-Haul & Submarine Cable Expansion

Global communication relies extensively on long-distance and submarine telecom cables, which form the backbone of international data transmission by connecting continents beneath oceans and across vast regions. With over 500 active and planned submarine cable systems stretching more than 1.7 million kilometers globally, infrastructure investment in this sector is accelerating. The surge in digital activity—driven by cloud computing, data centers, video streaming, and online platforms—continues to push demand for high-capacity, low-latency cables. Telecom providers and technology firms are investing heavily in expanding long-haul and undersea networks to meet future data needs. These systems must be secure, resilient, and designed for long-term reliability. Innovations in cable design and materials are also enhancing durability and bandwidth performance. This global effort to improve connectivity infrastructure supports a more digitally connected world, enabling seamless international communication, economic growth, and technological advancement across all regions is bolstering the telecom cable market growth.

Telecom Cable Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Telecom cable market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, and application.

Analysis by Type:

- Coaxial Cable

- Fiber Optic

- Data Center Cables

- Mobile Networks

- Twisted Pair Cable

- LAN Cables

Fiber Optic account for the majority of shares of 57.3% driven by their superior speed, bandwidth capacity, and long-distance transmission capabilities. This dominance is driven by the growing demand for high-speed internet, the rapid expansion of 5G networks, and the increasing reliance on cloud computing and data centers. Unlike traditional copper cables, fiber optics offer lower latency and higher reliability, making them ideal for modern communication needs. The surge in digital services, video streaming, and smart device connectivity further accelerates fiber optic adoption. Governments and telecom providers are prioritizing fiber-based infrastructure to ensure scalable and future-ready networks, reinforcing fiber optics as the preferred choice for both core and last-mile telecommunications applications globally.

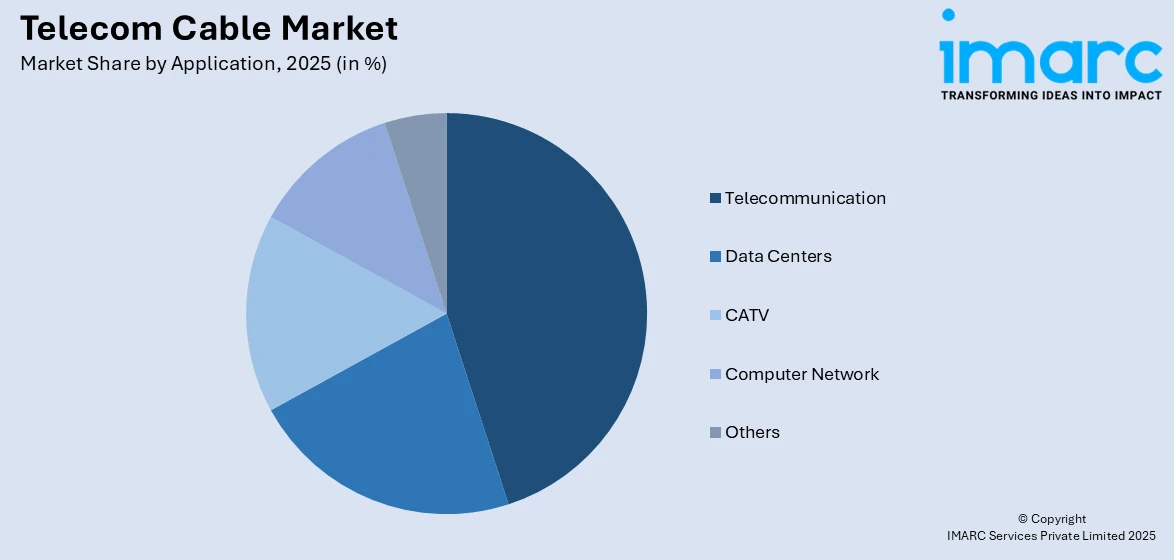

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Telecommunication

- Data Centers

- CATV

- Computer Network

- Others

Based in the telecom cable market forecast, the telecommunication dominate the market growth with a market share of 45.2% due to the rapidly growing need for high-speed, reliable connectivity across consumer and enterprise sectors. This dominance is driven by the expansion of mobile networks, 5G deployments, and rising internet usage worldwide. Telecom service providers are continually upgrading infrastructure with advanced fiber optic and coaxial cables to handle increasing data traffic, improve signal quality, and support digital services. The widespread adoption of smartphones, video streaming, cloud platforms, and IoT devices further amplifies demand for efficient communication networks. Additionally, government initiatives promoting digital inclusion and broadband access reinforce the sector's growth, making telecommunication the primary application area fueling ongoing cable market expansion.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the telecom cable market analysis, the Asia-Pacific leads the market with a significant 35.8% share due to rapid urbanization, large-scale infrastructure development, and strong government support for digital transformation. The region is witnessing massive investments in 5G networks, smart city projects, and broadband connectivity, especially in countries like China, India, South Korea, and Japan. Rising demand for high-speed internet, cloud computing, and IoT adoption is fueling the need for robust telecom infrastructure, including fiber optic and submarine cables. Additionally, a large and growing population with increasing smartphone and internet penetration contributes to the surge in data consumption. Local manufacturing capabilities and public-private partnerships further enhance the region’s position as a global hub for telecom cabling solutions, driving sustained market growth and innovation.

Key Regional Takeaways:

North America Telecom Cable Market Analysis

North America's telecom cable industry is growing steadily, driven by technological innovation and rising demand for high-speed connectivity. The region is actively increasing fiber-optic and coaxial cable plant to accommodate changing digital requirements such as 5G rollout, broadband internet, and data center growth. Government initiatives in the United States and Canada are taking on a leading role in filling the digital divide, particularly in remote rural communities. Telecom operators are spending big on next-gen cabling solutions for enhanced network performance, reliability, and capacity. Increasing attention is also being paid to environmentally friendly and smart cabling systems, with makers innovating smart cable technologies that support real-time monitoring and pre-emptive maintenance. Cloud computing, streaming services, and IoT devices continue to put more pressure on network infrastructure, with constant upgrading being the result. With both public and private sectors collaborating to digitize infrastructure, North America continues to be a prominent region within the global telecom cable market, where innovation is joined by extensive implementation.

United States Telecom Cable Market Analysis

The North American telecom cable market is primarily driven by the rapid deployment of 5G networks, which require advanced cabling infrastructure to support enhanced bandwidth and low latency. This trend is accompanied by increased investments in fiber optic networks, addressing the growing demand for high-speed internet across both urban and rural areas. According to the Fiber Broadband Association, USD 650 million has been invested and 5,600 jobs created in U.S. fiber manufacturing, fueled by the NTIA BEAD program and Build America, Buy America compliance, which aims to bolster domestic production and foster economic growth. The expansion of government initiatives aimed at modernizing digital infrastructure is further fueling market development. At the same time, the growing reliance on data-intensive applications such as video streaming and cloud computing is driving increased demand for telecom cables. Ongoing advancements in cable technology, including enhancements in durability and capacity, are improving network efficiency and extending cable lifespan. Furthermore, the rise of smart cities and the Internet of Things (IoT) is driving the need for resilient, scalable cabling solutions. Additionally, the increasing focus on cybersecurity and secure cabling systems is also influencing market trends.

Europe Telecom Cable Market Analysis

The telecom cable market in Europe is experiencing growth due to the rapid deployment of 5G infrastructure, which demands advanced cabling solutions for improved connectivity. In line with this, stringent regulations aimed at reducing carbon emissions are driving the adoption of energy-efficient cable technologies. Similarly, increasing investments in smart city developments and IoT applications are further contributing to market expansion. The rising demand for data centers to support cloud and edge computing is strengthening market potential. Furthermore, the growing emphasis on cybersecurity and network reliability is accelerating the use of high-quality, resilient cables. A recent industry study found that 40% of European organizations experienced cybersecurity incidents in the past year, with 84% reporting an increase in the frequency of such incidents. Additionally, 64% of business leaders anticipate future incidents, yet only 29% feel well-prepared to defend against them. The expansion of fiber-to-the-home (FTTH) initiatives is enhancing broadband accessibility across urban and rural areas. Moreover, the ongoing modernization of legacy telecommunication networks towards all-IP architecture is fueling infrastructure upgrades. Besides this, the rapid integration of renewable energy sources is creating demand for specialized telecom cables in smart grid communications, thereby supporting sustained market growth.

Asia Pacific Telecom Cable Market Analysis

The Asia-Pacific telecom cable market is primarily driven by the rapid rollout of 5G networks, which require advanced cabling infrastructure to support high bandwidth and low latency. In line with this, substantial investments in fiber optic networks are being made to meet the increasing demand for high-speed internet across both urban and rural regions. The expansion of 5G technology in countries such as China, India, Japan, and South Korea is propelling market growth. Since its launch in October 2022, 5G services have been rolled out in all States/ UTs across India and presently it is available in 99.6% of the districts in the country. Moreover, government initiatives aimed at digital infrastructure modernization, such as the Digital India program, are driving further investments in telecom cables. The growing reliance on data-intensive applications, including video streaming, cloud computing, and online gaming, is further fueling demand for telecom cables. Technological advancements in cable materials and design, such as improved durability, capacity, and efficiency, are enhancing network performance and longevity. Additionally, the rise of smart cities and the widespread adoption of Internet of Things (IoT) devices is increasing the demand for scalable and resilient cabling solutions across the region. Furthermore, the growing emphasis on cybersecurity is influencing the demand for secure telecom cable systems, adding another layer to market dynamics in Asia-Pacific.

Latin America Telecom Cable Market Analysis

In Latin America, the telecom cable market is expanding due to increasing investments in digital infrastructure aimed at closing connectivity gaps between urban and rural areas. Brazil invested BRL 186.6 Billion to drive digital transformation in its industrial sector, aiming to digitize 25% of industrial companies by 2026 and increase this to 50% by 2033, according to a report from the industry. Similarly, favorable government initiatives aimed at expanding broadband access and enhancing network reliability are significantly driving market growth. The rising demand for high-speed internet services, driven by the increased adoption of cloud computing and digital entertainment, is further accelerating the market appeal. Moreover, ongoing efforts to upgrade legacy telecom networks to support 5G technology are stimulating the need for advanced telecom cable solutions across the region.

Middle East and Africa Telecom Cable Market Analysis

The market in the Middle East and Africa is significantly influenced by the region's ambitious smart city initiatives, which necessitate advanced digital infrastructure and high-capacity telecom networks. Furthermore, the rapid development of undersea cable projects, which enhances regional and global data exchange, is impelling the market. The increasing investment in 5G deployment by both governments and private operators is accelerating network modernization and bandwidth demand. Besides this, the expanding digital finance and fintech ecosystem across Africa and the Gulf region is driving the need for secure, high-speed communication networks to support financial inclusion and digital transactions. Industry analysis revealed that Middle East fintech funding reached a peak in 2023, with fintech startups raising an impressive USD 4.2 Billion. This milestone highlights the region’s increasing importance as a hub for financial innovation and technology-driven investment.

Competitive Landscape:

The market for telecom cables has a highly dynamic and fragmented competitive environment where many players fight for market share through innovation, pricing, and geographic reach. Firms compete by providing cutting-edge cable technologies such as fiber optics and hybrid solutions to serve increased demand for faster and more secure communication. The emphasis is on creating robust, high-capacity cables to enable next-generation networks like 5G and smart infrastructure. High competition also fuels investment in green materials and smart cable technology. Moreover, companies also look for strategic partnerships and infrastructure ventures to consolidate their market. The rapid pace of the industry fosters ongoing product innovation and improvement of efficiency in order to keep up with changing technological requirements and consumer demands in both metropolitan and rural areas.

The report provides a comprehensive analysis of the competitive landscape in the telecom cable market with detailed profiles of all major companies, including:

- Belden Incorporated

- Commscope Holding Company Inc.

- Fujikura Ltd.

- Furukawa Electric Co. Ltd.

- Hengtong Group Co. Ltd.

- LS Cable & System Ltd. (LS Group)

- Nexans S.A.

- Proterial Cable America Inc.

- Prysmian S.p.A.

- Sumitomo Electric Industries Ltd.

Latest News and Developments:

- June 2025: LS Cable India launched 400 kV EHV and HTLS solutions to support India’s growing power and telecom infrastructure. With a focus on underground cabling, 5G, and future 6G networks, the company is expanding its product line and R&D to meet evolving market demands and urban development needs.

- May 2025: Emtelle and CommScope announced a collaboration to launch a North American-first solution combining Emtelle’s REVOLink3 blowable fiber cable with CommScope’s Prodigy hardened connectivity. This innovative partnership enables faster, cost-effective FTTH installations with improved interoperability, reduced visual impact, and simplified deployment across diverse network environments.

- April 2025: Pasternack launched its first line of fiber optic cable assemblies, offering simplex and duplex options with LC, SC, ST, and FC connectors. Designed for telecom, data centers, and aerospace, the products support same-day shipping, with multifiber and advanced configurations planned for later in the year.

- February 2025: China Telecom announced the early completion of the Asia Direct Cable (ADC) project, two months ahead of schedule. Spanning 10,000 km and delivering over 160 Tbps capacity, the submarine cable boosts Asia-Pacific connectivity, supporting cloud computing, big data, and regional digital transformation across six key countries.

- January 2025: Finolex Cables launched 'FinoUltra', a high-performance wired product for the domestic market. Designed for speed, reliability, and aesthetics, it supports seamless home connectivity. Built for modern homes, FinoUltra offers robust performance for streaming, browsing, and video calls with a sleek, durable design.

- October 2024: AFL launched the Apex X-1, a compact fiber optic splice closure designed for small networks and rural FTTx deployments. Supporting up to 864 SpiderWeb Ribbon fibers, the X-1 enhances installation efficiency, network reliability, and scalability, continuing AFL’s focus on high-density, user-friendly fiber management solutions.

- July 2024: ZTE and partners helped China Telecom launch the world's first live 1.2Tbit/s single-wavelength hollow-core fiber system. Achieving over 100Tbit/s unidirectional capacity across 20km, the system supports intelligent computing with ultra-fast, low-latency optical transport, marking a major advancement in high-capacity network infrastructure and R&D innovation.

Telecom Cable Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Coaxial Cable, Fiber Optic, Data Center Cables, Mobile Networks, Twisted Pair Cable, LAN Cables |

| Applications Covered | Telecommunication, Data Centers, CATV, Computer Network, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Belden Incorporated, Commscope Holding Company Inc., Fujikura Ltd., Furukawa Electric Co. Ltd., Hengtong Group Co. Ltd., LS Cable & System Ltd. (LS Group), Nexans S.A., Proterial Cable America Inc., Prysmian S.p.A., Sumitomo Electric Industries Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the telecom cable market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global telecom cable market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the telecom cable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telecom cable market was valued at USD 59.0 Billion in 2025.

The telecom cable market is projected to exhibit a CAGR of 5.07% during 2026-2034, reaching a value of USD 93.4 Billion by 2034.

Key factors driving the telecom cable market include rising demand for high-speed internet, rapid 5G deployment, increased data consumption, and the expansion of cloud computing and IoT. Government initiatives for digital infrastructure and growing reliance on fiber optic technology also significantly contribute to market growth and modernization.

Asia Pacific currently dominates the telecom cable market, accounting for a share of 35.8% driven by the rapid urbanization, expanding digital infrastructure, and strong government support for broadband and 5G deployment. High internet penetration, growing demand for smart technologies, and significant investments from both public and private sectors drive the region’s leadership in telecom cabling.

Some of the major players in the telecom cable market include Belden Incorporated, Commscope Holding Company Inc., Fujikura Ltd., Furukawa Electric Co. Ltd., Hengtong Group Co. Ltd., LS Cable & System Ltd. (LS Group), Nexans S.A., Proterial Cable America Inc., Prysmian S.p.A., Sumitomo Electric Industries Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)