Telecom Operations Management Market Size, Share, Trends and Forecast by Software Type, Service, Deployment Mode, and Region, 2025-2033

Telecom Operations Management Market Size and Share:

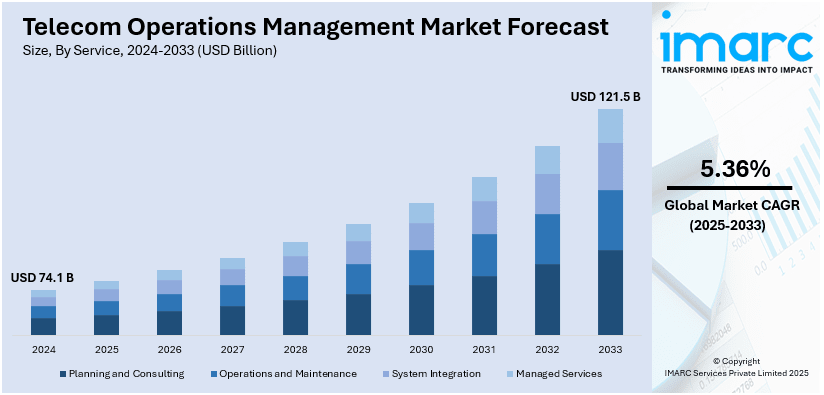

The global telecom operations management market size was valued at USD 74.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 121.5 Billion by 2033, exhibiting a CAGR of 5.36% from 2025-2033. North America currently dominates the market, holding a market share of over 33% in 2024. The telecom operations management market share is rising by increasing demand for streamlined network operations, rising adoption of cloud-based solutions, and growing need for efficient customer service management. Enhanced focus on reducing operational costs, advancements in telecom technologies like 5G, and the integration of AI and IoT further boost market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 74.1 Billion |

|

Market Forecast in 2033

|

USD 121.5 Billion |

| Market Growth Rate 2025-2033 | 5.36% |

The telecom operations management market growth is driven due to rapid digital transformation and increase the demand of advanced communication technologies. The rapid increase in global smartphone usage, along with the rollout of high-speed internet and 5G networks is contributing to market growth as more complex network infrastructures will need to be managed. The rising customer demand for improved customer experience and better billing systems also contribute to the market growth, including telecom providers looking for advanced solutions to optimize operations and reduce costs. Additionally, the rise of Internet of Things devices and cloud-based services has escalated the need for robust network management and data analytics tools.

The United States has emerged as a key regional market for telecom operations management market. Advanced telecom technologies including 5G and AI have boosted network complexity which requires advanced methods to run operations successfully. Telecom companies must invest in service assurance and network optimization tools as customers want better network quality while using their devices. Network reliability demands strong management systems as linked devices and data-driven apps produce more data which needs good handling methods. Regulatory requirements for digital transformation push all companies toward telecom solutions that help them operate better and save money.

Telecom Operations Management Market Trends:

Technological advancements

The growing need of telecom companies to effectively and timely address customer requirements in a highly competitive environment currently represents one of the key factors driving the market. Moreover, enhancement in new technologies, such as next-generation operations support systems, business support systems, service delivery platforms, and over-the-top (OTT) platforms, is propelling the growth of the market. The global over the top (OTT) market size reached USD 575.8 Billion in 2024. In addition, the increasing number of internet users is prompting communication service providers to offer advanced and innovative solutions. This, coupled with the escalating demand for low-cost data and voice services, is offering lucrative growth opportunities to industry investors. Moreoer, the rising adoption of telecom operations management on account of the improving infrastructure development of 5G networks is positively influencing the market. According to reports, the global adoption of 5G connections surged in 2023, reaching 1.76 Billion, an increase of 700 Million. Additionally, the rapid digitization of the telecommunication industry with the help of high-performing cloud platforms to engage their customers through data-driven experiences and enhanced operational efficiencies across core telecom systems is strengthening the growth of the market.

Digital transformation

The telecom operations management market is driven by the growing adoption of digital transformation across the telecom sector. With an increasing emphasis on enhancing customer experience, operational efficiency, and cost optimization, telecom operators are leveraging advanced technologies such as artificial intelligence (AI), machine learning (ML), and cloud computing to modernize their operations. These technologies enable better network management, predictive maintenance, and faster resolution of network issues, ensuring seamless service delivery. Moreover, the shift toward 5G technology demands advanced operational frameworks to handle complex infrastructure and large volumes of data, further boosting the need for efficient telecom operations management solutions. As per 5G Americas, North American 5G connections with 36% population penetration are estimated to reach 601 Million by the end of 2027; almost 100 Million per year. By enabling data-driven decision-making and proactive issue management, these solutions are becoming essential for telecom companies aiming to stay competitive in a rapidly evolving digital landscape.

Rising adoption of automation

Automation and AI are transforming telecom operations management by enabling efficient workflows, reducing operational costs, and enhancing service reliability. The ability to automate routine tasks like network monitoring, fault detection, and configuration management significantly reduces human error and downtime. AI-powered analytics provide deep insights into network performance, customer behavior, and potential operational risks, allowing telecom operators to take preemptive measures. The adoption of AI-driven chatbots and virtual assistants also helps improve customer support by delivering prompt and accurate solutions. Additionally, the increasing complexity of telecom networks, especially with the rollout of 5G, necessitates sophisticated automation tools to manage vast volumes of data and ensure optimal performance. As a result, automation and AI are driving the demand for innovative telecom operations management solutions that streamline processes and improve overall operational agility.

Telecom Operations Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global telecom operations management market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on software type, service, and deployment mode.

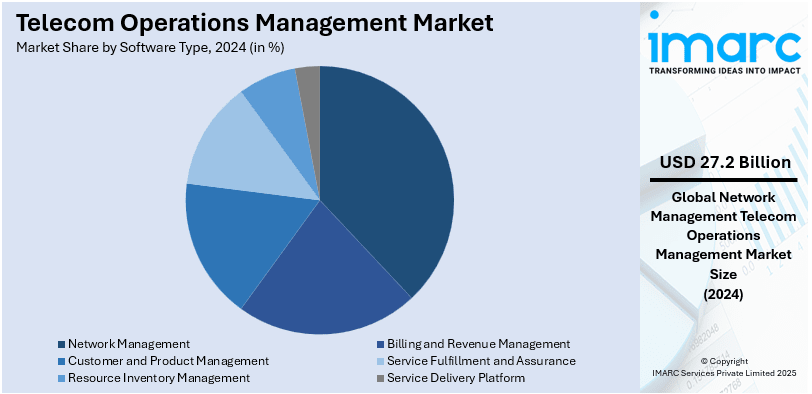

Analysis by Software Type:

- Billing and Revenue Management

- Customer and Product Management

- Service Fulfillment and Assurance

- Resource Inventory Management

- Network Management

- Service Delivery Platform

Network management stand as the largest segment, holding 36.7% od market share as it is essential for maintaining seamless communication services. It ensures the efficient operation, monitoring, and optimization of telecom networks, which are the backbone of service delivery. Besides, the growing adoption of advanced technologies like 5G, IoT, and cloud computing has significantly increased network complexity. Managing these intricate networks requires robust solutions, driving demand in this segment. Moreover, with the rise of cyber threats, network management systems incorporate advanced security features to protect against potential vulnerabilities, further boosting their importance.

Analysis by Service:

- Planning and Consulting

- Operations and Maintenance

- System Integration

- Managed Services

Planning and consulting lead the telecom operations management market due to substantial investment in planning services along. Telecom companies experience rising requirements for smooth connectivity and 5G network development and digital transition while needing planning services to direct their resource utilization properly toward new technology alignment. Planning and consulting services generate personalized pathway guidance which leads to economical deployment of sophisticated solutions. These solutions address crucial network optimization and compliance together with customer experience enhancement in order to help telecom companies stay competitive. These operations management services allow organizations to overcome their risks while exploiting data insights and operational future-proofing to establish their core role in telecom operations management.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based dominates the market due to their scalability, flexibility, and cost-efficiency. They enable telecom providers to manage complex operations, such as network monitoring, resource optimization, and customer support, with greater agility. Cloud platforms facilitate real-time data processing and analytics, empowering providers to make informed decisions and enhance service delivery. Additionally, they support seamless integration with emerging technologies like AI and IoT, driving innovation and operational efficiency. The pay-as-you-go model reduces capital expenditures, making them attractive for both large enterprises and smaller providers. Furthermore, cloud solutions ensure high availability, security, and remote accessibility, aligning with industry demands.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the market with 33% share due to its advanced telecommunications infrastructure, widespread adoption of cutting-edge technologies, and strong presence of leading market players. The region's high demand for efficient telecom services drives investments in operations management solutions to enhance network performance, reduce operational costs, and improve customer experiences. Moreover, the rapid adoption of 5G technology and increasing data traffic necessitate robust management systems. North America's regulatory framework encourages innovation and competitiveness, further boosting market growth. Additionally, enterprises' growing focus on digital transformation and automation in telecom operations solidifies the region's leadership in this market segment.

Key Regional Takeaways:

United States Telecom Operations Management Market Analysis

The U.S. telecom operations management market is significantly influenced by the country’s position as a hub for technological innovation, particularly in AI and automation. According to reports, the U.S. has been the breeding ground for the majority of AI startups, with 4,633 startups established between 2013 and 2022. In 2022 alone, 524 AI startups were founded, attracting USD 47 Billion in non-governmental funding. This robust growth in AI innovation is driving the demand for advanced, AI-driven telecom operations management solutions to optimize network performance, improve customer experiences, and reduce operational costs. Telecom operators in the U.S. are leveraging AI and machine learning technologies to manage the increasing complexities of modern telecom networks, particularly with the rise of 5G and IoT devices. Furthermore, the demand for seamless and high-quality service delivery is pushing telecom companies to invest in automation to improve efficiency and scalability. With regulatory frameworks also becoming more stringent, operators are adopting advanced network management solutions to ensure compliance and enhance security. The competitive landscape, combined with the rapid pace of technological advancements, is expected to continue driving innovation and investments in telecom operations management across the U.S.

Asia Pacific Telecom Operations Management Market Analysis

The Asia-Pacific (APAC) telecom operations management market is driven by rapid advancements in 5G adoption, which are reshaping the telecom landscape. According to GSMA, South Korea reached 31.3 Million 5G connections, representing more than 48% of all mobile connections in the country. Meanwhile, China has over 700 Million 5G connections, accounting for 41% of total mobile connections. This widespread 5G rollout is creating demand for advanced operations management systems to ensure optimal network performance and support high-speed, low-latency services. As countries like Japan, India, and South Korea continue to expand 5G infrastructure, telecom operators are increasingly adopting AI, machine learning, and automation tools to manage growing network complexities. The rising demand for digital services, coupled with the need for efficient network management, is further driving investments in telecom operations management solutions. The APAC region’s growing mobile penetration and digitalization efforts position it as a key market for telecom operations management technologies.

Europe Telecom Operations Management Market Analysis

The telecom operations management market in Europe is experiencing significant growth, driven by the rollout of 5G networks and the increasing adoption of digital technologies. In line with these trends, according to reports, 29% of EU enterprises were using Internet of Things (IoT) devices in 2021, primarily for securing their premises. This growing reliance on IoT is increasing the demand for robust telecom infrastructure and advanced network management solutions. As businesses across Europe digitize their operations, telecom operators are investing heavily in modernizing their networks to support IoT applications, smart cities, and other digital services. The rise of IoT, coupled with the adoption of AI and automation technologies, is driving operators to implement intelligent operations management systems to optimize network performance, improve service delivery, and reduce costs. Furthermore, regulatory pressures in Europe, such as data protection and cybersecurity laws, are encouraging telecom providers to enhance their network management capabilities to ensure compliance. With the growing competition among telecom operators in the region, investing in advanced operations management solutions has become crucial for maintaining a competitive edge and delivering differentiated services to consumers. As digital transformation accelerates, the demand for efficient and scalable telecom operations management solutions will continue to rise across Europe.

Latin America Telecom Operations Management Market Analysis

Latin America is experiencing one of the fastest-growing mobile markets globally. According to MGR, the region had 326 Million mobile internet users in 2018, and this figure is projected to rise to 422 Million by 2025. The growing mobile penetration, combined with the increasing demand for digital services and improved network infrastructure, is significantly driving the telecom operations management market. As mobile internet users expand across the region, telecom providers are investing in advanced technologies to meet this growing demand for reliable, high-speed connectivity, further accelerating the need for efficient network management solutions.

Middle East and Africa Telecom Operations Management Market Analysis

The Middle East and Africa (MEA) telecom operations management market is experiencing significant growth, particularly due to the expansion of 5G networks. Saudi Arabia leads the region in 5G adoption, with over 11.2 Million 5G subscriptions by the end of 2022, accounting for more than a quarter of the total mobile sector, according to industry reports. This surge in 5G users is driving the demand for advanced telecom management solutions to ensure optimal network performance, improve service delivery, and manage the growing complexities of 5G infrastructure. As digital services expand, telecom operators across the region are investing in cutting-edge operations management technologies.

Competitive Landscape:

Key players in the telecom operations management market are adopting various strategies to strengthen their position and maintain competitiveness. Leading companies are focusing on technological innovation, particularly by integrating AI, machine learning, and automation into their operations management solutions. These advancements enhance network efficiency, reduce operational costs, and improve service delivery, making telecom companies more agile and responsive to customer needs. Additionally, partnerships and collaborations with other technology providers are common. By teaming up with cloud service providers or AI specialists, these players gain access to new capabilities and expand their service offerings. Some are also acquiring smaller, innovative firms to bolster their product portfolios and improve customer service tools.

The report provides a comprehensive analysis of the competitive landscape in the telecom operations management market with detailed profiles of all major companies, including:

- Accenture plc

- Amdocs

- Cisco Systems Inc.

- Comarch SA

- Hewlett Packard Enterprise Company

- Huawei Technologies Co. Ltd.

- International Business Machines Corporation

- NEC Corporation (AT&T Inc.)

- Nokia Corporation

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Telefonaktiebolaget LM Ericsson

Latest News and Developments:

- January 2025: Moolah Wireless has launched Telecom Business Connect, a SaaS platform designed to streamline telecom operations for Mobile Virtual Network Operators (MVNOs). The platform provides tools for customer management, distributor coordination, inventory control, and compliance reporting, with integrations into Tier 1 providers to enhance operational efficiency.

- October 2024: ServiceNow Solutions is helping telecom operators address growing demands driven by 5G and IoT advancements. With mobile data traffic projected to rise 47% annually, the need for improved operational efficiency and security is crucial, as highlighted by a recent Verizon outage. ServiceNow automates supply chain operations, centralizes vendor management, and strengthens security with SecOps capabilities.

- September 2024: Dell Technologies has launched the AI for Telecom program to accelerate AI adoption in telecom operations, in partnership with NVIDIA and global operators. The initiative aims to simplify AI deployments for communications service providers (CSPs) and improve network performance, customer service, and edge computing capabilities.

- June 2024: Wavelo has launched a flexible, system-agnostic Product Catalog designed to streamline telecom operations for Communication Service Providers (CSPs). The catalog allows for quick integration and updates, helping CSPs adapt to market demands and improve customer experience. The new catalog enables CSPs to offer tailored plans and services, enhancing service delivery and network potential.

- March 2024: Netcracker Technology has been ranked highest in Telco Republic’s Disruptor Quintant for Next-Generation Telecom Operations and Business Support Systems, recognized for its innovation and success in global digital transformation projects. Its multi-domain strategy across 5G, fiber, and satellite networks, along with support for cloud deployments and a cloud-native BSS/OSS platform, contributed to the top ranking. The recognition highlights Netcracker’s strong position to support telecom transformations and future success in the evolving industry.

Telecom Operations Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Software Types Covered | Billing and Revenue Management, Customer and Product Management, Service Fulfillment and Assurance, Resource Inventory Management, Network Management, Service Delivery Platform |

| Services Covered | Planning and Consulting, Operations and Maintenance, System Integration, Managed Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Amdocs, Cisco Systems Inc., Comarch SA, Hewlett Packard Enterprise Company, Huawei Technologies Co. Ltd., International Business Machines Corporation, NEC Corporation (AT&T Inc.), Nokia Corporation, Oracle Corporation, SAP SE, Tata Consultancy Services Limited and Telefonaktiebolaget LM Ericsson., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the telecom operations management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global telecom operations management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the telecom operations management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telecom operations management market was valued at USD 74.1 Billion in 2024.

The telecom operations management market is estimated to exhibit a CAGR of 5.36% during 2025-2033.

The telecom operations management market share is rising by increasing demand for streamlined network operations, rising adoption of cloud-based solutions, and growing need for efficient customer service management. Enhanced focus on reducing operational costs, advancements in telecom technologies like 5G, and the integration of AI and IoT further boost market growth.

North America currently dominates the market due to its advanced telecommunications infrastructure and widespread adoption of cutting-edge technologies.

Some of the major players in the telecom operations management market include Accenture plc, Amdocs, Cisco Systems Inc., Comarch SA, Hewlett Packard Enterprise Company, Huawei Technologies Co. Ltd., International Business Machines Corporation, NEC Corporation (AT&T Inc.), Nokia Corporation, Oracle Corporation, SAP SE, Tata Consultancy Services Limited, Telefonaktiebolaget LM Ericsson, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)