Telecom Order Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Network Type, and Region, 2026-2034

Telecom Order Management Market Size and Share:

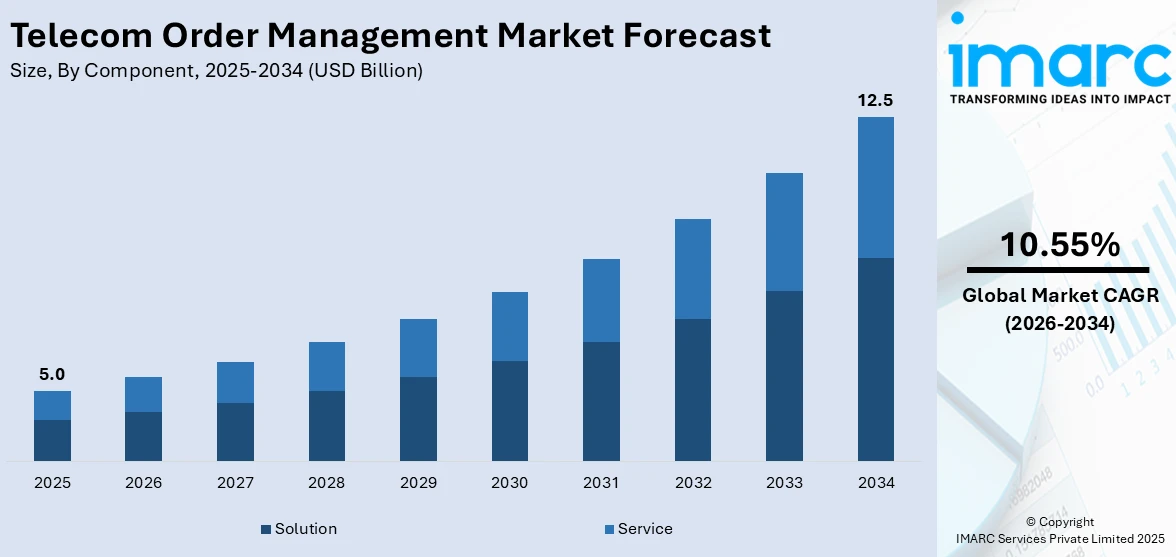

The global telecom order management market size was valued at USD 5.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 12.5 Billion by 2034, exhibiting a CAGR of 10.55% from 2026-2034. North America currently dominates the market, holding a market share of 37.6% in 2025. At present, telecom providers are working to enhance customer experience through enhanced order management processes. Furthermore, the increasing integration of new technologies, specifically the 5G network rollout, to deal with the growing complexity and volume of orders is bolstering the market growth. Apart from this, the heightened shift towards cloud-based order management systems to improve flexibility, scalability, and cost-effectiveness is expanding the telecom order management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.0 Billion |

|

Market Forecast in 2034

|

USD 12.5 Billion |

| Market Growth Rate 2026-2034 | 10.55% |

As businesses use cutting-edge technologies to streamline their operations, the telecom order management sector is currently seeing rapid expansion. The market is changing as a result of the integration of automation and artificial intelligence (AI), which enables telecom carriers to handle consumer requests more accurately and efficiently. Businesses are placing a strong emphasis on improving customer experiences by cutting down on order processing times and increasing the assurance of service delivery. In order to increase the scalability and flexibility of their order management systems, telecom service providers are implementing cloud-based solutions. They can now handle more consumer inquiries and transactions without compromising efficiency thanks to these technologies.

To get more information on this market Request Sample

The United States telecom order management market is experiencing rapid development as service providers are now investing more in digital transformation programs. Order management processes of telecom companies are embracing leading-edge technologies such as artificial intelligence (AI) and computerization to maximize operational efficiency. This transition is optimizing operational efficiency, minimizing errors, and streamlining the overall customer experience. Providers are concentrating on order processing automation and service provisioning to manage increasing customer requirements for quicker and more precise service delivery. Cloud-based order management solutions are gaining traction in the US as they provide scalability, flexibility, and cost savings. Telecom operators are adopting cloud-based solutions to efficiently manage high volumes of orders and improve processes across channels. The IMARC Group predicts that the US cloud managed services market size is expected to exhibit a growth rate (CAGR) of 10.55%.

Telecom Order Management Market Trends:

Integration with Emerging Technologies

Telecom operators are looking to merge their order management solutions with new technologies, specifically the 5G network rollout, to deal with the growing complexity and volume of orders. With 5G networks continuing to roll out, telecom providers need to support high-demand services that need more sophisticated, dynamic order management capabilities. The embedding of 5G technology into order management systems is allowing telecom operators to provide quicker speeds, lower latency, and more stable connectivity, which are essential for enabling new applications, including Internet of Things (IoT) devices, connected vehicles, and smart cities. Telecom companies are modifying their order management systems to support the high-volume, low-latency characteristics of 5G services so that they can provision new services efficiently and quickly. In addition, the roll-out of 5G is creating more intricate service packages, which need advanced order management solutions to monitor and manage multiple services per order, thereby offering a favorable telecom order management market outlook. With the integration of 5G features into their order management systems, telecommunication providers are improving their capacity to offer next-generation services while ensuring operational efficiency. With 5G's ongoing development and catalyst effect on demand for new telecom services, the requirement for sophisticated, flexible order management solutions is increasing. The IMARC Group predicts that the global 5G infrastructure market size will reach USD 358.85 Billion by 2033.

Growing Need for Better Customer Experience

Telecom providers are working to enhance customer experience through enhanced order management processes. With customer expectations for quicker and more precise service deliveries constantly going up, telecom providers are compensating by introducing sophisticated order management systems. These systems are being empowered with automation and artificial intelligence (AI) to minimize the processing time for orders and improve accuracy. With automated order entry, approval, and provisioning, telecom operators are reducing the threat of human error, improving response times, and offering seamless customer experience. As businesses continue to invest in technology for improving customer satisfaction, the demand for sophisticated order management systems continues to grow, making them an integral part of telecom service strategies. In 2024, Itential, a frontrunner in hybrid cloud network infrastructure automation and orchestration software, revealed at Knowledge 2024 a complete solution that integrates ServiceNow's Sales and Order Management for Telecom products with Itential’s network orchestration and integration platform, enabling Communications Service Providers (CSP) to speed up their market introduction and launch new, innovative services. In the ServiceNow Store, the Itential for OMT application offers an efficient solution that links ServiceNow to your network infrastructure, enabling orchestrated fulfillment for managing service orders.

Adoption of Cloud-Based Solutions

Telecom operators are quickly shifting towards cloud-based order management systems to improve flexibility, scalability, and cost-effectiveness in managing their businesses, thereby contributing to the telecom order management market growth. Through the use of cloud technology, businesses are deriving the capacity to scale their order management systems based on demand without being constrained by legacy on-premise infrastructure. In 2025, Dell Technologies launched the Open Telecom Transformation Program to increase the network cloud transformation for CSPs. Telecom businesses are offered by cloud solutions the capacity to handle high levels of customer orders effectively, even during periods of high demand. Such systems also provide more streamlined integration with other enterprise systems, including billing, customer relationship management (CRM), and inventory management, and this assists in developing an integrated ecosystem for improved data sharing and decision-making. Also, cloud-based order management systems enable telecom operators to obtain real-time updates and analytics so that monitoring of order progress becomes simpler and possible issues can be resolved before they affect service delivery.

Telecom Order Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global telecom order management market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, deployment mode, organization size, and network type.

Analysis by Component:

- Solution

- Customer Order Management

- Service Order Management

- Service Inventory Management

- Service

- Integration and Installation Services

- Consulting Services

- Support Services

Solution stands as the largest component in 2025, holding 65.8% of the market. It constitutes several subcategories like service order management, customer order management, and service inventory management. Customer order management deals with handling and processing customer orders from the inquiry stage to service delivery to ensure smooth order fulfillment and customer satisfaction. Service order management is meant to manage the complexity of service provision, involving processing service-specific orders such as broadband or 5G connections, to ensure that each service is rolled out in an optimal way. It entails controlling the network infrastructure and service assets, ensuring that hardware, software, and network elements necessary to complete customer orders are in place. These solutions are vital for telecom operators to optimize operational performance, minimize errors, and streamline service delivery across touchpoints.

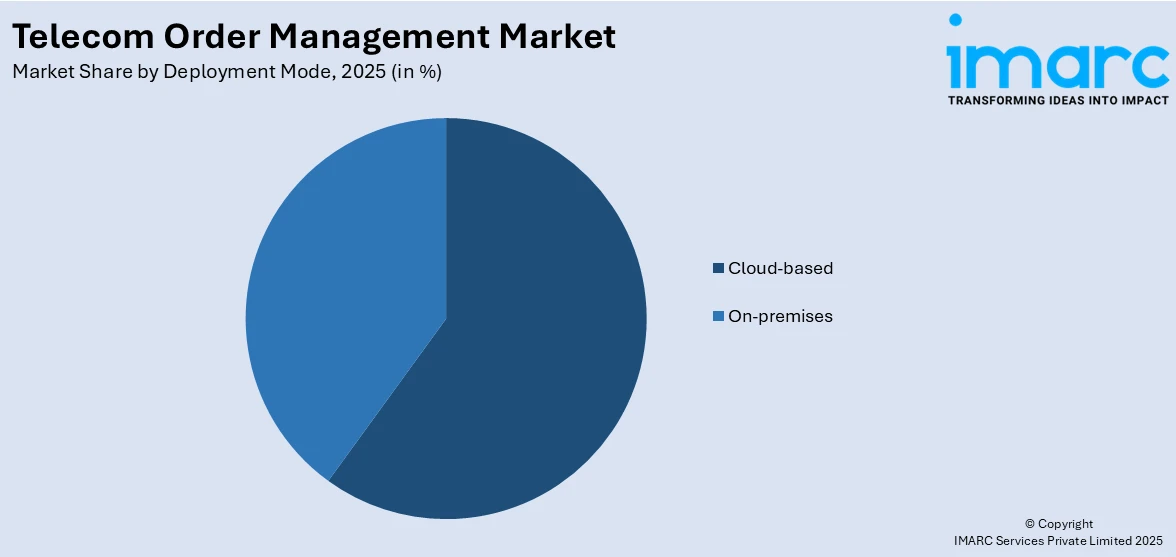

Analysis by Deployment Mode:

Access the comprehensive market breakdown Request Sample

- On-premises

- Cloud-based

Cloud-based stands as the largest component in 2025. It refers to utilizing cloud infrastructure to host and manage order management systems. With this model, telecom companies can access their order management systems through the Internet, removing the need for on-premises hardware and reducing the burden of system maintenance. Cloud-based solutions offer greater tractability, scalability, and cost-efficiency, allowing businesses to easily scale up or down based on demand without the requirement for significant upfront investments in information technology (IT) infrastructure. These systems are typically managed and maintained by service providers, ensuring the latest software updates and security features. Cloud-based solutions are becoming increasingly popular among telecom companies seeking to enhance operational efficiency, streamline updates, and provide remote accessibility for distributed teams.

Analysis by Organization Size:

- Large Organization

- Small and Medium Organization

Large organization leads the market with 73.8% of market share in 2025. It refers to established telecom companies with substantial resources, extensive customer bases, and complex operational requirements. It typically has large-scale networks, multiple service offerings, and numerous customer touchpoints that necessitate advanced order management systems to handle high volumes of transactions efficiently. It often prioritizes customization, integration, and scalability in their order management solutions for catering to diverse business needs across regions and departments. Due to the size, large organization also requires robust security measures, data governance, and compliance with industry regulations. With significant IT resources, large organization is more likely to adopt on-premises solutions or hybrid deployment models, although it is also embracing cloud-based solutions to improve flexibility, reduce costs, and enhance customer service.

Analysis by Network Type:

- Wireless

- Wired

Wired leads the market in 2025 as they are designed for managing orders in telecom companies that rely on traditional wired infrastructure, such as fiber-optic, coaxial cable, or DSL networks. These networks are typically used to provide services like broadband internet, landline telephony, and cable television. Telecom companies leveraging wired networks often need robust order management systems to handle the provisioning, installation, and maintenance of services, ensuring smooth customer experiences and efficient service delivery. As wired networks tend to have more stable and predictable performance compared to wireless networks, telecom providers can optimize their order management processes to deliver reliable and consistent service to customers. However, with the ongoing transition to next-generation technologies like 5G and the growing demand for wireless services, companies still relying on wired infrastructure must integrate their order management systems with emerging technologies to remain competitive. Efficient management of service orders, from customer acquisition to installation and troubleshooting, is crucial for maintaining operational efficiency and meeting customer expectations in the wired network segment.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of 37.6%. The industry is witnessing considerable growth currently as telecom service providers are rapidly embracing sophisticated technologies to enhance operational effectiveness. Firms are actively incorporating machine learning (ML) and artificial intelligence (AI) in their order management systems to streamline processes and improve precision. This phenomenon is helping telecom service providers minimize manual errors, accelerate order processing time, and deliver a better customer experience. AI is also utilized to forecast customer needs and streamline service delivery. Cloud solutions are gaining traction in North America, as telecommunication operators move from traditional on-premises models. Cloud technologies are also offering more scalability and flexibility, enabling service providers to handle high volumes of customer orders more efficiently. With cloud-based systems, telecom operators can minimize infrastructure expenses, automate their processes, and scale up rapidly to accommodate increased demand.

Key Regional Takeaways:

United States Telecom Order Management Market Analysis

The United States holds 87.70% share in North America. The market is majorly driven by rising demand for customized service bundles spanning fixed-line, mobile, and OTT platforms, necessitating agile order orchestration systems. In line with this, increased deployment of cloud-native architecture enabling scalable, flexible, and cost-effective solutions across telecom operations is impelling the market. The accelerated investment in nationwide 5G and fiber infrastructure, prompting the modernization of legacy order workflows to ensure service readiness, is fostering market expansion. As such, in May 2025, AT&T announced plans to roll out a nationwide 5G network reaching one-third of the US, following its USD 40 Billion investment in the spectrum. The effort aligns with its wider strategy to upgrade infrastructure and strengthen competitiveness in wireless and broadband segments. Similarly, growing regulatory emphasis on consumer data privacy and secure transactions is encouraging the adoption of compliant and transparent order management frameworks. The increasing interoperability with third-party platforms, pushing alignment with Open Digital Architecture standards to ensure seamless integration, is propelling the market growth. Apart from this, multi-channel commerce expansion, reinforcing the demand for unified order visibility across digital and traditional sales interfaces, is providing an impetus to the market.

Europe Telecom Order Management Market Analysis

The market in Europe is experiencing growth due to expanding fiber-to-the-home (FTTH) deployments. A survey by the FTTH Council Europe reported current fiber coverage across Europe at approximately 70% (homes passed) and projects it will rise to 87% by 2029. In accordance with this, strong regulatory emphasis on sustainable ICT under the EU Green Deal is encouraging telecom operators to adopt energy-efficient and digitally streamlined order workflows. Similarly, the rise of cross-border telecom services within the EU, necessitating harmonized and regulation-compliant order management platforms, is propelling the market growth. The heightened adoption of private 5G networks by enterprises, fueling demand for tailored provisioning and orchestration capabilities, is stimulating market appeal. Furthermore, the rapid integration of telecom order management with IoT service platforms is gaining traction with smart city initiatives and bolstering market development. The increasing demand for omnichannel service experience is promoting real-time order orchestration, augmenting product sales. Besides this, the rise in modular, API-driven vendor solutions is enhancing flexibility and accelerating deployment cycles.

Asia Pacific Telecom Order Management Market Analysis

The market for telecom order management in Asia Pacific is majorly propelled by rapid urbanization and high population density, creating demand for efficient service provisioning in large metropolitan areas. In addition to this, the rise in mobile-first digital consumption is encouraging telecom providers to modernize legacy systems for faster, low-latency service delivery. Similarly, intensifying competition among regional operators is driving investment in customizable order platforms to support differentiated offerings, which is propelling market growth. Furthermore, extensive 5G infrastructure rollouts across key markets such as China, South Korea, and Japan, increasing demand for integrated order-to-activation workflows, are enhancing market accessibility. Moreover, various telecom-fintech collaborations for bundled services are driving demand for unified, scalable order orchestration, expanding market scope. Accordingly, in January 2025, Bharti Airtel partnered with Bajaj Finance to launch a digital financial services platform.

Latin America Telecom Order Management Market Analysis

In Latin America, the market is progressing, attributed to expanding broadband access initiatives targeting underserved rural populations. Similarly, numerous telecom sector reforms promoting infrastructure sharing augmenting demand for interoperable, modular order management systems are strengthening the market demand. Furthermore, the rapid growth of mobile financial services, driving the need for integrated platforms capable of managing bundled telecom and digital payment solutions, is supporting market expansion. As per the fifth UBS Evidence Lab Global Mobile Banking B2B Survey, 73% of retail transactions in Brazil and 52% in Mexico are conducted digitally, with Brazil ranking second among emerging markets and third overall for digital transaction share. Moreover, rising cloud adoption is driving telecom operators in the region toward scalable, agile, cloud-native order management systems, thereby creating lucrative market opportunities.

Middle East and Africa Telecom Order Management Market Analysis

The market in the Middle East and Africa is significantly influenced by rapid mobile penetration and increasing demand for digital onboarding, particularly in underserved and remote areas. According to ITU data, Africa is now the world’s fastest-growing mobile phone sector, with mobile usage increasing at an annual rate of 65%, nearly twice the growth rate of Asia. Furthermore, favorable government-led smart city initiatives across GCC nations are driving the deployment of integrated telecom order orchestration platforms to support next-generation services. Additionally, rising global telecom and private equity investments are accelerating order management modernization and fostering market growth. Besides this, hyperscale data center growth accelerating the adoption of cloud-native order management systems for high-volume, complex service provisioning is impacting the market dynamics.

Competitive Landscape:

Market players in the telecom order management industry are actively enhancing their offerings by integrating advanced technologies like AI, automation, and ML into their solutions. These companies are focusing on developing cloud-based order management systems to offer greater scalability, flexibility, and cost-effectiveness to telecom service providers. Additionally, telecom order management solution providers are prioritizing system integrations with other enterprise systems like customer relationship management (CRM) and billing platforms, to streamline operations and improve decision-making. To stay competitive, many market players are also offering consulting, integration, and support services, ensuring that telecom providers can implement and optimize order management systems efficiently. Furthermore, as per the telecom order management market forecast, companies are expected to focus on 5G integration to address the complexities of next-generation service provisioning.

The report provides a comprehensive analysis of the competitive landscape in the telecom order management market with detailed profiles of all major companies, including:

- Cerillion

- Cognizant

- Comarch SA

- Fujitsu Limited (Furukawa Group)

- Infosys Limited

- International Business Machines Corporation

- Oracle Corporation

- Pegasystems Inc.

- Telefonaktiebolaget LM Ericsson

- Wipro Limited

Latest News and Developments:

- May 2025: Charter and Cox announced a USD 34.5 billion merger to form the largest U.S. cable provider. The deal aims to unify mobile and B2B strategies while enhancing telecom order management across 70 million locations. It strengthens bundling, Spectrum Mobile, and enterprise offerings amid broadband and video subscriber losses.

- March 2025: GX Group acquired Ping Communication to scale its telecom order management capabilities and target USD 50 Million revenue in LATAM by 2026. The deal strengthens GX’s broadband reach with WiFi 6/7, cloud-managed CPE, and AI-driven OSS, supporting top-tier clients like TELMEX and America Movil.

- March 2025: Prodapt launched AI agents on the ServiceNow platform to optimize telecom order management and enterprise productivity. Starting with a Customer Churn Prediction Agent, the initiative enhances telecom service and order workflows through AI-driven automation, supporting faster decisions, streamlined operations, and end-to-end integration across telecom enterprise systems.

- November 2024: Skyvera acquired CloudSense to enhance its telecom software portfolio with advanced CPQ and order management tools. The Salesforce-native platform will now leverage AI innovations from TelcoDR and Totogi to boost automation, streamline B2B telecom orders, and accelerate time-to-revenue globally.

- June 2024: Odido selected Ericsson to modernize its Service Order Management with a cloud-native, catalog-driven platform. The upgrade consolidates legacy systems, enhances telecom order fulfillment, supports 5G monetization, reduces time to market, and improves service orchestration across fixed, mobile, and enterprise segments, aligning with TM Forum's Open Digital Architecture.

Telecom Order Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Organization, Small and Medium Organization |

| Network Types Covered | Wireless, Wired |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cerillion, Cognizant, Comarch SA, Fujitsu Limited (Furukawa Group), Infosys Limited, International Business Machines Corporation, Oracle Corporation, Pegasystems Inc., Telefonaktiebolaget LM Ericsson, Wipro Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the telecom order management market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global telecom order management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the telecom order management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telecom order management market was valued at USD 5.0 Billion in 2025.

The telecom order management market is projected to exhibit a CAGR of 10.55% during 2026-2034, reaching a value of USD 12.5 Billion by 2034.

Key factors driving the telecom order management market include the increasing demand for improved customer experiences, the adoption of cloud-based solutions for scalability and flexibility, and the integration of emerging technologies like AI, automation, and 5G networks to handle complex orders and enhance service delivery.

North America currently dominates the telecom order management market, accounting for a share of 37.6%. The region benefits from advanced technology adoption, 5G rollout, and strong investments in digital transformation by telecom providers.

Some of the major players in the telecom order management market include Cerillion, Cognizant, Comarch SA, Fujitsu Limited (Furukawa Group), Infosys Limited, International Business Machines Corporation, Oracle Corporation, Pegasystems Inc., Telefonaktiebolaget LM Ericsson, Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)