Telecom Tower Market Report by Type of Tower (Lattice Tower, Guyed Tower, Monopole Towers, Stealth Towers), Fuel Type (Renewable, Non-Renewable), Installation (Rooftop, Ground-Based), Ownership (Operator-Owned, Joint Venture, Private-Owned, MNO Captive), and Region 2025-2033

Market Overview:

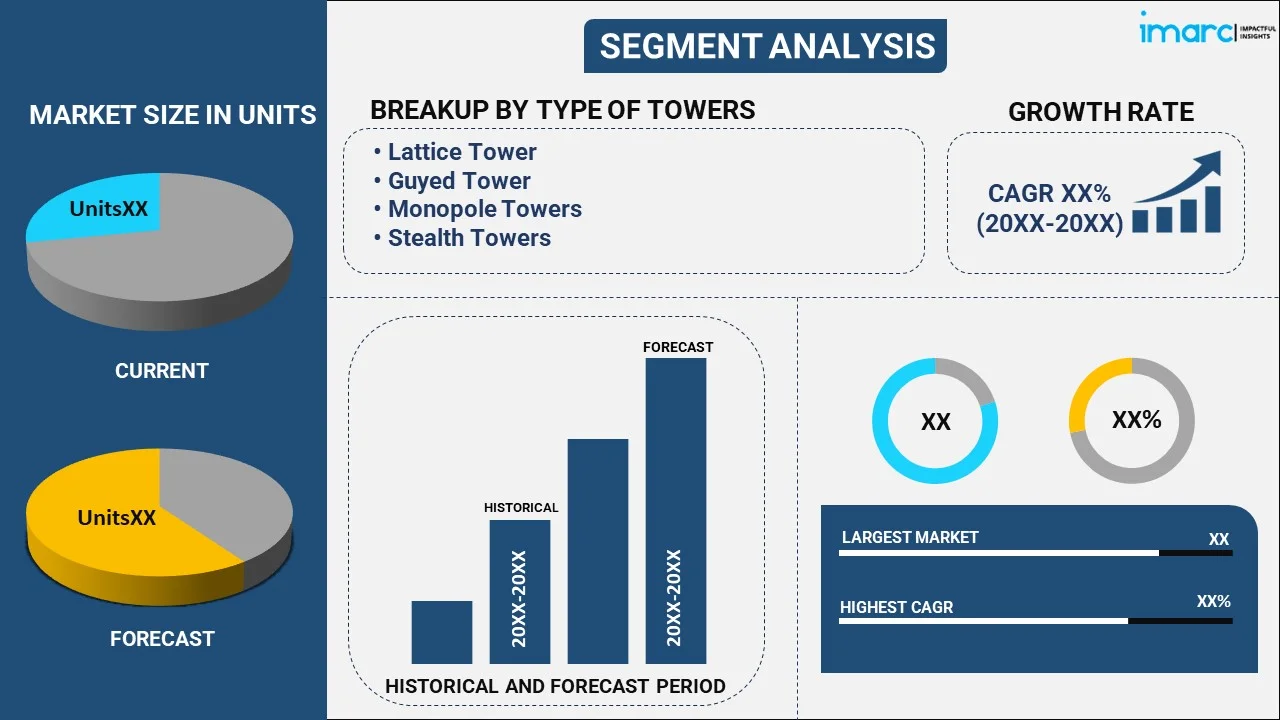

The global telecom tower market size reached 4.93 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 5.90 Million Units by 2033, exhibiting a growth rate (CAGR) of 2.02% during 2025-2033. The increasing investments in telecom infrastructure across developing economies, the rising integration of 5G-enabled technologies in manufacturing and industrial processes, and the development of smart agriculture solutions and precision farming technologies are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 4.93 Million Units |

| Market Forecast in 2033 | 5.90 Million Units |

| Market Growth Rate 2025-2033 | 2.02% |

A telecom tower, also known as a cell or mobile tower, is a critical infrastructure component in modern telecommunications networks. These tall structures support antennas and equipment that enable wireless communication between mobile devices and the network. It plays a pivotal role in providing cellular coverage, ensuring seamless voice calls, text messaging, and internet connectivity to a vast number of users. Strategically located across urban and rural areas, these towers form a network that allows mobile operators to extend their services and reach wider populations. They facilitate the efficient transfer of data, voice, and video signals, enabling the smooth functioning of mobile services. With the rapid growth in mobile users and the ever-increasing demand for data, these towers are essential in ensuring reliable and high-speed communication services globally.

The global market is primarily driven by the increasing mobile subscriber base and the rising smartphone adoption. In line with this, the expanding 4G and 5G network deployments to meet growing data demands are significantly contributing to the market. Furthermore, the rapid advancements in wireless communication technologies are positively influencing the market. Apart from this, the escalating demand for high-speed internet and data services is catalyzing the market. Moreover, the rapid expansion of the Internet of Things (IoT) devices and applications is propelling the market. Besides, the escalating need for enhanced network coverage and capacity in urban areas is strengthening the market. Additionally, the increasing trend of remote working and virtual communication is providing a boost to the market.

Telecom Tower Market Trends/Drivers:

The emergence of smart cities and smart infrastructure projects

The emergence of smart cities and smart infrastructure projects is creating a positive outlook for the market. As urbanization accelerates worldwide, cities are embracing technology to improve their efficiency, sustainability, and overall quality of life. Smart cities integrate digital technologies, including the Internet of Things (IoT), big data analytics, and cloud computing, to optimize urban services and enhance connectivity. These towers support the communication infrastructure required for these smart initiatives. They provide the backbone for wireless networks, enabling seamless data transmission and real-time connectivity for smart devices and sensors across the city. With the implementation of smart infrastructure projects like smart transportation systems, intelligent lighting, waste management, and energy-efficient buildings, the demand for robust and reliable communication networks is rising. Telecom towers enable these interconnected systems' seamless integration and functioning, making smart cities a reality.

Expansion of e-commerce and online services

The rapid expansion of e-commerce and online services is catalyzing the market. The widespread adoption of e-commerce platforms and the increasing popularity of online services, such as video streaming, gaming, and cloud computing, have led to data consumption. Telecom towers play a crucial role in supporting the robust and reliable communication infrastructure required to meet the demands of this digital ecosystem. They facilitate seamless data transmission and high-speed internet connectivity for millions of online transactions, video calls, and content downloads. With the advent of 4G and 5G technologies, these towers have become even more essential in ensuring faster data speeds and lower latency for a seamless online experience. Moreover, the growing usage of mobile devices for e-commerce and online services has driven the need for improved network coverage and capacity in urban and rural areas. As e-commerce transforms consumer behavior and online services become increasingly integral to daily life, the market is expected to witness sustained growth to cater to the growing digital demands of the modern world.

Growing demand for video streaming and online content consumption

The growing demand for video streaming and online content consumption is bolstering the market. With the expansion of video streaming platforms, online entertainment services, and user-generated content, video content consumption has bolstered. These towers play a crucial role in delivering seamless and high-quality video streaming experiences to users across the globe. These towers support the communication infrastructure that enables the transmission of large volumes of data for streaming videos and other content in real-time. The rise of Over-The-Top (OTT) platforms, live streaming events, and on-demand content has placed immense pressure on telecommunication networks to deliver uninterrupted and buffer-free video streaming experiences. As a result, mobile operators and internet service providers have invested in expanding and upgrading their network infrastructure, including the deployment of 4G and 5G networks, to meet the increasing demand. As video content continues to dominate online consumption patterns, these towers will remain integral in facilitating seamless and efficient data transmission, thus stimulating the market.

Telecom Tower Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global telecom tower market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type of tower, fuel type, installation and ownership.

Breakup by Type of Tower:

- Lattice Tower

- Guyed Tower

- Monopole Towers

- Stealth Towers

Lattice tower dominates the market

The report has provided a detailed breakup and analysis of the market based on the type of tower. This includes lattice tower, guyed tower, monopole towers, and stealth towers. According to the report, lattice tower represented the largest segment.

Lattice towers are characterized by their intricate steel framework, providing excellent stability and strength. They are commonly used in high-wind areas and for supporting heavy loads of antennas and equipment. Lattice towers are favored for their cost-effectiveness and versatility, making them popular among telecom companies.

On the other hand, guyed towers feature a central mast stabilized by multiple guy wires attached to the ground. They offer a cost-efficient solution for supporting antennas at great heights. Guyed towers are commonly seen in rural and remote locations due to their ease of installation and suitability for accommodating heavy loads.

Moreover, monopole towers are single, self-supporting structures, providing a sleek and aesthetically pleasing solution for urban and suburban environments. They are often used in densely populated areas where space is limited, and visual impact is a concern.

Besides, stealth towers are designed to blend into their surroundings, camouflaging themselves as trees, flagpoles, or other structures to minimize visual impact in sensitive locations. They are gaining popularity in urban areas and regions with strict regulations on tower aesthetics.

Breakup by Fuel Type:

- Renewable

- Non-Renewable

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes renewable and non-renewable.

Renewable fuels are derived from natural resources that are continuously replenished, making them sustainable in the long term. They include biofuels (such as ethanol and biodiesel), wind, solar, hydroelectric, geothermal, and biomass. Renewable fuels offer significant advantages in reducing greenhouse gas emissions, combating climate change, and promoting energy independence. As nations strive to transition towards cleaner and greener energy sources, investments in renewable fuels have increased substantially.

On the other hand, non-renewable fuels, also known as fossil fuels, are finite resources formed over millions of years. They include coal, oil, and natural gas. While these fuels have been the primary energy sources driving industrialization and economic growth, their combustion releases carbon dioxide and other pollutants, contributing to global warming and air pollution. As the world grapples with the challenges of climate change, there is a growing push to diversify energy sources and gradually reduce dependence on non-renewable fuels.

Breakup by Installation:

- Rooftop

- Ground-Based

Ground-based holds the largest share of the market

A detailed breakup and analysis of the market based on the installation have also been provided in the report. This includes rooftop and ground-based. According to the report, ground-based accounted for the largest market share.

Ground-based installations involve setting up energy systems on open land, typically in solar farms, wind farms, or large-scale power plants. These installations are commonly found in rural areas or regions with ample land. Ground-based installations are advantageous for their scalability and potential for higher energy generation capacity. They often rely on economies of scale, making them suitable for large energy demand centers and utility-scale projects.

On the other hand, rooftop installations involve placing energy systems, such as solar panels and small wind turbines, on the roofs of buildings and structures. This approach is especially popular in urban and residential areas with limited available land. Rooftop installations offer the advantage of utilizing unused space and can reduce energy transmission losses since power is generated closer to the point of consumption. Additionally, they contribute to decentralizing energy production, promoting energy self-sufficiency, and reducing strain on the grid.

Breakup by Ownership:

- Operator-Owned

- Joint Venture

- Private-Owned

- MNO Captive

Operator-owned holds the largest share of the market

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes operator-owned, joint venture, private-owned, and MNO captive. According to the report, operator-owned accounted for the largest market share.

Operator-owned assets are owned and operated by a single telecom or utility company. The telecom industry includes towers, networks, and other infrastructure wholly owned by a specific telecom operator. Such ownership grants the operator complete control over the assets, allowing for greater network management and decision-making flexibility.

On the contrary, joint ventures involve two or more companies cooperating to own and manage assets jointly. In telecom towers, joint ventures allow operators to pool resources and share the costs and risks associated with infrastructure deployment. Joint ventures can facilitate market entry, enable rapid expansion, and promote infrastructure sharing, leading to more efficient and cost-effective network deployment.

Moreover, non-operator entities, such as tower companies specializing in building and maintaining telecom infrastructure, own private-owned assets. These tower companies lease space on their towers to multiple telecom operators, fostering infrastructure sharing and providing a neutral platform for various operators.

Besides, Mobile Network Operator (MNO) captive refers to telecom towers owned by an operator and used exclusively to serve that operator's network needs. This model offers complete control to the operator over the infrastructure, but it may lead to suboptimal resource utilization if the towers are not shared with other operators.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Russia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest market.

The Asia Pacific region is home to some of the world's fastest-growing telecom markets, driven by rapid urbanization, population growth, and increasing smartphone adoption. Countries like China, India, Japan, and South Korea are key players in the region's telecom landscape. The growth of e-commerce, digital payments, and mobile services has fueled the demand for telecom infrastructure. With a focus on bridging the digital divide and expanding internet penetration, Asia Pacific witnesses significant investments in 4G and 5G networks and fiber-optic backbones. The region's vast and diverse geography necessitates varied telecom solutions, including satellite and undersea cables, to connect remote areas.

On the other hand, the North American telecom market is mature and highly competitive, characterized by well-established infrastructure and advanced technologies. With a strong emphasis on 5G deployment and digital transformation, telecom operators in North America continually strive to offer innovative services and solutions. The region's large urban centers have extensive fiber-optic networks, supporting high-speed internet and data services. In addition, North America has witnessed the development of smart cities and the Internet of Things (IoT) applications, driving further investment in telecom infrastructure. The demand for seamless connectivity, especially in remote areas, has led to the expansion of telecom towers and satellite communication systems.

Competitive Landscape:

Top telecom tower companies are actively supporting market growth through their strategic investments and technological advancements. These companies are continuously expanding their tower infrastructure to meet the rising demand for mobile and data services, especially in densely populated areas. By deploying advanced technologies such as 4G and 5G, they are enhancing network capacity and data speeds to provide seamless connectivity to users. Additionally, these companies are investing in research and development to develop innovative tower designs and materials, improving tower efficiency and sustainability. Furthermore, they are engaging in partnerships and collaborations with telecom operators and other stakeholders to streamline tower deployment processes and reduce operational costs. Their extensive experience and global presence allow them to navigate regulatory frameworks and efficiently secure tower installation permits. Moreover, these companies are actively adopting green energy solutions to power their towers, contributing to environmental sustainability.

The report has provided a comprehensive analysis of the competitive landscape in the telecom tower market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- American Tower Corporation

- AT&T Inc

- Cellnex Telecom S.A.

- China Tower Corporation Limited

- Crown Castle

- GTL Infrastructure Limited

- Helios Towers plc

- IHS Holding Limited

- Indus Towers Limited (Bharti Airtel)

- SBA Communications Corporation

- Telesites S.A.B de C.V.

- Viom Networks.

Recent Developments:

- In 2020, American Tower acquired InSite Wireless Group, LLC. This strategic move expanded American Tower's portfolio of wireless communication sites. It increased its presence in key markets, allowing the company better to serve its customers' growing needs for tower infrastructure.

- In 2020, AT&T collaborated with Microsoft to deliver a cloud-based 5G network for enterprise customers. This partnership aimed to leverage Microsoft's Azure cloud platform and AT&T's 5G network, enabling businesses to take advantage of edge computing capabilities and low-latency services, fostering innovation and digital transformation in various industries.

- In 2021, Cellnex Telecom acquired the Polish company Polkomtel Infrastruktura, expanding its presence in the Polish telecommunications market. The acquisition included a portfolio of approximately 7,000 telecom sites, strengthening Cellnex Telecom's position as a leading independent tower infrastructure provider in Europe.

Telecom Tower Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Units |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Type of Towers Covered | Lattice Tower, Guyed Tower, Monopole Towers, Stealth Towers |

| Fuel Types Covered | Renewable, Non-Renewable |

| Installations Covered | Rooftop, Ground-Based |

| Ownerships Covered | Operator-Owned, Joint Venture, Private-Owned, MNO Captive |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Tower Corporation, AT&T Inc, Cellnex Telecom S.A., China Tower Corporation Limited, Crown Castle, GTL Infrastructure Limited, Helios Towers plc, IHS Holding Limited, Indus Towers Limited (Bharti Airtel), SBA Communications Corporation, Telesites S.A.B de C.V., Viom Networks etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the telecom tower market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global telecom tower market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the telecom tower industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global telecom tower market reached a volume of 4.93 Million Units in 2024.

We expect the global telecom tower market to exhibit a CAGR of 2.02% during 2025-2033.

The increasing adoption of telecom towers, as they aid in connecting electronic signals, enabling communication among consumers, mitigating saturation of various devices, etc., is primarily driving the global telecom tower market.

The sudden outbreak of the COVID-19 pandemic has led to the rising deployment of telecom towers, owing to the growing demand for several consumer electronics to perform business-related operations, such as video conferencing, during the remote working scenario.

Based on the type of tower, the global telecom tower market can be categorized into lattice tower, guyed tower, monopole towers, and stealth towers. Among these, lattice tower holds the largest market share.

Based on the installation, the global telecom tower market has been segmented into rooftop and ground-based, where ground-based currently exhibits clear dominance in the market.

Based on the ownership, the global telecom tower market can be bifurcated into operator-owned, joint venture, private-owned, and MNO captive. Currently, operator-owned accounts for the majority of the total market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global telecom tower market include American Tower Corporation, AT&T Inc, Cellnex Telecom S.A., China Tower Corporation Limited, Crown Castle, GTL Infrastructure Limited, Helios Towers plc, IHS Holding Limited, Indus Towers Limited (Bharti Airtel), SBA Communications Corporation, Telesites S.A.B de C.V., and Viom Networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)