Telehandler Market Size, Share, Trends and Forecast by Product, Type, Ownership, Height, Capacity, Application, and Region, 2025-2033

Telehandler Market Size and Share:

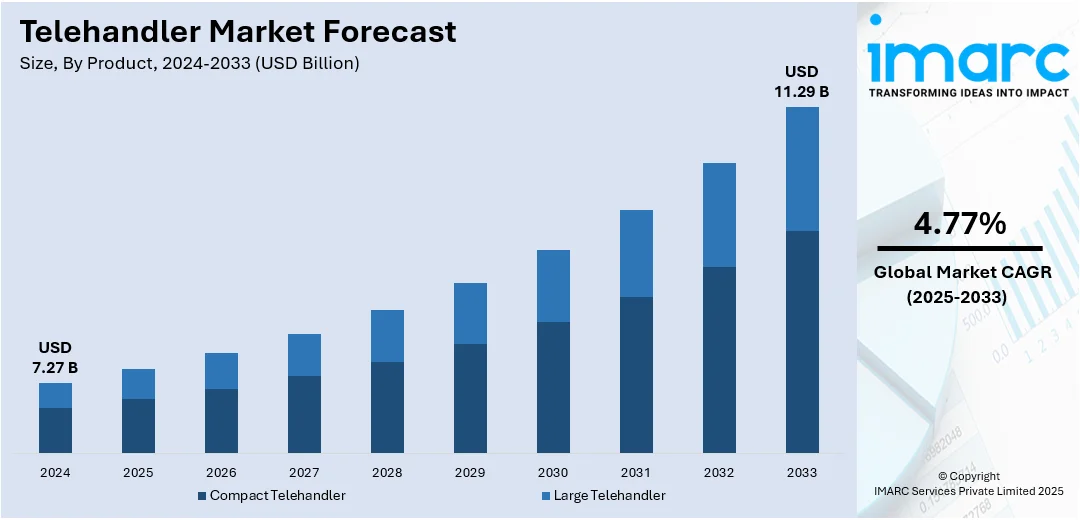

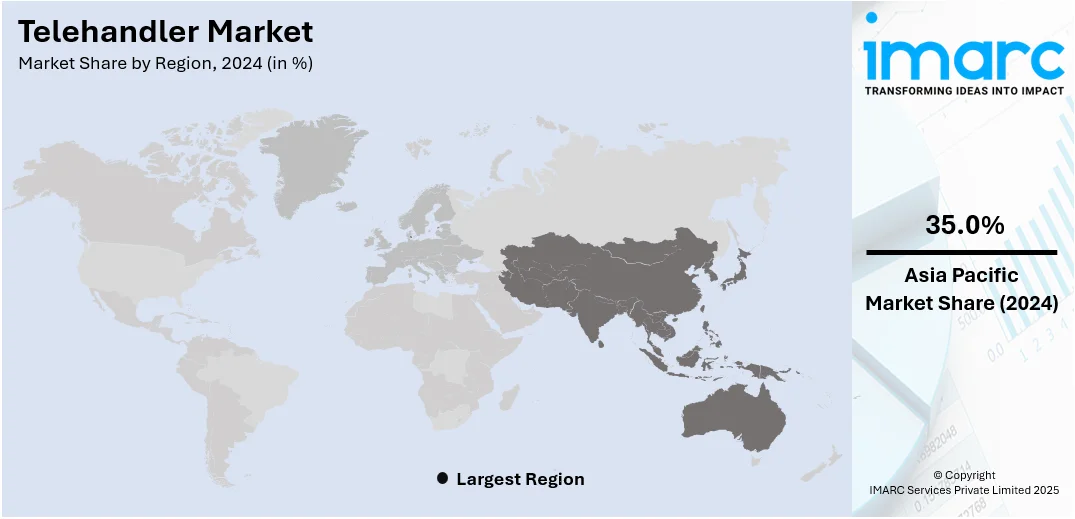

The global telehandler market size was valued at USD 7.27 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.29 Billion by 2033, exhibiting a CAGR of 4.77% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 35.0% in 2024. The dominance of the region is attributed to rapid urbanization, rising investment in infrastructure, and increasing industrial activity. The growing construction activity across emerging economies and adoption of advanced equipment to improve operational efficiency support this dominance and contribute to the increase in telehandler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.27 Billion |

|

Market Forecast in 2033

|

USD 11.29 Billion |

| Market Growth Rate 2025-2033 | 4.77% |

The growing public and private infrastructure initiatives are catalyzing the demand for material handling machinery. Telehandlers provide lifting, loading, and positioning capabilities ideal for extensive construction, roadwork, and utility setup. Their versatile functionalities make them crucial tools for speeding up project completion and minimizing reliance on various types of equipment. Furthermore, tighter safety and emission standards. Telehandlers built to comply with current regulations appeal to purchasers aiming to prevent fines and enhance safety at work. Manufacturers are synchronizing product offerings with regulatory demands, supporting the market growth through compliant, high-quality machines that fulfill legal and operational standards in important areas.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by the inclusion of features like remote monitoring, load control systems, and user-friendly interfaces to improve operator safety and performance. These enhancements enable real-time diagnostics, precise handling, and better maintenance planning. Additionally, the growing availability of electric telehandlers supports environmental compliance and lower operating costs, further boosting buyer interest and long-term equipment value retention. In 2025, JLG Industries launched its first electric telehandler, the E313, featuring a 3,500 lb. capacity, 13 ft. lift height, and 48V lithium-ion battery. The company also expanded its micro-sized scissor lift range with the ES1330M and ES1530M models, both under 2,000 lb. and designed for tight spaces. These innovations enhance eco-friendly and compact lifting solutions in North America.

Telehandler Market Trends:

Growing demand in construction industry

The telehandler market statistics shows contributions from the construction industry. Telehandlers are important in construction for lifting and handling materials. As the industry of construction continues to expand, particularly in emerging markets, so does the demand for telehandlers similarly increase. For instance, the UK Government projects that total construction output will grow by 3.5% in 2025 and 4.6% in 2026, further reinforcing the need for efficient material-handling equipment like telehandlers. This increased demand is as a result of how flexible the telehandlers are because they can handle different materials and work on different terrains including rough terrain models ideal for outdoor building sites. Moreover, the growing adoption of telehandlers owing to the shift towards mechanized and automated construction practices aimed at streamlining operations and improving efficiency is positively influencing the market. Additionally, increasing government investments in infrastructure projects like roads, bridges and commercial buildings is catalyzing the demand for telehandlers. These investments aim to stimulate economic growth, enhance transportation networks, and address urbanization challenges, all of which require robust material handling equipment like telehandlers.

Industrialization and infrastructure development

Efficient material handling solutions are necessary because of rapid industrialization and infrastructure development projects worldwide. Index of Industrial Production (IIP) saw a 1.2% year-on-year increase in May 2025, driven by growth in manufacturing sector at 2.6% in India. Telehandlers are indispensable in several industrial applications, including manufacturing, logistics, and warehousing. Besides their importance to construction field, telehandlers are becoming imperative in other industrial applications because of their versatility along with mobility capabilities. In manufacturing facilities, telehandlers facilitate the movement of materials and components across production lines, optimizing workflow and reducing manual handling efforts. The logistics sector also benefits from their ability to handle heavy loads in confined spaces and varied terrains, improving operational speed and safety. Additionally, warehouse operations rely on telehandlers for stacking, loading, and unloading tasks. Furthermore, the agricultural sector's modernization and mechanization is driving the demand for telehandlers equipped with specialized attachments tailored to farm-specific needs.

Growing adoption of modern farming practices

The telehandler market share has grown at a significantly faster rate as a result of modern framing practices. Notably, a recent report indicates that over 70% of farms worldwide are expected to adopt precision agriculture technologies by 2025, underlining the growing demand for technologically advanced and multi-functional equipment like telehandlers. Telehandlers are essential to improve production in agriculture as they streamline, automate, and save time through the integration of technology. These devices are more useful and adaptable because they are typically used for a variety of tasks like handling heavy items, loading and unloading, and transporting goods. In addition, the digitization and technological integration of telehandlers, due to user demands, are improving farming by decreasing labor costs and inputs while increasing productivity rates The telehandler market trends show a shift toward increased adoption of these versatile machines, driven by the growing need for efficiency and automation in modern agricultural practices.

Telehandler Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global telehandler market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, type, ownership, height, capacity, and application.

Analysis by Product:

- Compact Telehandler

- Large Telehandler

Compact telehandler holds the biggest market share owing to its operational flexibility, ease of movement, and appropriateness for restricted work environments. Its small size allows for effective operation in limited spaces without sacrificing lifting ability or reach. Compact telehandler is preferred because of its lower operating expenses, lesser fuel usage, and easier maintenance needs. Its capacity to manage several attachments enables users to execute various tasks with one device, boosting overall efficiency. Moreover, compact telehandler is generally more affordable regarding purchase and rental costs, making it an economical option for small to medium-sized enterprises (SMEs). Its intuitive controls and improved visibility features enhance safety during operation, lessening the learning curve for novice operators. With the ongoing expansion of urban development and light construction projects, the need for adaptable, space-saving equipment increases.

Analysis by Type:

- Rotating

- Non-rotating

Rotating telehandlers feature a boom mounted on a turret that can rotate 360 degrees, allowing for complete circular material handling without moving the machine. This rotating feature enables operators to perform tasks more effectively in tight or intricate work environments, especially where space or mobility is limited. Its capability to manage various tasks, such as lifting, placing, and rotating, minimizes the necessity for extra equipment, enhancing overall project efficiency. The incorporation of sophisticated controls and safety mechanisms boosts operator assurance and effectiveness, thereby promoting acceptance in high-demand industries.

Non-rotating consists of a stationary boom position and are commonly utilized in various sectors for typical lifting and material movement operations. Its straightforward design guarantees user-friendly operation, minimal maintenance needs, and decreased initial investment expenses. It works exceptionally well in open job sites where there is ample space for moving the equipment. Its strong lifting abilities and adaptability with different attachments make it essential for uses in construction, agriculture, and warehousing.

Analysis by Ownership:

- Rental

- Personal

The rental segment represents a significant portion of the market because of its affordability, versatility, and ease of use. Leasing enables companies to obtain sophisticated machinery without large upfront costs, making it perfect for temporary or project-specific requirements. Rental companies keep fleets with modern models that comply with up-to-date safety and emission regulations, guaranteeing dependable performance. This choice also lessens the responsibility of upkeep, repairs, and storage for users.

Businesses with regular or long-term equipment requirements favor personal ownership of telehandlers. Having machinery provides total control over utilization, accessibility, and personalization according to operational needs. This segment encompasses contractors, extensive agricultural companies, and industrial operations that incorporate telehandlers into routine activities. Personal ownership offers the benefit of long-term savings in high-usage situations, even with a greater initial cost.

Analysis by Height:

- Less Than 50 ft

- 50 ft & Above

Less than 50 ft is a crucial segment in the market because it is ideal for general construction, agricultural, and industrial uses. It provides a harmonious blend of reach, agility, and compact structure, making it ideal for utilization in tight or moderately sized environments. Its shorter height range often results in enhanced stability, decreased fuel use, and simpler mobility between work locations. The pricing is also more accessible, making it a favored option for small and medium businesses.

50 ft and above is mainly utilized in extensive construction, infrastructure, and heavy industrial ventures that demand significant vertical elevation. This range machine is designed for heavy-duty lifting and precise tasks, enabling effective material positioning at considerable heights. It has sophisticated stability and safety systems to ensure secure operations in challenging conditions. The telehandler market forecast predicts continued growth in demand for 50 ft and above models, driven by the expanding need for high-performance lifting solutions in large-scale construction and industrial projects.

Analysis by Capacity:

- Below 3 Tons

- 3-10 Tons

- Above 10 Tons

Below 3 tons capacity telehandlers mainly utilized for light tasks where nimbleness, fuel efficiency, and user-friendliness are emphasized. Their small dimensions and reduced weight render them ideal for activities in tight spaces or where minimal ground disturbance is necessary. Small contractors, agricultural users, and maintenance teams often opt for these machines, as they need to perform frequent, low-volume lifting tasks. With increasing demand for equipment that combines versatility and easy transport, this capacity range remains a focal point of strong interest, particularly in areas emphasizing cost-efficient operations.

The 3–10 tons segment occupies a notable portion of the market as it is ideal for medium-range lifting jobs in construction, industrial, and agricultural sectors. Machines within this category provide a suitable balance of load capacity and agility, allowing them to meet diverse job site needs. They facilitate effective management of larger materials while ensuring smooth operation and mobility. Their adaptability to various attachments increases versatility and minimizes the requirement for extra equipment.

Telehandlers with a capacity above 10 tons are built for robust tasks that require lifting and moving substantial, heavy materials. These powerful machines are generally utilized in infrastructure, mining, and industrial projects where strength and reach are essential. Fitted with strengthened parts and sophisticated hydraulic systems, they provide excellent performance in challenging environments.

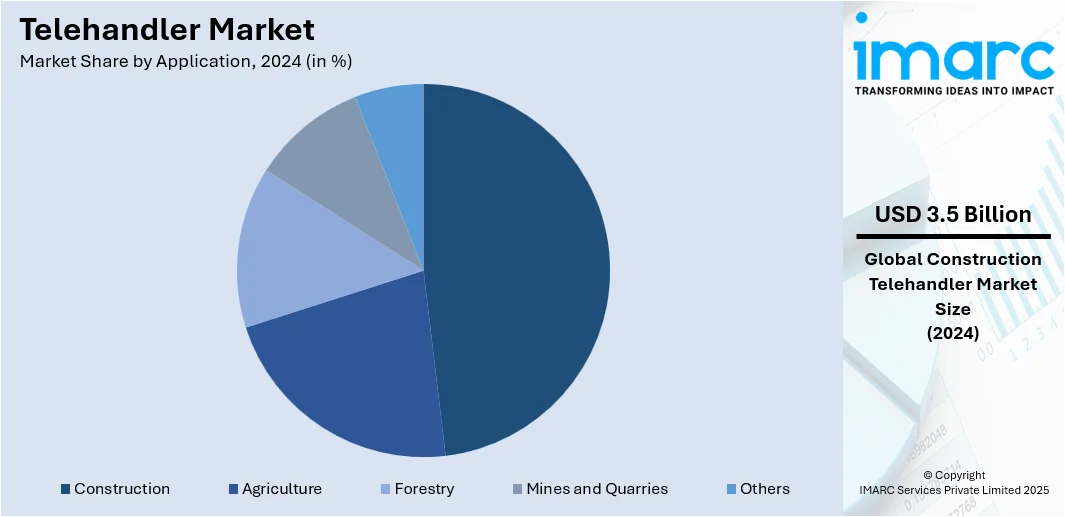

Analysis by Application:

- Construction

- Agriculture

- Forestry

- Mines and Quarries

- Others

Construction represents the largest segment, accounting 48.2% market share, because of the ongoing need for adaptable, high-efficiency machinery that aids in material handling for various project categories. Telehandlers are crucial for lifting, loading, and positioning materials at different heights and distances, thereby improving workflow efficiency on construction sites. Their versatility across various landscapes and capacity to support numerous attachments render them essential for activities demanding flexibility and accuracy. The incorporation of sophisticated control systems, safety features for operators, and engines that meet emission standards is in line with contemporary construction regulations and standards. Increasing investment in infrastructure, commercial, and residential development projects supports consistent demand for dependable and effective machinery. Additionally, the focus on project timelines and workforce efficiency promotes the utilization of machinery that can carry out various tasks with little preparation time. These operational benefits reinforce telehandlers as a favored option in the construction industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia pacific dominates the market with 35.0%, owing to swift urbanization, industrial advancement, and increasing infrastructure spending in developing nations. The area's elevated population density and economic development efforts generate continuous demand for agricultural and construction machinery. Government and private entities are focusing on modernizing transport, energy, and housing sectors, resulting in a greater use of adaptable machinery. For instance, in 2025, DLF announced a ₹5,500 crore investment for its new luxury housing project, DLF Privana North, in Gurugram's Sectors 76 and 77. This follows the rapid sell-out of previous projects like Privana South and West, which together generated over ₹12,700 crore. The new project will offer 1,150+ premium apartments across 18 acres. Such large-scale projects require adaptable machinery, including telehandler, to improve operational efficiency. Furthermore, the growing awareness about sophisticated material handling solutions and the expanding use of mechanized equipment to boost productivity is offering a favorable telehandler market outlook.

Key Regional Takeaways:

United States Telehandler Market Analysis

The telehandler market in the United States is witnessing growth because of the increasing number of major infrastructure projects throughout urban and suburban areas. Demand is greatly affected by the extensive use of automation and modern equipment in the logistics and warehousing industries, where telehandlers are essential for moving materials. Governor Gretchen Whitmer recently revealed that stakeholders and state agencies in Michigan have received USD 352 Million in funding from the Bipartisan Infrastructure Law (BIL), Inflation Reduction Act (IRA), and CHIPS Act to aid manufacturing and industrial modernization, highlighting the country’s dedication to revitalizing its industrial sector. Furthermore, the upgrading of public services and energy infrastructure, such as wind and solar energy facilities, is contributing to the industry growth. The incorporation of telematics and remote monitoring technologies in telehandlers is boosting operational efficiency and driving replacement needs. Additionally, increasing investment in agricultural mechanization is encouraging the adoption of multifunctional lifting tools like telehandlers in rural economies. Improved rental models backed by digital platforms are also streamlining access to equipment, especially for temporary projects.

North America Telehandler Market Analysis

The telehandler market in North America is propelled by ongoing infrastructure growth, urban renewal projects, and a consistent need for sophisticated material handling solutions in construction, agriculture, and industrial industries. Rising labor expenses are increasing dependence on mechanized machinery to enhance efficiency and minimize operational hold-ups. The regulatory framework in the region encourages the use of equipment that complies with emission regulations and safety measures, facilitating the upgrade of old machinery to more efficient models. Moreover, the incorporation of technology, such as telematics and operator support systems, is improving fleet management efficiency and operational accuracy, leading to greater acceptance. This shift toward modernization and regulatory compliance is further reflected in recent product introductions designed to meet the region’s evolving operational demands and performance standards. In 2024, Bobcat launched its TL623 telehandler, featuring a 6,000 lb. lift capacity and 7-meter lift height. It included a high-torque, emissions-compliant engine and five operating modes for efficiency and versatility across various tasks. The TL623 would be available in North America in Q4 2024.

Europe Telehandler Market Analysis

The telehandler market in Europe is progressing steadily, supported by the growing focus on energy-efficient machinery in various industrial applications. Strict emission regulations are encouraging end-users to embrace environment-friendly telehandlers featuring advanced engine technologies. A report from the UK Parliament indicates that the modular construction sector is projected to expand at an annual rate of 6.3%, attaining a worth of around USD 15.3 Billion by 2025, thereby catalyzing the demand for adaptable lifting solutions, such as telehandlers, throughout Europe. There is an increase in the need for modular building methods, where flexible lifting solutions are crucial for moving prefabricated components. The rising demand for compact telehandlers because of urban redevelopment initiatives with limited space is impelling the telehandler market growth. Additionally, the market gains from government-supported programs that advocate for sustainable construction methods and the use of modern technologies. The incorporation of digital diagnostics and predictive maintenance capabilities is becoming standard, enhancing uptime and lifecycle administration.

Asia Pacific Telehandler Market Analysis

The Asia Pacific telehandler sector is growing, primarily driven by quick urbanization, infrastructure advancement, and heightened construction efforts in major markets like China, India, and Southeast Asia. India has become one of the top recipients of foreign direct investment (FDI) globally, surpassing USD 1 trillion in total FDI inflows from April 2000 to September 2024. In this context, the construction industry represented about 5% of total equity FDI inflows, amounting to roughly USD 35.2 Billion during that timeframe. As investments in manufacturing corridors and economic zones increase, there is a significant demand for equipment that improves operational agility. Apart from this, telehandlers are becoming increasingly popular in vertical farming systems and high-density storage areas, as their reach and compact size provide notable benefits.

Latin America Telehandler Market Analysis

The telehandler market in Latin America is experiencing growth driven by a rise in mechanization in mid-sized construction and industrial sectors. There is a rise in the demand for equipment that can effectively carry out various material handling tasks within limited project timelines. As per the Brazilian Association of Infrastructure and Basic Industries, private investments are estimated to total around USD 70.6 Billion from 2025 to 2029, which is driving the need for telehandler to support extensive infrastructure growth. The rise of the retail distribution network and associated warehousing facilities is enhancing the utilization of telehandlers for inventory tracking and logistics assistance. Urban growth, seasonal building trends, changing labor dynamics, and SMEs' comfort with multi-use machinery are catalyzing the demand for compact telehandlers in secondary cities.

Middle East and Africa Telehandler Market Analysis

The telehandler market in the Middle East and Africa is growing due to rising investments in transportation and logistics infrastructure. Initiatives centered on intermodal freight terminals and cargo processing facilities are driving the need for machinery that can swiftly and accurately lift, transport, and position heavy loads. A report reveals that Saudi Arabia is investing USD 2.67 Billion into the establishment of 18 new logistics areas, signifying a notable advancement in regional logistics. Such projects are catalyzing the demand for adaptable equipment such as telehandlers. Urban mobility and smart city initiatives are promoting the use of multi-purpose telehandlers, shaped by a demand for durable, contemporary warehousing and chilly storage solutions.

Competitive Landscape:

Major participants in the industry are boosting initiatives related to innovation, product enhancement, and geographic growth. They assign resources to engineering improvements focused on boosting performance, longevity, and maintenance simplicity while complying with regulatory standards. For example, in 2025, SANY UK launched the STH742, a compact 7m telehandler designed for high lifting power, efficiency, and safety. It features a 55kW Stage V Deutz engine, ergonomic cab, and advanced safety systems like dynamic load monitoring and a reversing camera. The model expands SANY's telehandler lineup alongside its 14m and 18m units. Besides this, strategic alliances and joint ventures are sought to enhance market presence and distribution channels, facilitating entry into emerging markets. Continuing R&D investments concentrate on implementing innovative features in operator comfort, automation, and telematics integration to facilitate data-driven operations. Competitive differentiation is attained via customized product offerings, localized strategies, and service support frameworks that meet customer expectations.

The report provides a comprehensive analysis of the competitive landscape in the telehandler market with detailed profiles of all major companies, including:

- AB Volvo

- Caterpillar Inc.

- Doosan Infracore Co. Ltd.

- Haulotte Group (Solem SA)

- J.C. Bamford Excavators Limited

- JLG Industries Inc. (Oshkosh Corporation)

- Komatsu Limited

- Liebherr Maschinen Bulle AG

- Manitou Group

- Merlo S.p.A. Industria Metalmeccanica

- Skyjack Inc. (Linamar Corporation)

- Terex Corporation

- Wacker Neuson SE

Latest News and Developments:

- March 2025: Continental expanded its TeleMaster portfolio with the pneumatic V.ply tire co-developed with JLG and the Clean Non-Marking solid version. These additions enhanced durability, stability, and sustainability for telehandler fleets across diverse job sites. The V.ply tire offered improved flotation and wear, while the solid tire enabled mark-free indoor operation.

- March 2025: LGMG introduced its first telehandler, the H1056, at the 2025 ARA Show in Las Vegas. Featuring a 10,000-pound lift capacity and 56-foot height, it offered three steering modes, a 74-hp Cummins engine, and intuitive touchscreen controls. Designed for durability, it simplifies operation and maintenance for rental and jobsite versatility.

- February 2025: New Holland launched the TH6.26 compact telehandler for North America, designed for tight workspaces in agriculture and landscaping. It delivered a 6-meter lift height, 2.6-ton capacity, and featured a fuel-efficient engine, ergonomic cab, and advanced controls, including telematics, boom suspension, and fast tool-switching for enhanced performance and user comfort.

- January 2025: Caterpillar unveiled four next-generation telehandlers, TH0642, TH0842, TH1055, and TH1255, replacing its TL series. These models featured enhanced operator comfort, a 74–115 hp engine range, telematics, and improved lifting stability. With upgraded safety features, maintenance tools, and digital control systems, Caterpillar aimed to boost usability for retail and rental customers.

- January 2025: Kubota introduced its largest pivot-steer telehandler, the RT305T-2, offering a 1.2-ton lift and 4.3-meter reach. Powered by a 66 hp Stage V engine and featuring hydrostatic transmission, permanent four-wheel drive, and selectable diff locks, the model improved manoeuvrability and traction for construction and agricultural handling tasks.

Telehandler Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Compact Telehandler, Large Telehandler |

| Types Covered | Rotating, Non-rotating |

| Ownerships Covered | Rental, Personal |

| Heights Covered | Less Than 50 ft, 50 ft & Above |

| Capacities Covered | Below 3 Tons, 3-10 Tons, Above 10 Tons |

| Applications Covered | Construction, Agriculture, Forestry, Mines and Quarries, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, Caterpillar Inc., Doosan Infracore Co. Ltd., Haulotte Group (Solem SA), J.C. Bamford Excavators Limited, JLG Industries Inc. (Oshkosh Corporation), Komatsu Limited, Liebherr Maschinen Bulle AG, Manitou Group, Merlo S.p.A. Industria Metalmeccanica, Skyjack Inc. (Linamar Corporation), Terex Corporation and Wacker Neuson SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the telehandler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global telehandler market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the telehandler industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telehandler market was valued at USD 7.27 Billion in 2024.

The telehandler market is projected to exhibit a CAGR of 4.77% during 2025-2033, reaching a value of USD 11.29 Billion by 2033.

The telehandler market is primarily driven by increased construction activities, infrastructure development, and agricultural mechanization. The growing need for efficient material handling and equipment versatility across sectors is offering a favorable market outlook. Regulatory focus on safety and productivity, along with technological advancements in machine performance and operator comfort, further contributes to the market growth.

Asia Pacific currently dominates the telehandler market with 35.0%, owing to rapid urbanization, rising investment in infrastructure, and increasing industrial activity. The growing construction activity across emerging economies and adoption of advanced equipment to improve operational efficiency support this dominance. Government initiatives and economic growth further contribute to the sustained demand for telehandlers across the region’s key industries.

Some of the major players in the telehandler market include AB Volvo, Caterpillar Inc., Doosan Infracore Co. Ltd., Haulotte Group (Solem SA), J.C. Bamford Excavators Limited, JLG Industries Inc. (Oshkosh Corporation), Komatsu Limited, Liebherr Maschinen Bulle AG, Manitou Group, Merlo S.p.A. Industria Metalmeccanica, Skyjack Inc. (Linamar Corporation), Terex Corporation, Wacker Neuson SE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)