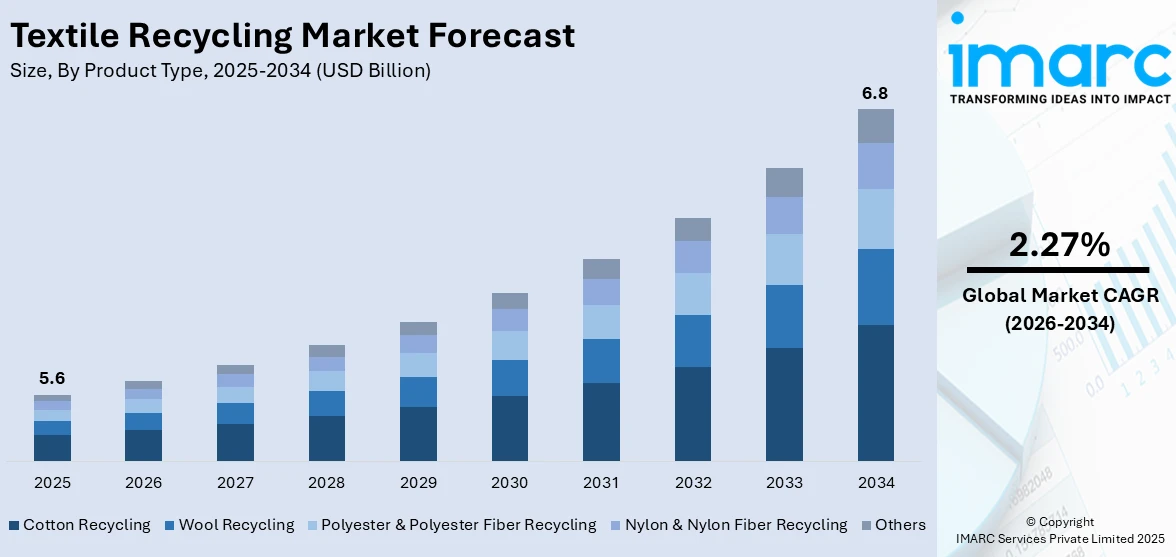

Textile Recycling Market Report by Product Type (Cotton Recycling, Wool Recycling, Polyester & Polyester Fiber Recycling, Nylon & Nylon Fiber Recycling, and Others), Textile Waste (Pre-consumer Textile, Post-consumer Textile), Distribution Channel (Online Channel, Retail & Departmental Store), End-Use (Apparel, Industrial, Home Furnishings, Non-woven, and Others), and Region 2026-2034

Textile Recycling Market Size:

The global textile recycling market size reached USD 5.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.8 Billion by 2034, exhibiting a growth rate (CAGR) of 2.27% during 2026-2034. The market is experiencing steady growth driven by increasing environmental concerns and the urgent need for sustainable waste management, innovations in recycling technologies, such as advanced sorting systems and chemical recycling, and government policies and regulations that encourage or mandate textile recycling.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.6 Billion |

|

Market Forecast in 2034

|

USD 6.8 Billion |

| Market Growth Rate 2026-2034 | 2.27% |

Textile Recycling Market Analysis:

- Major Market Drivers: The growing environmental concerns and the need for sustainable practices are driving the textile recycling market. The market grows even more from government initiatives on sustainability and landfill reduction.

- Key Market Trends: One of the textile recycling market trends includes new advanced sorting techniques and innovations in the processing of textile waste and technological adoption in textile recycling. Other growth drivers in the market involve increasing consumer awareness and demand for sustainable fashion.

- Geographical Trends: Europe leads the textile recycling industry. This occurs in line with tough EU regulations on waste management and an already high level of consumer awareness of environmental issues in the region.

- Competitive Landscape: The recycling activity is dominated by small, specialized firms and large textile companies. Strategic alliances and partnerships between apparel companies and recycling firms are common to enhance sustainability in the production processes.

- Challenges and opportunities: The textile recycling market analysis suggests that both blended fabrics and post-consumer waste present a technological challenge in the textile recycling market. Nevertheless, these challenges may also generate an opportunity for innovation in recycling technologies and in new ways to improve the quality and efficiency of recycled textiles.

To get more information on this market Request Sample

Textile Recycling Market Trends:

Environmental awareness and regulation

Growing consumer awareness of the environment and stringent government regulations in most countries are fueling the textile recycling market growth. Along with this, the increasing inclination toward sustainability across the globe is also propelling the market. Consumers are becoming more aware of the products they buy and, as a result, would prefer to use products that are less harmful to the environment. More and more consumers in this process demand responsible practices from supply chains, especially from the apparel manufacturing sector. This further encourages the manufacturer to recycle textiles. In addition, government agencies across the world are imposing stringent regulations related to waste management, and they have been given specific targets regarding recycling so that landfills become nullified and greenhouse gas emissions are reduced. The global apparel industry was estimated to be responsible for 1.8% of global greenhouse gas emissions in 2021, with the production of upstream materials, including textile fibers and fabrics, contributing approximately 90% of the sector's total carbon emissions. Thus, this is also providing impetus to the textile recycling market revenue. Moreover, the implementation of government pressures allows the textile recycling industry to grow and ensure that the apparel sector at large adopts more sustainable practices, thereby reducing the environmental footprint of the textile industry.

Technological advancements in recycling processes

The real potential for growth in the textile recycling market is with the adoption of new, advanced technologies, presenting more efficiency and effectiveness of operation. These include better sorting technologies able to distinguish between textiles based on their fiber composition and color, and more advanced mechanical and chemical recycling technologies. The latter enables a much more advanced mechanical and chemical recycling process, which makes a more extensive range of processing of textile waste possible, including blended fibers that have been traditionally considered hard to recycle. For instance, chemical recycling technologies convert textile waste into highly valuable raw materials that close the textile loop and reduce dependence on virgin resources. These types of innovations solve some of the critical challenges the market faces in textile recycling and serve to make the recycled option more economically feasible in competition with virgin raw materials, thereby encouraging more businesses to invest in recycling solutions. Therefore, it is creating a positive textile recycling market outlook.

Corporate sustainability commitments

The growth of the textile recycling market is influenced by the sustainability commitments of corporate entities. With the gradual increase in environmental impact across the globe, most corporations, especially in the fashion industry are attempting to reduce the overall amount of carbon emissions and increase the amount of recycled products. Additionally, initiatives are often a response to consumer demands for more sustainable products and practices. With the increasing recognition of the risks of resource scarcity and climate change, giant apparel and other firms are now setting aggressive targets in using recycled fibers in manufacturing new products, which increases the textile recycling demand. Such initiatives ensure the growth of the recycling market and support the competition of corporations in the market, as the purchasing choices of consumers are increasingly made based on sustainable criteria. At the International Conference on Cellulose Fibers in Cologne, LIST Technology AG (Arisdorf, Switzerland) presented the world's first 100% pulp-from-recycled-textile Lyocell T-Shirt. This was enabled by LIST KneaderReactor technology. The source material is post-consumer recycled textile, and the T-shirt is 100% recyclable. Furthermore, the increasing demand for textile recycling reshapes supply chains and stimulates the innovation of technologies and recycling practices for further market growth.

Textile Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on product type, textile waste, distribution channel and end-use.

Breakup by Product Type:

- Cotton Recycling

- Wool Recycling

- Polyester & Polyester Fiber Recycling

- Nylon & Nylon Fiber Recycling

- Others

Cotton recycling dominates the market

The report has provided a detailed breakup and analysis of the market based on product type. This includes cotton recycling, wool recycling, polyester & polyester fiber recycling, nylon & nylon fiber recycling, and others. According to the report, cotton recycling represented the largest segment.

Cotton recycling holds a significant textile recycling market share. Much of this advance can be ascribed to the substance's strong prevalence in clothing and the high environmental impact of conventionally grown cotton. As compared to synthetics, cotton cloth is quite biodegradable, so recycling is less complicated in comparison. In general, cotton can be mechanically broken down more easily into fibers which are subsequently spun into new yarns compared to synthetic fibers, which are usually more intricate to break down and recycle. Textile waste is collected, and the fabric is sorted and cleaned before it is mechanically broken down into fibers that can be spun into new yarns to be recycled. The reason that drives the demand for recycled cotton is its reduced ecological impacts since it uses much less water and energy compared to virgin cotton. It is being demanded by the consumer and the corporate sector as their increasing preference is for the material to be manufactured out of sustainable resources.

Breakup by Textile Waste:

- Pre-consumer Textile

- Post-consumer Textile

Pre-consumer textiles hold the largest share of the market

A detailed breakup and analysis of the market based on textile waste has also been provided in the report. This includes pre-consumer and post-consumer textiles. According to the report, pre-consumer textile represented the largest segment.

Pre-consumer textile waste is the biggest category of textile waste in the recycling market. It is in most cases the waste from the scraps and remnants of a making process before the product reaches the consumer. Therefore, it is the largest segment of the textile recycling market as the process is relatively easier and less costly than post-consumer waste. Pre-consumer waste is usually cleaner and free from the usage type of contamination, and in most cases, the materials are homogenous, which makes the process of sorting and recycling easy. Manufacture and recycling facilities are easily reintroduced into new textile products with a vast reduction of waste and resource consumption in the cycle of production. Economic gain margins for recycling pre-consumer waste are considerable since firms can reclaim value from what would otherwise be a waste of materials. This helps in cost reduction of production by using recycled material back in the manufacturing process, and it is in line with the growing trend of regulatory pressure and consumer demand for greener production practices. According to the textile recycling market forecast, the growing need to minimize environmental footprints will encourage industries to focus on efficient recycling of pre-consumer textile waste.

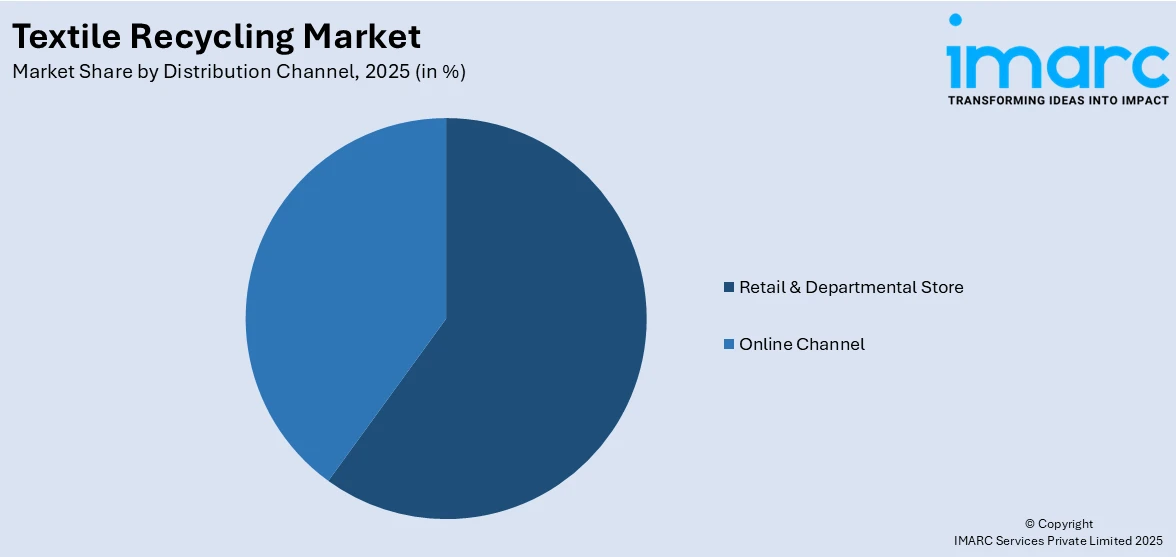

Breakup by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online Channel

- Retail & Departmental Store

Retail & departmental store holds the largest share in the market

A detailed breakup and analysis of the market based on distribution channel has also been provided in the report. This includes online channel and retail & departmental store. According to the report, retail & departmental store accounted for the largest market share.

Retail and departmental stores represent the largest segment of distribution channels for the textile recycling market and are at the forefront of the consumer supply chain. They provide the most important retail endpoints through which end-users are reached by recycled textiles. Due to their vast and fast-growing network, they powerfully affect the dynamics in the markets in terms of driving trends and product availability. This allows them to promote and retail recycled textile products to their better advantage, making such options available to a large portion of consumers. According to the textile recycling market report, a number of these retail outlets have integrated into their operations eco-friendly business models, mostly through links with recycling firms in need of an assured supply of recycled textiles. This helps to meet increasing consumer demand for sustainability and enhances the brand image of stores as environmentally responsible. By placing recycled textiles in these high-visibility outlets, awareness and demand for such products are developed within the public.

Breakup by End-Use:

- Apparel

- Industrial

- Home Furnishings

- Non-woven

- Others

Apparel holds the largest share in the market

A detailed breakup and analysis of the market based on end-use has also been provided in the report. This includes apparel, industrial, home furnishings, non-woven, and others. According to the report, apparel accounted for the largest market share.

Apparel is one of the largest end-use applications in the textile recycling market, reflecting the extensive use of various fabrics and the large amount of waste generated by the fashion industry. The convergence of these textile recycling market recent developments is driven by an increasing interest of the consumer base in sustainable fashion and the industry's attempt to respond to rising concerns with environmental issues related to resource depletion and waste generated. Converting textiles into apparel reduces the size of landfills utilized and minimizes the consumption of raw materials, but it is also congruent with changing consumer preferences toward green products. From luxury to fast fashion, brands are starting to use recycled fibers in making new collections to support their commitment to sustainability and to catch the growth in green products. In addition, the economy of scale benefits accruing from using recycled textiles for the making of new clothes results in massive environmental impact reductions, including in water consumption and greenhouse gases. On the other hand, with improved technology in the textile recycling processes that permit a better quality of fabric and texture in the recyclables, this trend is further augmented.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Others

North America leads the market, accounting for the largest textile recycling market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa (Turkey, Saudi Arabia, and others). According to the report, North America represents the largest regional market for textile recycling.

North America holds the highest share of the textile recycling market, primarily due to its stringent regulatory frameworks, high consumer awareness, and significant investments in recycling technologies. The United States and Canada enhance some of the strongest environmental protection regulations, as well as government policies that promote sustainable operations in the textile industry. This is further reinforced by the growing demand for eco-friendly products due to the extreme sensitization of sustainable practices by consumers. North American businesses have been the benchmark in innovation and investment in new recycling processes, which bring efficiency and quality improvements in recycling textile fibers. The textile recycling market overview suggests that collaboration within the industry emphasizes the promotion of textile recycling and, therefore, makes this market structure one of the strongest. Furthermore, the region hosts advanced recycling infrastructure that serves both its internal market and is best practice globally for textile sustainability.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the textile recycling industry include:

- Birla Cellulose (Aditya Birla Group)

- BLS Ecotech Ltd. (BLS Group)

- Boer Group

- Lenzing AG

- Martex Fiber (Leigh Fibers)

- Pistoni S.r.l.

- Remondis SE & Co. KG

- Respun (Kay Gee Enterprises)

- Unifi Inc.

- Usha Yarns Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Key players in the textile recycling market are increasing their capacity and outreach, innovating technologies, and investing in advanced recycling processes. The textile recycling companies are further partnering with fashion brands to have a consistent input material and simultaneously expanding the output of recycled textile products. In addition to this, advancements in sorting technologies and the efficiency of both mechanical and chemical recycling methods to handle a wide range of textile waste, including complex blends, are favoring the market. Along with this, they are also initiating moves to drive consumer awareness and increase sustainability through marketing campaigns and educative programs to achieve a more sustainable ecosystem around textile recycling. Therefore, this is further offering the textile recycling market recent opportunities.

Textile Recycling Market News:

- June 01, 2023: Boer Group Recycling Solution introduced mobile NIR spectroscopy solution to enhance the efficiency of identifying and sorting textile materials.

- May 24, 2023: Infinited Fiber Company signed an agreement with SOEX on textile waste feedstock for Infinited Fiber’s flagship factory.

Textile Recycling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cotton Recycling, Wool Recycling, Polyester & Polyester Fiber Recycling, Nylon & Nylon Fiber Recycling, Others |

| Textile Wastes Covered | Pre-consumer Textile, Post-consumer Textile |

| Distribution Channels Covered | Online Channel, Retail & Departmental Store |

| End-Uses Covered | Apparel, Industrial, Home Furnishings, Non-woven, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia |

| Companies Covered | Birla Cellulose (Aditya Birla Group), BLS Ecotech Ltd. (BLS Group), Boer Group, Lenzing AG, Martex Fiber (Leigh Fibers), Pistoni S.r.l., Remondis SE & Co. KG, Respun (Kay Gee Enterprises), Unifi Inc., Usha Yarns Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the textile recycling market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global textile recycling market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the textile recycling industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global textile recycling market reached a value of USD 5.6 Billion in 2025.

The global textile recycling market is expected to exhibit a CAGR of 2.27% during 2026-2034.

The coronavirus disease (COVID-19) outbreak and the adoption of social distancing measures in numerous countries have halted many industrial activities, including textile manufacturing, which is expected to have a negative impact on the market.

The growing environmental consciousness, along with the increasing awareness regarding the adverse effects of heavy industrial discharge from textile mills, is bolstering the market growth.

One of the key market trends is the introduction of informative initiatives by various recycling companies. These organizations are also introducing door-to-door pick-up programs for old garments, as well as installing cloth bins in parking spaces, parks, shopping malls, walkways, and other high visibility locations.

Based on the product type, the market is bifurcated into cotton, wool, polyester and polyester fiber, nylon and nylon fiber and other types of recycling. At present, cotton recycling represents the largest segment.

The market is categorized into pre-consumer and post-consumer textiles, wherein pre-consumer textiles dominate the market.

Based on the distribution channel, retail and departmental stores account for the largest market share.

On the basis of the end-use, the market has been classified into apparel, industrial, home furnishings, non-woven, and others. Apparel currently accounts for the majority of the market share.

Region-wise, Asia Pacific is the leading market. Other major regions are North America, Europe, Latin America, and Middle East and Africa.

The leading industry players are Birla Cellulose (Aditya Birla Group), BLS Ecotech Ltd. (BLS Group), Boer Group, Lenzing AG, Martex Fiber (Leigh Fibers), Pistoni S.r.l., Remondis SE & Co. KG, Respun (Kay Gee Enterprises), Unifi Inc., and Usha Yarns Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)