Thailand Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2025-2033

Thailand Air Freight Market Overview:

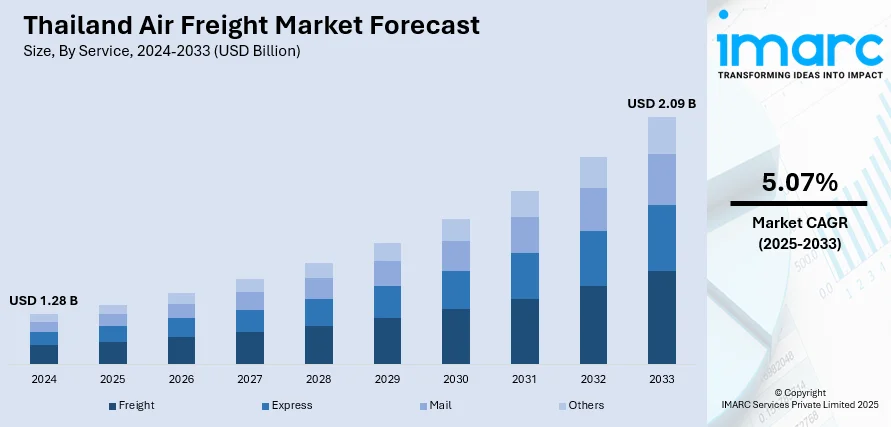

The Thailand air freight market size reached USD 1.28 Billion in 2024. Looking forward, the market is projected to reach USD 2.09 Billion by 2033, exhibiting a growth rate (CAGR) of 5.07% during 2025-2033. The market is majorly driven by Thailand’s strategic role in ASEAN trade, supported by infrastructure investments under the Eastern Economic Corridor program. Growing global demand for Thailand’s premium agricultural exports is increasing the need for specialized, temperature-controlled air cargo. Additionally, rapid e-commerce growth and expanded express delivery services are strengthening the market’s long-term trajectory, further augmenting the Thailand air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.28 Billion |

| Market Forecast in 2033 | USD 2.09 Billion |

| Market Growth Rate 2025-2033 | 5.07% |

Thailand Air Freight Market Trends:

Strategic Location and ASEAN Trade Integration

Thailand’s geographic position at the heart of Southeast Asia provides a strategic advantage for its air freight sector, particularly as intra-ASEAN trade continues expanding. As a founding ASEAN member, Thailand benefits from regional trade agreements, including the ASEAN Free Trade Area (AFTA) and the Regional Comprehensive Economic Partnership (RCEP), both of which facilitate streamlined cross-border cargo movements. Major Thai airports, especially Suvarnabhumi Airport and Don Mueang, serve as transshipment hubs for goods moving between China, Southeast Asia, and global markets. Air freight supports Thailand’s key export sectors, including electronics, automotive components, and high-value agricultural products. The government’s Eastern Economic Corridor (EEC) initiative further amplifies this advantage by integrating aviation hubs with deep-sea ports and special economic zones, enhancing multimodal transport efficiency. The development of smart logistics zones around major airports is also helping reduce cargo processing times and operational costs. In 2023, Thailand handled 1.2 million tons of air cargo, ranking as the 21st largest air cargo market globally, with aviation contributing USD 35.1 Billion to the country’s GDP. The sector also supported 3.8 million jobs and facilitated USD 34.1 Billion in international tourist spending. Thailand’s positioning as a trade conduit for ASEAN partners is contributing substantially to Thailand air freight market growth, strengthening its role as a key logistics hub for regional and international commerce.

To get more information of this market, Request Sample

Growth of E-Commerce and Express Delivery Services

The surge in Thailand’s e-commerce market is reshaping domestic and cross-border logistics demand, placing new emphasis on fast, reliable air freight solutions. Consumers increasingly expect next-day or two-day delivery for online purchases, ranging from electronics to luxury goods. Air cargo facilitates rapid movement of high-demand products from international suppliers, particularly for cross-border transactions with China, Japan, and South Korea. Additionally, partnerships between global express delivery providers and Thai logistics firms are improving connectivity, warehouse automation, and last-mile delivery integration. Suvarnabhumi Airport is undergoing expansions to handle increased air cargo volumes driven by e-commerce, with dedicated terminals for express shipments under development. Major Thai retailers and platforms are leveraging air freight to support promotional events and seasonal sales campaigns, further accelerating volumes during peak periods. In December 2024, Thailand transported over 130,000 tons of air cargo, with approximately 128,000 tons comprising international shipments and around 2,900 tons being domestic freight. Furthermore, logistics technology startups in Thailand are pioneering innovative solutions for inventory tracking, customs clearance, and real-time order updates, supporting e-commerce logistics efficiency. These developments, combined with rising consumer expectations and regional trade flows, highlight the growing importance of air freight in sustaining Thailand’s evolving retail and e-commerce landscape.

Thailand Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

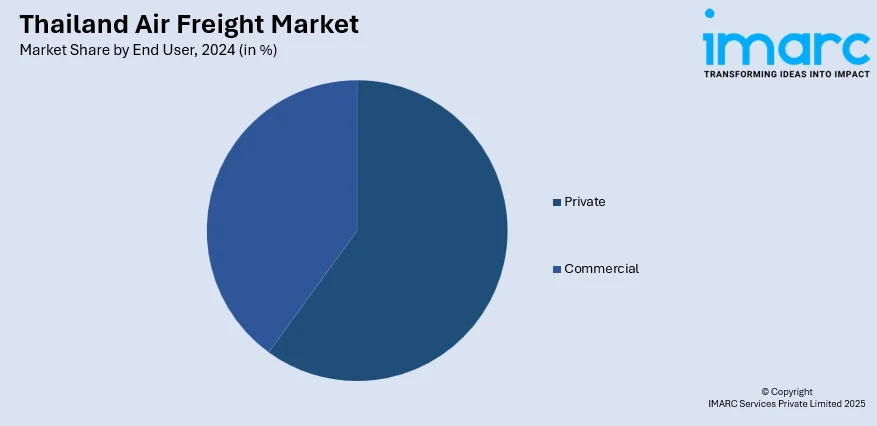

End User Insights:

- Private

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes private and commercial.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Air Freight Market News:

- On May 8, 2025, Thai Airways International and Kansas Modification Center (KMC) signed a Memorandum of Understanding (MoU) to initiate Thailand’s first Boeing 777-300ER passenger-to-freighter (P2F) conversion program. The conversions will be conducted at Thai Airways’ MRO centers in Don Mueang and the Eastern Economic Corridor, aiming to strengthen Thailand’s air freight capabilities, aligning with the increasing regional demand for widebody freighter capacity.

Thailand Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End Users Covered | Private, Commercial |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand air freight market on the basis of service?

- What is the breakup of the Thailand air freight market on the basis of destination?

- What is the breakup of the Thailand air freight market on the basis of end user?

- What is the breakup of the Thailand air freight market on the basis of region?

- What are the various stages in the value chain of the Thailand air freight market?

- What are the key driving factors and challenges in the Thailand air freight market?

- What is the structure of the Thailand air freight market and who are the key players?

- What is the degree of competition in the Thailand air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)