Thailand Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2025-2033

Thailand Craft Beer Market Overview:

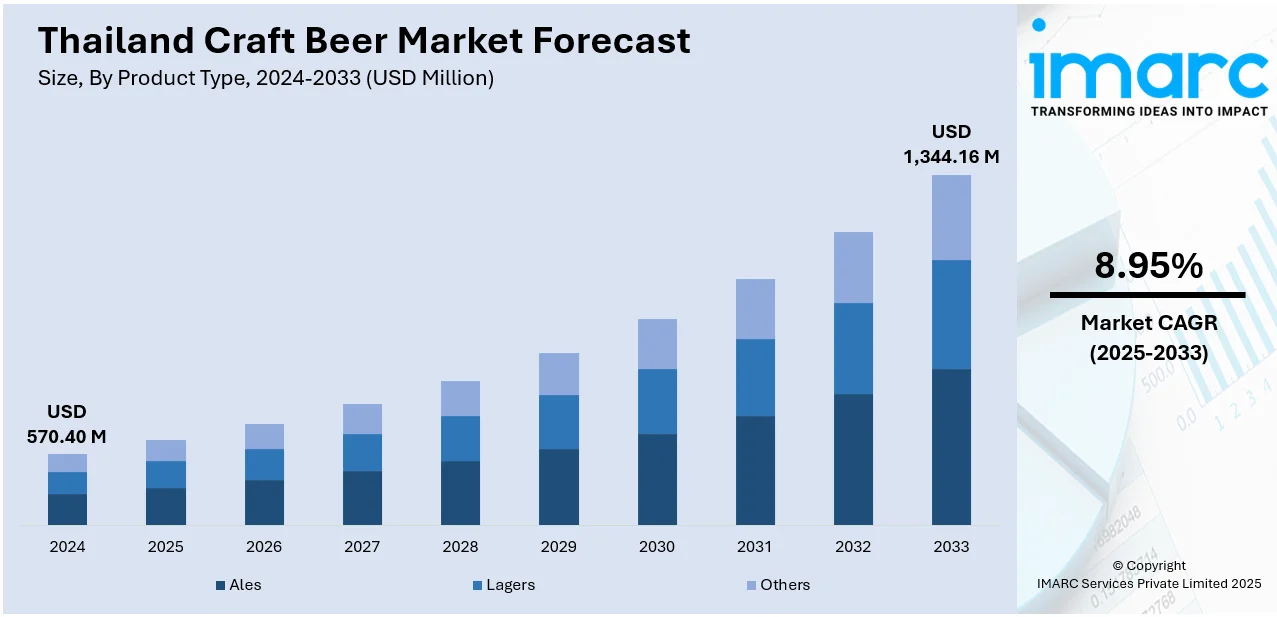

The Thailand craft beer market size reached USD 570.40 Million in 2024. The market is projected to reach USD 1,344.16 Million by 2033, exhibiting a growth rate (CAGR) of 8.95% during 2025-2033. The market is experiencing robust growth as discerning consumers, particularly urban millennials and young professionals, increasingly favor locally brewed, artisanal beverages. Manufacturers are responding with innovative flavor profiles and premium offerings to capture evolving tastes. Distribution channels are diversifying, with specialty bars, breweries, e‑commerce platforms, and select retail chains expanding access. Regional microbreweries are thriving, buoyed by tourism and cultural authenticity. This convergence of consumer demand, product innovation, and distribution expansion is propelling the Thailand craft beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 570.40 Million |

| Market Forecast in 2033 | USD 1,344.16 Million |

| Market Growth Rate 2025-2033 | 8.95% |

Thailand Craft Beer Market Trends:

Localization of Ingredients Elevates Craft Identity

Thailand's craft beer industry is embracing locally sourced ingredients, applying regional tastes like lemongrass, tamarind, mango, and pandan to the brewing process. Localization is raising the profile of Thai craft beer's identity and developing taste profiles that represent cultural heritage. Brewers are being influenced by traditional Thai food and herbs, utilizing native crops not just for flavor but sustainability as well. More and more microbreweries started attending local festivals early in 2024 to exhibit local brews as a testament to innovation in flavor creation and support for agriculture. The trend also supports a decrease in carbon footprint through reduction of imported raw materials. There is also community outreach through workshops and taste gatherings that is educating consumers about local ingredients and how they are used in brewing. The local sourcing practice fits into the wider trend toward responsible manufacturing and authenticity. In March 2024, Chiang Mai-based 'Eleventh Fort' brewery launched its seasonal Nam Dok Mai Mango Ale at the Craft Beer Chiang Mai Festival, highlighting the use of locally grown mangoes and drawing strong consumer interest for its fruity profile and sustainable sourcing.The same is boosting Thailand craft beer market growth, further entrenching the sector's development toward eco-friendly, culture-reflective brewing.

To get more information on this market, Request Sample

Premiumization Drives Urban Craft Consumption

In 2024, there was a discernible surge in demand for high-end, small-batch beers that transformed buying patterns in Bangkok and other city centers. The transition is especially marked among the younger population who value exclusive flavors and craft-quality over mass-market equivalents. This desire for premium beer experience has triggered a craze for bespoke craft bars and microbreweries serving carefully curated tap lists. Locations are adding tasting rooms and seasonal rotating menus more and more, highlighting the prestige of craft brands. The growth of specialty beer events and tasting festivals since the mid-2024 period also has created platforms for displays of limited-release beers, which also increased awareness. The trend is also complemented by changing lifestyle behaviors that promote personal expression and exploration by culture through food and beverage. Digital engagement is accelerating exposure, with social platforms and online ordering bringing the craft scene to the forefront. These interrelated drivers are propelling Thailand craft beer market trends, as urban lifestyle changes, innovation, and consumer education fuel demand for high-quality, differentiated brewing experiences.

Health-Conscious and Eco-Friendly Brewing Gains Momentum

Thailand's craft beer industry is changing as brewers embrace greener, healthier standards. Across 2025, eco-friendly brewing emerged as a focal point at leading craft fairs in Bangkok, where manufacturers showcased energy-efficient machinery and herbal brewing supplements. Health-conscience beer products like low-alcohol, unfiltered, or gluten-free models were also a main attraction, appealing to consumers with lifestyle-based preferences. Breweries are using biodegradable packaging more often and investing in alternative energy, such as solar integration, to decrease their carbon impact. These innovations are often linked with outreach programs within the community that encourage responsible drinking and education on nutritional consciousness. As the trend continues to gain momentum, branding and labeling have also adapted to highlight transparency and sustainability. As a response to growing environmental and wellness issues, new market entrants are giving these values priority from the start. Convergence of wellness trends and brewing innovation is pushing the industry and becoming a defining aspect of today's Thailand craft beer market.

Thailand Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

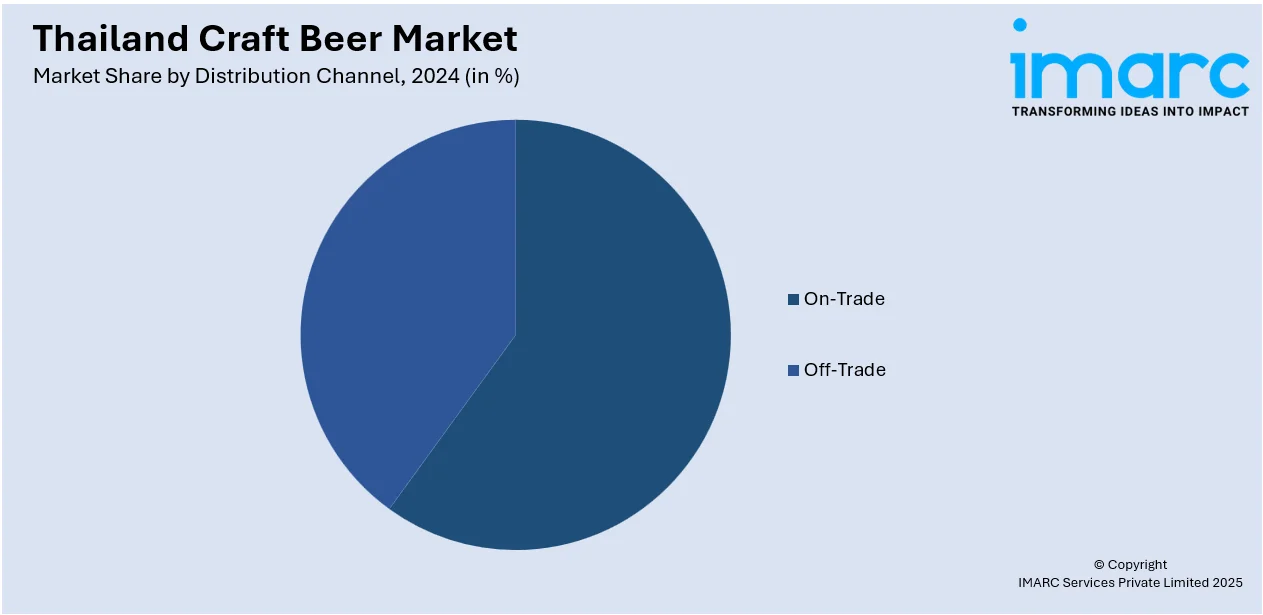

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Craft Beer Market News:

- In April 2025, Bangkok-based startup Life Below Labs launched Thailand’s first yeast-production facility. The lab supplies high-quality, locally cultivated yeast strains, enhancing flavor consistency and supporting innovation in the country’s craft beer sector. This milestone strengthens the local brewing ecosystem with sustainable, science-driven solutions.

- In December 2024, ThaiBev’s Chang launched its first unpasteurised premium beer in a 100% recyclable screw-cap aluminium bottle. Designed to retain cold temperatures and enable convenient consumption via 7-Eleven outlets, the innovation received 98% positive taste feedback. Chang targets sales of 25 million bottles in 2025.

Thailand Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand craft beer market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand craft beer market on the basis of product type?

- What is the breakup of the Thailand craft beer market on the basis of age group?

- What is the breakup of the Thailand craft beer market on the basis of distribution channel?

- What is the breakup of the Thailand craft beer market on the basis of region?

- What are the various stages in the value chain of the Thailand craft beer market?

- What are the key driving factors and challenges in the Thailand craft beer?

- What is the structure of the Thailand craft beer market and who are the key players?

- What is the degree of competition in the Thailand craft beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)