Thailand Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Thailand Duty-Free and Travel Retail Market Overview:

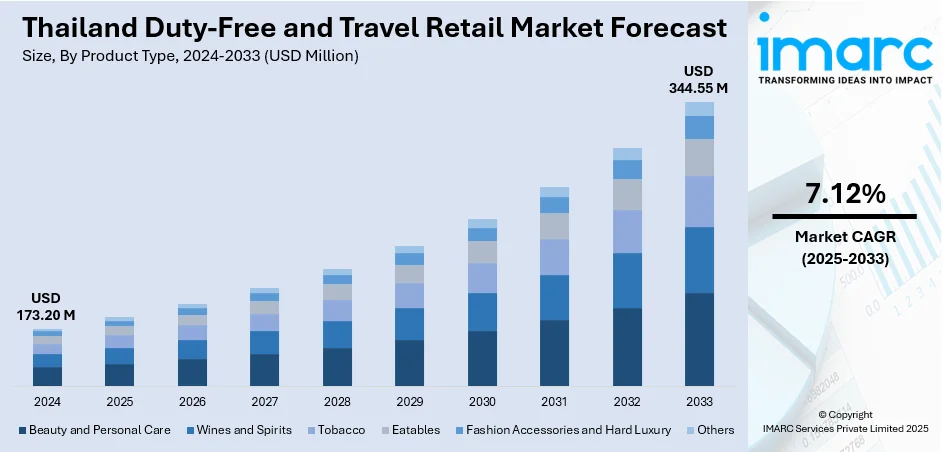

The Thailand duty-free and travel retail market size reached USD 173.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 344.55 Million by 2033, exhibiting a growth rate (CAGR) of 7.12% during 2025-2033. High tourism, especially in airports and tourist hotspots, is one of the factors contributing to Thailand duty-free and travel retail market share. Popular products include luxury goods, cosmetics, and alcohol. The sector benefits from tax exemptions, attracting international travelers seeking premium goods at competitive prices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 173.20 Million |

| Market Forecast in 2033 | USD 344.55 Million |

| Market Growth Rate 2025-2033 | 7.12% |

Thailand Duty-Free and Travel Retail Market Trends:

Urban Luxury Shopping Hubs Boosting Duty-Free Sales

Premium shopping hubs that mix duty-free and duty-paid retail in city centers are gaining ground. New projects combine large retail spaces with luxury brands and easy access for travelers and locals alike. This approach taps into growing visitor numbers in major cities and the desire for high-end goods without airport queues. In France, operators are expanding similar urban stores to capture footfall beyond terminals. Downtown shopping spots offer convenience, variety, and an upscale vibe that fits international tourists’ expectations. These city-center sites also help retail groups strengthen ties with local suppliers and luxury labels. Shoppers get more choice and brands secure better exposure in prime urban locations, creating fresh momentum for retail beyond airports. These factors are intensifying the Thailand duty-free and travel retail market growth. For example, in May 2024, King Power announced plans to open a new downtown duty-free and duty-paid shopping hub at Bangkok’s USD 3.9 Billion ‘One Bangkok’ project. Located in the central business district, the King Power One Bangkok store would be part of a vast 160,000 sq m retail space. The move aims to strengthen King Power’s position in Thailand’s travel retail market by blending luxury shopping with urban convenience.

To get more information on this market, Request Sample

High-Spending Tourists Driving Upscale Airport Retail

Upscale airport stores in France are seeing strong growth as more high-net-worth travelers look for exclusive buys during transit. Airports in Paris, Nice, and Lyon are redesigning terminals to include larger luxury boutiques, fine dining, and personalized shopping services. Labels once limited to flagship city stores now secure prime spots airside, aiming to catch travelers when they’re relaxed and open to impulse purchases. Tax-free prices, VIP lounges, and concierge delivery to gates turn the shopping experience into a highlight of the journey. With Asian and Middle Eastern tourists returning in bigger numbers, spending per passenger is rising. French airports are partnering with local designers and heritage brands to showcase limited-edition collections that can’t be found elsewhere. Digital pre-ordering and pick-up points also push more sales, catering to busy travelers who want convenience. This push to turn terminals into luxury retail zones strengthens France’s position as a premium shopping destination, keeping it competitive with other global hubs that invest heavily in airport retail appeal.

Thailand Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

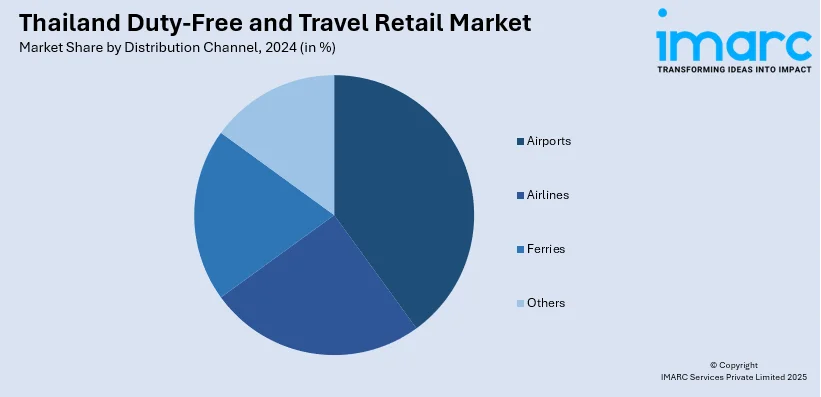

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Duty-Free and Travel Retail Market News:

- In May 2025, Thailand’s Tourism Authority launched the Amazing Thailand Grand Sale 2025 to attract tourists from China, India, and Southeast Asia. King Power Duty Free is a major venue, offering deals and perks to boost duty-free and travel retail spending. The campaign aims to lift Thailand’s status as a shopping destination and bring a surge in tourism revenue.

Thailand Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand duty-free and travel retail market on the basis of product type?

- What is the breakup of the Thailand duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Thailand duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the Thailand duty-free and travel retail market?

- What are the key driving factors and challenges in the Thailand duty-free and travel retail market?

- What is the structure of the Thailand duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Thailand duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)