Thailand E-Commerce Market Size, Share, Trends and Forecast by Business Model, Mode of Payment, Service Type, Product Type, and Region, 2025-2033

Thailand E-Commerce Market Overview:

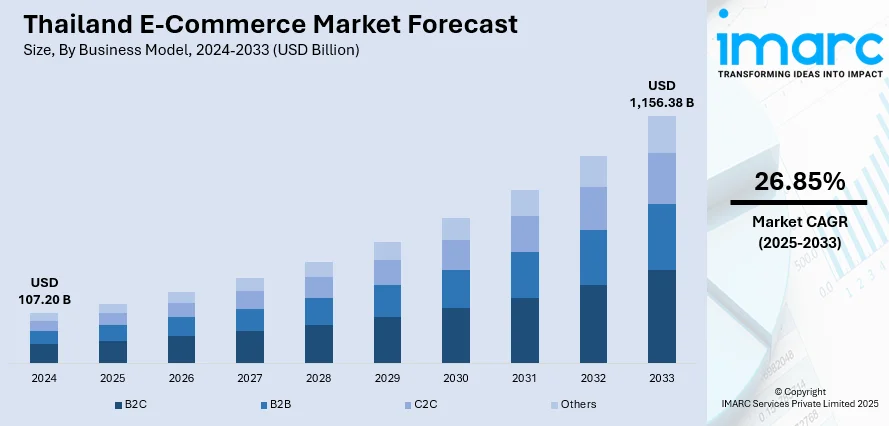

The Thailand e-commerce market size reached USD 107.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,156.38 Billion by 2033, exhibiting a growth rate (CAGR) of 26.85% during 2025-2033. The e-commerce market is expanding through platform-driven trust features and seamless digital infrastructure. Verified sellers, buyer protection, and efficient return policies enhance confidence, while integrated payment and logistics systems simplify transactions. These developments attract broader demographics, boost purchase frequency, and support small businesses in competing effectively, further contributing to the expansion of the Thailand e-commerce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 107.20 Billion |

| Market Forecast in 2033 | USD 1,156.38 Billion |

| Market Growth Rate 2025-2033 | 26.85% |

Thailand E-Commerce Market Trends:

Platform-Backed Authenticity and Buyer Protection

A major factor for the e-commerce growth in Thailand is the increasing emphasis on verified shopping environments where trust is built into the platform design. Individuals are more likely to complete purchases when they feel confident about product authenticity, seller reliability, and post-purchase support. Platforms that spotlight certified sellers, offer guarantees, and provide clear return policies create a safer space for online transactions. This shift reduces the hesitation often associated with digital shopping, especially in markets where counterfeit goods or unclear seller reputations have been a concern. For local businesses, being part of these secure ecosystem levels the playing field. It allows them to compete not just on price, but on trust and convenience. Features like integrated client service, transparent reviews, and perks like free shipping or loyalty rewards help retain buyers and reduce cart abandonment. As e-commerce platforms continue to focus on curation and buyer assurance, they are drawing in new user segments, including older shoppers or first-time buyers, who may have previously preferred offline retail. This trust-focused approach is reshaping buyer behavior and encouraging more frequent, higher-value transactions across a wider range of categories. In 2024, TikTok Shop Mall launched in Thailand to support local businesses by offering a secure platform where shoppers can buy authentic products from certified stores. The Mall featured over 1,000 brands and provides benefits like free shipping and easy returns, enhancing buyer confidence. This initiative aimed to boost Thailand’s digital economy by helping small and medium businesses grow alongside established brands.

To get more information on this market, Request Sample

Integrated Payment and Logistics Systems

Digital payment usage in Thailand is expanding rapidly as people are becoming more confident using quick response (QR) codes, mobile wallets, and instant bank transfers for everyday purchases. The shift is driven by local fintech innovation and active government support that lowered the barriers for both buyers and sellers. For instance, in 2024, Thailand announced the launch of its 145 billion baht ($4.28 billion) digital wallet programme to boost short-term economic development. The initiative provided 10,000 baht in cryptocurrency or cash to individuals over 16, with 32 million already registered. Such a move not only encourages the use of digital wallets but also draws more people into the online economy. On the logistics side, rapid fulfillment, such as same-day and next-day delivery, is becoming the norm in city centers. E-commerce platforms integrate directly with regional delivery providers, enabling real-time tracking and quick handoffs. Combined, the ease of payment and speed of delivery are decreasing hesitation among first-time buyers and encouraging repeat use. Smaller sellers now have the infrastructure to compete on service quality without needing their own fleets or payment gateways. These developments are supporting the Thailand e-commerce market growth, giving rise to a more varied mix of products and sellers. As transactions become faster and less dependent on cash or physical stores, Thailand’s online shopping habits continue to accelerate across all income levels and regions.

Thailand E-Commerce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on business model, mode of payment, service type, and product type.

Business Model Insights:

- B2C

- B2B

- C2C

- Others

The report has provided a detailed breakup and analysis of the market based on the business model. This includes B2C, B2B, C2C, and others.

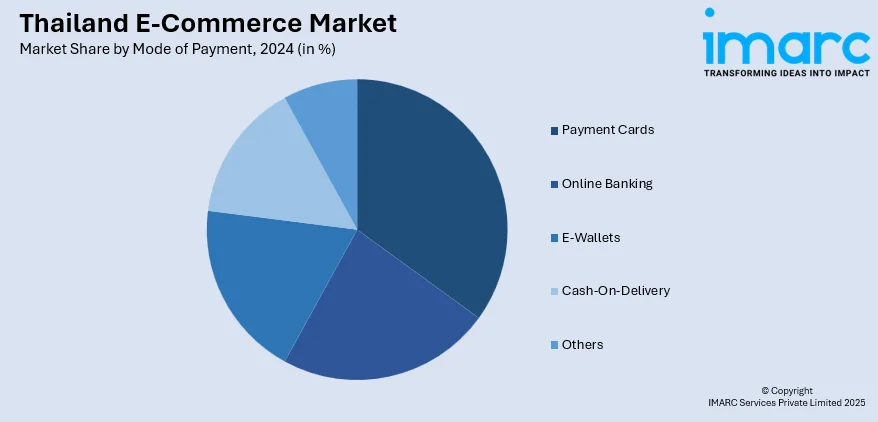

Mode of Payment Insights:

- Payment Cards

- Online Banking

- E-Wallets

- Cash-On-Delivery

- Others

A detailed breakup and analysis of the market based on the mode of payment have also been provided in the report. This includes payment cards, online banking, e-wallets, cash-on-delivery, and others.

Service Type Insights:

- Financial

- Digital Content

- Travel and Leisure

- E-Tailing

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes financial, digital content, travel and leisure, e-tailing, and others.

Product Type Insights:

- Groceries

- Clothing and Accessories

- Mobiles and Electronics

- Health and Personal Care

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes groceries, clothing and accessories, mobiles and electronics, health and personal care, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand E-Commerce Market News:

- In May 2025, Huawei launched its first overseas e-commerce store for HUAWEI eKit on Shopee Thailand, partnering with AIOT to offer digital solutions for SMEs. The store provides advanced networking products and services to help Thai SMEs enhance efficiency and digital transformation.

- In May 2025, Thailand’s Senate committee proposed the Platform Economy Act to reduce foreign dominance in e-commerce by requiring separate registration and reporting for online and offline businesses. The law aims to protect local SMEs with tax incentives and mandates that at least 20% of products sold online be domestically produced. It also addresses counterfeit imports and unfair competition from foreign platforms, promoting a national e-marketplace for Thai sellers.

Thailand E-Commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | B2C, B2B, C2C, Others |

| Mode of Payments Covered | Payment Cards, Online Banking, E-Wallets, Cash-On-Delivery, Others |

| Service Types Covered | Financial, Digital Content, Travel and Leisure, E-Tailing, Others |

| Product Types Covered | Groceries, Clothing and Accessories, Mobiles and Electronics, Health and Personal Care, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand e-commerce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand e-commerce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand e-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Thailand e-commerce market size reached USD 107.20 Billion in 2024.

The Thailand e-commerce market is expected to reach USD 1,156.38 Billion by 2033, exhibiting a CAGR of 26.85% during 2025-2033.

Market growth is driven by increasing internet penetration, rising smartphone usage, and growing consumer preference for online shopping. The expansion of digital payment systems, enhanced logistics infrastructure, and supportive government policies further accelerate e-commerce adoption. Additionally, the rise of social commerce and demand for convenience and personalized shopping experiences are propelling the market forward.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)