Thailand E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2025-2033

Thailand E-Invoicing Market Overview:

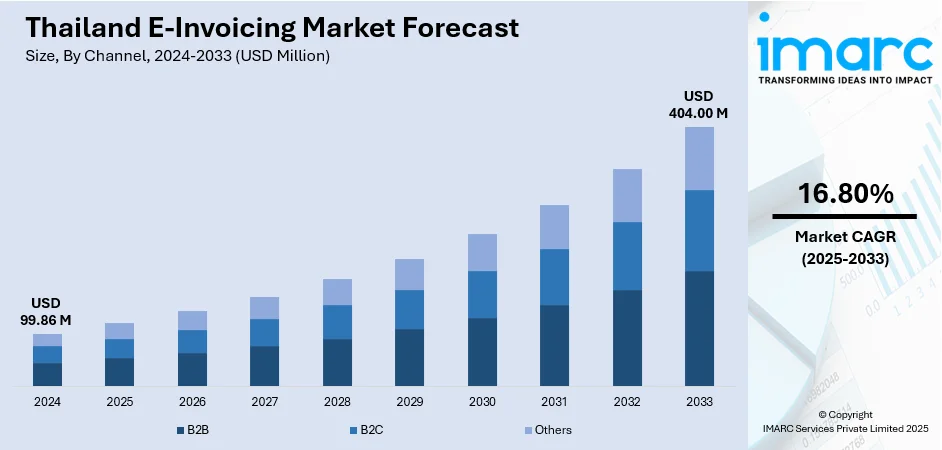

The Thailand e-invoicing market size reached USD 99.86 Million in 2024. Looking forward, the market is expected to reach USD 404.00 Million by 2033, exhibiting a growth rate (CAGR) of 16.80% during 2025-2033. The market is fueled by regulatory change, digitalization, and growing demand for operational effectiveness among companies. Government requirements are compelling companies to move to e-invoicing for better tax compliance and transparency. Companies are also driven by the possibility of minimizing human mistakes, speeding up payment cycles, and improving audit preparedness. Cooperative initiatives among government, industry associations, and technology providers are making implementation more readily available, which plays a significant role in the growth of the Thailand e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 99.86 Million |

| Market Forecast in 2033 | USD 404.00 Million |

| Market Growth Rate 2025-2033 | 16.80% |

Thailand E-Invoicing Market Trends:

Regulatory Push and Growing Tax Compliance

The market for e-invoicing in Thailand is undergoing a significant change led by the regulatory drive to improve tax transparency and curb fraud. The Thai Revenue Department has progressively introduced compulsory e-invoicing for companies, with phased implementation across different sectors. This regulatory drive has provided a compelling reason for businesses to implement digital invoicing solutions—to comply and simplify their accounting reporting processes. Domestic SMEs are strongly driven by the potential to reduce audit pressures and guarantee VAT reporting accuracy. This has created an increasing need for standardized e-invoice types that conform to government standards but adapt well with current accounting systems. In addition, companies are looking at e-invoicing as a means of facilitating stronger internal controls and supply chain transparency, which feeds back into increased trust with government entities and commercial partners.

To get more information on this market, Request Sample

Technological Innovation and Platform Development

The Thai marketplace is seeing rapid technological innovation with respect to e-invoicing, with local and foreign software companies releasing region-specific platforms. Developers are adding support for multi-language inputs, such as Thai script and compliance messaging, and mobile-friendly user interfaces to serve businesses in tier‑2 and tier‑3 cities where mobile access is more common than desktop connectivity. Several fintech startups are providing cloud invoicing platforms integrated with e-wallets and QR payment systems—rider the wave of Thailand's high-end adoption of mobile payment technologies. Such platforms create compliant e-invoices and enable real-time delivery tracking to government tax portals, automated invoice-to-payment reconciliation, and AI-driven error identification. Businesses are thus embracing e-invoicing as a regulatory requirement, which helps with speeding cash flow, and enables faster collection of payments, further propelling the Thailand e-invoicing market growth.

Industry Collaboration and Ecosystem Development

One of the prominent factors governing Thailand's e-invoicing facility is the development of cross-industry cooperation and ecosystem creation. Industry groups—like retail, manufacturing, and logistics—have been collaborating with governments and software providers to create tailored e-invoicing processes for their industries. These projects provide interoperability between systems, consistent compliance rules, and industry-specific functionality, like associating invoices with product tracking or inventory control. In addition, business ecosystems, including grocery store chains and auto dealerships, are implementing vendor and supplier onboarding programs to promote the use of e-invoicing among small suppliers. These programs usually involve training, subsidized access to software, and integration assistance, which are especially helpful in helping rural province-based SMEs. As a result, e-invoicing in Thailand is becoming part of an enhanced digital ecosystem—integrating corporate players, tax authorities, and small businesses—thereby accelerating financial inclusion, enhancing supply chain efficiency, and furthering an interconnected, transparent economy.

Thailand E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud-based and on-premises.

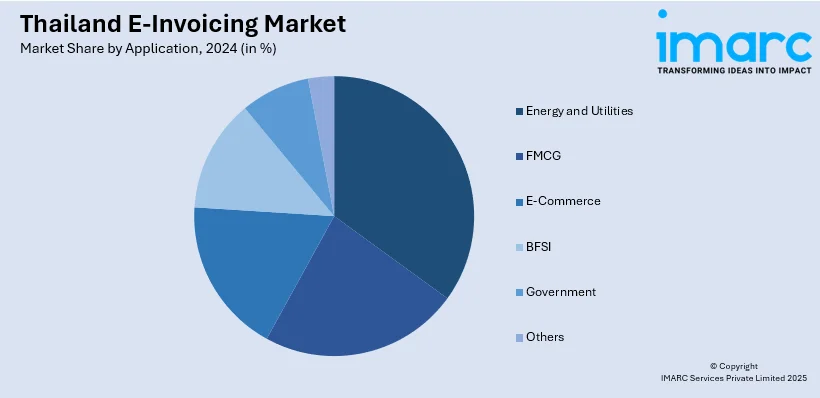

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand E-Invoicing Market News:

- In January 2025, it was revealed that from Thursday (January 16) through February 28, making purchases at selected stores allows shoppers to obtain a tax deduction of up to 50,000 baht through the Thai government’s “Easy E-Receipt 2.0” initiative. Designed to encourage local expenditure among earners, the initiative permits salaried individuals to subtract shopping expenses up to 50,000 baht from their income prior to determining the taxable amount. The campaign follows the very successful initiative launched last year, which contributed to advancing Thailand towards a completely digital tax system.

Thailand E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand e-invoicing market on the basis of channel?

- What is the breakup of the Thailand e-invoicing market on the basis of deployment type?

- What is the breakup of the Thailand e-invoicing market on the basis of application?

- What is the breakup of the Thailand e-invoicing market on the basis of region?

- What are the various stages in the value chain of the Thailand e-invoicing market?

- What are the key driving factors and challenges in the Thailand e-invoicing market?

- What is the structure of the Thailand e-invoicing market and who are the key players?

- What is the degree of competition in the Thailand e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)