Thailand Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033

Thailand Footwear Market Overview:

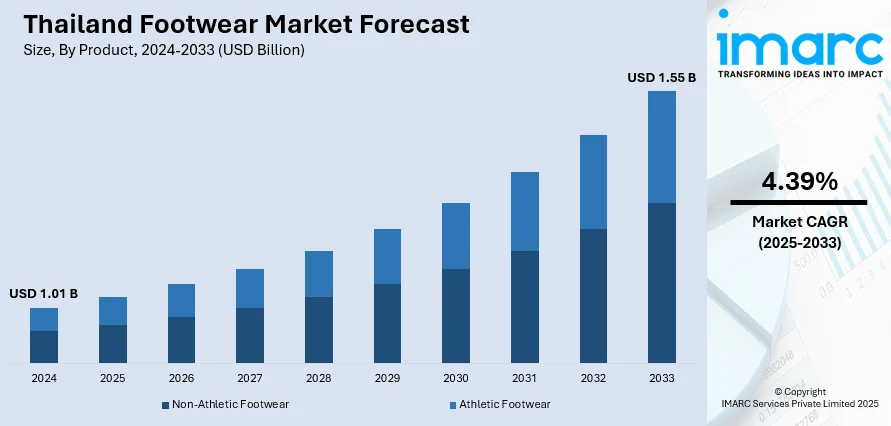

The Thailand footwear market size reached USD 1.01 Billion in 2024. The market is projected to reach USD 1.55 Billion by 2033, exhibiting a growth rate (CAGR) of 4.39% during 2025-2033. The market is witnessing steady growth driven by rising urbanization, changing consumer lifestyles, and increasing demand for both fashion and athletic footwear. Local manufacturers are innovating with eco-friendly materials and digital platforms to attract younger demographics. Additionally, the expansion of e-commerce and omni-channel retailing is enhancing product accessibility across urban and semi-urban areas. As consumer preferences evolve, market players are adapting swiftly to shifting trends, contributing to a positive trajectory in the Thailand footwear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.01 Billion |

| Market Forecast in 2033 | USD 1.55 Billion |

| Market Growth Rate 2025-2033 | 4.39% |

Thailand Footwear Market Trends:

Eco-Conscious Production Enhances Brand Appeal

Sustainability is rapidly shaping Thailand’s footwear production landscape, as manufacturers adopt environmentally responsible methods to align with shifting consumer values. In 2024, the SX Marketplace in Bangkok featured over 300 sustainable brands, many of which showcased footwear made from corn, cassava, sugarcane-based bioplastics, and recycled rubber highlighting Thailand’s capacity for innovation in biodegradable materials. These efforts reflect a broader push toward circular design principles and traceable supply chains, in part supported by government-backed sustainability forums and policies. Footwear producers are increasingly prioritizing zero-waste production models and using renewable resources to meet both local and international eco-certification standards. Consumers, particularly younger demographics, are now more inclined to support brands offering transparency, ethical sourcing, and green packaging. This transition not only reduces the industry’s carbon footprint but also strengthens Thailand’s export appeal to markets with strict environmental requirements. These developments underscore Thailand footwear market trends, where eco-conscious manufacturing is becoming a key differentiator, reinforcing consumer trust and accelerating Thailand Footwear market growth in sustainable fashion segments.

To get more information of this market, Request Sample

Rapid Growth of E-Commerce Platforms

Thailand’s footwear retail landscape is being transformed by the rapid growth of e-commerce, supported by shifting consumer habits and digital innovation. In May 2025, Thailand’s footwear e-commerce revenue reached approximately in millions, reflecting consistent monthly growth across platforms. This digital surge is enabled by mobile-first interfaces, virtual try-on features, and AI-powered product suggestions that enhance the customer shopping experience. Improved logistics services such as next-day delivery, flexible return options, and nationwide fulfillment centers have made online shopping more accessible, especially for urban and suburban populations. Additionally, digital platforms are empowering smaller, independent Thai footwear designers to enter the national market without the cost of physical retail outlets. Social media integration is further helping brands to directly engage with consumers, creating personalized campaigns and building brand loyalty. These advancements have made online retail a central channel for footwear sales and a key driver of accessibility and scale. Together, they support ongoing Thailand footwear market growth, with digital channels playing a pivotal role in reshaping the traditional retail model and expanding market penetration.

Smart Manufacturing Powers Footwear Innovation

Thailand’s footwear manufacturing sector is embracing a wave of smart technologies that enhance precision, sustainability, and global competitiveness. In 2025, local factories are integrating 3D printing for rapid prototyping and custom-fit shoe designs, alongside pilot programs introducing automated stitching and cutting systems. These advancements help reduce material waste and ensure consistent product quality. Meanwhile, factories are installing RFID tracking and IoT sensors in warehouses to improve inventory management and reduce fulfillment errors. AI-driven design tools are aiding in demand forecasting and optimal pattern layouts, allowing producers to better align production with market preferences. Vocational institutes are also introducing training in additive manufacturing and digital production, preparing a workforce adept at managing Industry 4.0 operations. By combining traditional craftsmanship with high-tech methods, Thailand is establishing a resilient and innovative footwear ecosystem. This trend exemplifies evolving footwear market, reflecting a transformative shift toward intelligent, agile manufacturing that supports sustainable growth and product differentiation.

Thailand Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, distribution channel, pricing, and end-user.

Product Insights:

- Non-Athletic Footwear

- Athletic Footwear

The report has provided a detailed breakup and analysis of the market based on the product. This includes non-athletic footwear and athletic footwear.

Material Insights:

- Rubber

- Leather

- Plastic

- Fabric

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes rubber, leather, plastic, fabric, and others.

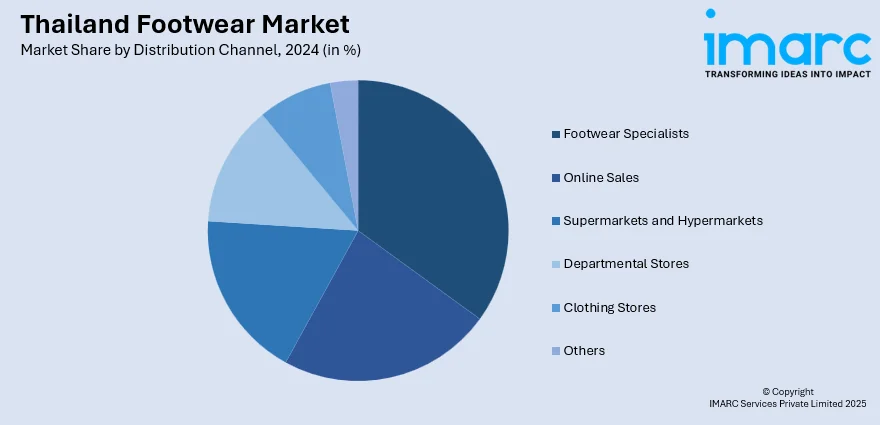

Distribution Channel Insights:

- Footwear Specialists

- Online Sales

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes footwear specialists, online sales, supermarkets and hypermarkets, departmental stores, clothing stores, and others.

Pricing Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes premium and mass.

End-User Insights:

- Men

- Women

- Kids

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes men, women, and kids.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Easter, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Footwear Market News:

- September 2024: Nanyang unveiled its Chang Dao Moo Deng Edition sandals, capitalizing on Thailand’s viral baby pygmy hippo. Developed in collaboration with the Zoological Park Organization (Khao Kheow Open Zoo), the new footwear features a playful “bounce” design and is priced at 199 baht per pair. Part of the campaign’s proceeds supports the Zoo’s “Moo Deng Project” benefiting flood victims and animal welfare. This launch marks another creative move from the 70‑year‑old brand to engage consumers through popular culture.

Thailand Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Online Sales, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Others |

| Pricings Covered | Premium, Mass |

| End-Users Covered | Men, Women, Kids |

| Regions Covered | Bangkok, Easter, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand footwear market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand footwear market on the basis of product?

- What is the breakup of the Thailand footwear market on the basis of material?

- What is the breakup of the Thailand footwear market on the basis of distribution channel?

- What is the breakup of the Thailand footwear market on the basis of pricing?

- What is the breakup of the Thailand footwear market on the basis of end-user?

- What is the breakup of the Thailand footwear market on the basis of region?

- What are the various stages in the value chain of the Thailand footwear market?

- What are the key driving factors and challenges in the Thailand footwear?

- What is the structure of the Thailand footwear market and who are the key players?

- What is the degree of competition in the Thailand footwear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)