Thailand Glamping Market Size, Share, Trends and Forecast by Age Group, Accommodation Type, Booking Mode, and Region, 2025-2033

Thailand Glamping Market Overview:

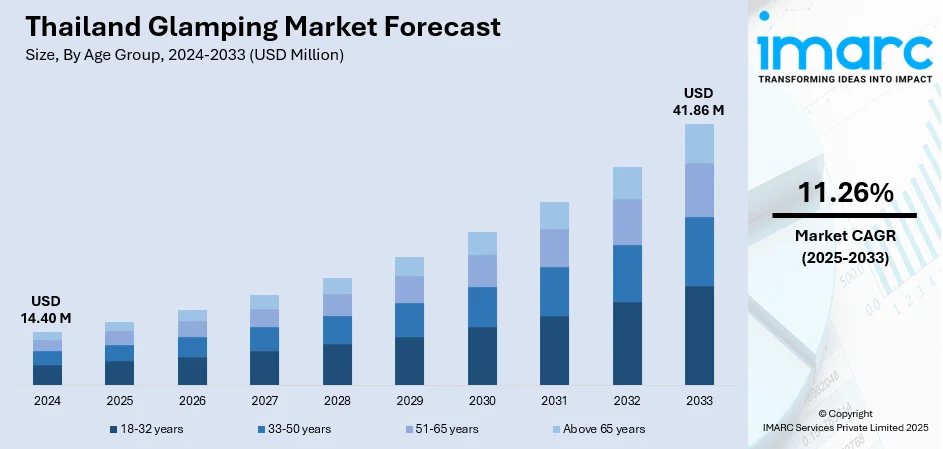

The Thailand glamping market size reached USD 14.40 Million in 2024. The market is projected to reach USD 41.86 Million by 2033, exhibiting a growth rate (CAGR) of 11.26% during 2025-2033. The market is propelled by the country's rising popularity among affluent domestic and international tourists seeking unique outdoor stays. In addition to this, higher disposable incomes and growing interest in experiential travel support premium camping facilities equipped with modern amenities. Moreover, the implementation of government initiatives to promote sustainable tourism and eco-friendly accommodations encourages investments in luxury glamping resorts across scenic destinations, which is also augmenting the Thailand glamping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.40 Million |

| Market Forecast in 2033 | USD 41.86 Million |

| Market Growth Rate 2025-2033 | 11.26% |

Thailand Glamping Market Trends:

Expansion of Online Booking Platforms and Digital Distribution

A significant trend shaping the market development is the broad shift toward online booking platforms and digital sales channels. As per industry reports, as of the second quarter of 2024, 5G connections made up 26.6% of all mobile connections in Thailand, and network coverage had expanded to reach 95% of the population. This high-speed connectivity supports travelers who increasingly expect the ease of browsing, comparing, and booking unique outdoor stays through major travel sites, dedicated glamping portals, and mobile apps. In response, glamping operators are enhancing their presence on top booking engines and developing user-friendly websites with secure payments and instant confirmations to meet these changing expectations. In addition to this, social media marketing, partnerships with influencers, and virtual tours enable smaller or remote sites to attract a wider audience and gain credibility among tech-savvy travelers. Moreover, reviews and user-generated content play a critical role in shaping purchasing decisions, making reputation management and responsive customer service vital for operators. Also, dynamic pricing tools and real-time availability updates have also become standard, enabling businesses to adjust rates based on demand and seasonality. By leveraging digital channels effectively, the glamping sector in the country can attract last-minute bookings, increase occupancy rates year-round, and tap into younger demographics who plan their getaways primarily online.

To get more information on this market, Request Sample

Robust Growth of Thailand’s Domestic and International Tourism Sector

The steady expansion of the tourism sector in the country is a major driver propelling the Thailand glamping market growth. According to industry reports, in 2024, Thailand welcomed 940,051 tourists, marking its highest annual visitor count to date. This rising influx of visitors is boosting demand for distinctive and memorable accommodation options that go beyond standard hotels. Glamping sites, with their blend of comfort and closeness to nature, are increasingly seen as an attractive choice for both domestic and international travelers seeking new experiences. Besides, the country’s diverse landscapes provide ideal settings for premium camping experiences. In addition to this, ongoing infrastructure improvements, including better road networks and regional airports, have enhanced accessibility to remote glamping sites, making weekend getaways feasible for urban residents and enticing international visitors to explore lesser-known areas. Moreover, Thailand’s government and tourism boards actively promote new destinations under various campaigns that encourage travelers to move beyond traditional city stays and beach resorts. Also, increasing disposable incomes and an expanding middle class contribute to higher demand for niche accommodations like glamping, which promise privacy, comfort, and a connection with nature. Meanwhile, international tourist arrivals, supported by relaxed visa policies and targeted promotions, bring in visitors from key markets such as China, Europe, and Southeast Asia. The strong performance of the broader tourism sector provides fertile ground for glamping operators to diversify offerings and cater to changing traveler expectations.

Thailand Glamping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on age group, accommodation type, and booking mode.

Age Group Insights:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 18-32 years, 33-50 years, 51-65 years, and above 65 years.

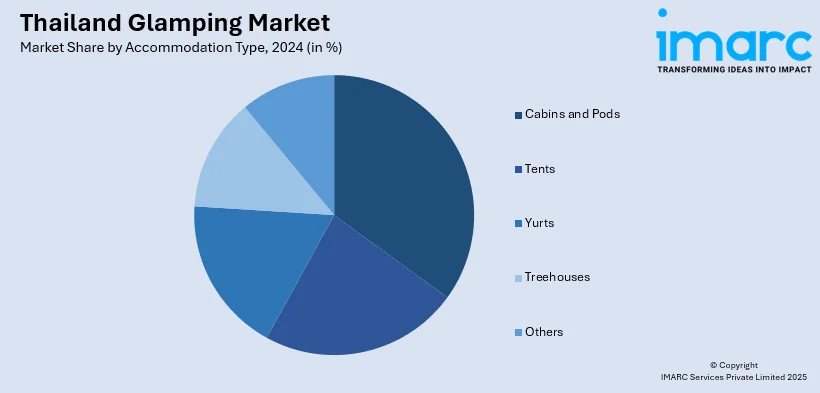

Accommodation Type Insights:

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

A detailed breakup and analysis of the market based on the accommodation type have also been provided in the report. This includes cabins and pods, tents, yurts, treehouses, and others.

Booking Mode Insights:

- Direct Booking

- Travel Agents

- Online Travel Agencies

The report has provided a detailed breakup and analysis of the market based on the booking mode. This includes direct booking, travel agents, and online travel agencies.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Glamping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Accommodation Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Booking Modes Covered | Direct Booking, Travel Agents, Online Travel Agencies |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand glamping market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand glamping market on the basis of age group?

- What is the breakup of the Thailand glamping market on the basis of accommodation type?

- What is the breakup of the Thailand glamping market on the basis of booking mode?

- What is the breakup of the Thailand glamping market on the basis of region?

- What are the various stages in the value chain of the Thailand glamping market?

- What are the key driving factors and challenges in the Thailand glamping market?

- What is the structure of the Thailand glamping market and who are the key players?

- What is the degree of competition in the Thailand glamping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand glamping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand glamping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand glamping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)