Thailand IT Training Market Size, Share, Trends and Forecast by Application, End-User, and Region, 2025-2033

Thailand IT Training Market Overview:

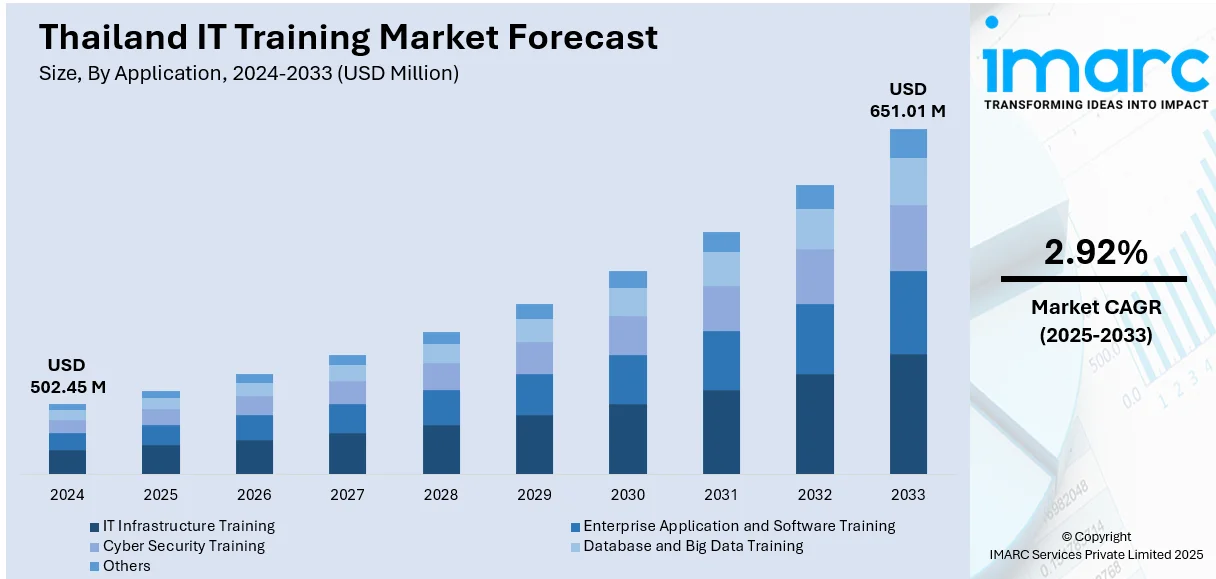

The Thailand IT training market size reached USD 502.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 651.01 Million by 2033, exhibiting a growth rate (CAGR) of 2.92% during 2025-2033. At present, organizations in Thailand are rapidly experiencing digital transformation, and it strongly drives the need for training in information technology (IT). This trend, along with the rising focus of the government on the introduction of supportive policies and subsidization schemes to improve the digital literacy of Thailand is bolstering the market growth. Moreover, the heightened demand for specialized IT certification among corporate employees is expanding the Thailand IT training market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 502.45 Million |

| Market Forecast in 2033 | USD 651.01 Million |

| Market Growth Rate 2025-2033 | 2.92% |

Thailand IT Training Market Trends:

Rising Digital Transformation in Industries

Organizations in Thailand are rapidly experiencing digital transformation, and it strongly drives the need for information technology (IT) training. Organizations have been focusing on investing heavily in developing technologies like artificial intelligence (AI), cloud computing, cybersecurity, and big data to boost productivity and stay competitive. With organizations rolling out these systems, they are in turn looking for skilled experts who can run, maintain, and secure digital infrastructures optimally. This is pushing workers to take part in upskilling and reskilling training provided by IT training companies. Businesses are also forming partnerships with training centers to provide customized programs in line with their digital strategies. Education facilities and government programs are also complementing these efforts by implementing organized IT training courses. Overall, the large-scale use of digital technologies in the public and private sectors is generating consistent demand for IT special education and training services throughout Thailand. In 2025, Thailand is greatly enhancing its cybersecurity strength with the successful conclusion of the second phase of a national training initiative that has trained more than 100,000 people in essential cyber skills. The project, supported by the Ministry of Digital Economy and Society (DE), seeks to align Thailand's cyber security measures with global standards.

To get more information on this market, Request Sample

Growing Government Support and Policy Initiatives

The government of Thailand is playing a crucial part in bolstering the IT training environment through the introduction of supportive policies and subsidization schemes to improve the digital literacy of Thailand. It is implementing national plans such as "Thailand 4.0" and the "Digital Economy Promotion Master Plan," which give top priority to upskilling the workforce in digital technologies. The government agencies are working hand-in-hand with private companies and academic institutes to market IT-related courses and certifications. These programs are aimed at both urban and rural segments to provide equal access to digital skill creation. Scholarships, online courses, and state-funded bootcamps are implemented to enable youth and professionals to gain market-relevant IT skills, thereby propelling the Thailand IT training market growth. The government is also regularly investing in digital infrastructure, which indirectly increases demand for a technologically skilled workforce. Through actively supporting the establishment of IT training programs, the public sector is developing an environment where digital skills are becoming a pre-requisite for economic development and job opportunities. For instance, in 2025, The Ministry of Labor’s Department of Skill Development (DSD), in partnership with Microsoft Thailand, is promoting AI skills enhancement via the THAI Academy. The program seeks to educate 100,000 Thai employees and job applicants across the nation in AI capabilities, enabling them to adjust to the changing job market and improve the nation’s global competitiveness. This serves as a vital basis for propelling Thailand’s digital economy.

Rising Demand for Specialized and Certification-Based Training

Thai employers are increasingly looking for job applicants with specialized IT certification, and this is driving the demand for formal IT training programs. The market today is experiencing increased training in fields like data science, software development, cybersecurity, and cloud engineering as organizations are demanding employees to have hands-on skills in specialized areas. Students are pursuing globally accepted certification courses to improve their employment opportunities and salary potential. Training providers are responding by increasing course offerings and providing flexible learning arrangements like hybrid and online courses. Corporates are also sponsoring certificate courses to retain their current staff and give them more power. This is being driven by a scarcity of talent for advanced IT positions, which is encouraging individuals to go for specialized training as a stepping stone for career growth.

Thailand IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end-user.

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes IT infrastructure training, enterprise application and software training, cyber security training, database and big data training, and others.

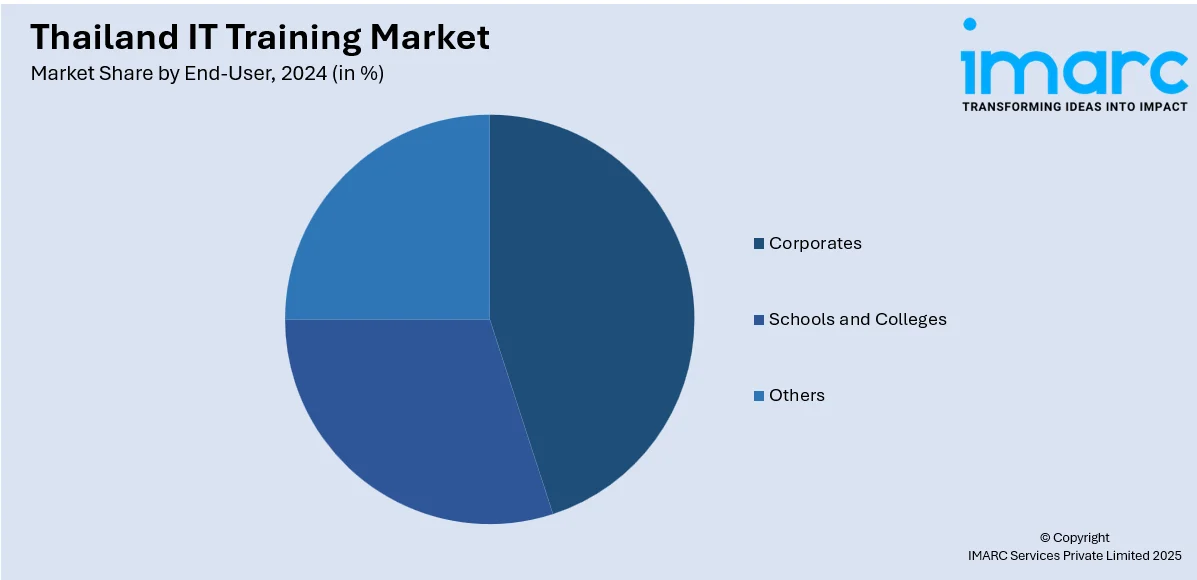

End-User Insights:

- Corporates

- Schools and Colleges

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes corporates, schools and colleges, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporate, Schools and Colleges, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the Thailand IT training market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand IT training market on the basis of application?

- What is the breakup of the Thailand IT training market on the basis of end-user?

- What is the breakup of the Thailand IT training market on the basis of region?

- What are the various stages in the value chain of the Thailand IT training market?

- What are the key driving factors and challenges in the Thailand IT training market?

- What is the structure of the Thailand IT training market and who are the key players?

- What is the degree of competition in the Thailand IT training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand IT training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)