Thailand Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

Thailand Logistics Market Overview:

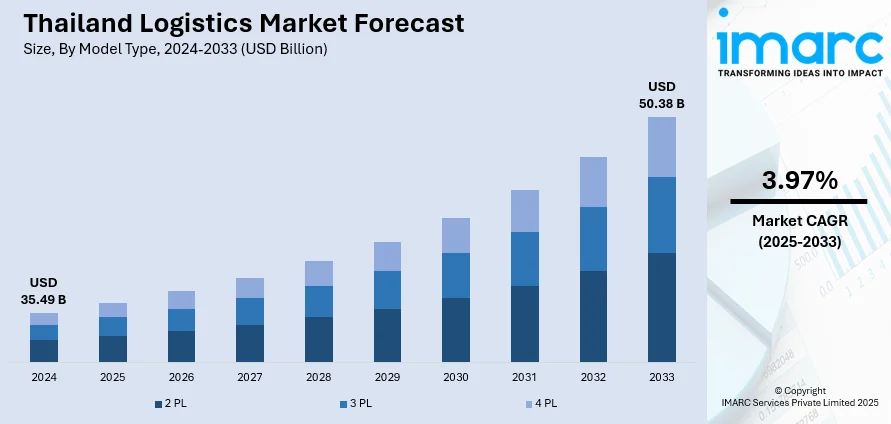

The Thailand logistics market size reached USD 35.49 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 50.38 Billion by 2033, exhibiting a growth rate (CAGR) of 3.97% during 2025-2033. The logistics market in Thailand is driven by the rapid rise of e-commerce and a strong push toward sustainability. Businesses are investing in modern infrastructure, green technologies, and efficient delivery systems to meet user expectations, regulatory demands, and global standards for environmentally responsible and fast logistics solutions, contributing to the expansion of the Thailand logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 35.49 Billion |

| Market Forecast in 2033 | USD 50.38 Billion |

| Market Growth Rate 2025-2033 | 3.97% |

Thailand Logistics Market Trends:

Increasing Demand for Sustainability and Green Logistics

Growing environmental awareness and tightening regulatory frameworks are driving a major shift toward sustainable logistics practices in Thailand. Companies are prioritizing the reduction of their carbon footprint by adopting fuel-efficient transportation methods, optimizing delivery routes, and transitioning to eco-friendly packaging materials. There is also a notable rise in the use of renewable energy sources in warehouses and the implementation of technologies designed to reduce waste and energy usage across the supply chain. These changes are not only compliance-driven but also reflect the rising expectations of eco-conscious individuals and global sustainability standards. A prominent example of this movement is the 2025 collaboration between DHL Supply Chain Thailand and Michelin, which introduced a fully electric prime mover aimed at cutting logistics-related emissions by 195 metric tons per year. This initiative aligns with both companies' long-term goal of achieving net-zero emissions by 2050 and showcases the use of smart fleet management to advance green transportation. By setting a benchmark for environmental responsibility in logistics, the partnership illustrates how targeted innovations can significantly reduce environmental impact while maintaining operational efficiency. As more businesses follow this lead, sustainability is becoming a core competitive differentiator in Thailand’s logistics sector, encouraging further investment in clean technologies, energy-efficient infrastructure, and responsible supply chain practices that collectively support a more resilient and environmentally conscious logistics ecosystem.

To get more information of this market, Request Sample

Growing E-Commerce and Retail Expansion

The rapid expansion of e-commerce is a key factor contributing to the Thailand logistics market growth. As individual behavior shifts increasingly toward online shopping, there is a rise in the need for highly efficient warehousing, streamlined supply chains, and reliable last-mile delivery services. Businesses are responding by investing in more advanced logistics infrastructure and technologies to ensure quicker and more dependable fulfillment. This trend is not limited to local retailers but also includes international players, who are scaling operations, boosting the demand for integrated logistics solutions capable of managing high volumes and diverse product categories. A notable example of this momentum is JD Logistics launch of a new Shenzhen–Bangkok air cargo route operated by JD Airlines in 2025. This route facilitates fast delivery of high-demand items like electronics, apparel, and fresh produce, significantly enhancing cross-border e-commerce between China and Thailand. It also reinforces Southeast Asia’s regional supply chains and supports JD’s ambition to establish a global “2–3 Day Delivery Circle.” Such initiatives highlight how the growth of e-commerce is prompting logistics providers to expand their reach, modernize operations, and improve delivery speed across borders. As Thailand positions itself as a strategic hub in the region, the country’s logistics sector is becoming more dynamic, agile, and technology-driven, closely aligning with the evolving demands of digital commerce and international trade.

Thailand Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

A detailed breakup and analysis of the market based on the model type have also been provided in the report. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, seaways, railways, and airways.

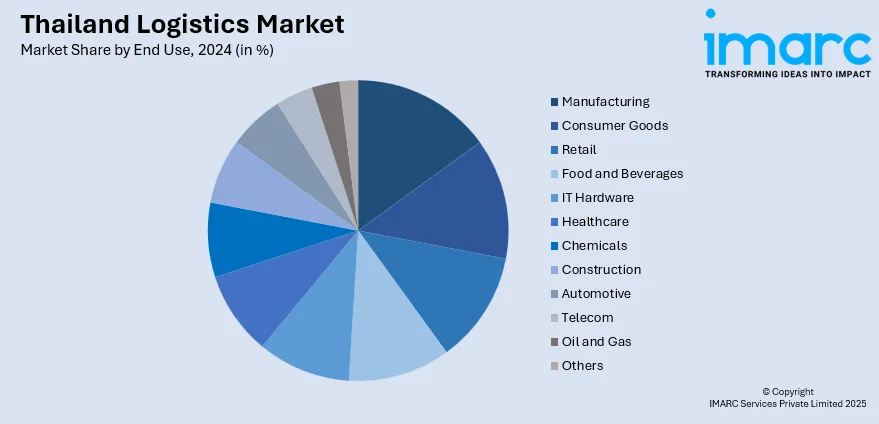

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Logistics Market News:

- In May 2025, Mober launched its electric vehicle (EV) logistics operations in Thailand with 21 EV trucks and a 1,600-sqm charging hub in Bangkok's Bang Na district. The fleet will support IKEA Thailand's last-mile deliveries, promoting greener urban logistics. This move aligns with Mober’s goal to expand sustainable logistics solutions across Southeast Asia.

- In February 2025, Rhenus Logistics opened a new 10,000-square-meter logistics facility at KM19 in Thailand to enhance supply chain efficiency across the Asia-Pacific region. The site features 17 loading docks, temperature-controlled storage, and advanced warehouse management systems. This expansion supports Rhenus’ goal of delivering flexible, high-standard logistics solutions.

Thailand Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand logistics market on the basis of model type?

- What is the breakup of the Thailand logistics market on the basis of transportation mode?

- What is the breakup of the Thailand logistics market on the basis of end use?

- What is the breakup of the Thailand logistics market on the basis of region?

- What are the various stages in the value chain of the Thailand logistics market?

- What are the key driving factors and challenges in the Thailand logistics market?

- What is the structure of the Thailand logistics market and who are the key players?

- What is the degree of competition in the Thailand logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)