Thailand Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

Thailand Online Travel Market Overview:

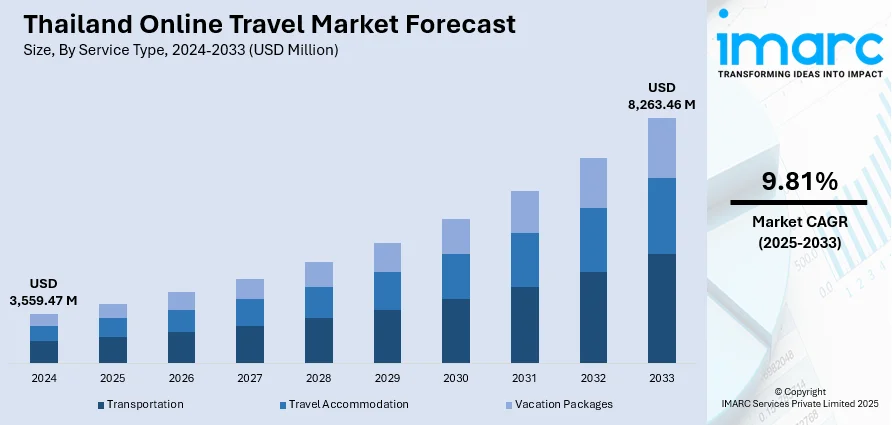

The Thailand online travel market size reached USD 3,559.47 Million in 2024. The market is projected to reach USD 8,263.46 Million by 2033, exhibiting a growth rate (CAGR) of 9.81% during 2025-2033. The market is witnessing sustained growth, fueled by expanding internet access, increased mobile adoption, and a strong consumer shift toward digital booking platforms. Segmented by service type, platform, booking mode, age demographic, and region, the market reflects evolving traveler demands for tailored experiences. Growth is further supported by enhanced digital payment infrastructure, rising local OTA competitiveness, and ongoing improvements in tourism infrastructure. These trends are expected to strengthen market structures and positively influence the Thailand online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,559.47 Million |

| Market Forecast in 2033 | USD 8,263.46 Million |

| Market Growth Rate 2025-2033 | 9.81% |

Thailand Online Travel Market Trends:

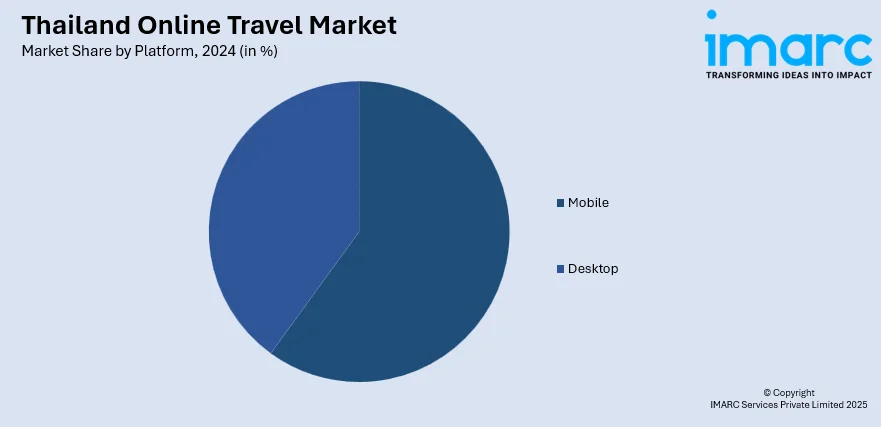

Mobile-Centric Booking Surge in Thailand

In June 2023, 89 % of Thai users booked travel via smartphone, underscoring the country’s strong mobile-first trend in online travel agency usage. Thai OTAs are leveraging this preference by optimizing apps with AI-enabled recommendation engines, one-tap payments via Prompt Pay, and seamless integration with QR-based systems. These platforms now offer dynamic itinerary planners, interactive local guides, and push notifications for real-time price drops or flash deals, all within mobile environments. The convenience of biometric logins and saved preferences supports frictionless transaction flows. Travel apps also embedded social features such as sharing trip stories or in-app community reviews to enhance engagement. Post-booking experiences now include chatbot support and instant access to digital boarding passes and hotel check-ins, further boosting user retention. As mobile remains the primary booking channel, Thailand’s digital travel landscape is evolving into a fully localized, app-driven ecosystem capable of delivering end-to-end travel solutions. This strategic shift is central to driving sustained Thailand online travel market growth.

To get more information on this market, Request Sample

Domestic Exploration Anchored in Sustainability

In March 2025, the Tourism Authority of Thailand (TAT) launched Net Zero and Carbon Neutral tourism frameworks, highlighting a national commitment to sustainable sector growth. These initiatives have prompted travel platforms to prominently feature eco-conscious stays, such as solar-powered resorts on Koh Mak and promote community-based homestays in Chiang Mai and Nan via the Thai Ecotourism and Adventure Travel Association (TEATA). OTAs are adapting by integrating dedicated filters like “low‑carbon,” “community immersion,” and “wellness retreat,” while providing insights into each provider’s environmental accreditation. Package deals now bundle experiences such as organic farm visits, guided nature walks, and renewable-energy boat tours. Investors and travelers alike are increasingly drawn to curated content highlighting destination impact, supporting both local economies and eco-friendly practices. Online platforms now act as gatekeepers of quality and credibility in this evolving eco‑travel segment. This shift toward sustainable, regionally driven tourism embodies key Thailand online travel market trends.

Inbound Recovery through Digital Facilitation

In May 2025, Thailand mandated the use of the new Thailand Digital Arrival Card (TDAC) for all foreign visitors, replacing the traditional TM6 paper form. This e-authorisation move has driven OTAs and airline booking platforms to integrate TDAC submission directly into their flows, simplifying entry procedures and reducing friction for international travelers. Platforms are now offering multilingual support covering languages like Mandarin, Arabic, and Russian and displaying prices in the target user’s currency. Visa guidance, embassy-linked assistance, and travel insurance bundling are presented as seamless, step-by-step modules within the booking process. AI-powered chat assistants operate 24/7, helping foreign tourists with itinerary planning, translation, and cultural norms. These localized features are complemented by targeted promotions in key source markets to promote “soft‑power” highlights such as Thai cuisine, wellness tourism, and cultural festivals. By smoothing the traveler journey from pre-trip planning to final entry, Thailand’s digital gateways are transforming inbound travel capabilities. These enhancements are foundational to strengthening the Thailand online travel market.

Thailand Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages. |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand online travel market on the basis of service type?

- What is the breakup of the Thailand online travel market on the basis of platform?

- What is the breakup of the Thailand online travel market on the basis of the mode of booking?

- What is the breakup of the Thailand online travel market on the basis of age group?

- What is the breakup of the Thailand online travel market on the basis of the region?

- What are the various stages in the value chain of the Thailand online travel market?

- What are the key driving factors and challenges in the Thailand online travel market?

- What is the structure of the Thailand online travel market and who are the key players?

- What is the degree of competition in the Thailand online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)